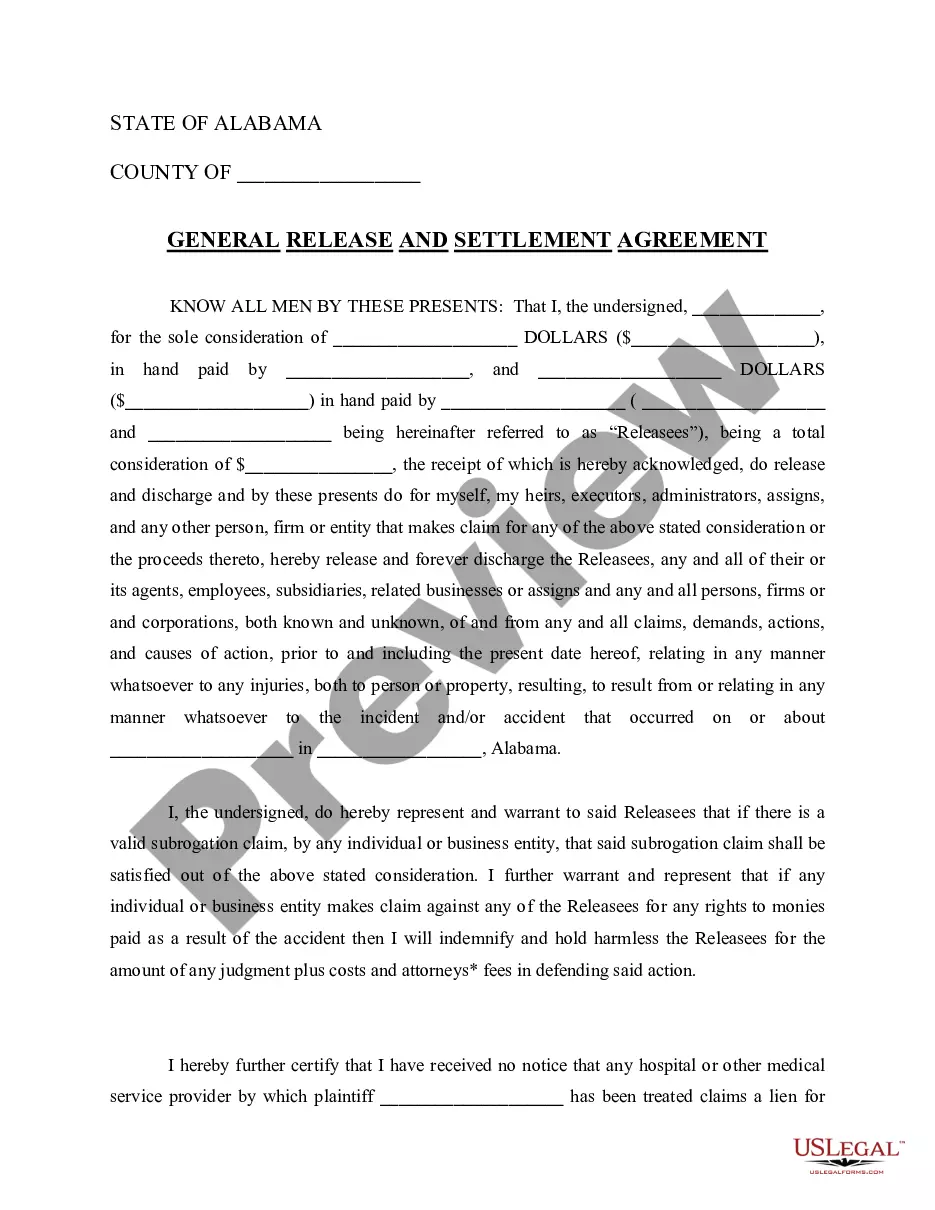

Settlement Agreement CS Docket, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Agreement Form Withdrawal

Description

How to fill out Alabama Settlement Agreement CS Docket?

There's no further justification to spend time looking for legal documents to satisfy your local state obligations.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our website provides over 85k templates for any business and personal legal situations organized by state and area of application.

Utilize the Search field above to look for another sample if the previous one did not meet your requirements.

- All forms are properly drafted and authenticated for legitimacy, so you can trust in obtaining an updated Alabama Agreement Form Withdrawal.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained paperwork at any time needed by accessing the My documents tab in your profile.

- If you have never used our service previously, the procedure will require a few additional steps to finish.

- Here's how new users can locate the Alabama Agreement Form Withdrawal in our collection.

- Read the page content thoroughly to ensure it includes the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

To amend the Certificate of Formation for your Alabama LLC, you'll need to submit a Certificate of Amendment with the Alabama Secretary of State. You'll include three forms totalthe original amendment and two copiesand a $50 filing fee.

To withdraw or cancel your foreign Alabama LLC in Alabama, you must provide in duplicate the completed Foreign Limited Liability Company Certificate of Withdrawal form, in duplicate, with the filing fee to the Secretary of State by mail, in person or by fax.

To dissolve your limited liability company in Alabama, you must provide the completed original and two copies of the Domestic LLC Articles of Dissolution form to the Judge of Probate in the county where the original Certificate of Formation was recorded, by mail or in person. The filer's original signature is required.

One way to transfer LLC ownership in Alabama is to have the existing members of the LLC buy out the partner who wants to leave. The leaving partner's ownership interest is then split among the remaining LLC members. To handle the transfer of ownership this way, you need to create a buy/sell agreement.

The remaining three Illinois, Mississippi and Pennsylvania don't tax distributions from 401(k) plans, IRAs or pensions. Alabama and Hawaii don't tax pensions, but do tax distributions from 401(k) plans and IRAs.