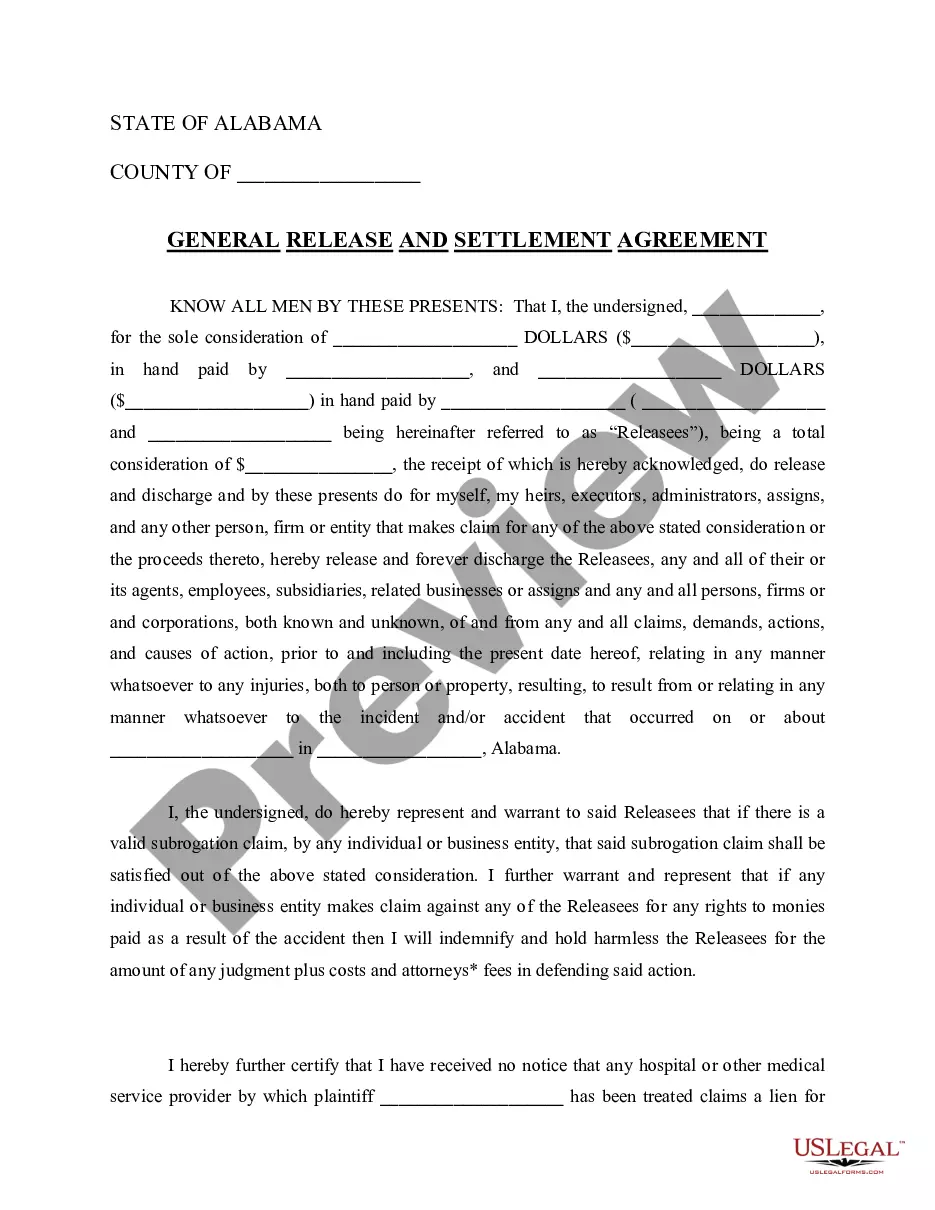

Settlement Agreement CS Docket, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Agreement Form With Calculations

Description

How to fill out Alabama Settlement Agreement CS Docket?

Well-constructed official paperwork is one of the essential assurances for steering clear of complications and legal disputes, yet acquiring it without assistance from a lawyer may be time-consuming.

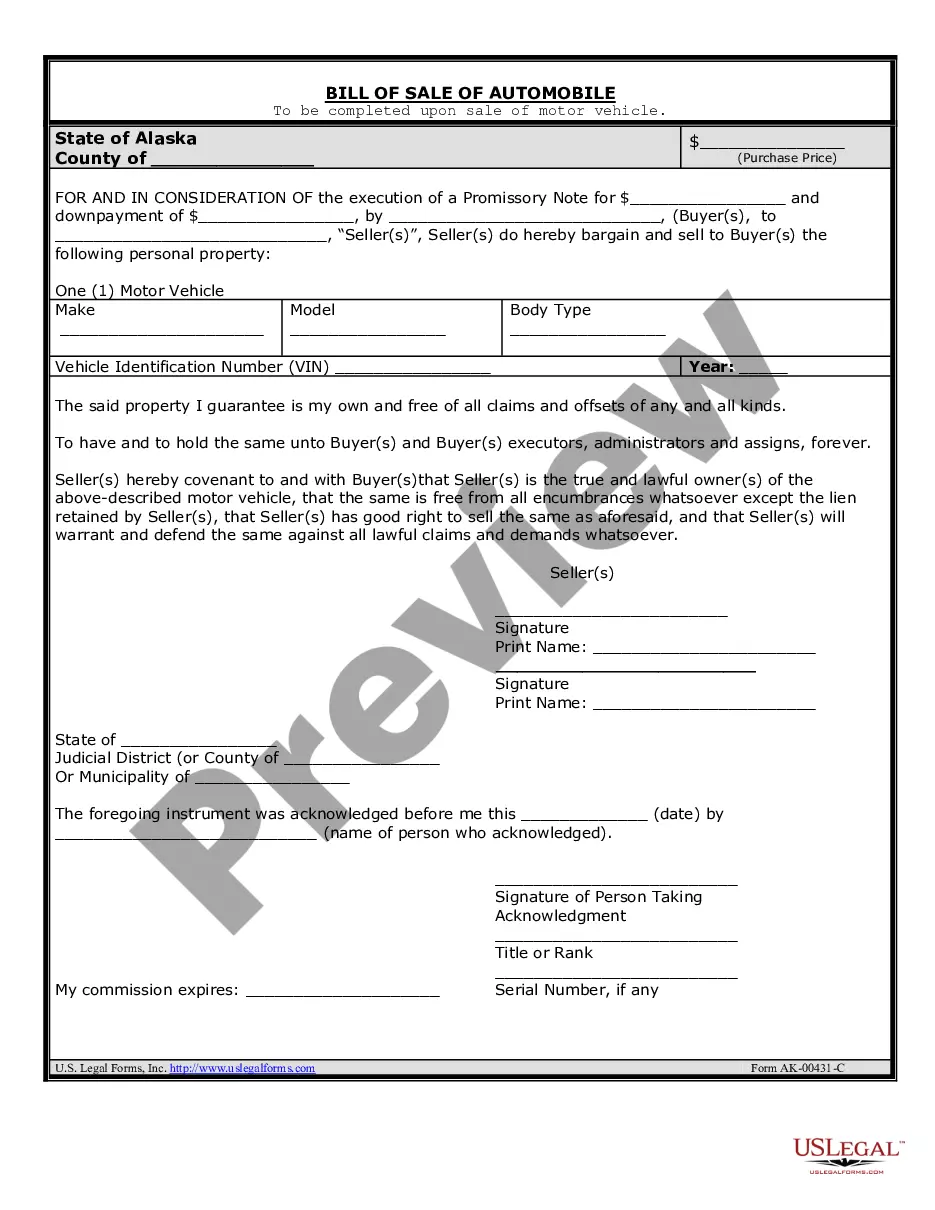

Whether you need to swiftly locate an up-to-date Alabama Agreement Form With Calculations or any other forms for work, family, or commercial situations, US Legal Forms is always ready to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button adjacent to the selected document. Additionally, you can retrieve the Alabama Agreement Form With Calculations anytime, as all paperwork ever procured on the platform remains accessible within the My documents tab of your profile. Conserve time and money on preparing official documents. Experience US Legal Forms today!

- Ensure that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar located at the top of the page.

- Select Buy Now upon discovering the suitable template.

- Choose your pricing plan, sign in to your account, or set up a new one.

- Select your preferred payment method to purchase the subscription plan (using either a credit card or PayPal).

- Opt for PDF or DOCX file format for your Alabama Agreement Form With Calculations.

- Hit Download, then print the template to complete it or import it into an online editor.

Form popularity

FAQ

The Alabama Business Privilege Tax is levied for the privilege of being organized under the laws of Alabama or doing business in Alabama (if organized under the laws of another state or country).

The tax rate for business privilege tax is graduated, based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. The minimum business privilege tax is $100.

Disregarded entity owners that are not subject to the Alabama business privilege tax include, but are not limited to: resident individual taxpayers; nonresident individual taxpayers; general partnerships; and, foreign business entities not doing business in the state of Alabama and not registered with the Alabama

Total Alabama Net Worth Multiply line 8 (Net Worth Subject to Apportionment) by line 9 (Apportionment Factor).Deductions.Computation of Privilege Tax Due.Federal Taxable Income for C-corporations, Real Estate Investment.Line 17b. Tax Rate Federal Taxable Income Apportioned and Allocated to Alabama.

To calculate your total business privilege tax due, you'll need to multiply your total net worth ($1,000,000) by your assigned tax rate (. 00125). So, in this case, your business privilege tax would be $1,250. The minimum tax payment for all entities is $100.