Sample Parole Support Letter From Mother With Cancer

Description

How to fill out Alabama Letter To Parol Board Members By Attorney Requesting Parol Of Inmate For Family?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and substantial financial investment.

If you're looking for a simpler and more economical method of generating Sample Parole Support Letter From Mother With Cancer or any other paperwork without unnecessary obstacles, US Legal Forms is always available to you.

Our online database of over 85,000 current legal forms covers nearly every dimension of your financial, legal, and personal issues.

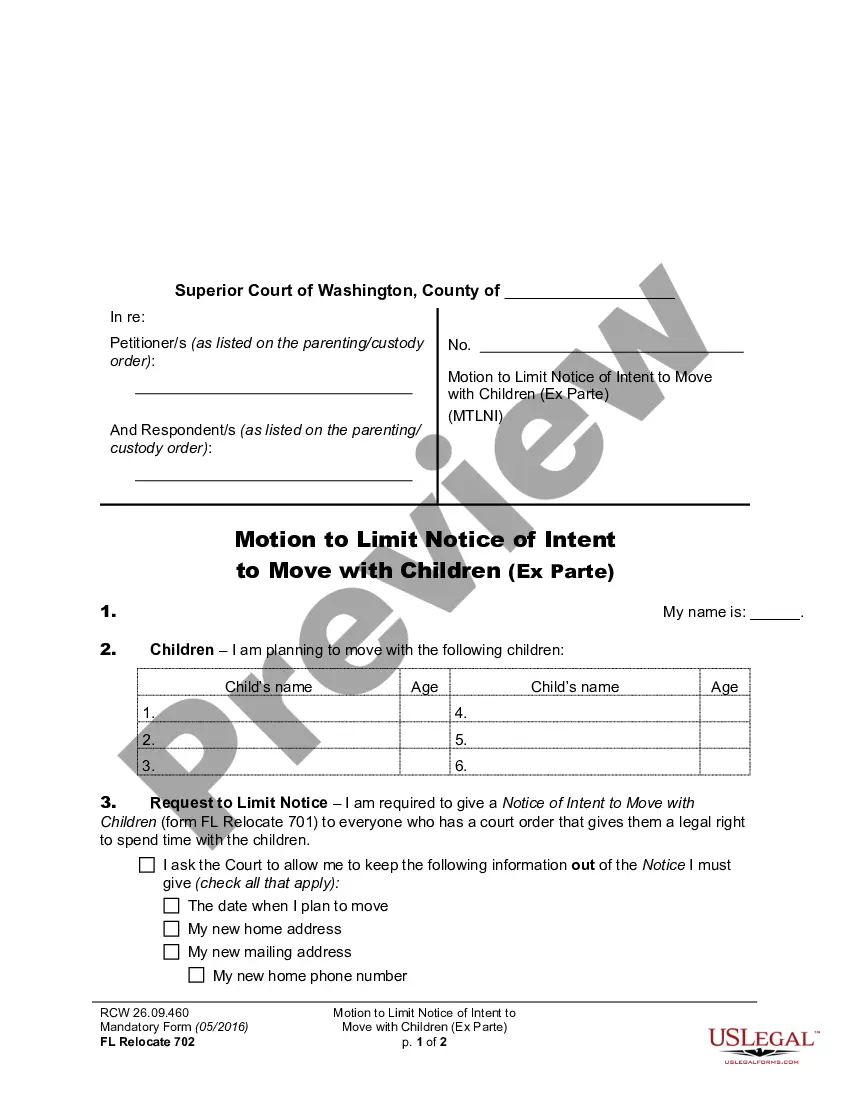

Before proceeding to download the Sample Parole Support Letter From Mother With Cancer, consider these suggestions: Check the document preview and descriptions to ensure you have found the right document. Verify that the template you select complies with the rules and regulations of your state and county. Choose the most appropriate subscription option to acquire the Sample Parole Support Letter From Mother With Cancer. Download the file, then complete, sign, and print it out. US Legal Forms has a solid reputation and more than 25 years of experience. Join us today and make form completion an easy and efficient process!

- With just a few clicks, you can swiftly find state- and county-specific templates carefully assembled by our legal professionals.

- Utilize our platform anytime you need trustworthy and dependable services to rapidly locate and download the Sample Parole Support Letter From Mother With Cancer.

- If you are familiar with our services and have formerly established an account with us, simply Log In to your account, find the template, and download it or re-download it whenever you want in the My documents section.

- Don’t have an account? No problem. Setting it up takes just a few minutes and allows you to browse the catalog.

Form popularity

FAQ

Contents of a Debt Settlement Agreement Date of the agreement. Name and address of the creditor. Name and address of the debtor. Original loan amount and its date. Rate of interest. Due date of the loan. Final settlement amount. Signatures of both parties.

Cancellation of debt (COD), sometimes referred to simply as debt cancellation, occurs when a creditor relieves a borrower from a debt obligation. Debtors may be able to negotiate with a creditor directly for debt forgiveness. They can also have debts canceled through a debt relief program or by filing for bankruptcy.

Other Options. You can contact the collections agency directly and ask if it is willing to let you terminate your contract for a cancellation fee. Get the terms of cancellation in writing and pay any fee on time.

To cancel your DMP, you need to contact your provider and ask to cancel. They will inform your creditors that the agreement has been cancelled, so you can expect to start dealing with them yourself again.

If you stop making monthly payments to your debt management plan, you will be removed from the program and your rates will shoot back up to their previous levels. Some plans will drop you after missing a single payment, while others may be generous enough to allow up to three missed payments.

It is often used when a borrower cannot keep up with their unsecured debts. With credit card debt, for example, you might be able to cut your balance by up to 50%. 1 For example, if you owe $20,000 on a credit card, and can scrape up $10,000 in cash, you might be able to settle for that amount.

The money you pay into a settlement account is yours! Money that a debt settlement company asks you to set aside in an ?escrow? or ?settlement? account belongs to you. You may cancel the account at any time, and the escrow company must refund all of your money minus any fees the settlement company legally earned.

Settling a debt will generally help your credit a little, although not as much as paying your bills in full. However, if you intentionally stop making payments on an account that's current or only slightly past due, that could significantly hurt your credit scores in the meantime.