Power Attorney For Bank Account

Description

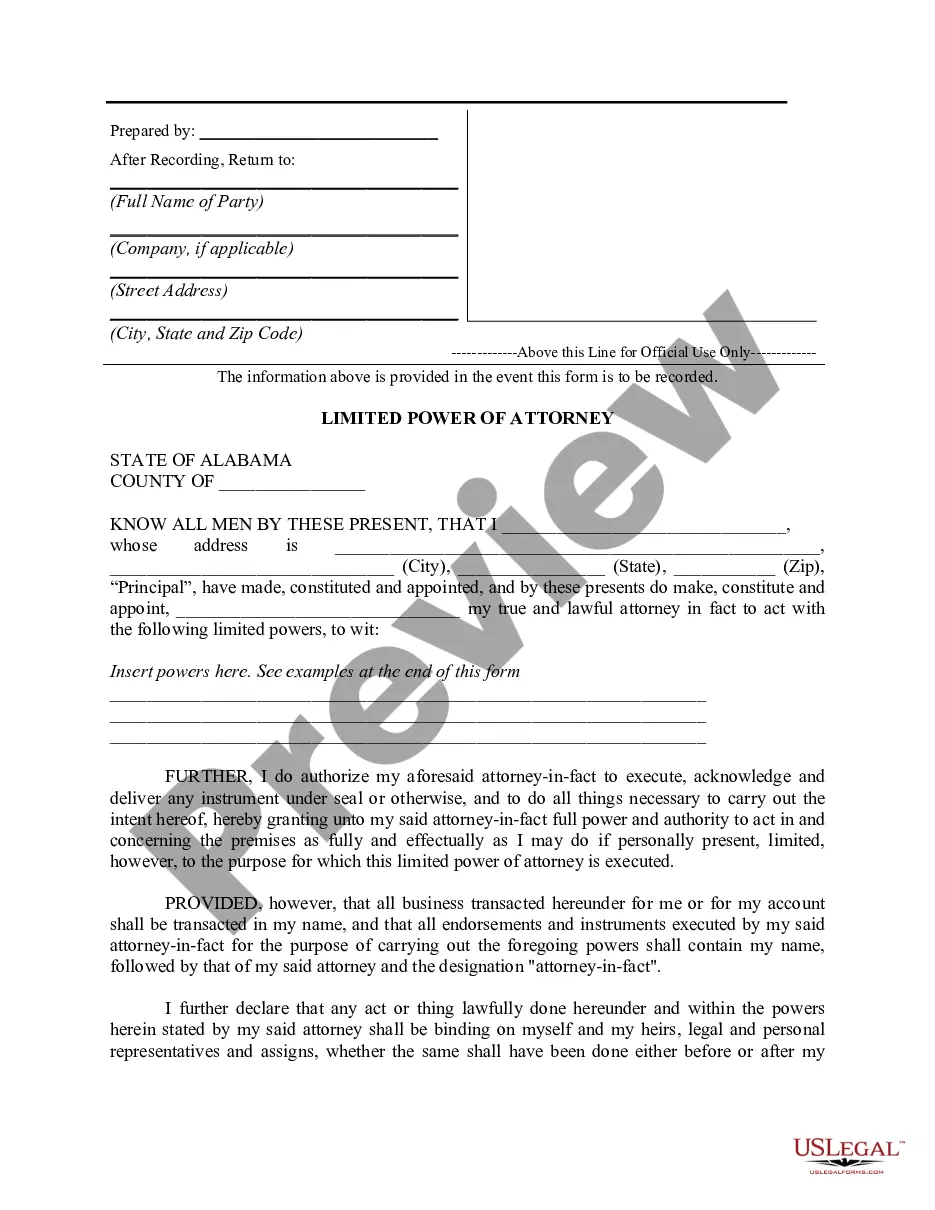

How to fill out Alabama Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you already have an account with US Legal Forms, log in and navigate to your dashboard to locate and download the power of attorney form for bank accounts.

- If this is your first visit, review the form previews available on the site to ensure you select the correct power of attorney that aligns with your needs and complies with local laws.

- Use the search function to find alternative forms if necessary, verifying that the one you choose meets your specific requirements.

- Make your purchase by selecting the 'Buy Now' button, and choose the subscription plan that best fits your needs. You will need to create an account to access the full library.

- Complete your transaction by entering your payment details via credit card or PayPal to finalize your subscription.

- Download your chosen form and store it on your device. You can also find it later in the My Forms section of your profile.

US Legal Forms provides a robust collection of over 85,000 legal documents, ensuring you have access to more forms than you would find elsewhere at a similar cost.

With the support of premium legal experts, you can confidently complete your documents accurately. Don't wait to secure your financial future—sign up today!

Form popularity

FAQ

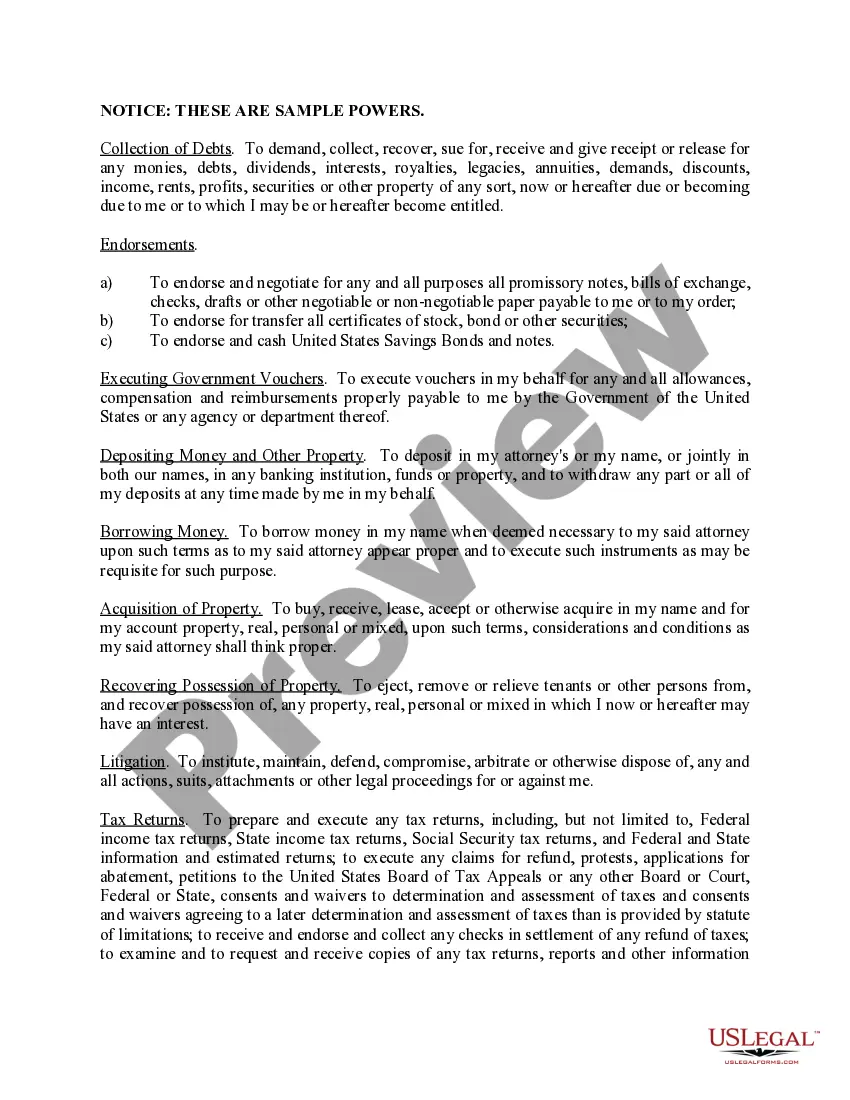

To add a power of attorney to your bank account, you typically need to provide the bank with a copy of the signed power of attorney document. It’s a good idea to also bring valid identification for both yourself and the individual receiving power. For a smooth process, ensure the power of attorney for your bank account adheres to the bank’s requirements; platforms like US Legal Forms can offer the necessary guidance.

A power of attorney allows one person to manage another’s bank account, making transactions and decisions on their behalf. The individual granted this power must act in the best interest of the account holder and follow any guidelines specified in the document. Understanding how a power of attorney for a bank account works is essential, and you can easily clarify this process with templates from US Legal Forms.

Banks are cautious about powers of attorney to prevent fraud and protect clients' financial assets. They want to ensure that any transaction is legitimate and authorized by the account holder. Consequently, clear and compliant documentation is crucial, and you might find using platforms like US Legal Forms helpful in meeting these demands.

A bank might deny a power of attorney if the document lacks necessary information, is not properly signed, or does not meet state requirements. Additionally, discrepancies in the identity of the person granting the power could raise concerns. It’s crucial to ensure your power of attorney for a bank account is valid and thorough to minimize the chances of denial.

The approval time for a power of attorney at a bank can vary depending on the institution's policies. Typically, banks review the document for accuracy and authenticity, which may take anywhere from a few hours to several days. To speed up the process, ensure the power of attorney for your bank account is clear and complete; consider using US Legal Forms to draft flawless documents.

In Tennessee, a power of attorney for a bank account must be in writing and signed by the person granting the authority. It’s important to specify what powers you are granting, such as accessing your bank account or handling financial transactions. Always check the latest state laws, or use US Legal Forms to ensure compliance and proper formatting.

To write a power of attorney letter for a bank, begin by clearly stating that you are granting the authority to another individual to manage your bank account. Include your full name, the name of the person receiving power, and specific details about the powers being granted. Make sure to sign and date the document. Consider using a platform like US Legal Forms for templates that simplify this process.

While a power of attorney for bank account can be incredibly helpful, it does come with some disadvantages. One major concern is the risk of misuse or abuse of power by the agent. Additionally, if the person granting the power loses capacity, the agent may make decisions without oversight. Therefore, choosing a trustworthy agent and understanding the implications of this arrangement is essential for peace of mind.

Typically, a power of attorney can add themselves to a checking account if the document grants such authority. However, the bank may have its specific requirements for adding an individual to an account, which often include presenting the power of attorney documents. It’s vital that the power of attorney clearly outlines the ability to add accounts to prevent misunderstandings in the future. Always consult with the bank to understand their process.

Yes, most banks do honor durable power of attorney documents, provided they are properly executed and meet the bank's requirements. However, policies may vary from one financial institution to another, so it is wise to check with your bank in advance. It’s crucial to ensure the document is clear and specifically states the authority regarding bank accounts. This way, you can avoid any potential issues when trying to access the account.