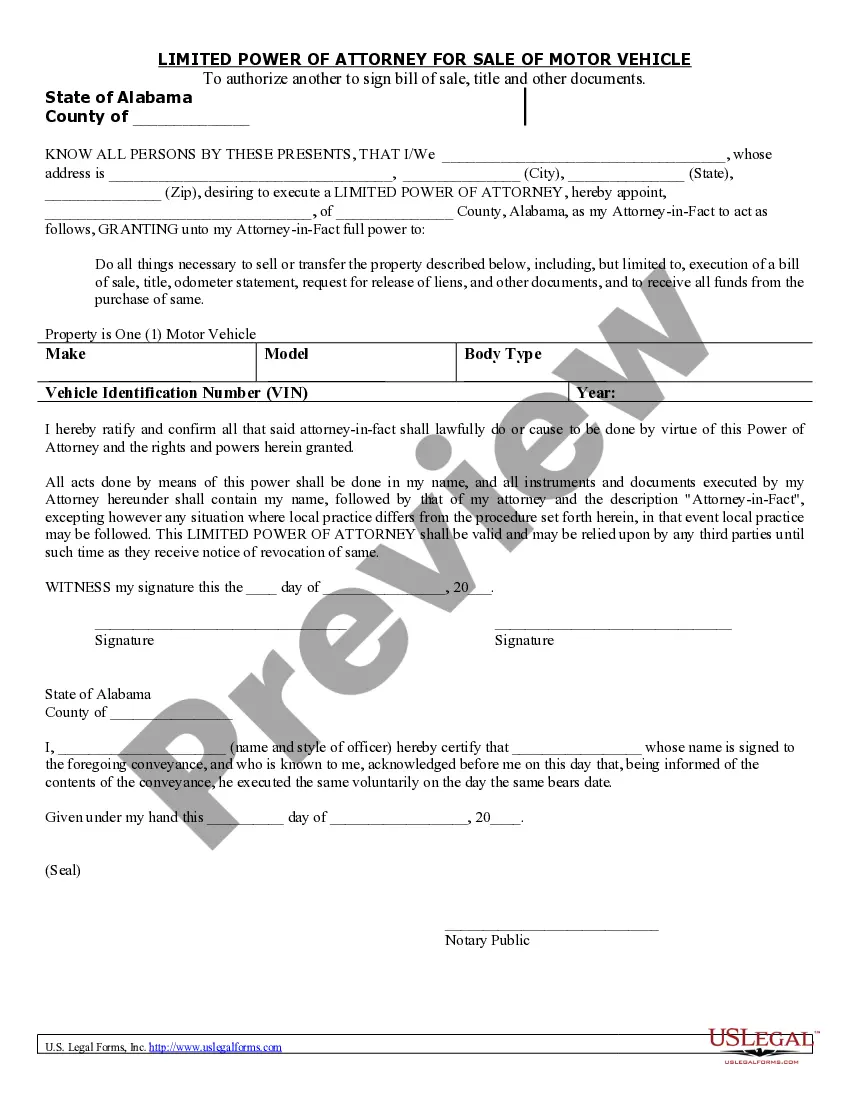

This is a limited power of attorney authorizing your agent to execute a bill of sale, title and other documents in connection with the sale of a motor vehicle. This form contains a state specific acknowledgment. This form allows your agent to do all things necessary to sell or transfer property, including the execution of a bill of sale, title, odometer statement, request for release of liens and other documents and to receive all funds from the purchase of the same.

Alabama Withholding Power Of Attorney

Description

How to fill out Alabama Power Of Attorney For Sale Of Motor Vehicle?

Bureaucracy necessitates exactness and correctness.

Unless you regularly handle the completion of paperwork like Alabama Withholding Power Of Attorney, it can result in some confusions.

Choosing the right sample from the beginning will guarantee that your document submission occurs smoothly and avoid any troubles of having to re-submit a document or redo the same task from the start.

If you are not a registered user, finding the required sample would involve a few additional steps.

- You can always procure the suitable sample for your documents at US Legal Forms.

- US Legal Forms is the largest online forms repository that contains over 85 thousand samples for various fields.

- You can obtain the most recent and appropriate version of the Alabama Withholding Power Of Attorney just by searching it on the website.

- Locate, store, and save templates in your profile or refer to the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can obtain, compile in one place, and review the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your forms list is kept.

- Browse through the descriptions of the forms and save those you need at any moment.

Form popularity

FAQ

The Alabama state tax rates depend on two factors: your adjusted gross income and filing status. Alabama state tax rates are at 2%, 4%, and 5%.

U.S. States that Require State Tax Withholding FormsAlabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.More items...

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

Companies who pay employees in Alabama must register with the AL Department of Revenue for a Withholding Account Number and register with the AL Department of Labor for an Unemployment Compensation Account Number. Register online with the AL Dept of Revenue to receive a Withholding Account Number within 5-7 days.