What is Power of Attorney?

Power of Attorney documents grant authority to a person to make decisions for you. They are often used in situations where you are unable to act. Explore state-specific templates for your needs.

Power of Attorney documents allow someone to act on your behalf. Attorney-drafted templates are quick and straightforward to fill out.

A collection of essential legal forms for planning later stages of life, ensuring your affairs are organized and secure.

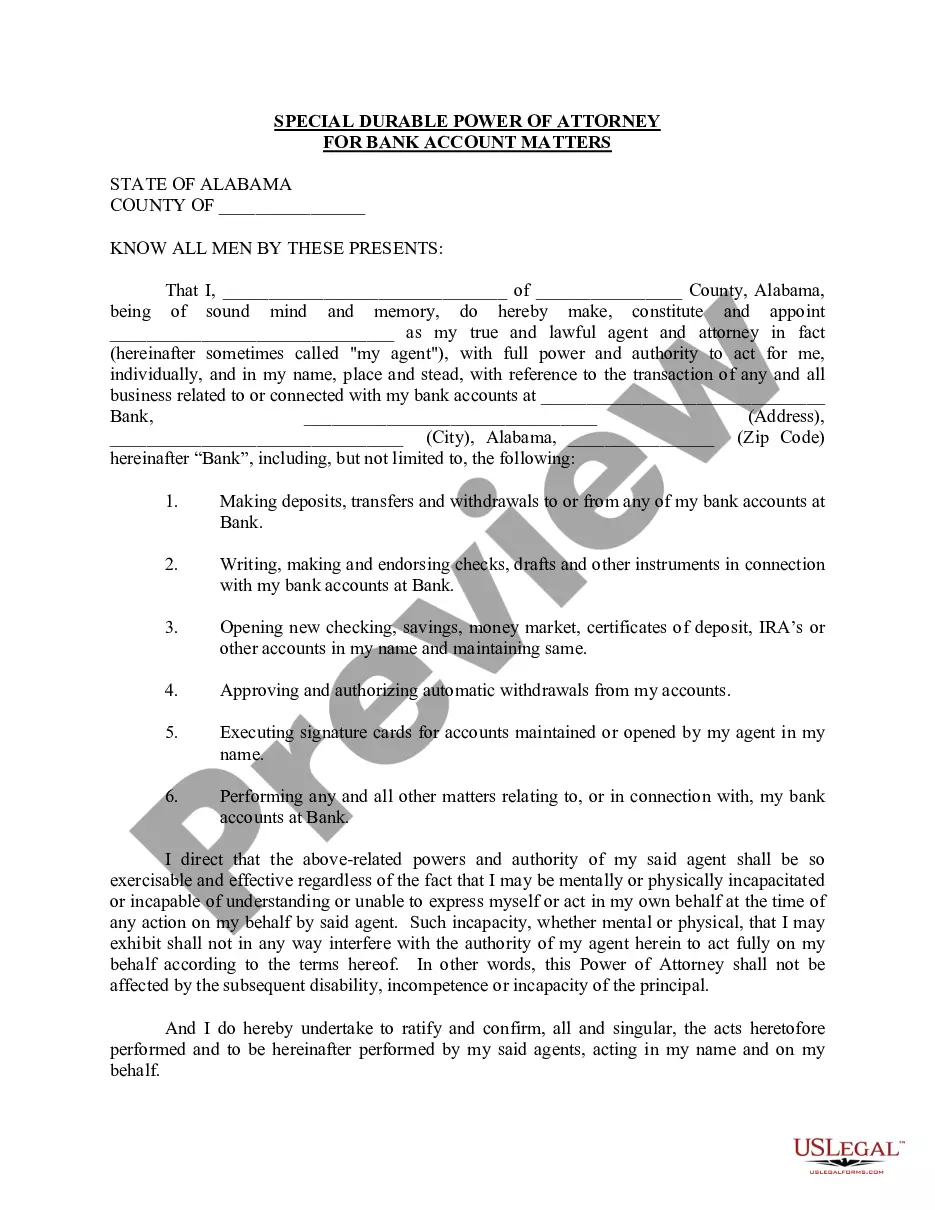

Designate someone to manage your financial affairs, even if you become incapacitated. This document offers immediate powers to your chosen agent.

Grant your chosen agent broad financial authority to manage your property if you become disabled or incompetent.

Prepare for future uncertainties with multiple related legal forms designed to protect your health and finances, all in one convenient package.

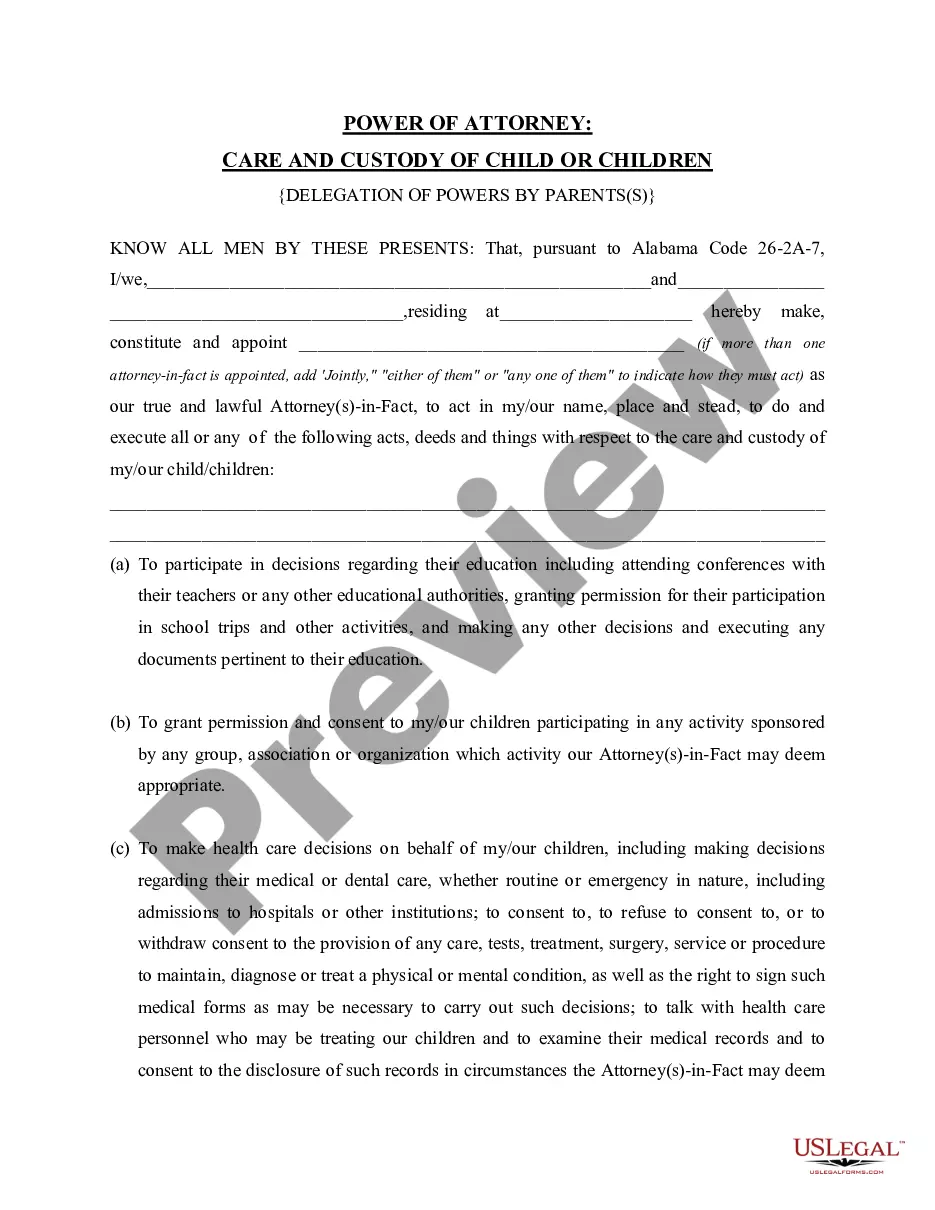

Delegate parental authority for child's education and health decisions to someone you trust.

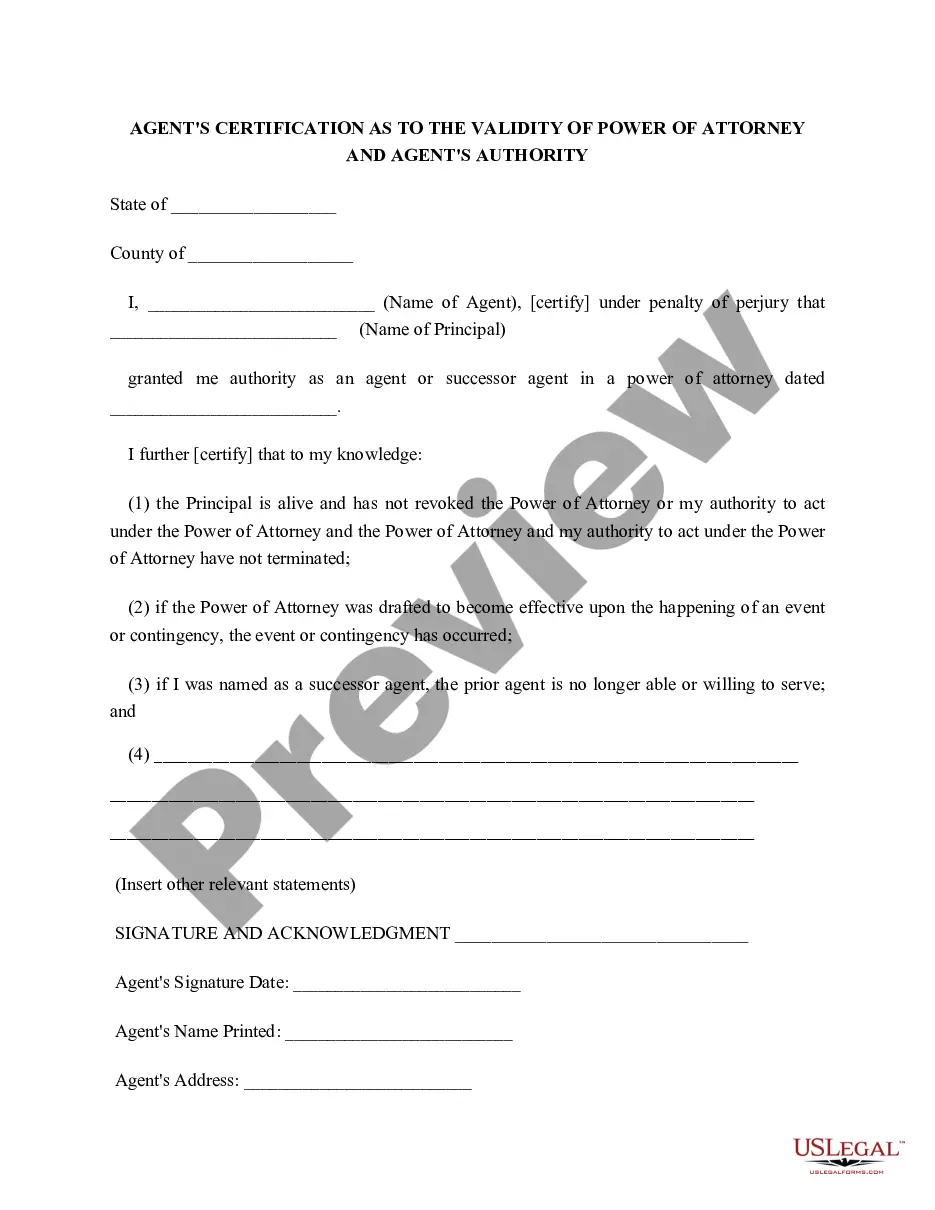

Certify the validity of a power of attorney to confirm your authority to act on someone else's behalf.

Access essential legal forms to ensure your healthcare wishes are honored and organized.

Empower someone to manage your bank account transactions, even if you become incapacitated.

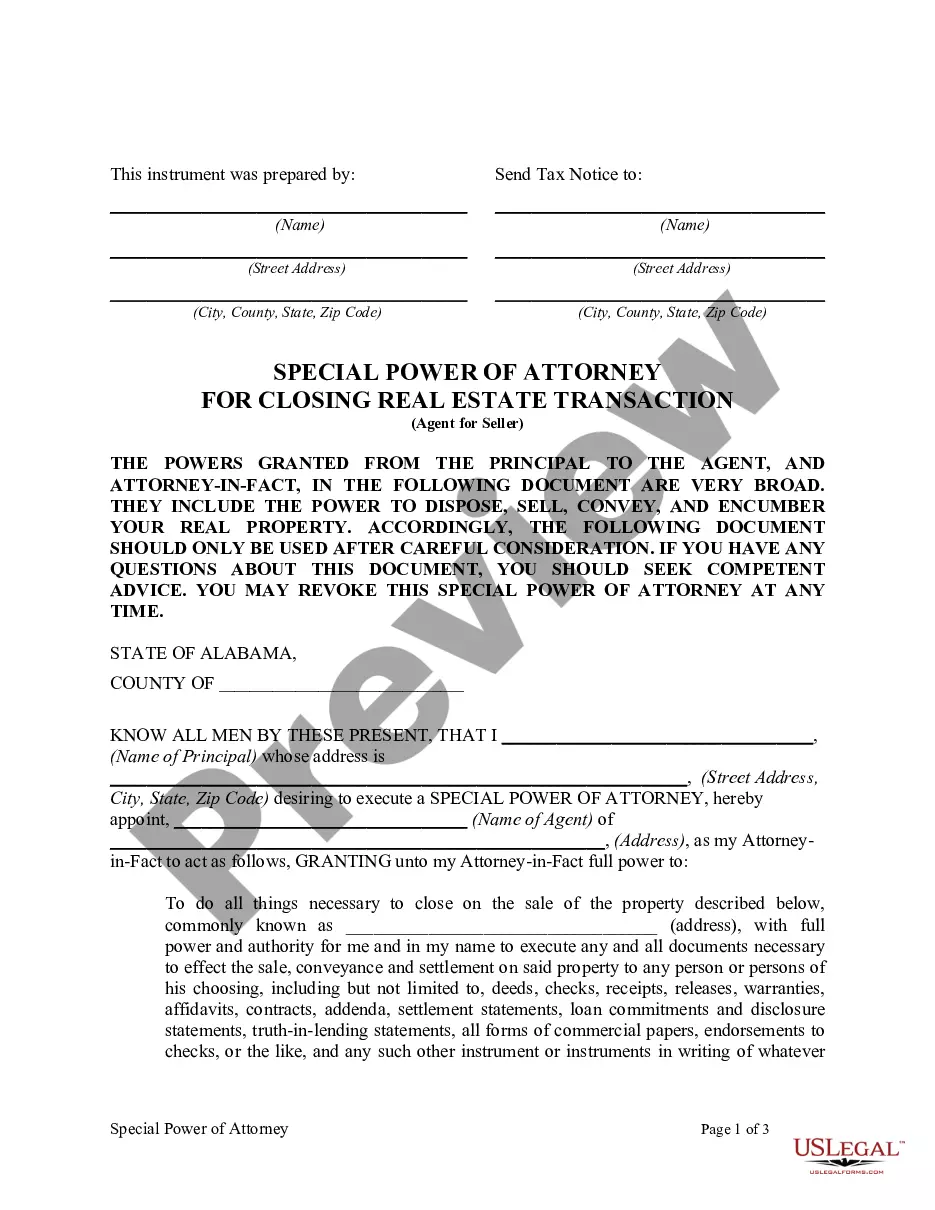

Empower someone to handle your real estate sale, including signing documents and collecting funds, with this specialized power of attorney.

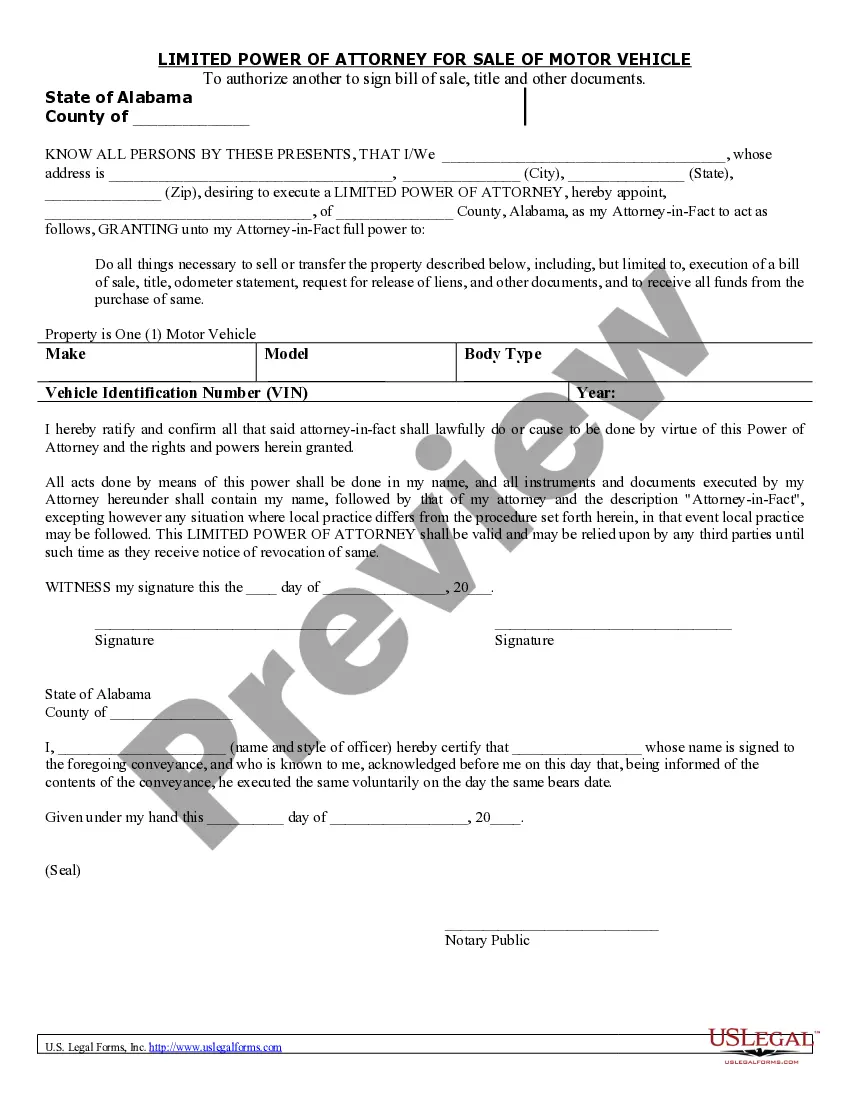

Authorize someone to sell your vehicle with this essential form, ensuring a smooth transfer of ownership and proper documentation.

Power of Attorney allows designated individuals to act on your behalf.

You can specify the powers granted in the document.

A Power of Attorney can be revoked at any time while competent.

An agent must act in your best interest and according to your wishes.

Documents may need notarization or witnesses for validity.

Different types serve various needs, from financial to healthcare decisions.

It's important to choose a trustworthy person as your agent.

Begin quickly with these steps.

A trust can help manage assets outside of probate, while a will handles distribution after death.

Without a plan, state laws will dictate asset distribution and decision-making.

Review your plan regularly or after major life events, such as marriage or relocation.

Beneficiary designations typically override your will, directing assets directly to named individuals.

Yes, you can appoint separate individuals for financial and healthcare decisions.