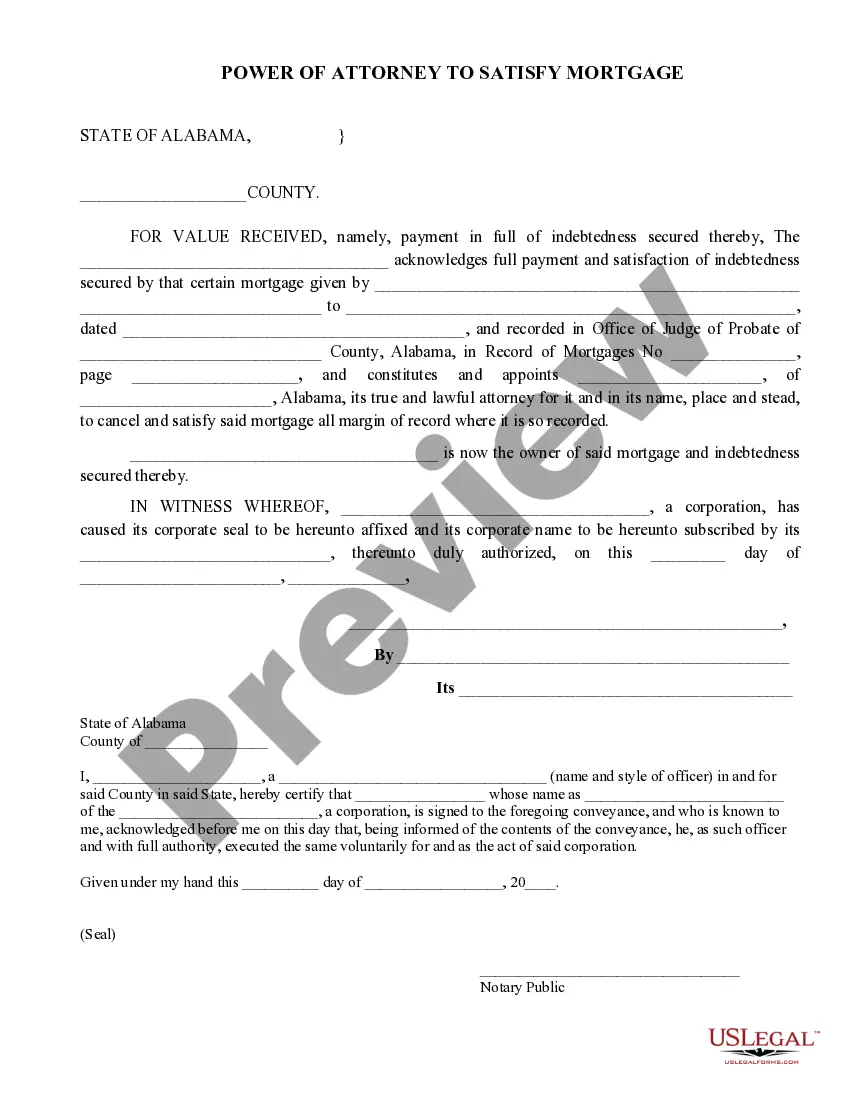

Power Of Attorney For A Mortgage Alabama Form 2848a

Description

How to fill out Alabama Power Of Attorney To Satisfy Mortgage?

There's no longer a necessity to squander hours searching for legal documents to satisfy your local state criteria. US Legal Forms has compiled all of them in one location and streamlined their availability.

Our website provides over 85,000 templates for various business and personal legal situations categorized by state and purpose.

All forms are properly drafted and verified for legitimacy, allowing you to feel confident in obtaining a current Power Of Attorney For A Mortgage Alabama Form 2848a.

Print your form to fill it out by hand or upload the sample if you choose to edit it online. Completing formal documentation under federal and state regulations is quick and easy with our platform. Experience US Legal Forms now to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, make sure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all downloaded documents whenever necessary by accessing the My documents section in your profile.

- If you are new to our platform, the process will require a few additional steps to finalize.

- Here's how new users can find the Power Of Attorney For A Mortgage Alabama Form 2848a in our repository.

- Examine the page content thoroughly to ensure it includes the sample you need.

- Utilize the form description and preview options, if available.

- Use the search field above to find another sample if the previous one was not suitable.

- Click Buy Now next to the template title once you identify the correct one.

- Select the most appropriate pricing plan and either create an account or Log In.

- Complete your subscription payment using a card or through PayPal to proceed.

- Select the file format for your Power Of Attorney For A Mortgage Alabama Form 2848a and download it to your device.

Form popularity

FAQ

The Alabama Electing Pass-Through Entity Tax Act (Act 2021-1 and Act 2021-423) allows Alabama S-Corporations and Subchapter K entities (pass-through entities or PTEs) to elect to pay Alabama income tax at the entity level.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

While Alabama does not technically require you to get your POA notarized, notarization is very strongly recommended. Under Alabama law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuinemeaning your POA is more ironclad.

The laws governing PoA forms vary in each state; however, in Alabama, your Power of Attorney will require notarization. If your agent will have the ability to handle real estate transactions, the Power of Attorney will need to be signed before a notary and recorded or filed with the county.

How To Get an Alabama Financial Power of Attorney FormChoose an agent. Your agent must be over age 18 and willing and able to act in your best interests.Assign duties to your agent. Your agent's duties depend entirely on you.Hire a notary public.Distribute copies.Revoking a Financial Power of Attorney.