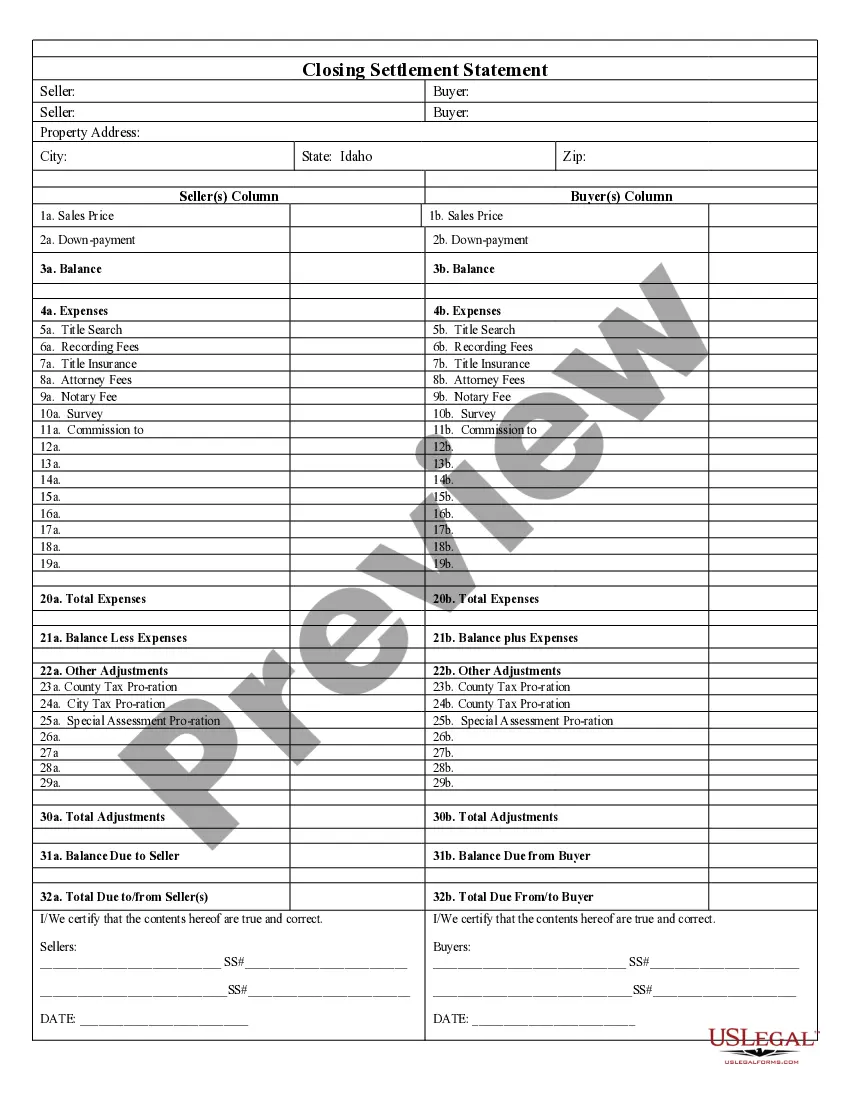

Alabama Trust Formation

Description

How to fill out Alabama Living Trust For Husband And Wife With Minor And Or Adult Children?

Managing legal documents can be exasperating, even for seasoned professionals.

When you are searching for an Alabama Trust Formation and lack the opportunity to invest time in finding the correct and current version, the process can be challenging.

US Legal Forms caters to all your requirements, encompassing personal and business documents, all centralized in one platform.

Leverage advanced tools to complete and manage your Alabama Trust Formation.

Here are the steps to follow after downloading the form you need: Confirm that this is the correct form by previewing it and reviewing its details; ensure that the template is acceptable in your state or county; select Buy Now when you are ready; choose a subscription plan; select the format you prefer, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- Tap into a comprehensive resource library filled with articles, guides, and materials pertinent to your situation and needs.

- Conserve time and energy in locating the necessary documents by using US Legal Forms’ sophisticated search and Preview feature to find Alabama Trust Formation and obtain it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to access the documents you have previously downloaded and to organize your files as desired.

- If this is your initial experience with US Legal Forms, establish an account to gain unrestricted access to all the advantages of the library.

- A robust online form repository could be transformative for anyone seeking to navigate these issues effectively.

- US Legal Forms stands as a frontrunner in online legal documentation, boasting over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can easily access various legal and business forms tailored to your state or county.

Form popularity

FAQ

In Alabama, the cost for comprehensive estate plan drafting can range from $1,200 to $4,250 or more, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Alabama can range from roughly $350 to $850. A Alabama trust typically costs anywhere between $1,200 and $2,950.

Funding a trust in Alabama involves transferring ownership of your assets into the trust. For real estate, this means preparing a new deed for the property in the name of the trust. For bank accounts, you would need to contact your bank to have them change the account holder to the trust.

It involves managing and distributing the assets within the trust ing to the grantor's instructions. In Alabama, the costs for trust administration can range from $1,800 to $4,250 or more, depending on the complexity of the trust and the services required.

To create your own living trust in Alabama, you need to first create or have the trust document created for you. It must include the name of the trustee and list your beneficiary or beneficiaries. This legal document must then be signed by the settlor in front of a notary public who will notarize the signature.

The net income shall be taxed at the rate of five percent. The separate trust shall not be allowed any personal exemption. (2) No item of income or loss shall be apportioned to any beneficiary of the trust from the separate trust described in subdivision (1).