Idaho Closing Statement

What is this form?

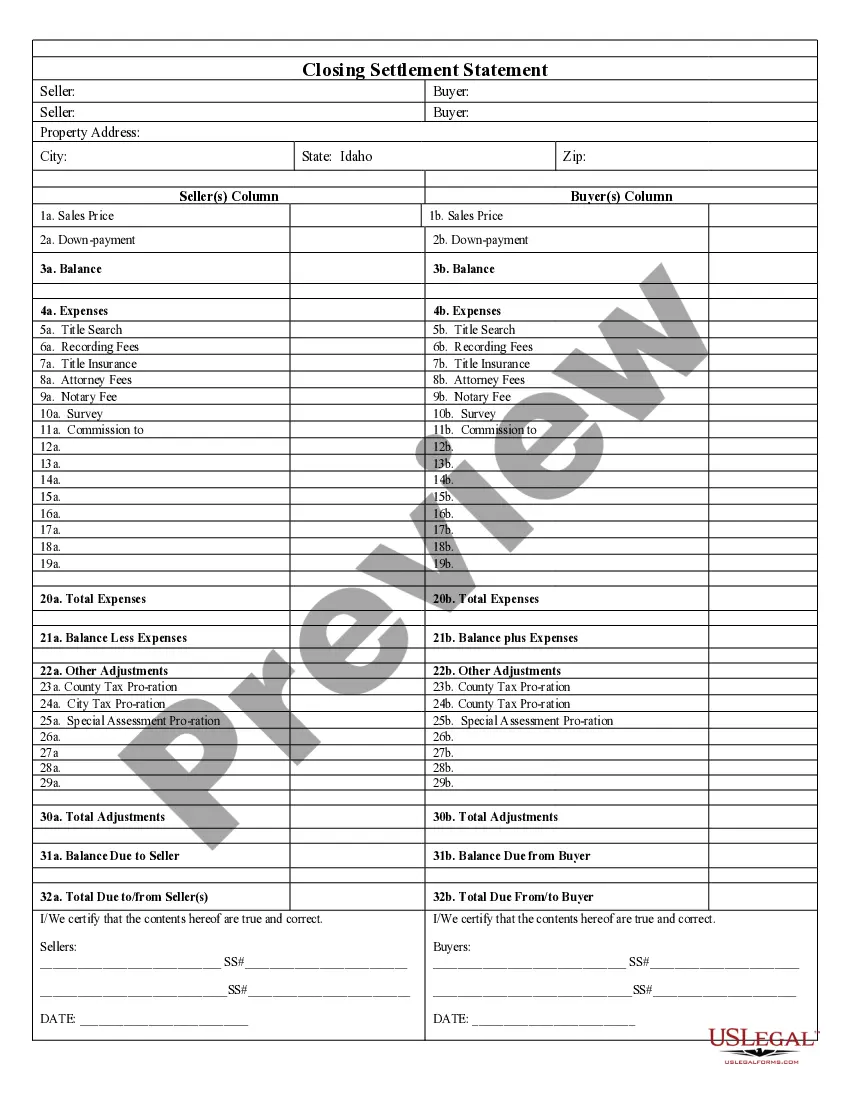

The Closing Statement is a vital document used in real estate transactions, particularly for cash sales or owner-financed deals. This form details all the financial aspects of the transaction, providing a clear account of expenses and balances between the buyer and seller. Unlike other real estate forms, the Closing Statement is specifically designed to capture the final settlement details and is signed by both parties to verify its accuracy.

What’s included in this form

- Balance: Shows the total amount due from the buyer or to the seller.

- Expenses: Lists all costs associated with the transaction, including title searches, recording fees, and attorney fees.

- Title Insurance: Specifies the cost associated with the title insurance policy.

- Notary Fee: Outlines any applicable fees for notarizing the document.

- Adjustments: Covers prorations for taxes, assessments, and other financial adjustments between the parties.

- Signatures: Both buyer and seller must sign to certify the document's accuracy.

When this form is needed

This form is necessary during the closing phase of a real estate transaction. It should be used when a property is sold via cash payment or when the seller provides financing. The Closing Statement ensures both parties are aware of the financial details, confirming that all expenses are accounted for before finalizing the sale.

Who needs this form

- Buyers and sellers involved in a real estate transaction.

- Real estate agents or brokers facilitating a sale.

- Attorneys assisting clients with real estate closings.

Completing this form step by step

- Identify the parties involved, including both the seller and buyer.

- Enter the property details and transaction type (cash or owner financing).

- List all expenses, including fees for services, taxes, and insurance.

- Calculate total adjustments and balances to determine amounts due.

- Have both parties review the document for accuracy and sign it.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all relevant expenses can lead to disputes later.

- Not verifying the accuracy of the signer details can invalidate the form.

- Neglecting to adjust for property taxes may result in unexpected costs.

Why use this form online

- Convenient access allows for quick completion and downloading.

- Editable fields ensure all specific details can be included easily.

- Reliable templates crafted by licensed attorneys for legal adequacy.

Looking for another form?

Form popularity

FAQ

Step 1: File a petition to begin probate. You'll have to file a request in the county where the deceased person lived at the time of their death. Step 2: Give notice. Step 3: Inventory assets. Step 4: Handle bills and debts. Step 5: Distribute remaining assets. Step 6: Close the estate.

There is a general rule that executors have an 'executor's year' to complete the estate administration. This means that you should be aiming to have the estate finalised and distributed within 12 months from the date of death.

Closing the bank account typically is the last step after the court or beneficiaries have approved the executor's accounting and the estate is ready to close. There may be a few final bills requiring payment, such as compensation to the executor for her services.