Alabama Family Trust Forms

Description

Form popularity

FAQ

In Alabama, a trust operates by designating a trustee who manages the assets on behalf of the beneficiaries. When you complete your Alabama family trust forms, you clearly outline how the assets should be handled during your lifetime and after your passing. The trustee is responsible for adhering to these instructions, providing both flexibility and protection for your loved ones. Understanding the trust’s terms and conditions helps ensure that your intentions are honored.

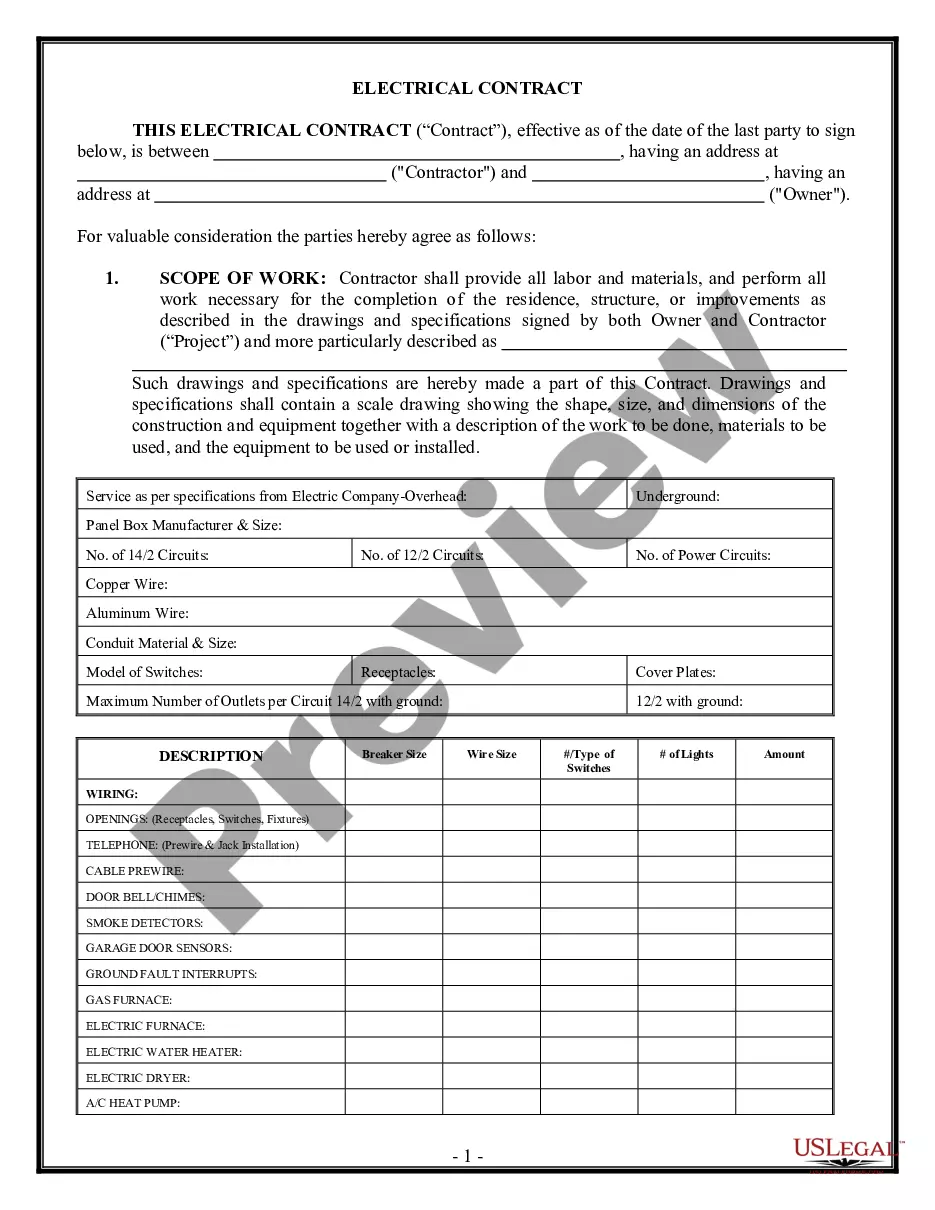

Structuring a family trust typically involves deciding on the type of trust you want, such as a revocable or irrevocable trust. Next, you will need to fill out the necessary Alabama family trust forms, detailing the grantor, beneficiaries, and how you want the assets managed. It’s important to specify the roles of trustees and to consider tax implications. For streamlined guidance, consider using platforms like uslegalforms to ensure everything is set up correctly.

One major mistake parents often make is failing to adequately fund the trust. Many believe that simply creating Alabama family trust forms is enough, but without transferring assets into the trust, it holds no value. Additionally, parents may overlook updating the trust as their circumstances change, such as adding new children or changing beneficiaries. Always review and revise your trust for it to serve its intended purpose.

Filing a trust in Alabama involves several steps, starting with the creation of the trust document using appropriate Alabama family trust forms. Once the trust document is ready, it should be signed and notarized to ensure its validity. Depending on your specific situation, you may also need to file the trust with the local court, especially if you are transferring real estate or other assets into the trust. Utilizing services like US Legal Forms can facilitate this process and provide necessary guidance.

In Alabama, trusts must adhere to specific rules set forth by state law. These include valid creation of the trust through written documentation and proper execution of the Alabama family trust forms. The trust must clearly define the roles of the trustee and the beneficiaries, and it must not contravene any existing laws. It is advisable to consult with a legal expert to ensure full compliance.

In Alabama, a trust generally does not need to be recorded with a government office. However, some forms of property, especially real estate, may require a deed transfer to avoid public disclosure. Utilizing the right Alabama family trust forms can clarify your responsibilities and ensure your assets are protected without unnecessary complications.

Creating a family trust in Alabama involves several key steps. First, you will need to choose the appropriate Alabama family trust forms that align with your specific needs. After completing the necessary forms, you must fund the trust by transferring assets into it. Consulting with a legal professional can ensure that your trust meets all regulations and functions as intended.

One downside of a family trust is the potential for complexity. Setting up Alabama family trust forms can involve intricate legal and financial considerations, which may require professional assistance. Additionally, while family trusts can offer privacy and asset protection, they may also entail ongoing management responsibilities that some individuals find cumbersome.