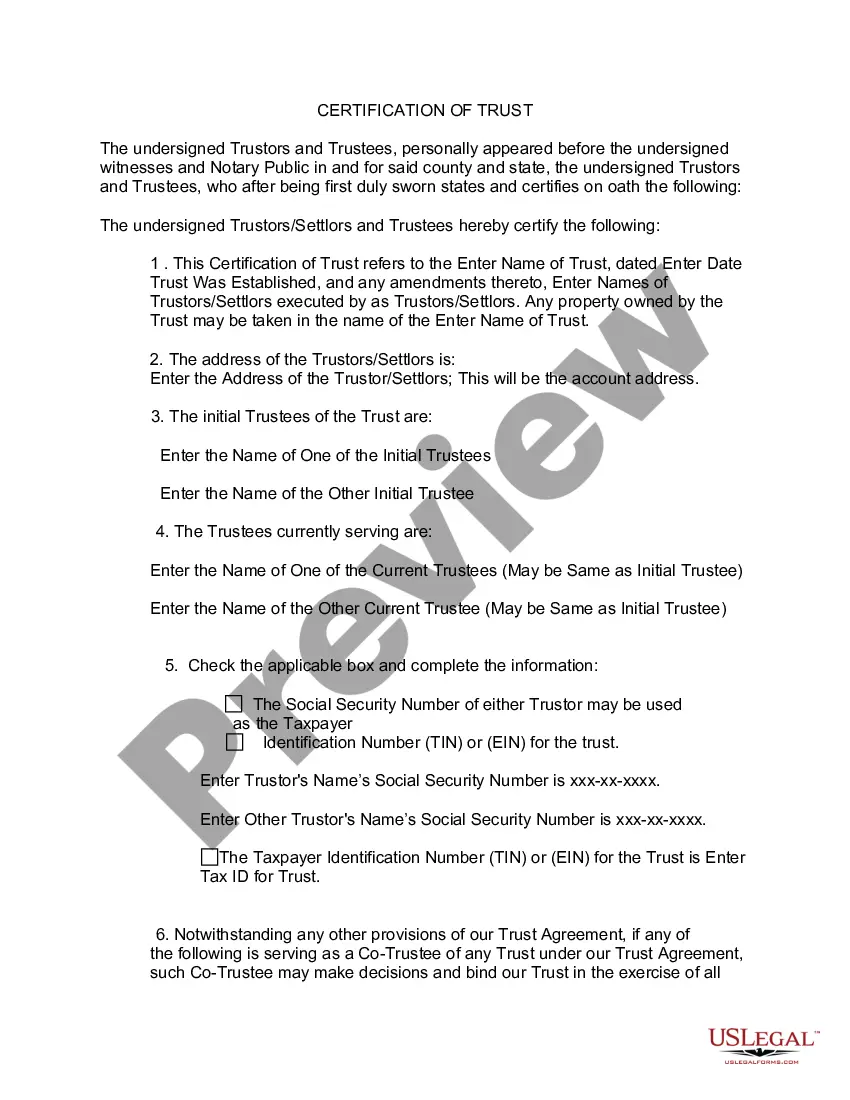

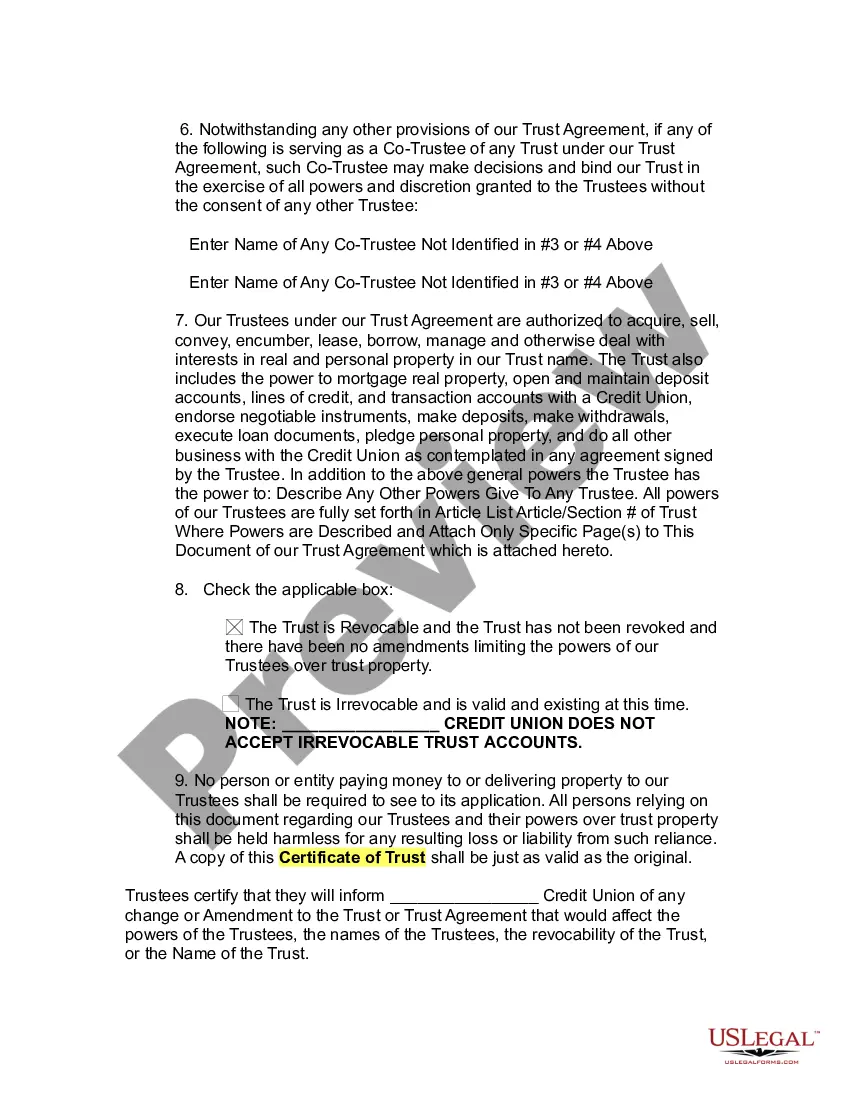

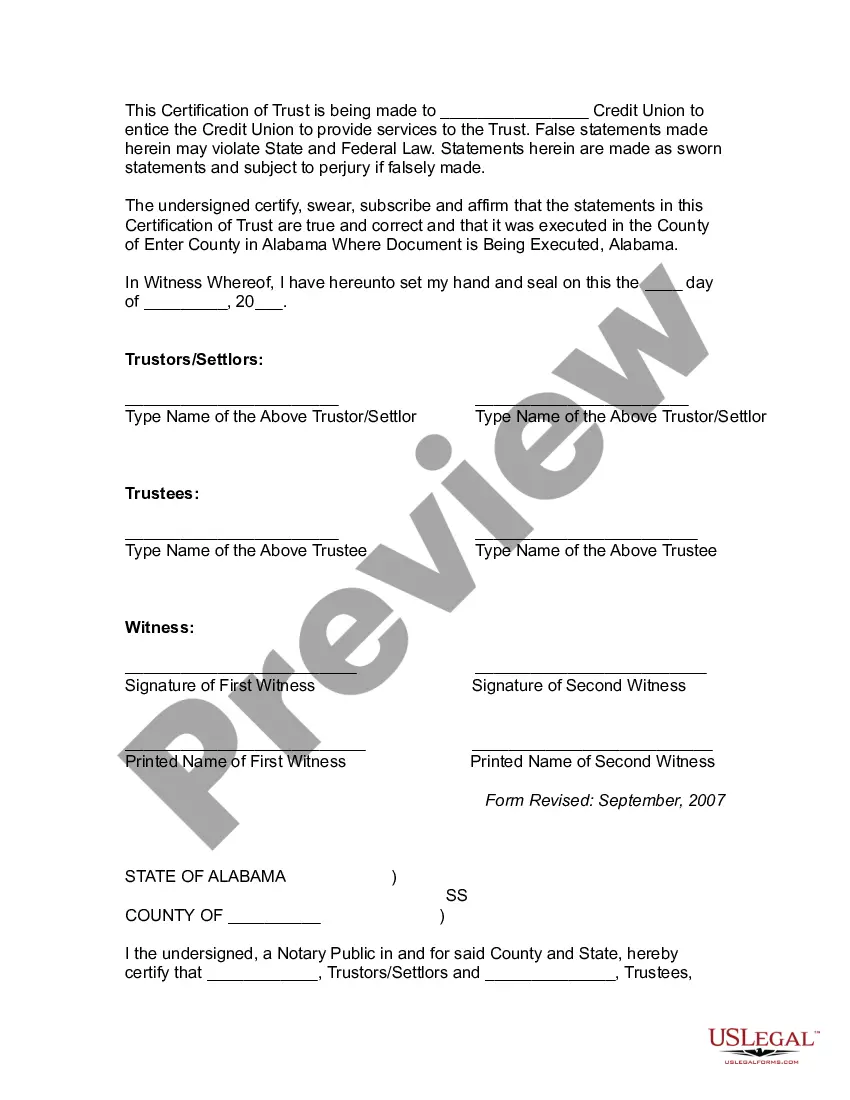

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

Alabama Trusts Certificate Withholding

Description

Form popularity

FAQ

A withholding certificate in Alabama refers to a document that provides specific instructions regarding the amount of income tax to be withheld. Trusts may need these certificates to ensure compliance with Alabama trusts certificate withholding requirements. Obtaining a withholding certificate not only streamlines tax processes but also helps clarify responsibilities. Utilizing platforms like US Legal Forms can simplify the acquisition of these necessary documents.

Yes, Alabama does tax trusts. Trusts are subject to state income tax, similar to individual taxpayers. The taxation rates depend on the income generated by the trust. Understanding how Alabama trusts certificate withholding applies to specific trust situations can help manage tax liabilities effectively.

In Alabama, specific tax withholding requirements apply to various entities, including trusts. Trusts must comply with state regulations regarding Alabama trusts certificate withholding, ensuring that a proper percentage of income tax is deducted. Each trust should obtain the appropriate certificates to align with withholding obligations. By following these guidelines, you can avoid penalties and ensure tax compliance.

To obtain a tax exempt certificate in Alabama, you must meet certain eligibility criteria set by the state. Start by completing the appropriate application form, which may vary based on your organization type. Once your application is submitted and approved, you will receive your tax exempt certificate. For streamlined access and guidance, consider leveraging US Legal Forms, which offers resources to help navigate Alabama trusts certificate withholding efficiently.

To generate a withholding certificate in Alabama, you need to complete the IRS Form W-8 or W-9, depending on your specific circumstances. This form helps you certify your taxpayer status and ensures proper reporting of income. After filling it out, submit it to your financial institution or employer for processing. Using a reliable resource, like US Legal Forms, can simplify this process and ensure you comply with all regulations regarding Alabama trusts certificate withholding.

The A4 form is an Employee’s Withholding Exemption Certificate used in Alabama for withholding tax purposes. This form allows employees to claim exemptions from withholding, which can impact the amount of tax withheld from their paychecks. Understanding the implications of the A4 form is vital for anyone involved in Alabama trusts certificate withholding, as it can influence tax management for trusts. Proper completion of the form aids in ensuring compliance with Alabama tax regulations.

Yes, withholding can be distributed on a trust in Alabama. Trusts often earn income that may be subject to withholding taxes, depending on the type of income involved. By understanding Alabama trusts certificate withholding, trustees can make informed decisions regarding tax distributions. This approach helps ensure compliance while also effectively managing trust income and distributions.

To apply for a withholding account in Alabama, you need to complete the appropriate application forms provided by the Alabama Department of Revenue. This process typically includes providing your business information, such as your Employer Identification Number (EIN). It's essential to ensure that your application accurately reflects your obligations related to Alabama trusts certificate withholding, especially if your business involves trust operations. Once approved, you can manage your withholding tax responsibilities more effectively.

In Alabama, withholding tax applies to various types of income, including salaries and wages. Employers must calculate and withhold a certain percentage based on employee earnings. Additionally, understanding Alabama trusts certificate withholding ensures that tax obligations are met for income generated by trusts. By following these rules, both employers and employees can avoid penalties and ensure compliance.

The amount you should withhold for Alabama taxes can depend on several factors, including your filing status, number of allowances, and income level. To estimate your withholding accurately, refer to the Alabama Department of Revenue’s guidelines. The Alabama trusts certificate withholding framework helps you understand your obligations better. For detailed calculations and resources, USLegalForms can assist you in determining the right withholding amounts.