Garnishments For Tipped Employees

Description

Form popularity

FAQ

The IRS can garnish up to 25% of your disposable income for tax debts, but this limit can change based on personal circumstances and filing status. For tipped employees, it's vital to factor in how fluctuating wages influence this garnishment. If you need clarity on handling IRS garnishments, resources like US Legal Forms provide valuable assistance.

The federal minimum wage for tipped employees is set at $2.13 per hour, provided they earn sufficient tips to reach at least the standard minimum wage of $7.25 per hour overall. This wage structure significantly impacts how much can be garnished from tipped employees' paychecks. If you find yourself navigating garnishments for tipped employees, it's essential to know your rights regarding minimum wage.

The maximum amount that can be garnished from a paycheck depends on the type of debt involved and federal guidelines. Generally, 25% of disposable earnings is the cap, but state laws might impose stricter restrictions. If you're a tipped employee, understanding these rules on garnishments for tipped employees is crucial to protecting your paycheck.

A creditor can garnish up to 25% of your disposable earnings or the amount by which your weekly wages exceed 30 times the federal minimum wage, whichever is less. This applies to various debts and is especially relevant for tipped employees, who may experience fluctuating income. Knowing the limits helps you manage garnishments for tipped employees more effectively.

The maximum garnishment for an employee is typically calculated based on disposable income, which is the amount left after legally required deductions. For tipped employees, this amount can vary, reflecting factors like paycheck size and local laws. It's essential to understand how garnishments for tipped employees can impact your overall earnings.

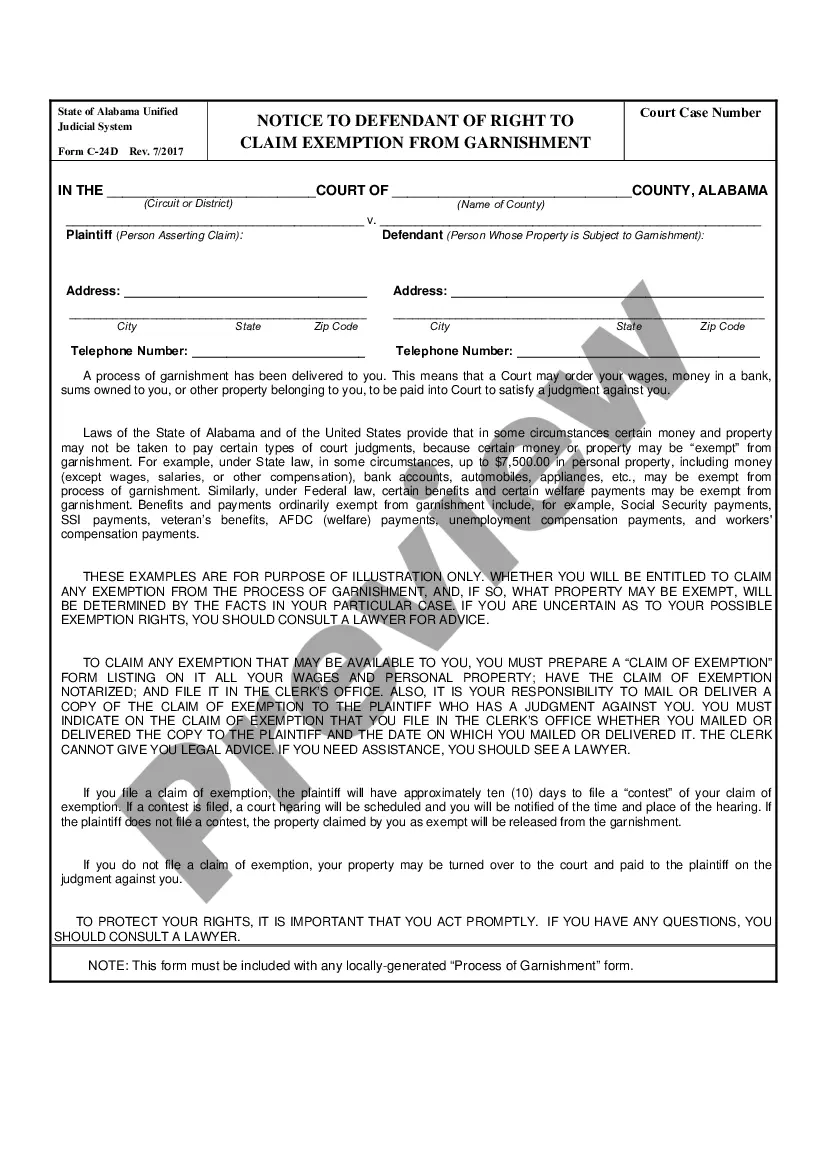

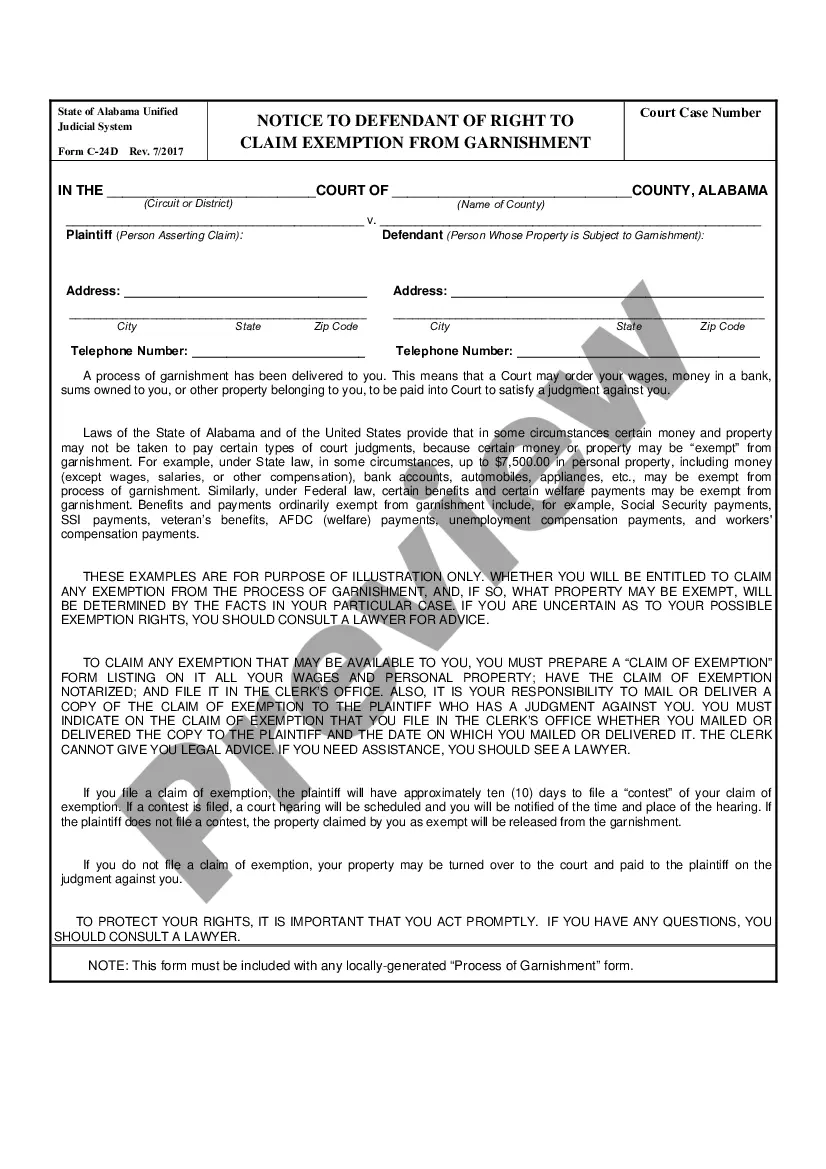

In Alabama, the maximum amount that can be garnished from wages is similar to federal limits, allowing garnishments of up to 25% of disposable income. This also applies to tipped employees, whose total income, including tips, should be factored in when determining garnishment amounts. For detailed information specific to your situation, exploring the US Legal Forms platform can help ensure you are well-informed about your rights and obligations.

The most your wages can be garnished generally falls under federal guidelines, which cap the garnishment at 25% of disposable earnings. However, specific regulations may vary by state, affecting how much can ultimately be withheld from your paycheck as a tipped employee. Understanding these limits can help you manage your finances effectively, so consider consulting resources like US Legal Forms for personalized assistance.

The maximum amount that can be garnished from your paycheck varies by federal and state law, but generally, wage garnishments cannot exceed 25% of your disposable earnings. For tipped employees, it's crucial to account for your total earnings, including tips, when calculating this limit. If you are unsure about how much can be garnished from your wages, the US Legal Forms platform can provide clear guidance tailored to your situation.

Navigating garnishments for tipped employees can be challenging, but understanding your rights is essential. Often, employers must follow specific legal guidelines before garnishing wages. You might explore options like negotiating with creditors or entering a payment plan. For tailored assistance, platforms like US Legal Forms can provide valuable resources to help you address wage garnishments effectively.

Yes, tips can be subject to wage garnishment under certain circumstances. When an employee has outstanding debts, a court may issue a garnishment order that affects both their regular wages and tips. It's important for tipped employees to know this, especially when dealing with financial obligations. USLegalForms provides resources to help you understand garnishments for tipped employees and what rights you have.