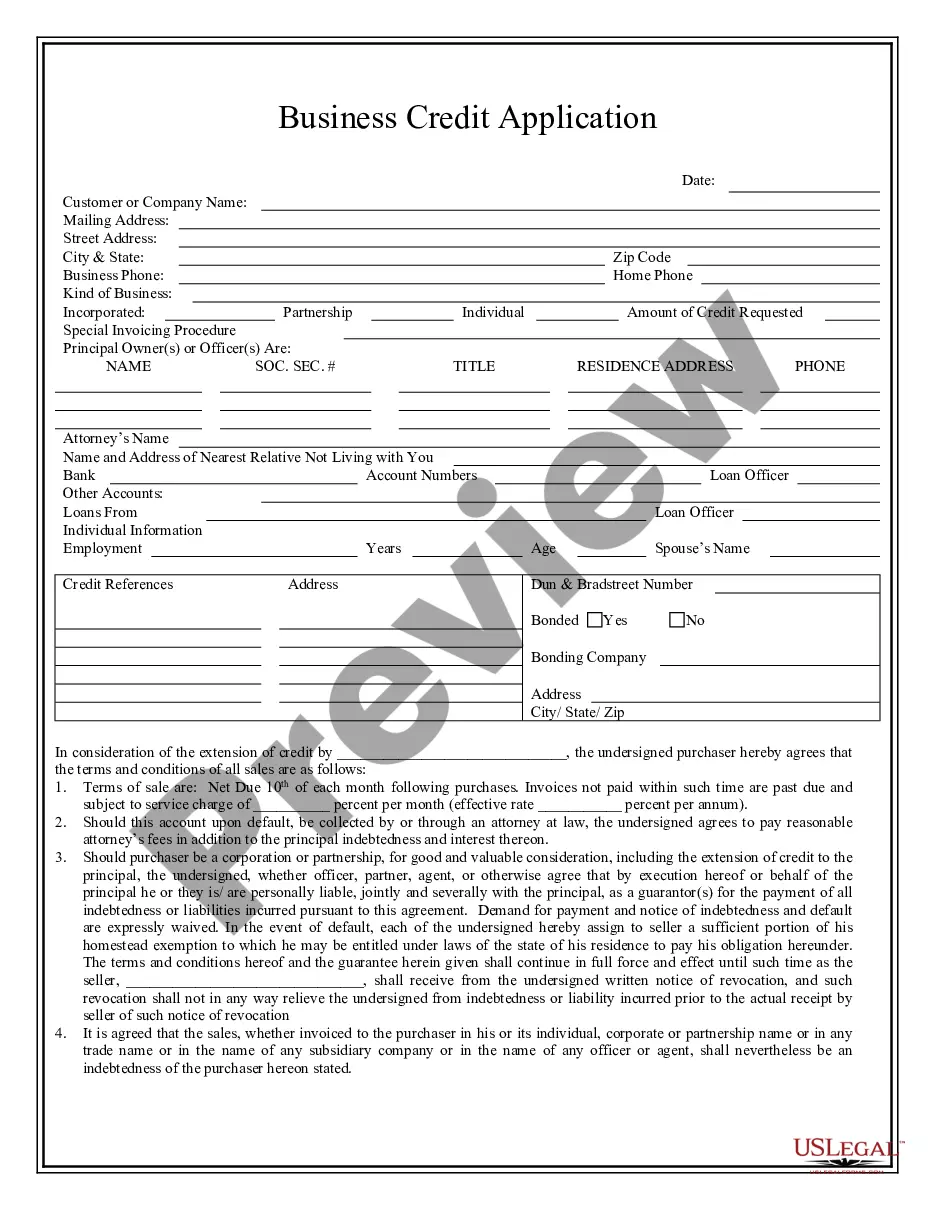

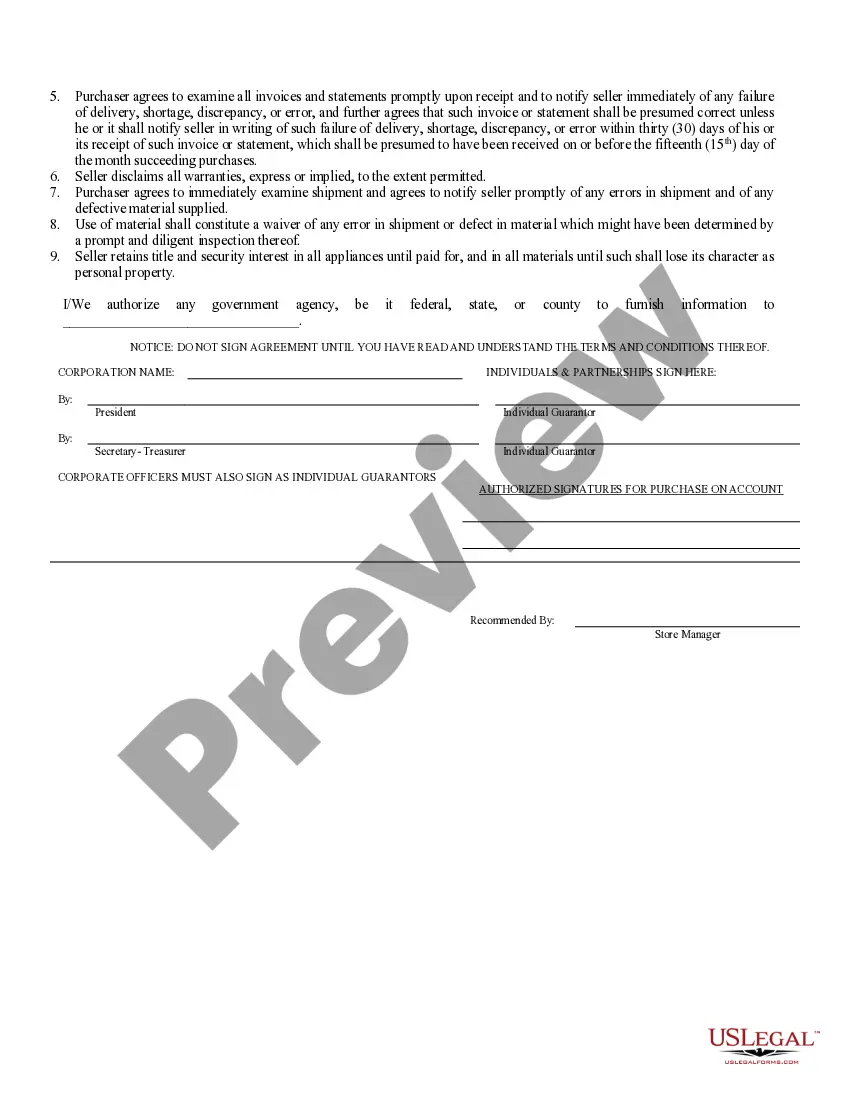

Business Credit Application With Personal Guarantee Template

Description

How to fill out Alabama Business Credit Application?

- Log in to your US Legal Forms account if you're a returning customer. Ensure your subscription is active or renew it as required.

- If you're new to the service, start by checking out the Preview mode and description to find the right form that meets your local jurisdiction's requirements.

- In case the form doesn't fit your needs, utilize the Search feature to discover alternatives that suit your requirements.

- Click the Buy Now button for your chosen document and select a subscription plan that works for you. Note that registration is necessary to access comprehensive resources.

- Proceed to checkout by entering your payment information, using either a credit card or a PayPal account.

- Once your purchase is complete, download the template to your device. You can access your documents anytime in the My Forms section of your profile.

In summary, using the US Legal Forms service for your business credit application can simplify the often daunting task of legal documentation. With over 85,000 forms at your fingertips and the option to consult premium experts, you can ensure accuracy and compliance.

Don’t wait – get started today and secure your business's financial future with the right legal templates!

Form popularity

FAQ

Yes, a personal guarantee can show up on your personal credit report. If you default on a business debt, the lender has the right to pursue your personal assets. Therefore, when utilizing a business credit application with personal guarantee template, be mindful of your personal financial position. This awareness can help you make informed decisions about your business's borrowing strategy.

Most business credit cards require a personal guarantee, especially for small businesses. This means you agree to be personally responsible for the debt if the business defaults. When you fill out a business credit application with personal guarantee template, this guarantee is often highlighted. It's vital to understand the implications of this before applying.

Yes, lenders usually review your personal credit when you apply for business credit. This practice is common, particularly for new businesses that lack established credit histories. A business credit application with personal guarantee template often triggers this review, as it secures the lender's interest. Understanding this can help you prepare your personal finances ahead of time.

To create a business credit application form, outline the essential information you need. This typically includes business name, type, financial statements, and personal credit details. Using a business credit application with personal guarantee template can simplify this process. You can find useful templates on platforms like US Legal Forms, which provide a structured way to gather necessary information.

In many cases, a business line of credit can show up on your personal credit if you have signed a personal guarantee. When you utilize a business credit application with personal guarantee template, the lender may report your credit activity to personal credit bureaus. This means that any missed payments or defaults can impact your personal credit score, making it important to manage your business finances prudently.

Yes, your personal credit can affect your LLC, especially when applying for loans or credit lines. Lenders often check your personal credit history when reviewing your business credit application with personal guarantee template. This can influence their decision on approvals and interest rates. Therefore, maintaining a good personal credit score is essential for your business's financial opportunities.