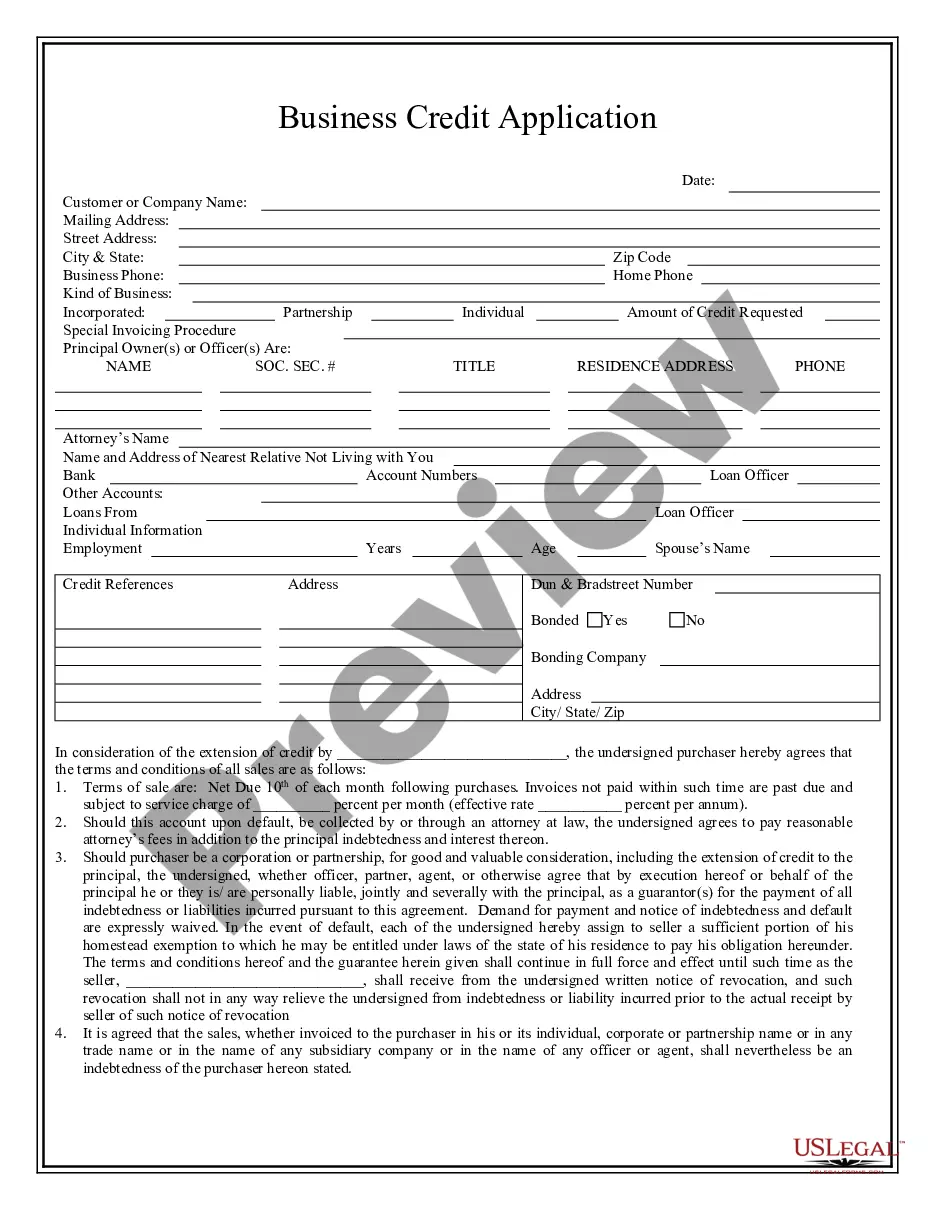

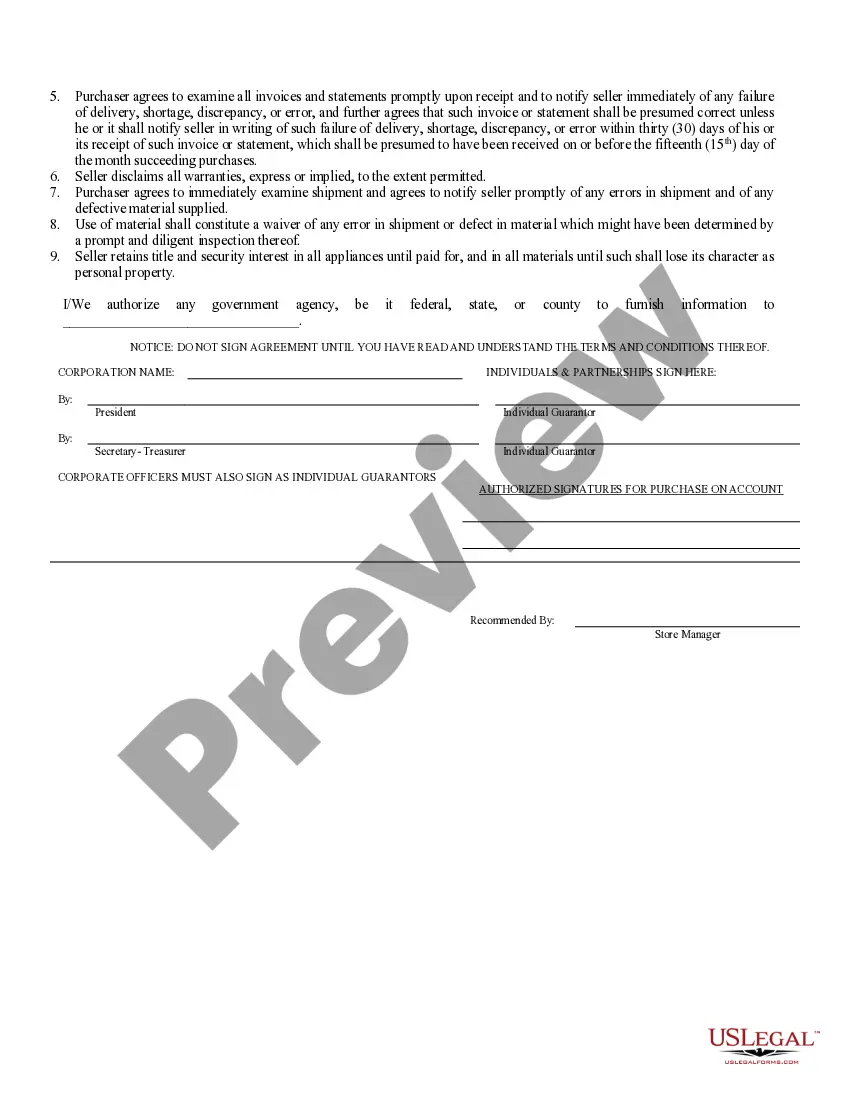

Business Credit Application Example

Description

How to fill out Alabama Business Credit Application?

- If you are a returning user, log in to your account and locate the specific form template you need. Click the Download button to save it to your device. Ensure your subscription is active; if not, renew it as per your payment plan.

- For first-time users, begin by previewing the available forms. Carefully review the descriptions to confirm you have selected the right document that aligns with your local requirements.

- If you need to refine your search, utilize the Search tab to find more templates. When you spot the correct one, proceed with the next step.

- To acquire the document, select the Buy Now button and pick a subscription plan that suits you. You'll need to create an account for access.

- Complete your purchase by entering your payment details through a credit card or PayPal account.

- Finally, download the form and save it on your device. You can access it anytime via the My Forms section in your account.

By choosing US Legal Forms, you gain the advantage of a robust collection of forms, surpassing competitors with over 85,000 fillable and editable documents. Furthermore, you can access premium experts to assist you in completing your forms accurately.

In conclusion, utilizing US Legal Forms for your business credit application needs simplifies the process, ensuring you have access to the right tools and support. Start your journey today, and experience their comprehensive library!

Form popularity

FAQ

For new business credit, you should estimate your expected annual revenue based on your business plan and projected sales. If your business is still in the startup phase, it's acceptable to provide a realistic projection instead of actual figures. Using a detailed business credit application example can help clarify what figures are appropriate, ensuring transparency in your application.

To fill out a business credit card application, start by gathering all necessary documents such as your financial records and business details. Ensure that you provide accurate and honest information where asked, particularly regarding income and debt levels. Following a comprehensive business credit application example can guide you through the process carefully.

Getting approved for a business credit card can vary based on your business's financial health and credit history. While it may seem daunting, having a solid business credit application example and demonstrating good credit practices can significantly increase your chances of approval. You can take proactive steps to improve your credit position before applying.

Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) when applying for credit as a business owner. This is particularly advantageous for business credit applications, as it can help protect your personal information and strengthen your business credit profile.

The 5 C's of credit for small business evaluate creditworthiness and provide valuable insights to lenders. These include Character, Capacity, Capital, Conditions, and Collateral. Understanding these factors will strengthen your business credit application example, while also helping you prepare for any lender inquiries.

When completing a business credit card application, you should include essential details such as your business name, type of business entity, and employer identification number (EIN). Additionally, provide information about your annual revenue and the total number of employees. A well-prepared business credit application example can make this process much smoother.

A business credit application example typically involves a document that outlines your company’s financial information and creditworthiness. This document allows lenders to evaluate your business’s ability to repay loans or credit lines. By providing an example, you can see what details to include, such as income statements, tax returns, and business plans. Using tools like US Legal Forms can help you create a professional business credit application that meets lender expectations.

Typically, it takes about three to six months for an LLC to generate a credit score after establishing credit accounts. During this period, maintaining timely payments and a low debt-to-credit ratio is crucial. Utilize a business credit application example to understand how credit accounts positively influence your score. This proactive approach will help your LLC build a solid credit rating over time.

The fastest way to secure business credit for your LLC is to establish a strong business foundation and apply for credit with reputable lenders. Start by obtaining an Employer Identification Number (EIN) and registering with business credit bureaus. You can refer to a business credit application example to guide you through applying efficiently. Following these steps paves the way to faster credit approval and better terms.

Yes, you can include expected income on a business credit card application. This information helps lenders assess your ability to repay the credit extended to your LLC. A business credit application example often specifies how to accurately report your income. Be honest and realistic about your expected earnings to avoid complications later.