Leased

Description

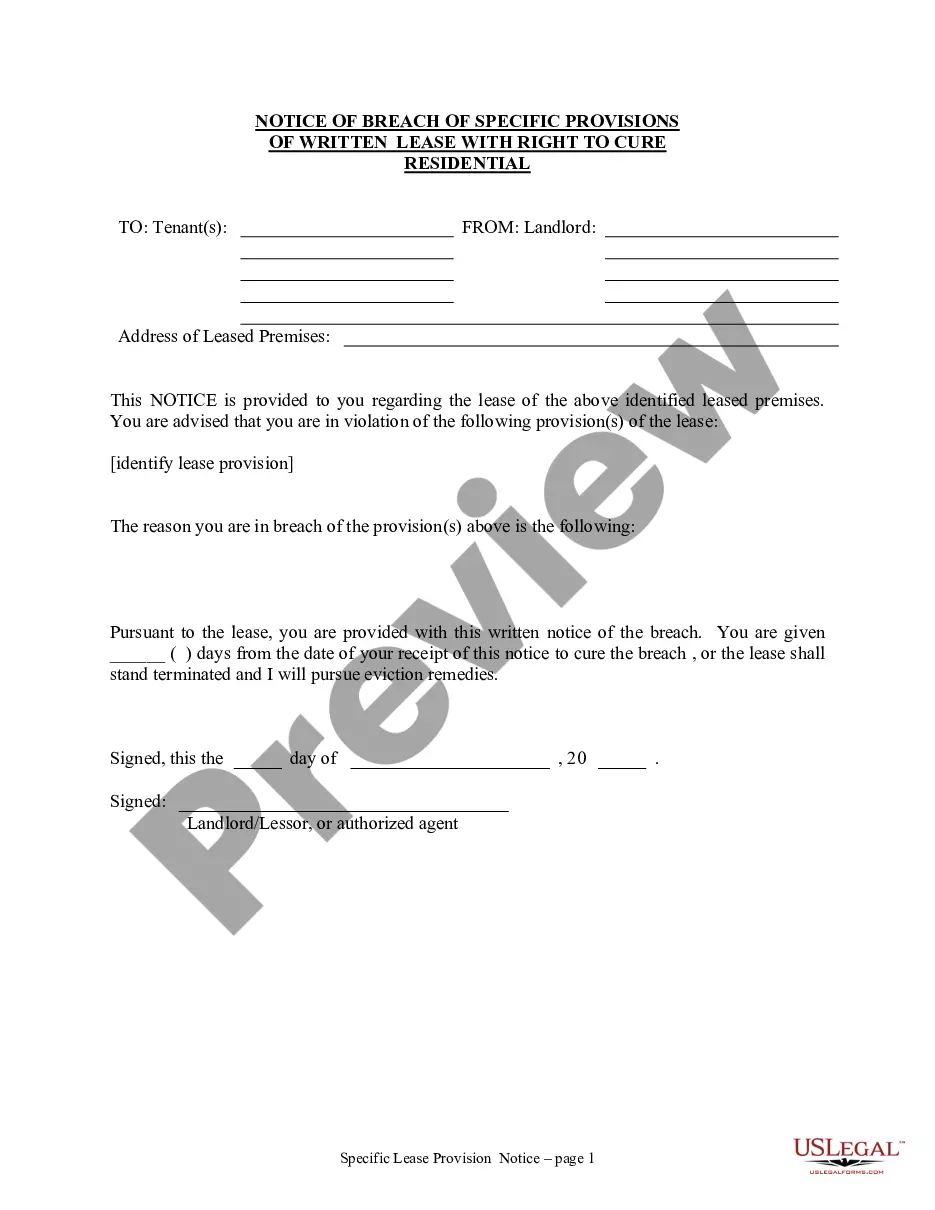

How to fill out Alabama Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Residential Property From Landlord To Tenant?

- Verify your subscription status and log in to your account. If you have previously used US Legal Forms, simply log in and click the Download button for the necessary form.

- For first-time users, begin by exploring the Preview mode. Review the form description to ensure it meets your needs and complies with your local jurisdiction requirements.

- In case you need a different form, utilize the Search tab at the top. If the current selection isn’t right, finding a more suitable template will assist you.

- Proceed to purchase the document by clicking the Buy Now button. Select the subscription plan that best suits your requirements, and create an account to access the form library.

- Complete your transaction by entering your payment details with either a credit card or PayPal, ensuring a secure purchase.

- Download your form directly to your device. You can also access it anytime in the My Documents section of your profile.

By following these streamlined steps, you can gain access to over 85,000 fillable legal forms at your convenience. US Legal Forms not only provides a robust collection of documents but also access to premium experts for guidance.

Start your venture with US Legal Forms today for a seamless legal document experience, and ensure your legal needs are efficiently met.

Form popularity

FAQ

A lease agreement should be clear and straightforward, typically containing headings for the parties involved, the property description, the lease term, and the rental amount. It should also include sections detailing the responsibilities of both the landlord and the tenant. A well-structured lease protects both parties, ensuring rights and obligations are clearly understood. You can find examples of effective lease agreements on US Legal Forms to guide you.

Calculating a leased property involves considering the total lease payments over the lease term and any additional costs associated with the lease. Start by determining monthly payments, multiplying them by the number of months in the lease, and then adjust for any down payment or residual value at the end of the lease. This calculation allows you to understand the total financial commitment for the leased item.

Yes, you can write your own lease agreement, but it is crucial to include all necessary terms. The agreement should detail the duration of the lease, rental amount, security deposit, and obligations for both parties. For clarity and protection, it is often beneficial to use a template. The US Legal Forms platform provides customizable lease agreement templates that can save you time and effort.

To write off a leased vehicle, maintain accurate records of your lease payments and business use. You can generally deduct a portion of the lease payments based on how much you use the vehicle for business versus personal purposes. Consult with a tax professional to ensure compliance with IRS regulations and to maximize your deductions. Keep in mind that the US Legal Forms platform offers resources for tracking and writing off leased vehicles correctly.

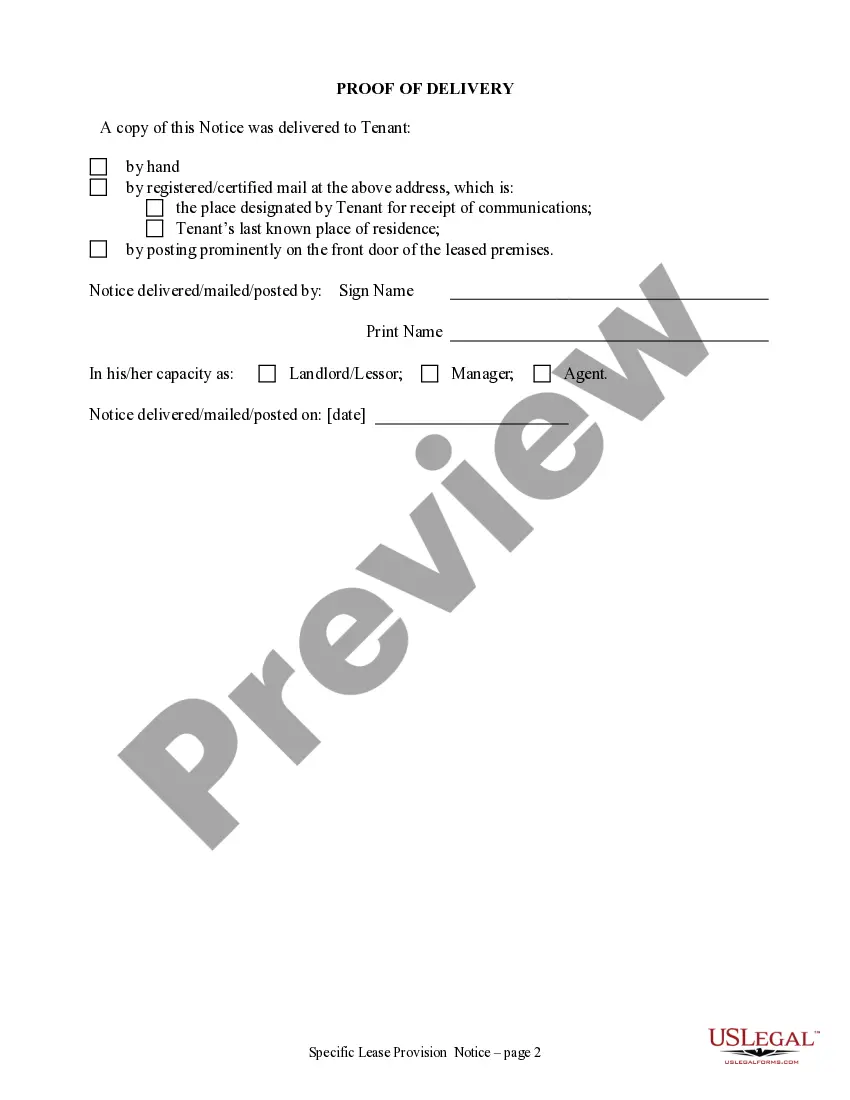

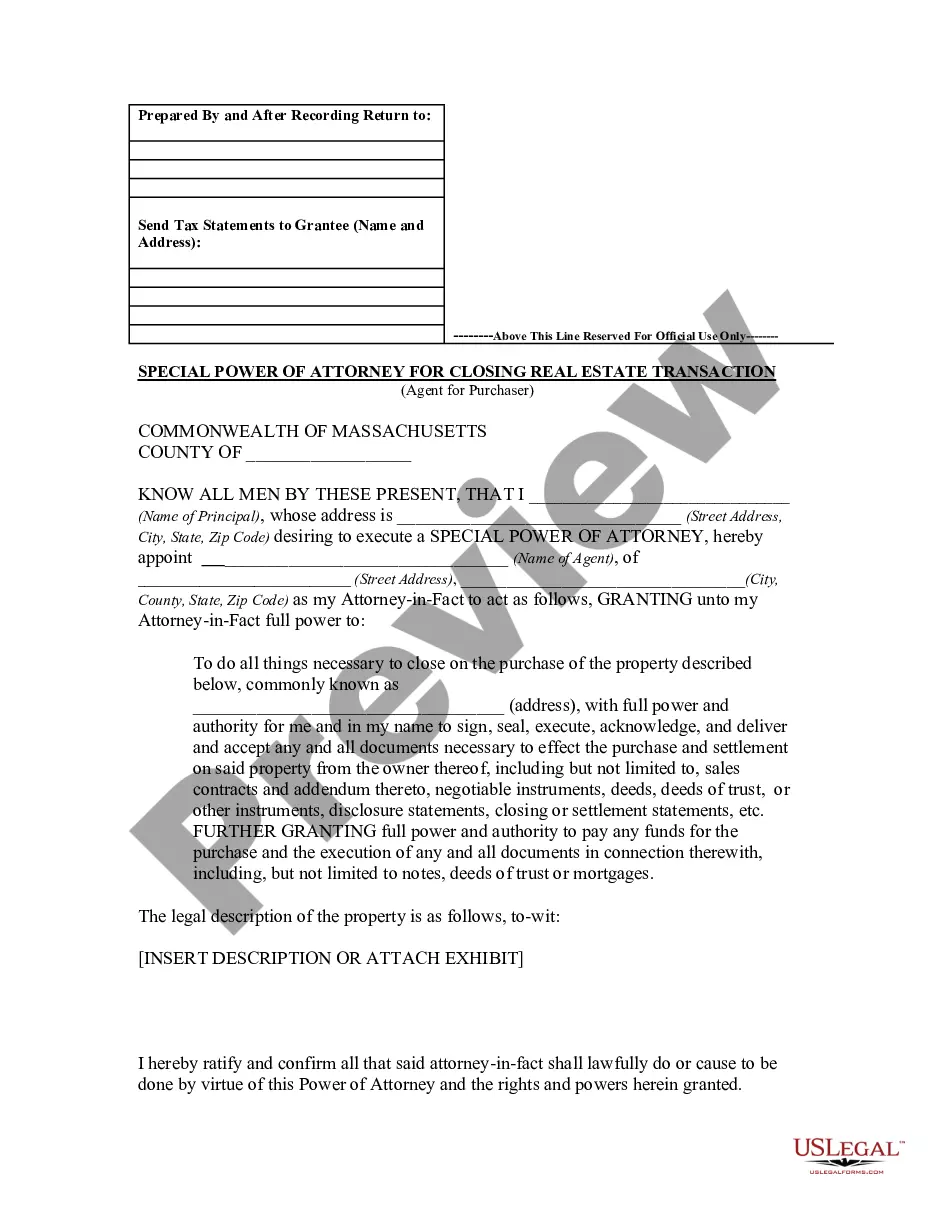

When filling out an agreement form, begin by clearly stating the purpose of the agreement. Include both parties' names, contact information, and any relevant deadlines. Be sure to summarize the main terms of the agreement, such as obligations, payment schedules, and duration. Once complete, make copies for all parties involved to maintain transparency.

Filling out a lease agreement form in PDF format is simple. Use a PDF editor or converter tool to open the document, and then fill in the necessary fields with your information. Ensure that you save the completed document properly before sharing it with the landlord for review. If you need a reliable lease agreement template, US Legal Forms offers various options that you can easily customize.

To fill a lease agreement, first read the document thoroughly to understand all terms and conditions. Next, input your personal information, such as your name and address, along with the property details like the address and rental amount. Make sure to include lease dates and any additional terms you wish to specify. Finally, both parties should review, sign, and keep copies for their records.

The minimum credit score for a lease generally ranges from 620 to 650, though some lenders may have more flexible options. A higher score usually leads to better lease terms and lower monthly payments. Always consider checking your credit score before applying to increase your chances of getting approved for your leased vehicle.

While getting approved for a lease can seem daunting, it largely depends on your financial background. If you maintain good credit and a steady income, you will likely find the process manageable. Still, if you face hurdles, platforms like US Legal Forms can help simplify the paperwork and guide you through the process.

To qualify for a lease, you need to provide proof of income, show a valid driver's license, and have a satisfactory credit score. Lenders also look for a clean driving record and proof of residency. Ensuring you meet these qualifications will make the process of securing your leased vehicle smoother.