Alabama Board Of Adjustment Withdrawal

Description

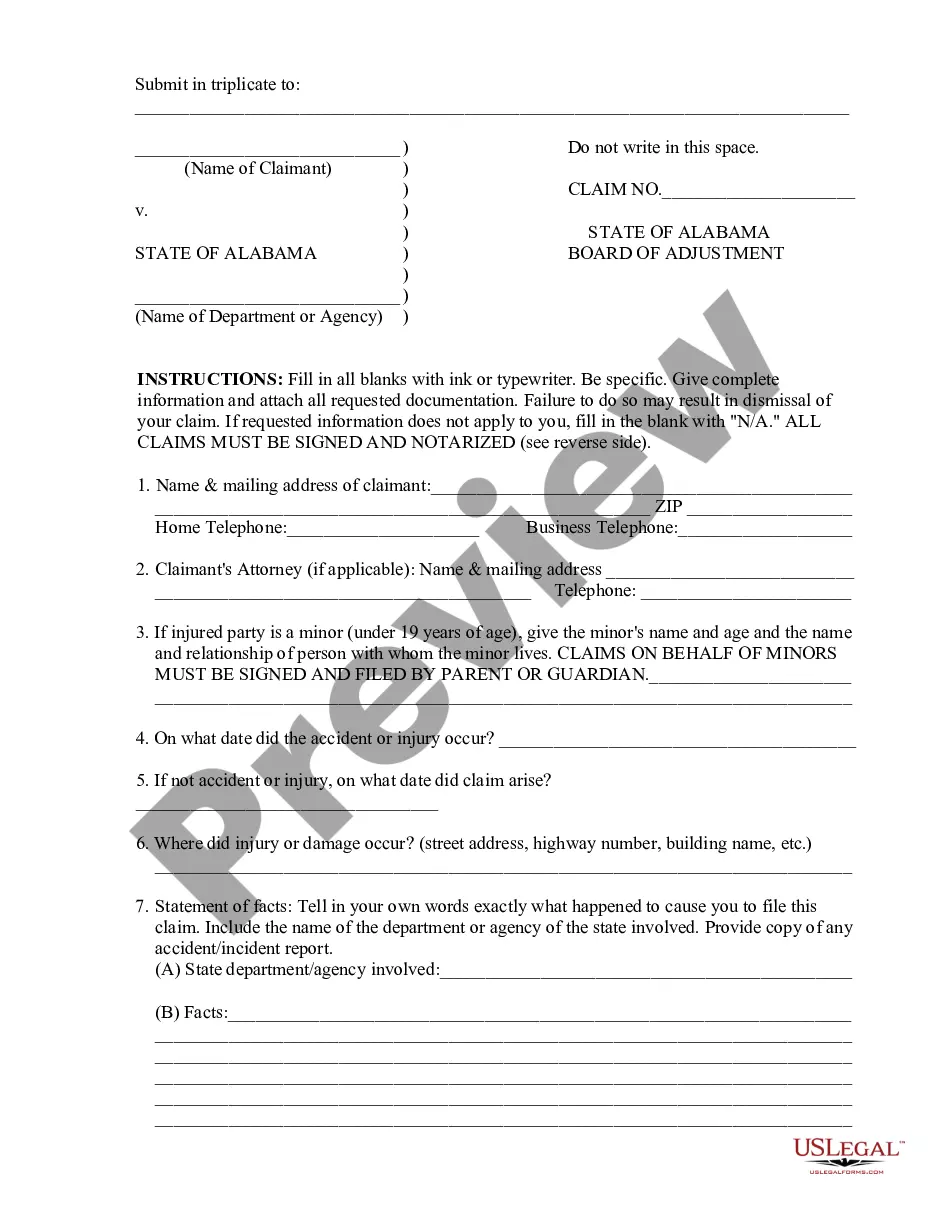

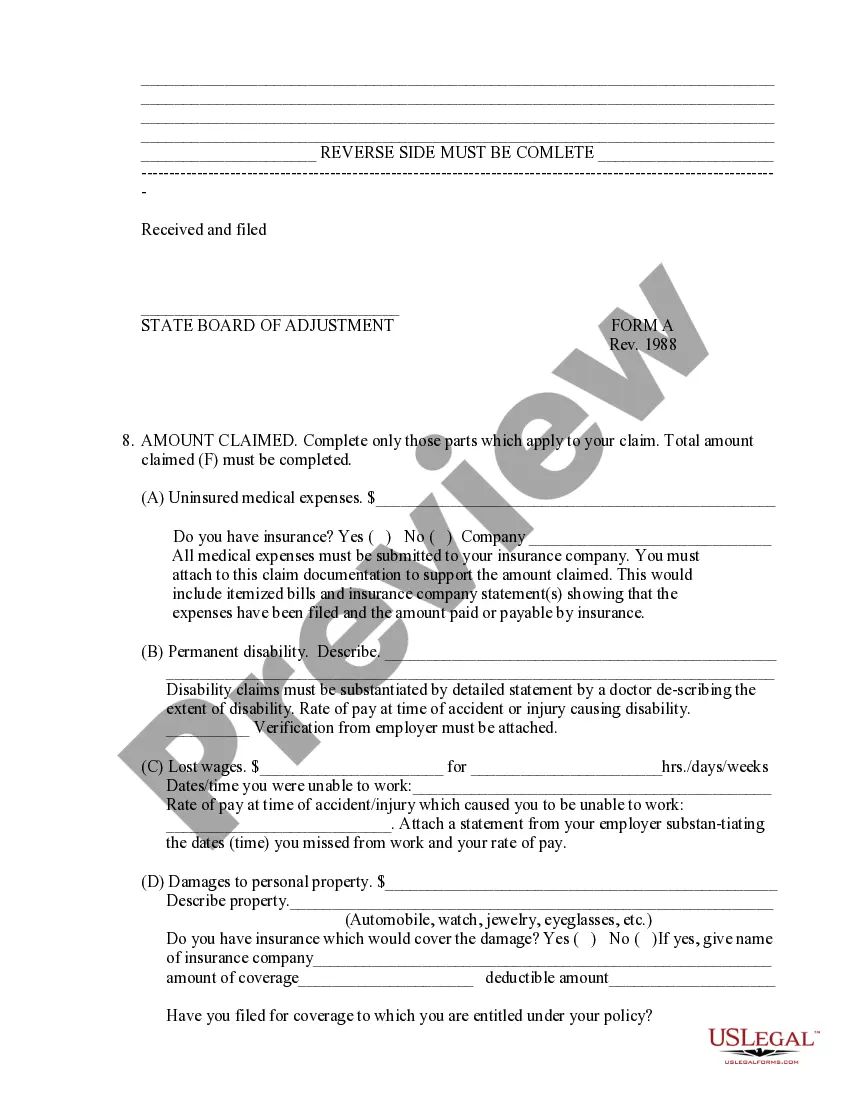

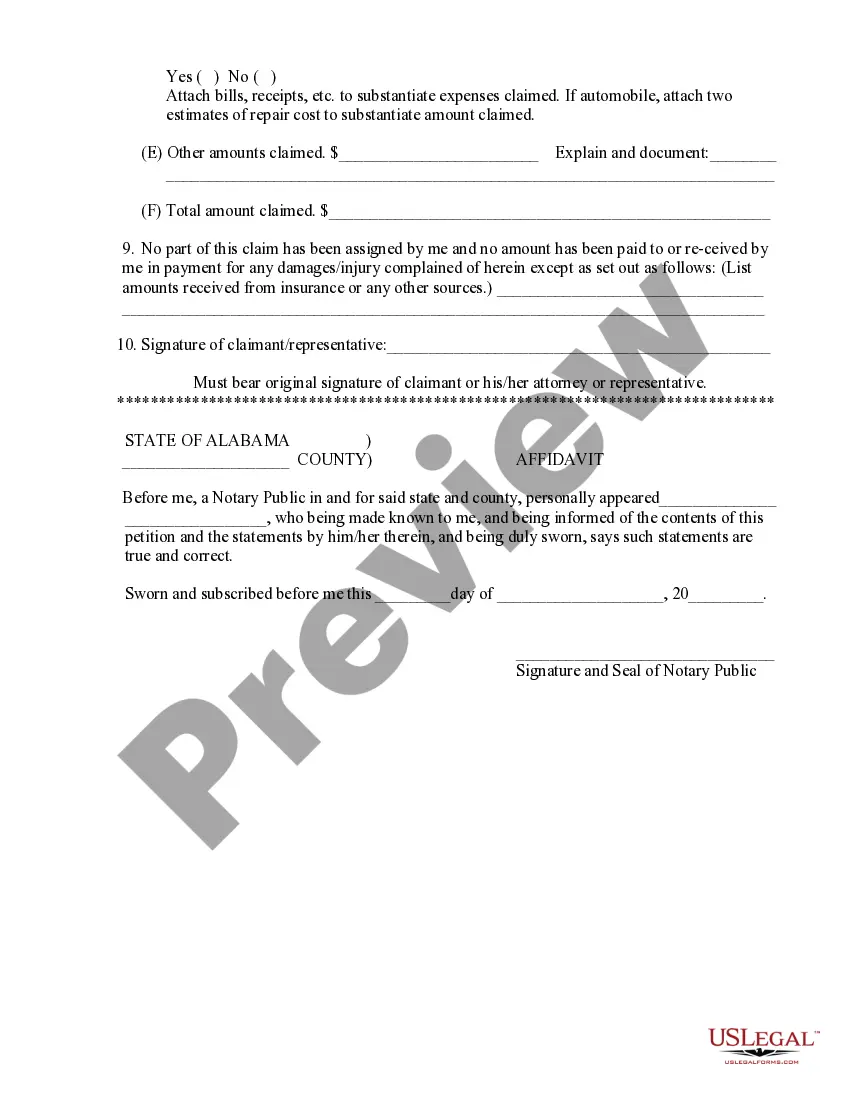

How to fill out Claim Form To State Of Alabama Board Of Adjustment For Personal Injury?

The Alabama Board Of Adjustment Withdrawal displayed on this page is a reusable legal document crafted by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers access to more than 85,000 validated, state-specific documents for any corporate and personal situation. It is the quickest, simplest, and most trustworthy method to acquire the papers you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Select the format you prefer for your Alabama Board Of Adjustment Withdrawal (PDF, Word, RTF) and save the document on your device.

- Look for the document you require and examine it.

- Browse through the file you searched and preview it or check the form description to confirm it meets your needs. If it doesn't, utilize the search feature to find the correct one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

To file as head of household, you must: Pay for more than half of the household expenses. Be considered unmarried on the last day of the tax year, and. You must have a qualifying child or dependent.

The Maryland Form 511 An Electing PTE Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members. taxhelp@marylandtaxes.gov.

Maryland Form 1 is the Annual Report and Business Personal Property Return that is required to be filed by all Maryland business entities. Form 1 can be filed online through . Form 1, along with the filing fee, is due by April 15th.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland.

The Maryland LLC Annual Report costs $300 per year. This fee is paid every year for the life of your LLC, and it applies to all Maryland LLCs. And every Maryland LLC must file a Business Personal Property Tax Return. Some LLCs will owe additional fees based on the information on this return.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland.

A Maryland annual report, also known as a personal property return report, is a comprehensive report that a business files every year. It includes information on the business's activities during the prior year.

Maryland Annual Report Due Dates and Fees Maryland Annual Report Fee ScheduleBusiness TypeCostHow to FileCorporations ? foreign and domestic$300*Online or Paper FormLLCs ? foreign and domestic$300*Online or Paper FormNonprofits, Cooperatives, and Religious Corporations$0*Online or Paper Form3 more rows

Purpose of Form Form 510/511D is used by a pass-through entity (PTE) to declare and remit estimated tax for nonresi- dents. The PTE may elect to declare and remit estimated tax on behalf of resident members. Effective July 1, 2021, PTEs may elect to pay tax for all mem- bers at the entity level.