Foreclosure S

Description

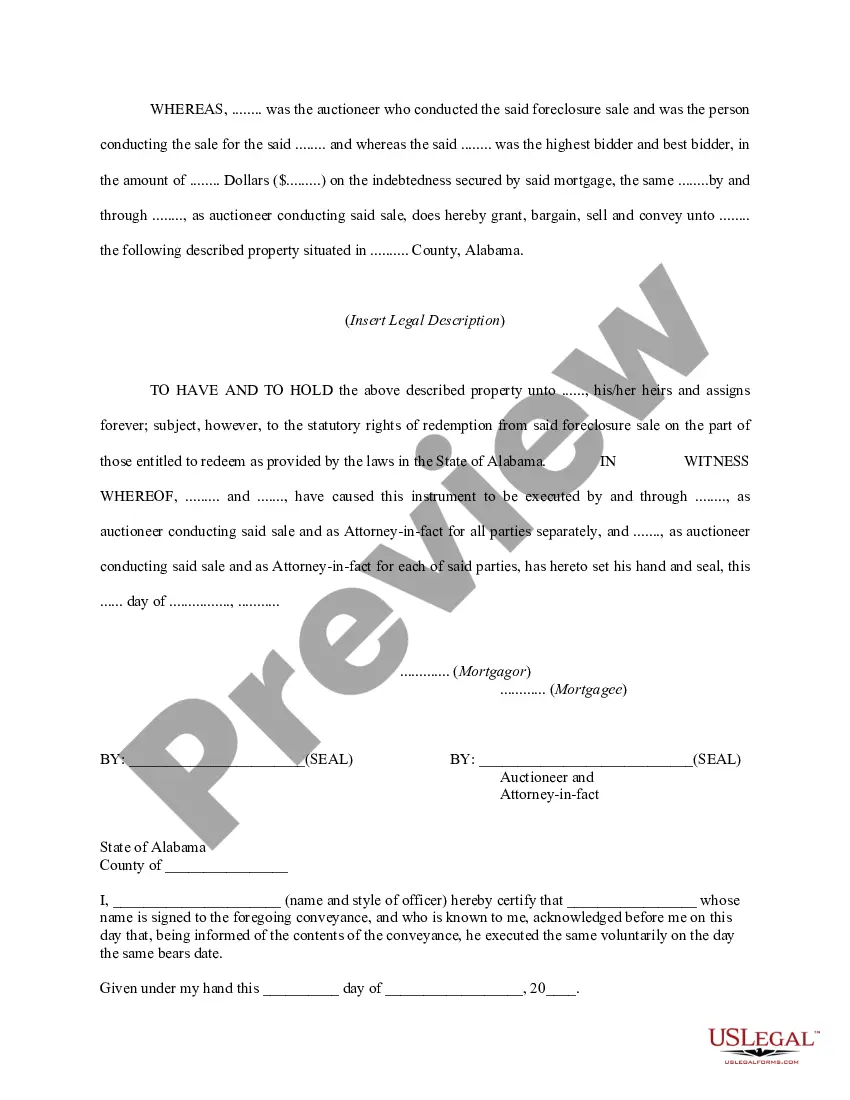

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you are a returning user, log in to your account and download your needed foreclosure form directly. Ensure your subscription is current; otherwise, renew it as per your plan.

- For new users, start by browsing the Preview mode and form description. It’s crucial to select the right document that aligns with your local jurisdiction's requirements.

- Need a different template? If your chosen form doesn’t fit, utilize the Search tab to find the correct foreclosure document.

- Proceed to purchase. Click the Buy Now button and select a subscription plan that suits your needs. You will need to create an account for full access.

- Finalize your transaction by entering your credit card or PayPal information to pay for the subscription.

- Download your completed form. Save it on your device and access it anytime from the My Forms section of your account.

By following these steps, you can easily navigate through the US Legal Forms library and secure the necessary documentation for any foreclosure situation.

Remember, leveraging US Legal Forms ensures that you have access to over 85,000 legally vetted documents, along with support from premium experts for precise completion.

Form popularity

FAQ

The 120-day rule typically applies to residential mortgage contracts. This includes contracts backed by government agencies and conventional loans. It serves to protect borrowers from rapid foreclosure actions. Understanding which contracts fall under this rule can help you better navigate your obligations during foreclosures.

In Michigan, foreclosures start with the lender sending a notice of default after missed mortgage payments. After 15 days, if the payment is not made, the lender can proceed to auction the property. Michigan’s law allows homeowners a redemption period of six months post-auction to reclaim their property by paying the owed amount. Understanding Michigan's laws can greatly aid you during foreclosures.

Certain exceptions exist to the 120-day foreclosure rule. For example, if a borrower files for bankruptcy, the foreclosure process may pause or change. Additionally, certain government-backed loans may have different guidelines. Familiarizing yourself with these exceptions can provide better strategic planning during foreclosures.

Writing about foreclosures involves clear and precise communication. Start with a strong statement that defines what foreclosure means, followed by its implications for homeowners. Include relevant laws, protections, and the various phases of a foreclosure process. Using platforms like USLegalForms can assist in drafting foreclosure documents accurately and efficiently.

California recently enacted laws to protect homeowners from aggressive foreclosure practices. These laws require lenders to provide more details about the modification process, enabling homeowners to understand their rights better. Additionally, homeowners now have greater access to forbearance and assistance programs. Staying informed about these changes can aid you when facing potential foreclosures.

Foreclosures typically involve six key phases. First, the lender issues a notice of default after missed payments. Second, the lender begins the legal process to reclaim the property. Third, a foreclosure auction takes place, where the home is sold to the highest bidder. Fourth, the winning bidder takes ownership of the home. Fifth, the former homeowner has a redemption period in which they can reclaim the property. Finally, eviction may occur if the former homeowner does not leave. Understanding these phases helps you navigate the complex landscape of foreclosures.

While foreclosures can be great deals, they come with certain disadvantages. Properties may be sold As-Is, which means you may face significant repairs or liens that were not initially disclosed. Additionally, the bidding process can be competitive, and buyers often must move quickly due to time constraints.

Banks may negotiate on foreclosures, depending on the specifics of the property and the market conditions. It is common for banks to consider reasonable offers, especially if a foreclosure has been on the market for a while. Engaging a knowledgeable real estate agent can help you navigate this negotiation process effectively.

In Texas, the foreclosure process generally follows a non-judicial process, meaning it does not require court involvement. A property can usually be foreclosed within about 30 days after the required notice is given. Understanding Texas laws and utilizing resources like uslegalforms can simplify your navigation through this process.

Typically, down payments for foreclosed homes can range from 3% to 20%, depending on your financing. If you utilize a government program, the down payment could be lower. Always check the specific requirements from your lender and consider various financing options available for foreclosures.