Foreclosure Meaning

Description

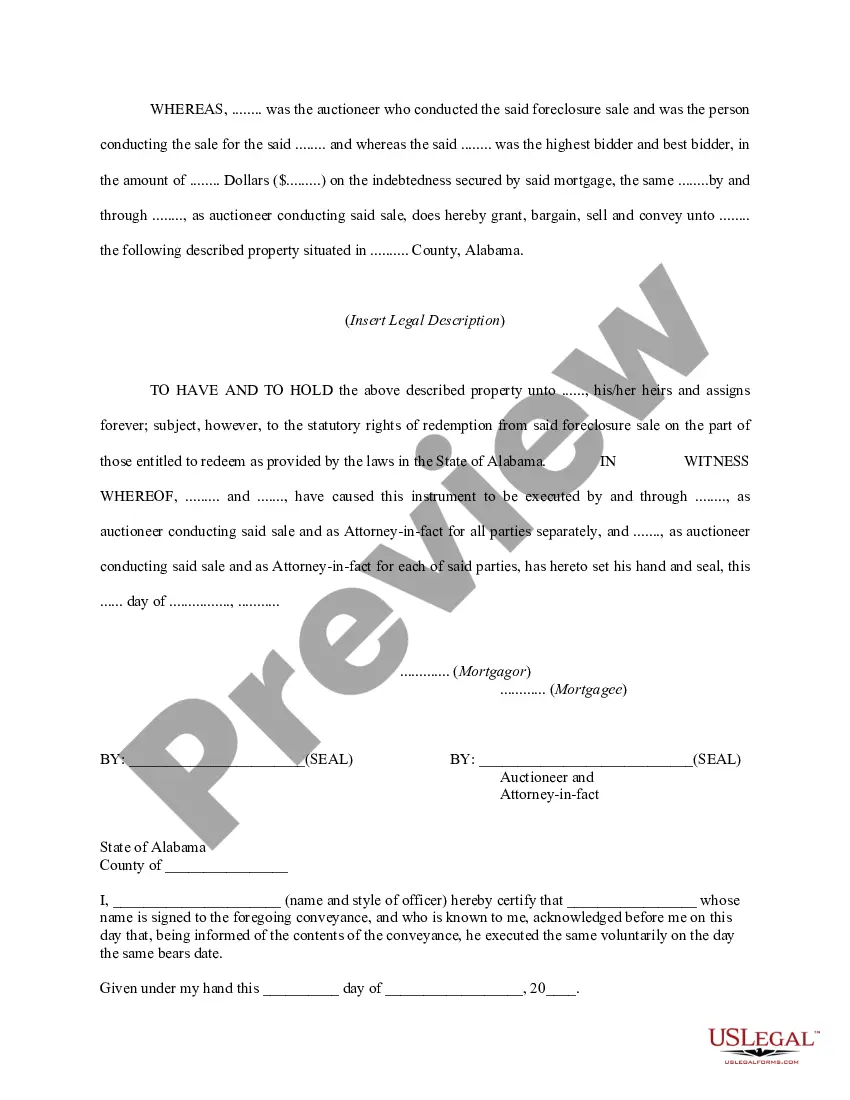

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log in to your US Legal Forms account. Ensure your subscription is active; if it has expired, renew it according to your payment plan.

- Preview the available forms related to foreclosure. Carefully read the descriptions to select the correct document that meets your legal requirements.

- If you do not find the right form, utilize the Search feature to locate other templates that might be more suitable.

- Purchase the selected document. Click on the Buy Now button and choose your preferred subscription plan, creating an account to access the library.

- Complete the transaction by entering your payment information, either through credit card or PayPal.

- Download the completed form to your device for immediate access and editing. You can always retrieve it later from the My Forms section in your profile.

In conclusion, using US Legal Forms not only saves you time but also provides the assurance of using reliable, legally sound documents tailored for your needs. Their extensive library of over 85,000 forms and access to experts ensures you're always prepared.

Start your journey today with US Legal Forms and simplify your legal process!

Form popularity

FAQ

When you let a house go into foreclosure, you ultimately lose ownership of the property, and the lender can sell it to recoup their losses. This means any investment you made in the home is also lost, affecting your finances for years to come. The foreclosure meaning encapsulates the gravity of this situation, emphasizing the need for homeowners to act quickly. Engaging with resources like uslegalforms can assist you in understanding your options before reaching this point.

The downside of a foreclosure often includes significant damage to your credit score, which can take years to recover. Additionally, you may lose your home and any equity that you have built over time. The emotional toll can also be substantial, as it can lead to stress and uncertainty about the future. To understand the full impact, it's helpful to explore the foreclosure meaning and the implications it carries.

Foreclosures in Maryland follow a legal process that begins when a homeowner defaults on their mortgage payments. The lender can file a complaint to start the court proceedings, which leads to a potential auction of the property. Understanding foreclosure meaning is essential as it lays out the rights of both borrowers and lenders. You can find helpful resources and forms on the US Legal Forms platform to assist you through every step of this process.

In Maryland, foreclosure usually begins after a homeowner misses three consecutive mortgage payments. However, the exact timeline can vary based on the terms set by the lender and other factors. Understanding foreclosure meaning is crucial, as it highlights the importance of staying in communication with your lender to prevent this situation. Consulting with a legal expert or utilizing resources like US Legal Forms can also help clarify your options.

Filing for foreclosure means initiating a legal process to reclaim property due to unpaid mortgage debt. This action is typically taken by lenders when borrowers default on their mortgage obligations. Understanding foreclosure meaning is crucial for both borrowers and lenders, as it defines the legal grounds and implications for all parties involved. Utilizing resources like US Legal Forms can simplify this complex process for concerned homeowners.

The primary financial loss in a foreclosure typically falls on the homeowner. They not only lose their property but also face significant damage to their credit score. This loss can limit their ability to obtain credit in the future, which can be severely financially debilitating. Recognizing foreclosure meaning can help you take measures to avoid such losses, empowering you to make informed decisions.

The biggest cause of foreclosures is often financial hardship, which can arise from job loss, medical bills, or unexpected expenses. When homeowners struggle to make their mortgage payments, they risk entering foreclosure. Understanding foreclosure meaning helps equip you to address these challenges proactively. By being aware of potential risks, you can seek out solutions before it reaches the foreclosure stage.

Recovering from foreclosure can be quite challenging, and many homeowners find it a lengthy process. The impact on credit scores can create barriers to securing new loans or housing. It’s important to understand the foreclosure meaning and its long-term implications as this knowledge can guide you through recovery strategies. Working with professionals and using resources like US Legal Forms can offer guidance during this difficult time.

The borrower typically suffers the most in a foreclosure situation. When a property goes into foreclosure, it can lead to significant emotional and financial distress for the homeowner. Additionally, families often face the loss of their homes and the stress associated with relocating. Therefore, grasping the foreclosure meaning can help you understand the stakes involved.

Foreclosure is spelled F-O-R-E-C-L-O-S-U-R-E. This term refers to the legal process where a lender seeks to reclaim property when the borrower fails to make mortgage payments. Understanding foreclosure meaning is essential for homeowners as it impacts both their financial and emotional well-being. Knowing how to correctly spell and comprehend this term can lead to better discussions with professionals.