Foreclosure For Dummies

Description

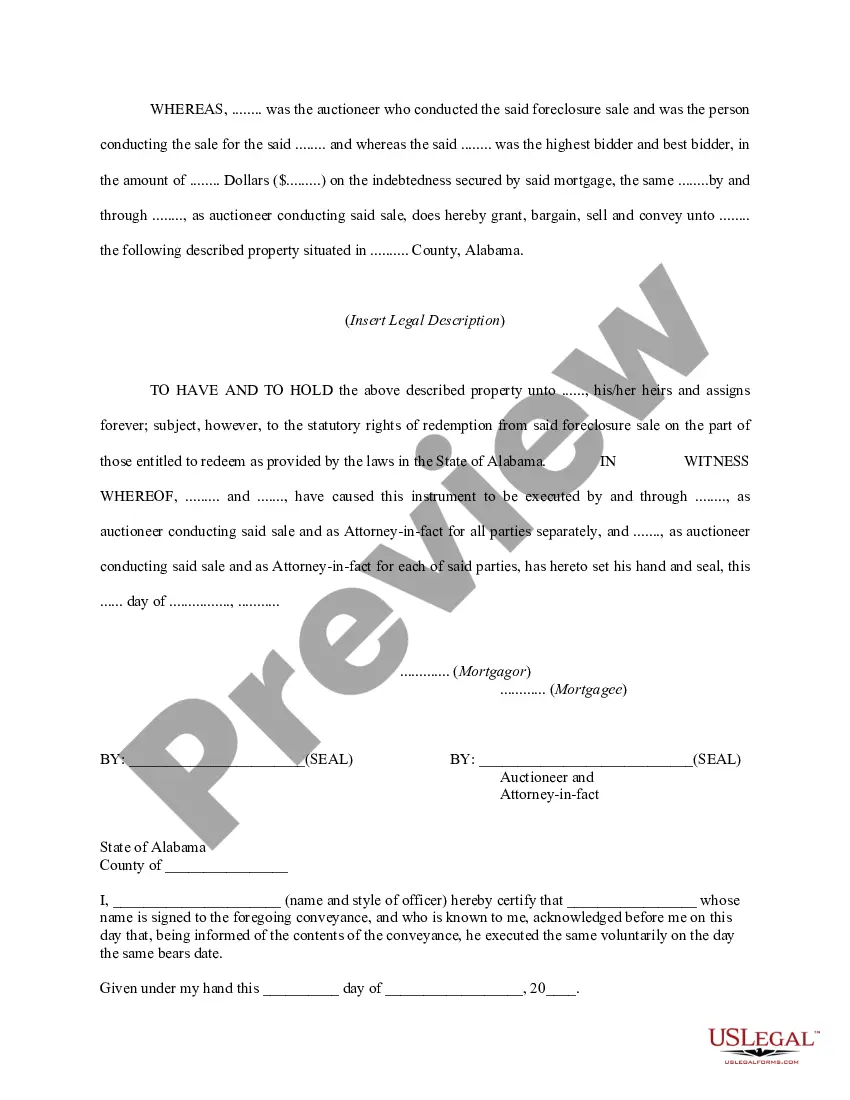

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you are a returning user, log in to your account and access your needed form template by clicking the Download button. Ensure your subscription is active; if not, renew it based on your plan.

- For first-time users, begin by checking the Preview mode and form description to confirm you have selected the right document that aligns with your local jurisdiction requirements.

- If necessary, search for another template using the Search tab above to find the most suitable option for your needs.

- Proceed to purchase your selected document. Click on the Buy Now button and select a subscription plan that fits your requirements. You'll need to register to gain access to the comprehensive library.

- Complete the payment process by entering your credit card information or utilizing your PayPal account for subscription fees.

- Finally, download your form to your device for completion and future reference, accessible anytime from the My Forms section of your profile.

By using US Legal Forms, you benefit from an extensive library of over 85,000 customizable legal forms, ensuring easy and precise completion of your legal documents. With premium expert assistance available, you can feel confident in the legality and accuracy of your filings.

Take control of your foreclosure situation and simplify your document management today. Start your journey with US Legal Forms for a stress-free experience!

Form popularity

FAQ

In Florida, the foreclosure process can take anywhere from several months to over a year. This timeline often depends on the specific circumstances of each case, including whether the homeowner contests the foreclosure. Despite the lengthy process, potential buyers can seize opportunities as they arise. For a clearer understanding of Florida's foreclosure process, tools like 'Foreclosure for dummies' can provide valuable guidance.

In Washington, the foreclosure process generally takes about seven months from the time the lender initiates the action. However, this duration can vary based on several factors, including court scheduling and possible defenses raised by the homeowner. This timeline allows potential buyers in the foreclosure market to prepare and plan accordingly. Resources such as 'Foreclosure for dummies' can guide you through what to expect in Washington’s foreclosure landscape.

In New York, the foreclosure process requires lenders to file a lawsuit to begin the foreclosure action. Homeowners have the right to respond and present defense arguments in court. Additionally, New York has a mandatory settlement conference requirement to explore alternatives to foreclosure. Knowing these rules can help you make informed decisions, and resources like 'Foreclosure for dummies' can provide essential insights to protect your rights.

Foreclosure requirements can vary by state, but generally, they involve a borrower defaulting on a mortgage payment. Lenders typically wait a few months before proceeding to foreclosure to give borrowers a chance to repay their debts. Homeowners facing foreclosure may also have the opportunity to negotiate with their lenders to avoid the process altogether. Remember, understanding these requirements can be simplified through resources like 'Foreclosure for dummies' to help you navigate the legal landscape.

The process of getting a foreclosed home typically starts with research on available properties. You can find listings through real estate websites or local auctions. Once you identify a property, you may need to get financing and participate in the bidding process. It's essential to understand that while foreclosures can offer great deals, they often require repairs and some due diligence on the buyer's part, making it accessible even for those following the 'Foreclosure for dummies' guide.

Writing about foreclosure typically involves explaining the legal process and the implications for homeowners. Focus on clarity and accessibility, ensuring that your audience gains a basic understanding of foreclosure. If you need guidance on how to express these concepts in simple terms, US Legal Forms can be a helpful resource for learning about foreclosure for dummies.

To get a foreclosure dismissed, you need to present a valid legal defense or negotiate a resolution with your lender. This could involve proving that the lender did not follow proper procedures or that you have remedied your payment issues. US Legal Forms provides templates and legal information that can assist you in understanding the process of managing foreclosure for dummies.

The 120-day rule for foreclosure mandates that lenders must wait at least 120 days after a missed payment before filing for foreclosure. This rule gives homeowners time to catch up on payments or explore other options. Understanding this rule is an important part of learning about foreclosure for dummies, and US Legal Forms can help you navigate it.

The fastest way to stop a foreclosure typically involves seeking financial assistance or negotiating with your lender. Immediate action is crucial, and filing for bankruptcy may provide a temporary stay on foreclosure proceedings. US Legal Forms offers invaluable resources that can help simplify this process and clarify foreclosure for dummies.

The best alternative to foreclosure often includes options like a short sale or a deed in lieu of foreclosure. These alternatives allow homeowners to peacefully exit their mortgage obligations without a damaging foreclosure on their record. By seeking help from US Legal Forms, you can learn more about these alternatives and master the foreclosure for dummies concept.