Foreclosing On A House

Description

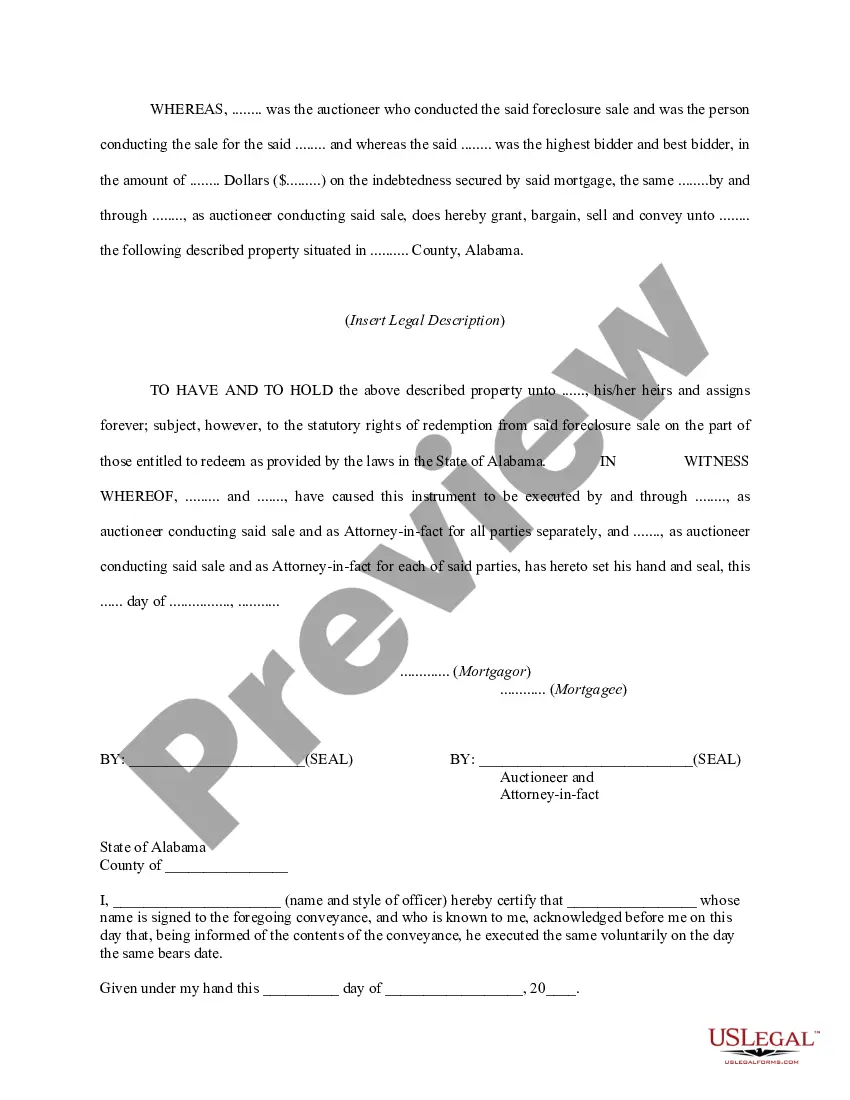

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you're a returning user, log in to your account to download the required form template using the Download button. Ensure your subscription remains active; if not, renew it according to your plan.

- For new users, start by browsing the Preview mode and reading the form description to select the correct document matching your local jurisdiction.

- Should you find discrepancies, utilize the Search tab to identify another suitable template. Once you locate the right one, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting an appropriate subscription plan. You will need to create an account for full access.

- Complete your purchase by entering your credit card information or opting for PayPal. After payment, you'll receive access to your document.

- Download the form to your device for completion. You can also revisit it anytime in the My Forms section of your profile.

With US Legal Forms, you gain access to over 85,000 editable legal forms, ensuring you have more options compared to other services at a similar cost. Additionally, their premium experts are available to help you ensure your documents are accurate.

Start simplifying your legal processes today! Explore the vast resources provided by US Legal Forms.

Form popularity

FAQ

Recovering from foreclosure can be challenging, yet it is achievable. It requires dedication to improving financial habits and rebuilding credit over time. People often focus on saving, purchasing a secured credit card, and maintaining a budget. Support from resources like US Legal Forms can provide guidance to simplify the process of recovery after foreclosing on a house.

The foreclosure process in Connecticut typically takes several months to over a year, depending on the case. Initially, the lender sends a notice of default, followed by court proceedings. Homeowners may have opportunities to negotiate terms or delay the process. Understanding the timeline can help you make informed decisions while dealing with foreclosing on a house.

Recovering from a foreclosure is certainly possible, though it may take time and effort. Individuals can start by rebuilding their credit through consistent payments and responsible financial habits. Seeking financial counseling can also help create a plan to get back on track. Many people find success with persistence and support after foreclosing on a house.

Yes, in certain circumstances, you can reverse a foreclosure before the sale is finalized. By paying off the outstanding debt or coming to an agreement with the lender, you may reclaim your home. Additionally, homeowners may seek legal options to challenge the foreclosure. It's important to act quickly and understand your rights in this process.

When you let a house go into foreclosure, you lose ownership of the property. The lender repossesses the home and sells it to recover the debt. Furthermore, a foreclosure negatively impacts your credit score, making it harder to secure loans in the future. It’s essential to consider the long-term effects before deciding to let foreclosure happen.

Foreclosing on a house in New Mexico follows a judicial process. The lender must file a lawsuit to obtain a court order for the foreclosure. Once the process begins, the homeowner receives notice and has the chance to respond. If the court rules in favor of the lender, the property can be sold at a public auction.

Generally, lenders begin the foreclosure process after three to six missed payments. However, the exact timeline can depend on the lender’s specific policies and state laws. Therefore, staying in touch with your lender can provide clarity on your situation and offer alternatives to prevent foreclosing on a house.

The biggest cause of foreclosure is typically the inability of homeowners to make their mortgage payments. This situation often arises from unexpected life changes, such as job loss or sudden medical bills. By understanding and addressing your financial situation early on, you can potentially avoid the unfortunate experience of foreclosing on a house.

Acquiring a foreclosure home often involves participating in auction processes or working with real estate agents specializing in distressed properties. You can research listings, attend foreclosure auctions, or even consider online platforms dedicated to showcasing these homes. Remember, conducting thorough inspections and due diligence is crucial before investing in a property that has gone through foreclosure.

Foreclosure is typically triggered when a homeowner misses multiple mortgage payments. After about three to six months of missed payments, the lender might initiate foreclosure proceedings. It's vital to communicate with your lender as soon as you struggle to make payments, as they may offer assistance to help avoid foreclosure on a house.