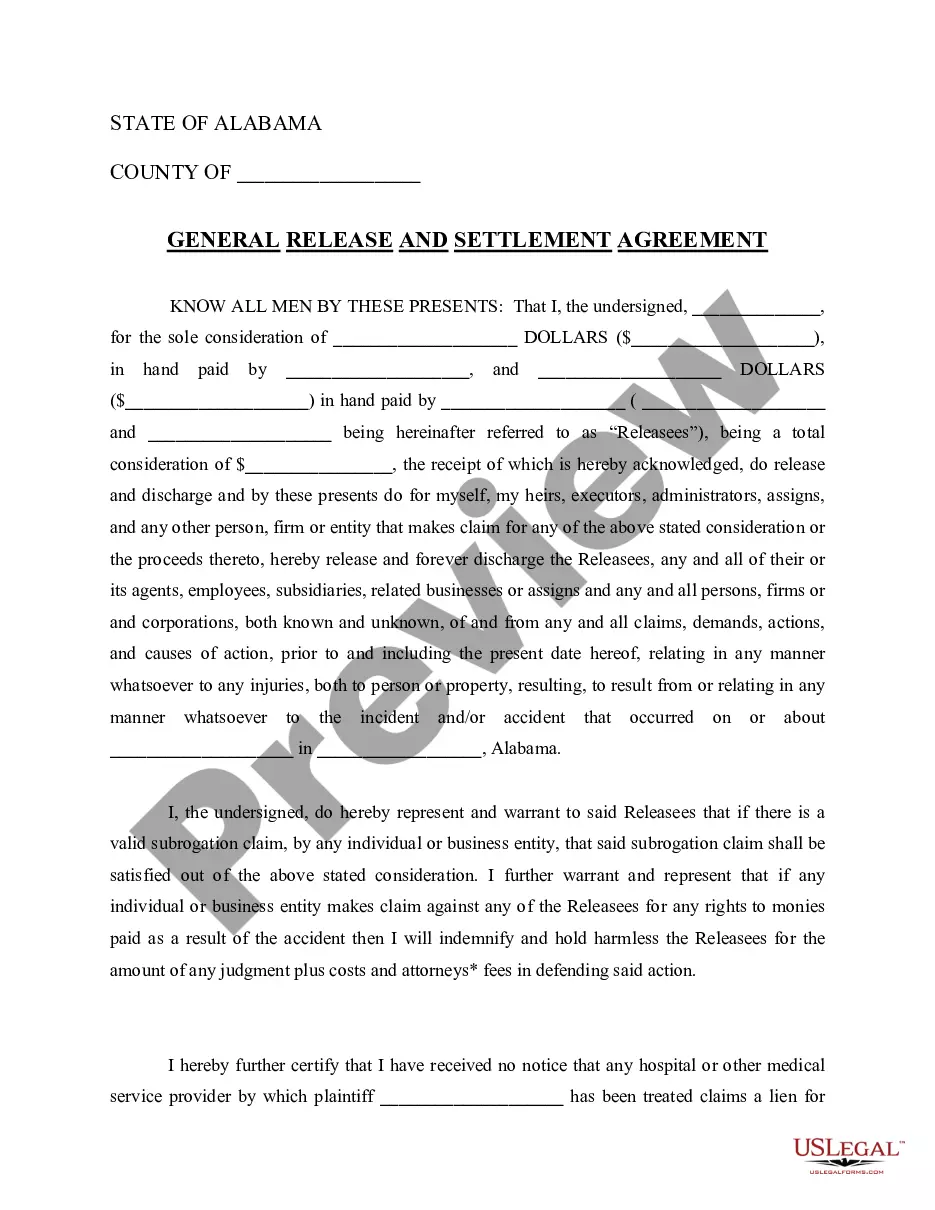

Settlement Agreement With Estate

Description

How to fill out Alabama Sample Of A Settlement Agreement?

- If you’ve used US Legal Forms before, log in to your account and download the required form by clicking the Download button, ensuring your subscription is current.

- For new users, begin by previewing form descriptions to confirm you select the right template that aligns with your jurisdiction.

- If necessary, utilize the Search tab to explore more templates until you find the one that meets your specifications.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan, after which you'll need to create an account for full access.

- Complete your purchase by entering credit card information or using your PayPal account.

- Download the form and save it on your device. You can also revisit it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms not only offers a vast collection of legal templates but also provides access to premium experts to assist you, ensuring your documents are accurate and compliant. Simplify your legal document needs today.

Start your journey with US Legal Forms and confidently handle your settlement agreement with ease!

Form popularity

FAQ

A valid settlement agreement with estate components requires mutual consent from all parties and must clearly outline the terms and obligations. Additionally, it should comply with state laws and have the necessary signatures. Ensuring that all elements are met prevents later disputes and preserves the integrity of the agreement.

To obtain a settlement agreement with estate matters, first communicate your intentions with all parties involved. Then, consult an attorney for a customized draft that meets legal standards. If you prefer a more straightforward approach, you can also utilize USLegalForms to find templates that fit your specific situation.

Typically, you have up to one year to settle an estate after death, although this can vary by state. In some cases, it may extend due to complications such as disputes or asset appraisal. Prompt action can help navigate estate settlement efficiently. For detailed resources, explore USLegalForms to understand specific timelines in your jurisdiction.

The timeline for writing a settlement agreement with estate matters varies based on complexity. Generally, it may take a few days to a couple of weeks. This timeframe allows for thorough discussions among parties and necessary revisions. Using resources like USLegalForms can streamline the process and provide efficient templates.

It's essential for a qualified attorney to draft the settlement agreement with estate matters. An attorney ensures that the document complies with state laws and accurately reflects the wishes of the parties involved. This expertise can help avoid potential disputes in the future. Consider using USLegalForms to access templates and guidance tailored to your specific needs.

The purpose of a settlement agreement is to resolve disputes and outline the responsibilities of each party involved. This document serves to establish clear expectations, minimize conflicts, and provide a definitive resolution to a disagreement. Implementing a settlement agreement with estate can be particularly beneficial in estate situations, allowing parties to settle matters amicably and efficiently.

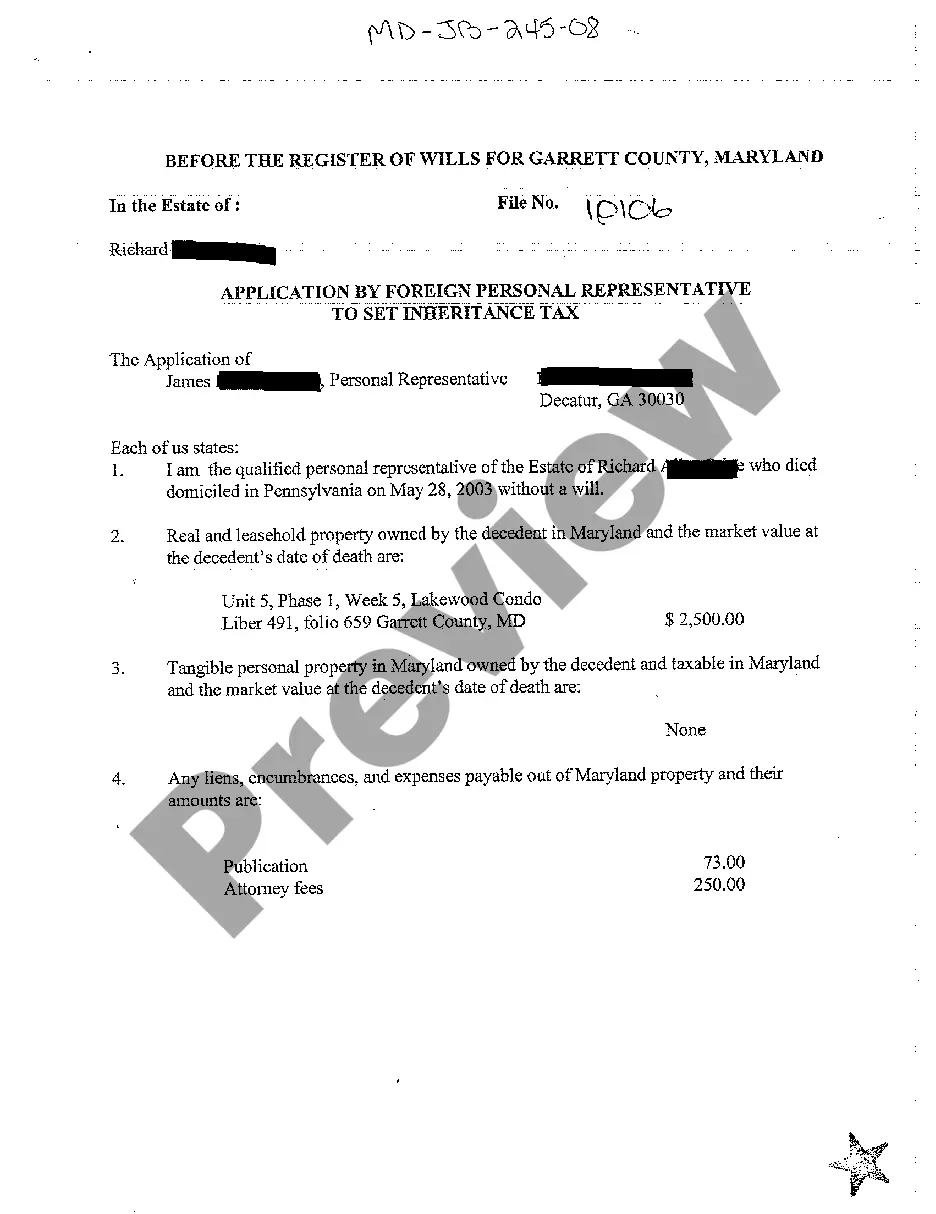

A family settlement agreement in lieu of probate is a legal document that allows family members to agree on the distribution of an estate without going through the lengthy probate process. This agreement can save time and reduce legal costs associated with settling an estate. By using a family settlement agreement with estate, family members can maintain harmony while ensuring that the wishes of the deceased are honored.

A settlement agreement in real estate is a legally binding contract that outlines the terms and conditions agreed upon by parties involved in a property transaction. This document typically includes details about the sale, financing, and obligations of each party. Utilizing a settlement agreement with estate can facilitate a smoother transfer of property ownership and ensure clarity in financial responsibilities.

You can settle an estate without a lawyer by educating yourself on the estate laws in your state. Start by gathering essential documents, such as the will and asset inventories. You can also leverage online resources, like US Legal Forms, to create a settlement agreement with estate that meets legal requirements. While it is possible to go through this process independently, consider consulting with a professional if you encounter any complexities.

To settle a deceased estate, begin with validating the will, if one exists, and then inventory the assets. Next, settle any debts and taxes owed by the estate, followed by distributing the remaining assets based on the will or state laws. Ensuring your settlement agreement with estate is thorough and clear will help prevent future disputes among heirs.