Quitclaim With Mortgage

Description

Form popularity

FAQ

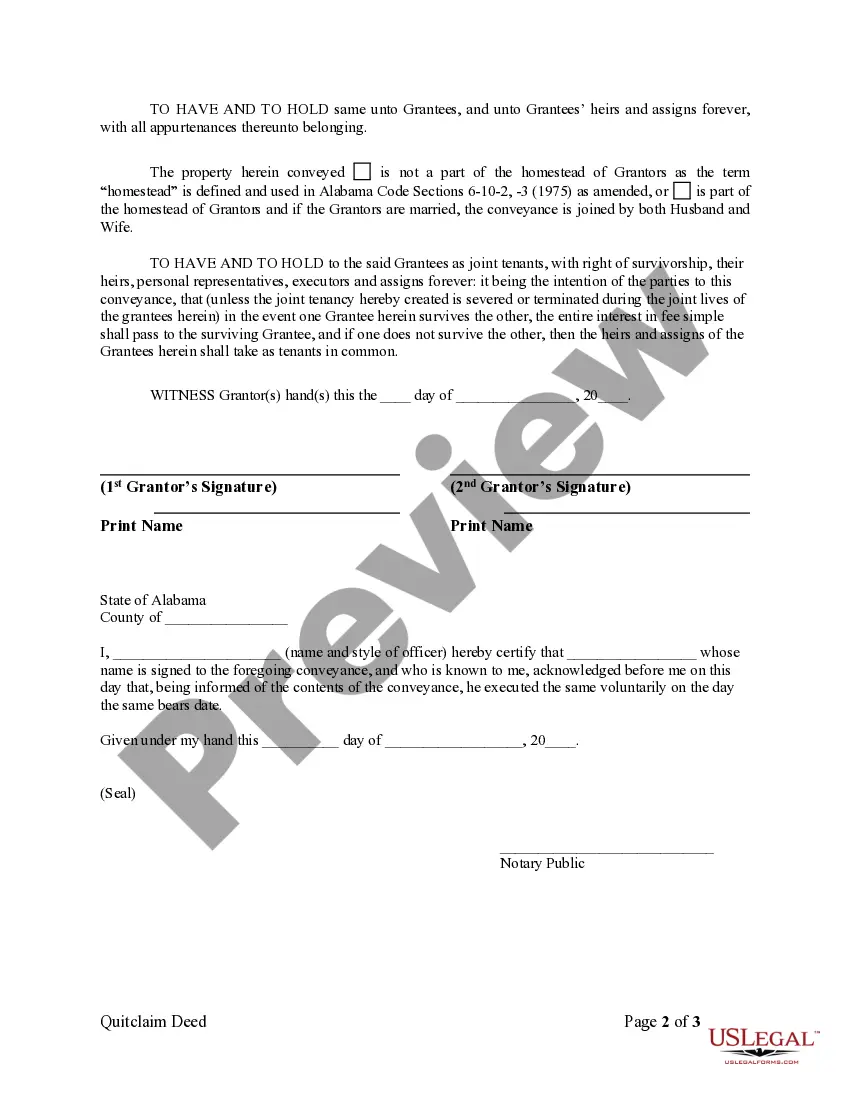

Yes, a quitclaim should be notarized to ensure its legal enforceability in the Philippines. Notarization provides an official record and proof of the transaction, which is vital in cases involving a quitclaim with mortgage. This formality helps prevent disputes later on, safeguarding the interests of all parties involved.

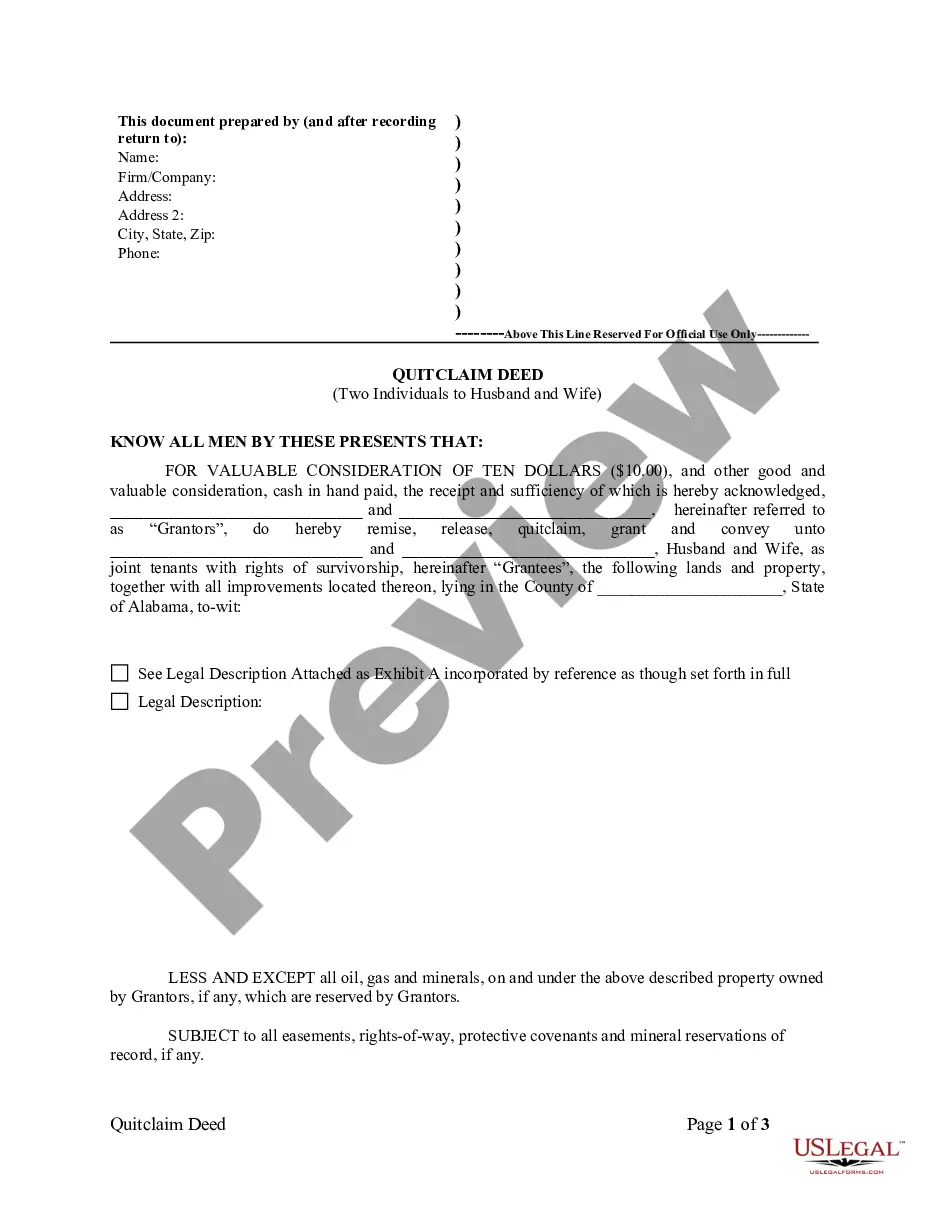

A quit claim deed serves as a tool for transferring a property’s ownership rights from one party to another without guaranteeing any title validity. Its primary aim is to simplify the transfer of real property, especially when dealing with a quitclaim with mortgage. This deed is often used to resolve family matters, such as inheritance or divorce settlements.

Removing someone from a mortgage without refinancing can be complex, but it can be achieved through a quitclaim deed. This document transfers rights, indicating that the co-owner relinquishes their interest in the mortgage. However, it's crucial to notify the lender and ensure the remaining party meets all lending requirements, particularly in a quitclaim with mortgage situation.

In the Philippines, certain contracts must be notarized, including those involving real estate transfers, leases longer than one year, and loans exceeding a specified amount. Notarization adds a layer of legal validity, which is especially important for quitclaim with mortgage scenarios. This protects all parties involved and facilitates smoother transactions.

To initiate a quitclaim in the Philippines, you need to provide proof of ownership, such as a title or real estate tax declaration. Both parties must agree on the transfer of rights, and it is advisable to seek legal counsel to ensure everything is compliant with local laws. Additionally, if a mortgage is involved, clarification of the quitclaim with mortgage terms is essential.

Once a spouse signs a quit claim deed in California, they generally relinquish their claim to the property. However, it's crucial to know that quitting ownership does not eliminate any existing mortgage obligations. For situations involving quitclaim with mortgage, both parties should carefully discuss their rights and responsibilities, possibly seeking legal guidance to clarify any lingering concerns.

In California, the person who is transferring their property interest signs the quitclaim deed. This typically involves the grantor, who vacates their rights to the property. In cases involving quitclaim with mortgage, both parties may benefit from a thorough review of the deed to ensure that any existing mortgage obligations are clearly understood.

The quitclaim deed is often the preferred choice during divorce proceedings. It allows one spouse to relinquish their interest in the property, which simplifies the transfer process. In the context of quitclaim with mortgage, this type of deed can help resolve any financial obligations tied to the property swiftly.

A quitclaim deed in California can be prepared by individuals, but it's recommended to consult a professional. Attorneys and title companies have the expertise in drafting these documents to meet state requirements. This expertise becomes crucial, especially in quitclaim with mortgage scenarios, to protect the interests of all parties involved.

In California, anyone can prepare a deed, provided they meet specific legal requirements. Often, individuals choose to work with licensed professionals, such as attorneys or title companies, to ensure accuracy. This is particularly important when dealing with quitclaim with mortgage situations, where precise wording is essential to prevent future disputes.