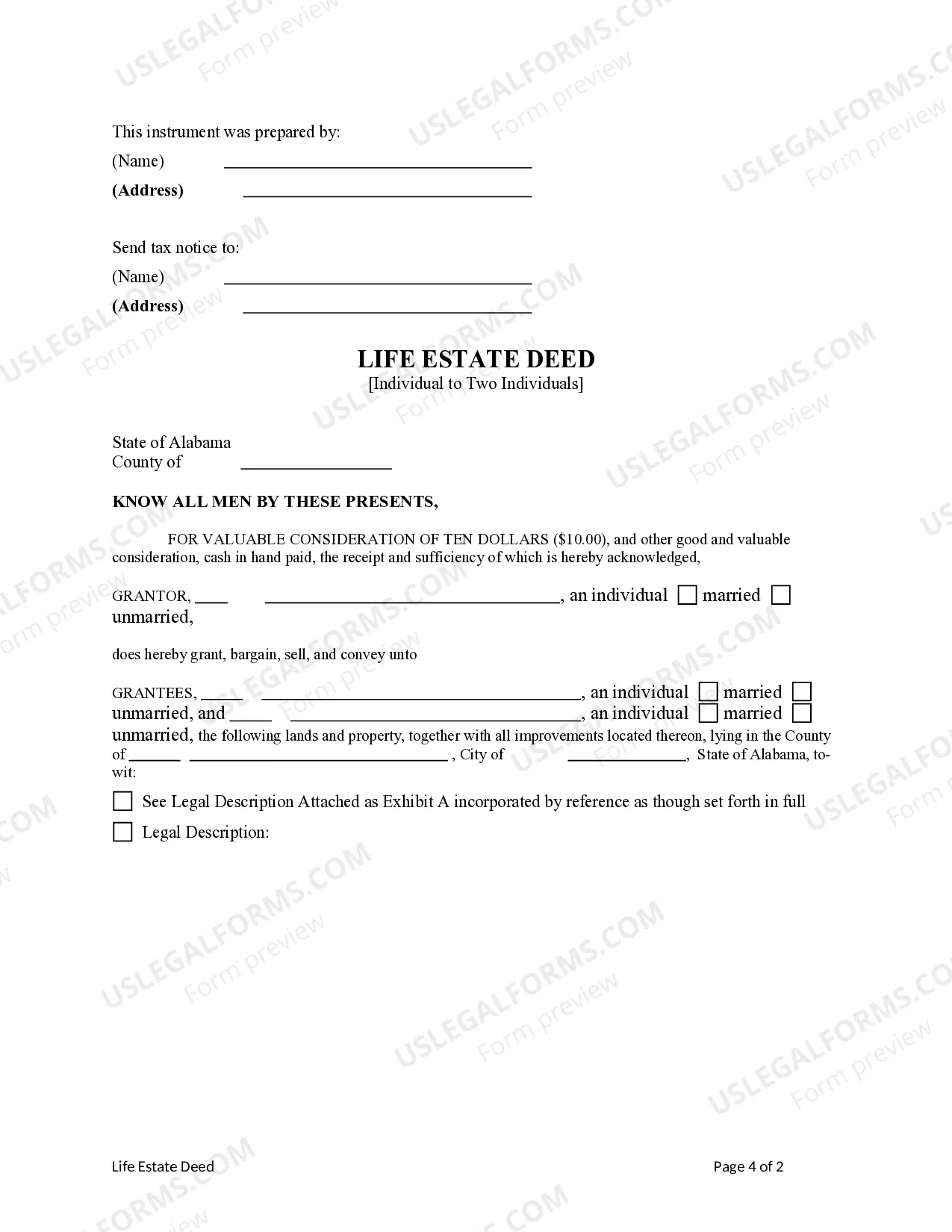

This form is a Life Estate Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and warrants the described property to the Grantees and retains a life estate in the property. This deed complies with all state statutory laws.

Life Estate With Existing Mortgage

Description

Form popularity

FAQ

In Canada, the person who holds a life estate has the right to use and occupy the property during their lifetime. However, the property’s title remains with the remainderman, who will inherit the property after the life tenant passes away. When dealing with a life estate with existing mortgage, it is crucial to understand that the mortgage obligation typically stays with the original owner. Therefore, both parties should discuss their responsibilities to ensure a smooth transition.

Another name for a life estate is a 'life tenancy.' This term refers to the same legal arrangement where an individual holds rights to a property during their lifetime, despite any existing mortgage. Life tenancies can have significant implications, especially when combined with estate planning and financial considerations. Always consider consulting resources like USLegalForms to navigate these complexities effectively.

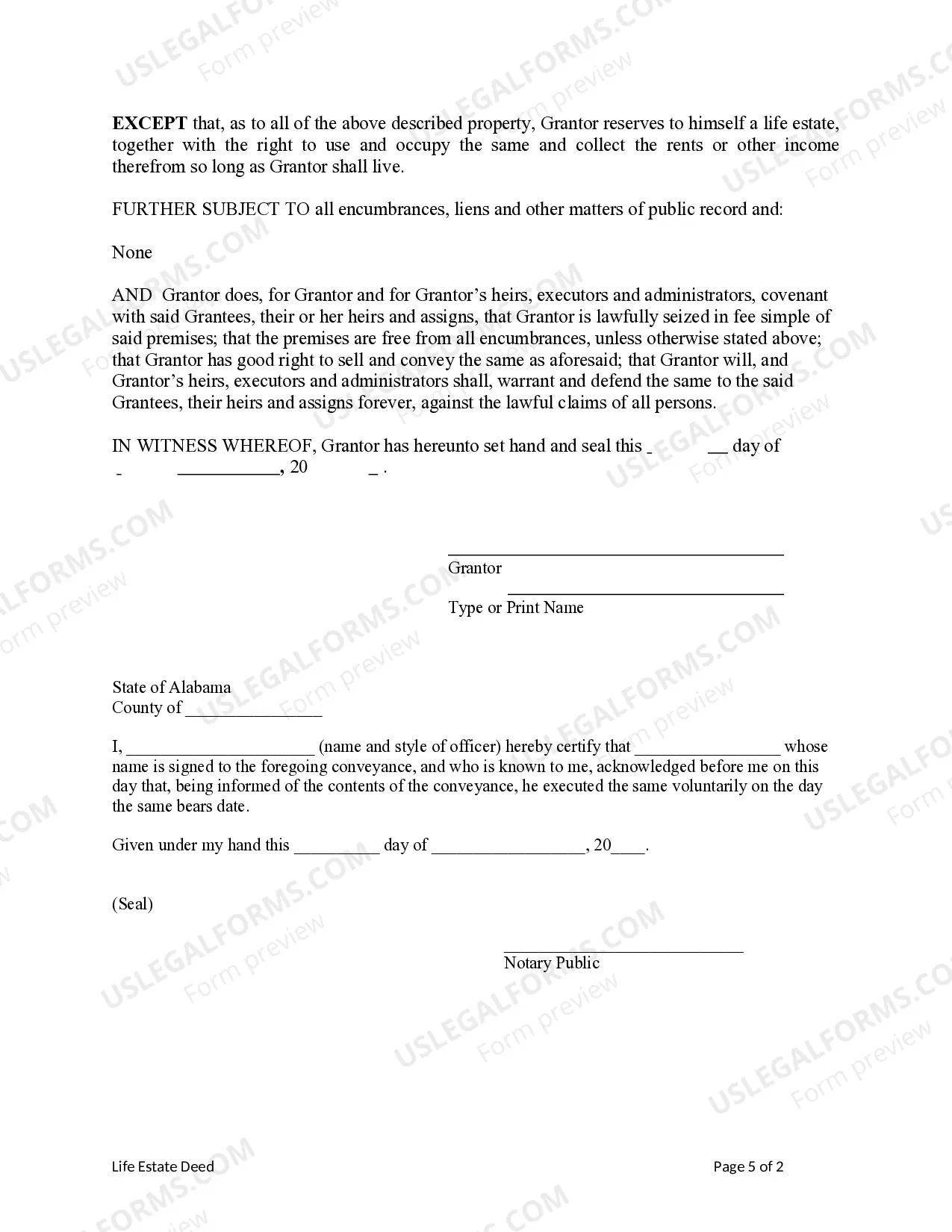

The most common way to create a life estate is through a property deed. This legal document outlines the life tenant's rights and specifies what happens to the property after their death. You can also establish a life estate with existing mortgage obligations, which can complicate ownership transfer. It’s wise to seek guidance from a legal expert to ensure the deed meets your needs.

Getting around a life estate with existing mortgage can be complex. One option is to sell the property, but this typically requires the life tenant's consent. Another possibility is to refinance the mortgage to eliminate some liabilities. It's essential to consult with a legal professional for personalized advice tailored to your situation.