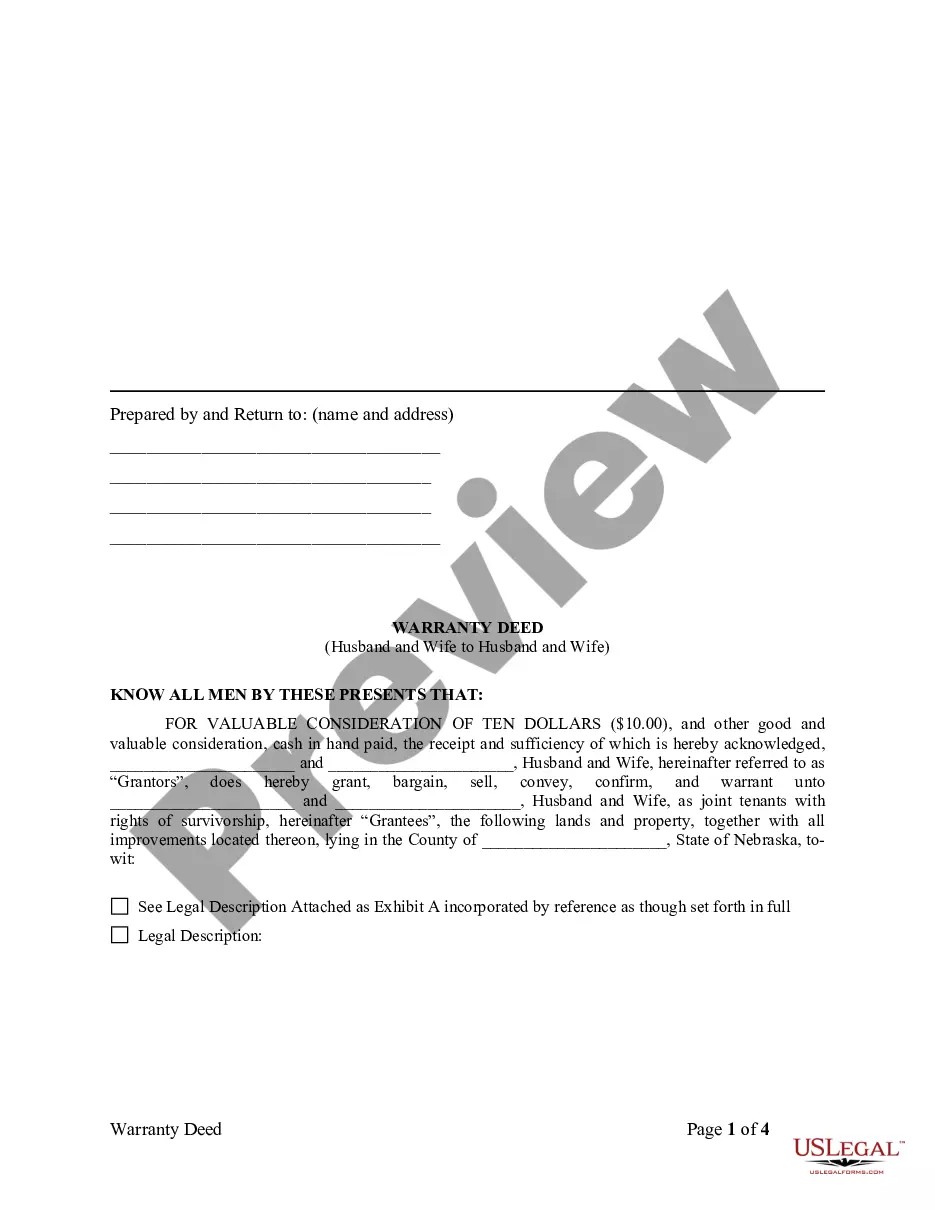

Nebraska Warranty Deed from Husband and Wife to Husband and Wife

About this form

This Warranty Deed from Husband and Wife to Husband and Wife is a legal document that facilitates the transfer of property ownership. In this deed, both the grantors (husband and wife) convey the property to the grantees (husband and wife). This form includes warranties that the property is free from encumbrances, except for specified exceptions, making it distinct from other forms of property deeds. It is crucial for legally documenting such transfers between spouses, ensuring a clear title to the property.

Key parts of this document

- Identification of grantors and grantees: Names and details of both parties involved in the transaction.

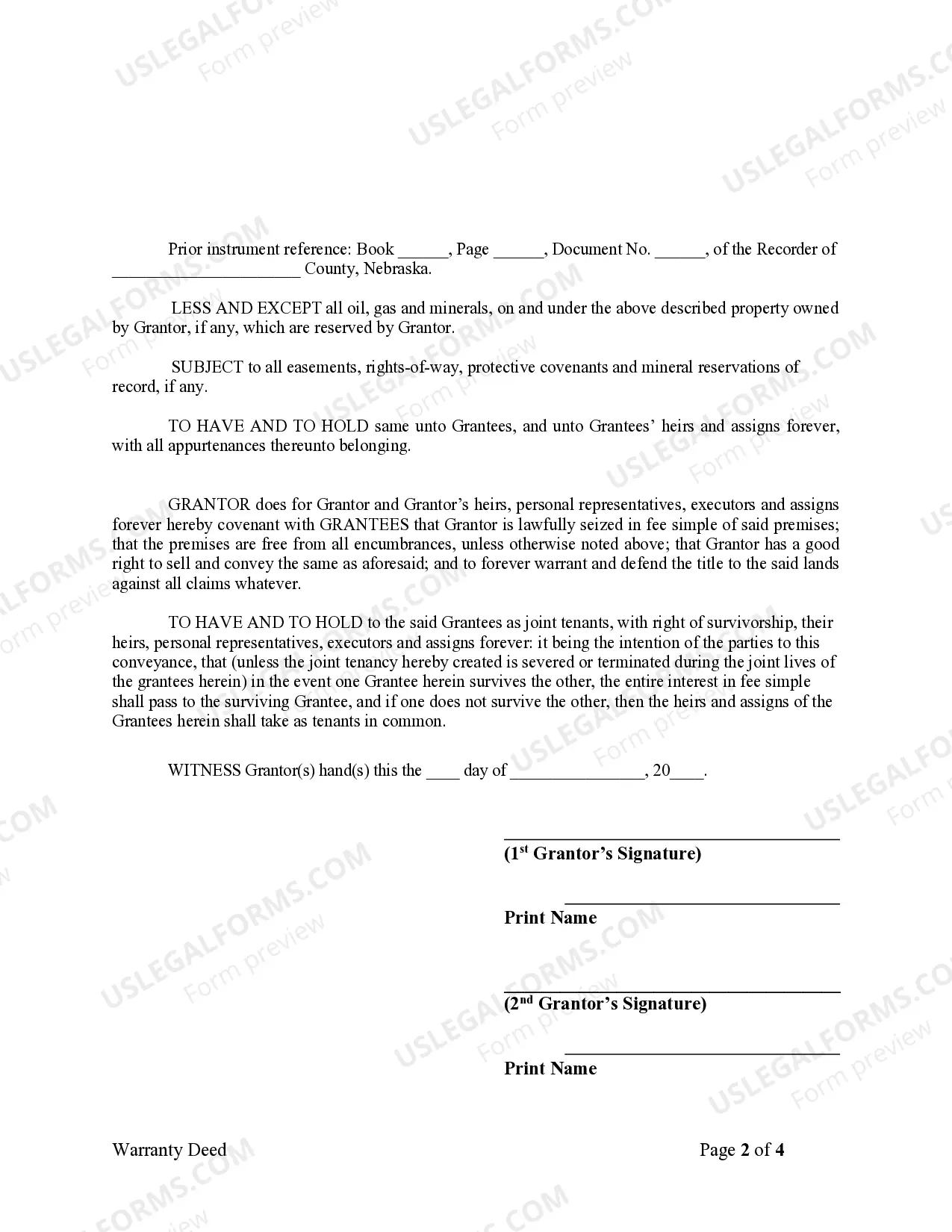

- Property description: A clear definition of the property being transferred, including any reservations.

- Warranties of title: A statement ensuring the property is free from encumbrances, barring any noted exceptions.

- Notary acknowledgment: A section for a notary public to verify the identities of the signers and their willingness to execute the deed.

When to use this document

This form should be used when a married couple wishes to transfer real estate ownership between themselves. Common scenarios include transferring property for estate planning, refinancing, or simplifying property titles. This form can also be used in cases where both spouses want to clarify ownership rights distinctly.

Intended users of this form

- Married couples transferring property between themselves.

- Individuals planning for estate matters where property needs to be clearly titled.

- Couples who want to ensure a legally recognized transfer of ownership without selling the property to third parties.

Completing this form step by step

- Identify the parties: Enter the names and details of the husband and wife as grantors and grantees.

- Specify the property: Accurately describe the property being transferred, including its address and legal description.

- Detail exceptions: Clearly note any reservations, such as oil, gas, and mineral rights, as necessary.

- Acknowledge before a notary: Both parties must sign the document in the presence of a notary public for verification.

- Retain a copy: Ensure to keep a signed copy of the deed for your records, along with the notarized acknowledgment.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Typical mistakes to avoid

- Failing to provide complete and accurate descriptions of the property.

- Overlooking the notarization requirement, which can invalidate the deed.

- Not specifying exceptions or encumbrances correctly, which may lead to legal disputes.

Why complete this form online

- Convenience: Download and complete the form from anywhere at any time.

- Editability: Easily modify the document to fit specific needs without starting from scratch.

- Reliability: Access professionally drafted forms that comply with legal standards.

State-specific compliance details

This form complies with all state statutory laws applicable to Warranty Deeds, making it versatile for use across various jurisdictions. Ensure to check for any unique state-specific regulations that might affect property transfer processes.

Form popularity

FAQ

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Can a spouse or partner sign on their spouse's behalf? The short answer is no. This is a legally binding contract that typically must be notarized and is legally binding in court, therefore, all signatures and even initials need to be from the actual person themselves.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.