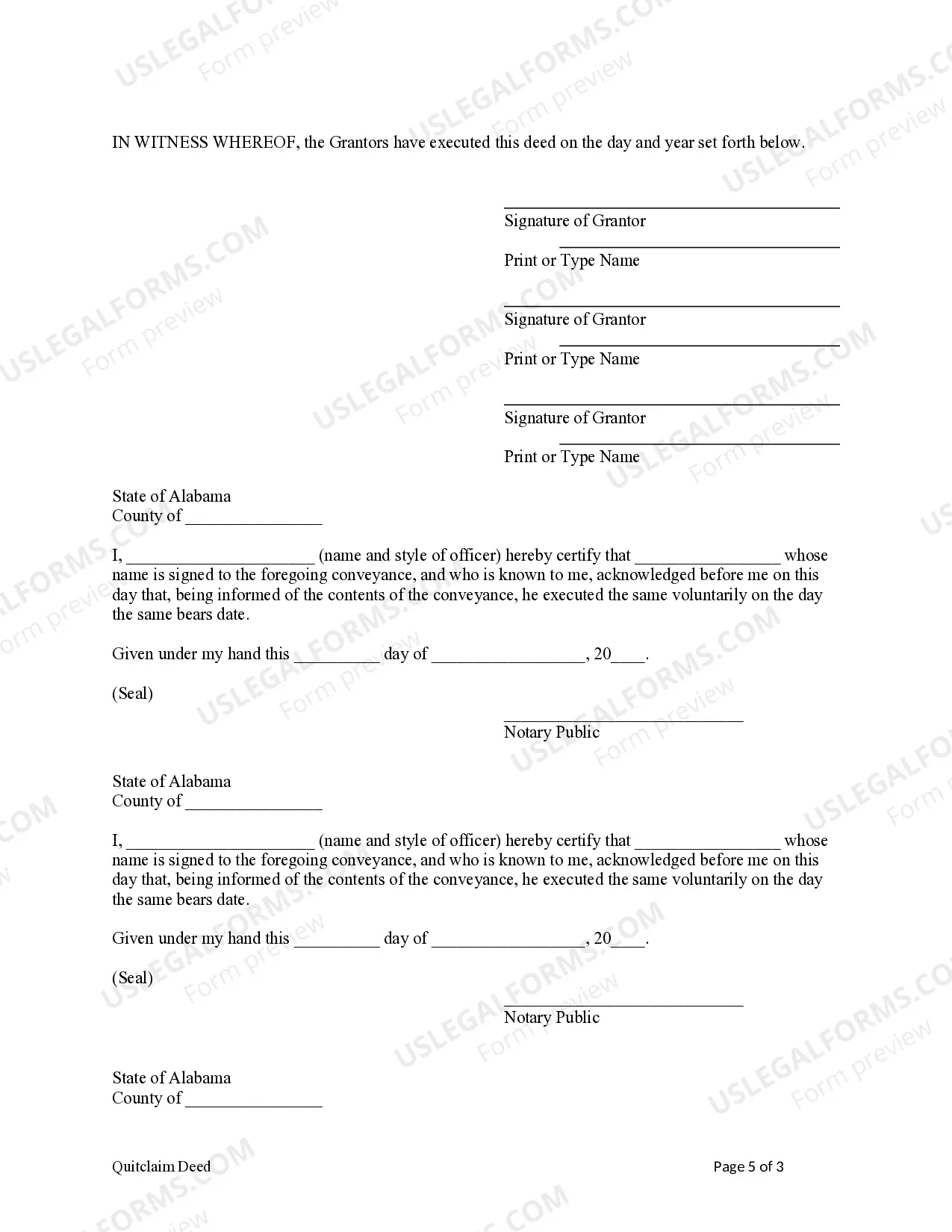

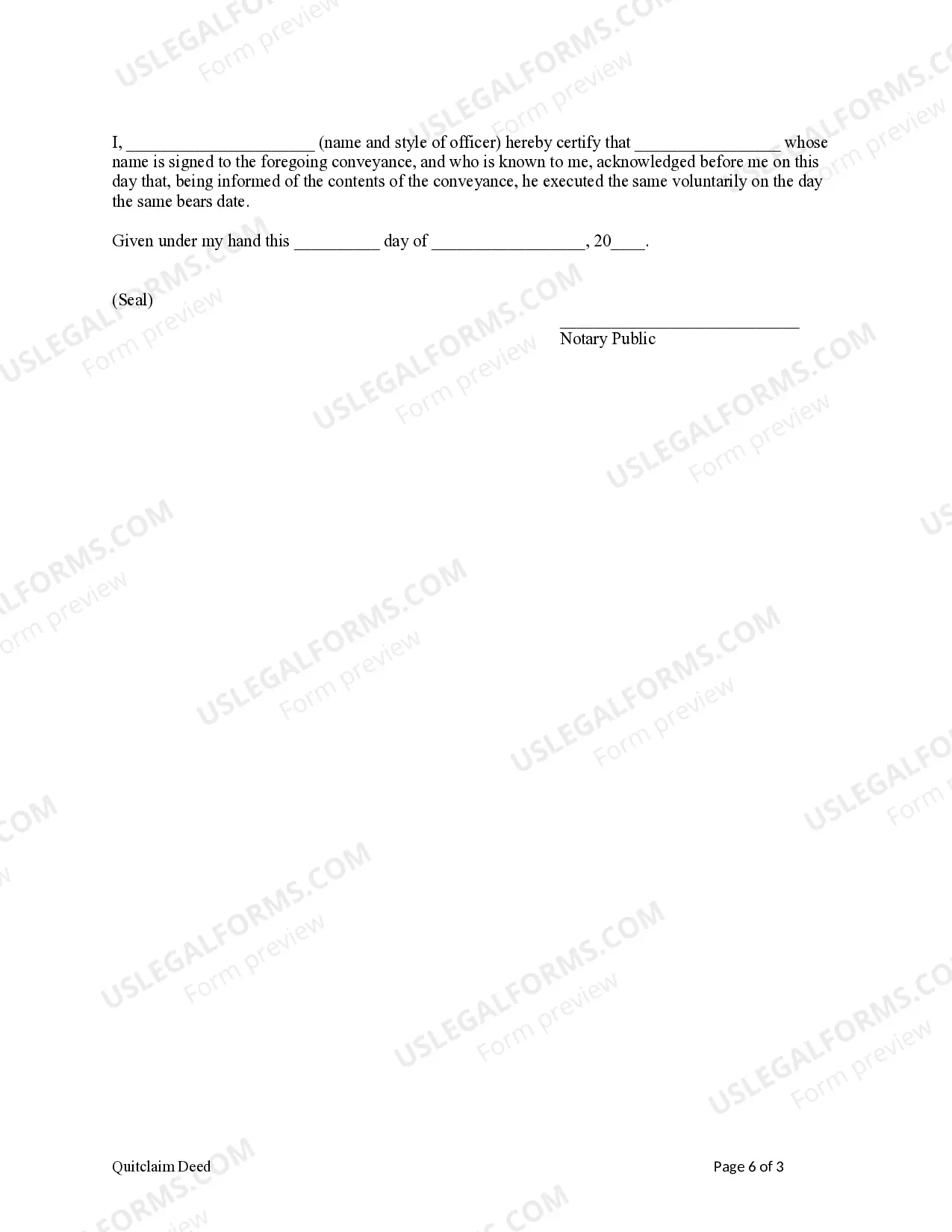

Quitclaim Deed Two With Mortgage Owed

Description

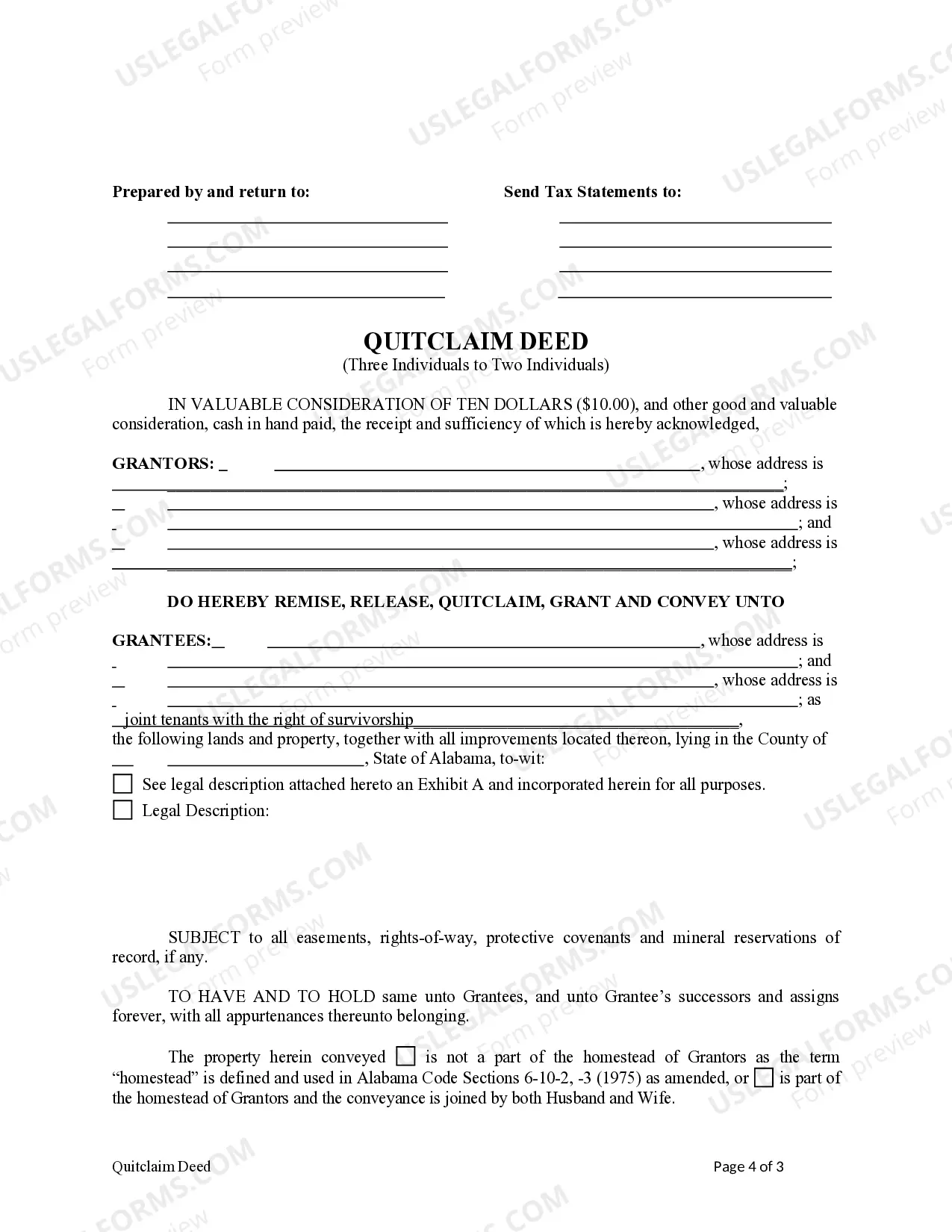

How to fill out Alabama Quitclaim Deed From Three Individuals To Two Individuals?

There's no longer a necessity to spend hours searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and made their access easier.

Our site provides over 85k templates for any business and personal legal situations organized by state and area of use.

Utilize the form description and preview options, if available, to aid in your search. If the previous one wasn’t suitable, use the search bar above to look for another sample.

- All forms are properly drafted and validated for authenticity.

- You can trust in acquiring a current Quitclaim Deed Two With Mortgage Owed.

- If you are familiar with our platform and already possess an account, ensure your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can access all obtained paperwork at any time by opening the My documents tab in your profile.

- If you've not engaged with our platform previously, the process will involve a few additional steps.

- Here's how new users can obtain the Quitclaim Deed Two With Mortgage Owed in our catalog.

- Review the page content carefully to verify it includes the sample you require.

Form popularity

FAQ

Certain conditions can void a quitclaim deed, including a lack of legal capacity, improper execution, or legal duress during the signing process. For instance, if the document was signed under pressure or without understanding, this could lead to its invalidation. Utilizing US Legal Forms can help you prepare valid quitclaim deeds two with mortgage owed, ensuring compliance with legal standards.

A quitclaim deed can be invalidated by a variety of factors, such as fraud, lack of proper signatures, or failure to meet state requirements. Additionally, if the grantor does not have actual ownership interest, the deed may be considered null. Having the right information and guidance, such as from US Legal Forms, can help ensure your quitclaim deed two with mortgage owed holds up legally.