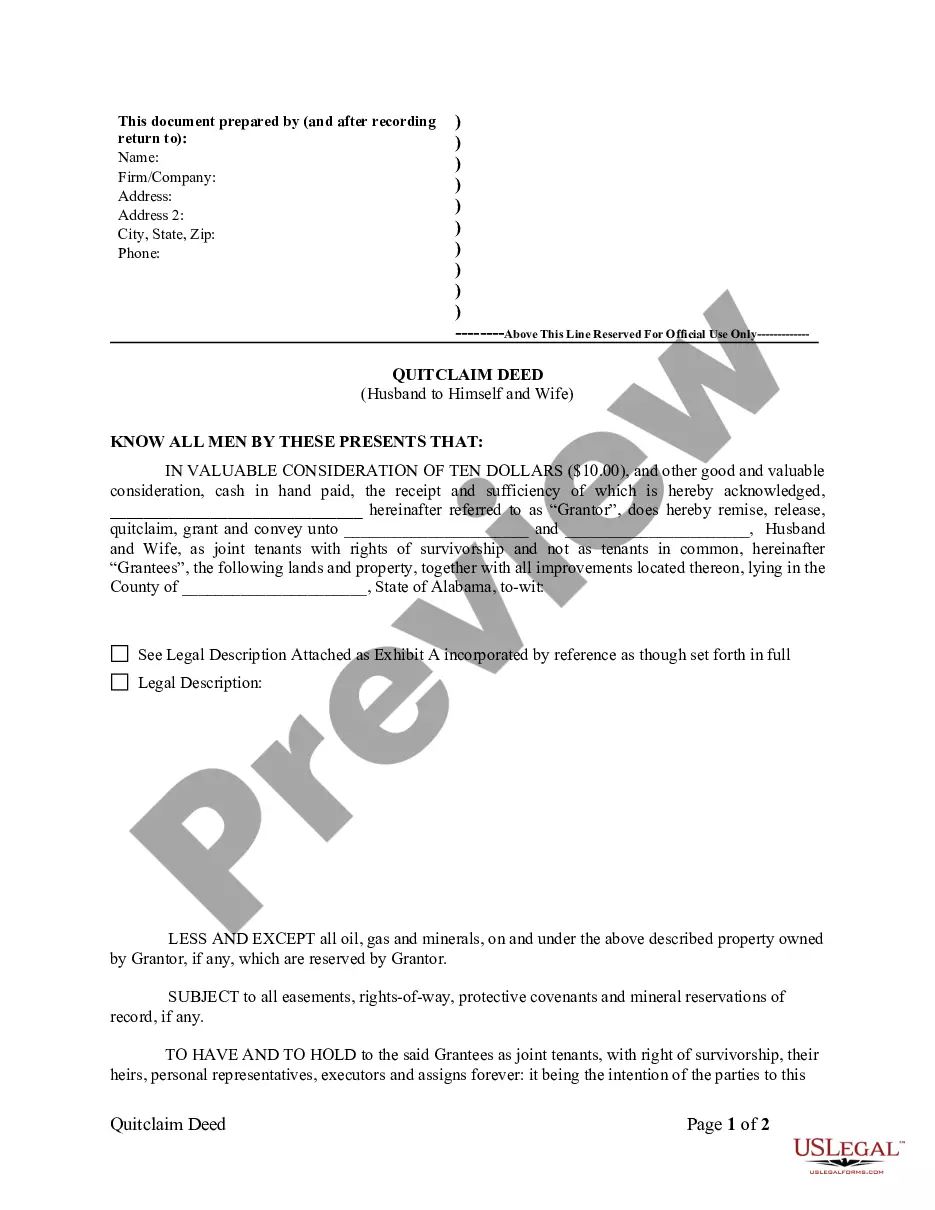

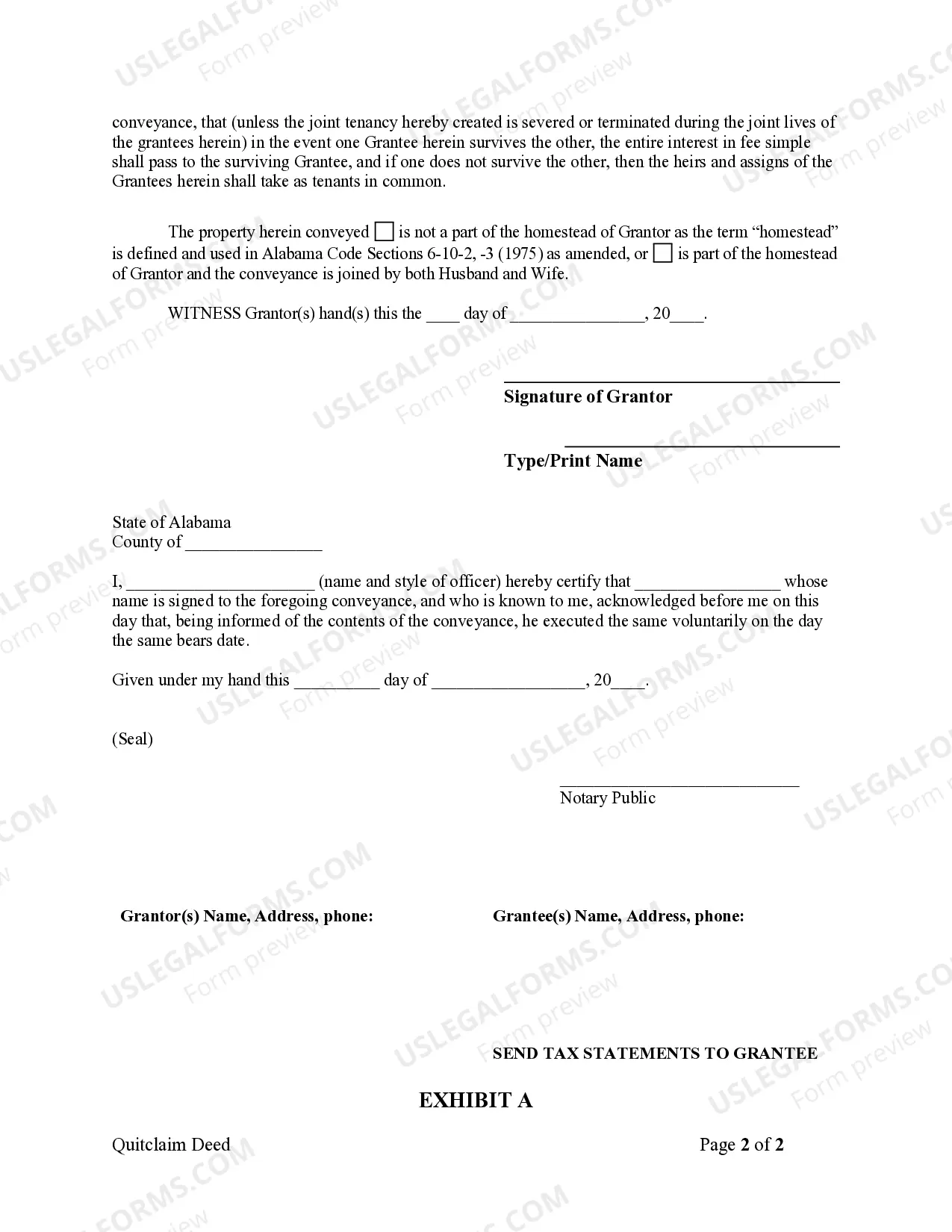

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Quitclaim Deed Real Estate Form

Description

Form popularity

FAQ

The best way to transfer property to a family member is often through a quitclaim deed real estate form due to its simplicity and efficiency. This form allows you to easily transfer ownership without complicated legal procedures. However, it's always wise to consider consulting a legal professional to ensure that the transfer meets any necessary legal requirements and protects both parties involved.

A quitclaim deed real estate form is most commonly used to transfer property between family members or in situations like divorce settlements. This form allows the transferring party to relinquish any claim they have to the property without guaranteeing a clear title. It's a convenient tool for friendly transactions but it is essential to understand its limitations.

The best deed to transfer property often depends on your specific situation. A quitclaim deed real estate form is a popular choice for transferring property because it allows for a simple and quick transfer of ownership without the need for a title search. If you are transferring property between family members or trusted parties, this form can be ideal. However, it is wise to consult with a legal expert to choose the best option for your circumstances.

A quitclaim deed in the Philippines is a legal document that allows a property owner to transfer their interest in real estate to another party without making any guarantees about the title. This deed is particularly useful when there is a trust or family arrangement, as it simplifies the transfer process. When using a quitclaim deed real estate form, both parties understand that the transferor is not providing warranties about the property's condition or title. For those looking to simplify property transfers, US Legal Forms offers the necessary quitclaim deed real estate form to facilitate this process smoothly.

Filling out a quitclaim deed real estate form in Washington requires attention to detail. Begin by accurately entering the property description and the full names of both the grantor and grantee. Ensure all signatures are notarized for authenticity. Utilizing a platform like US Legal Forms can simplify this process, providing you with the correct templates and guidance needed to complete the form successfully.

Transferring property to a family member using a quitclaim deed real estate form in Washington state is straightforward. Prepare the quitclaim deed by including the property description and the names of both parties. After both parties sign and notarize the document, record it at your local county recorder's office to finalize the transfer. This process simplifies property exchanges among family members while ensuring everything is legally acknowledged.

To fill out a quitclaim deed real estate form in Washington state, first, obtain a blank form from a reliable source, such as US Legal Forms. Next, identify the property by including its legal description and parcel number. Clearly state the names of the grantor and grantee along with their addresses. Finally, ensure both parties sign and date the document in front of a notary to make it legally binding.

Indeed, a quitclaim deed real estate form must be notarized in the Philippines to be legally recognized. Notarization adds an extra layer of protection by confirming the authenticity of the signatures and the agreement. It is wise to have a notary public involved to facilitate the process and ensure compliance with local laws. With a properly notarized quitclaim, you can confidently proceed with your property transfer.

Yes, a quitclaim deed real estate form in the Philippines must be notarized to ensure its validity. Notarization confirms that the grantor willingly transferred their rights and that proper identification has occurred. This step protects both parties involved in the transaction by preventing future disputes over ownership. Therefore, it's crucial not to overlook this requirement when executing a quitclaim.

In the Philippines, various contracts require notarization, including sales agreements, leases, and quitclaim deeds real estate forms. Notarization serves to authenticate the identities of the parties involved and provides legal assurance about the transaction's legitimacy. By ensuring that crucial documents are notarized, individuals can reduce the risk of disputes later on. When you prepare a quitclaim deed, for example, notarization becomes essential to validate the transfer.