Deed In Lieu Of Foreclosure Template For Reverse Mortgage

Description

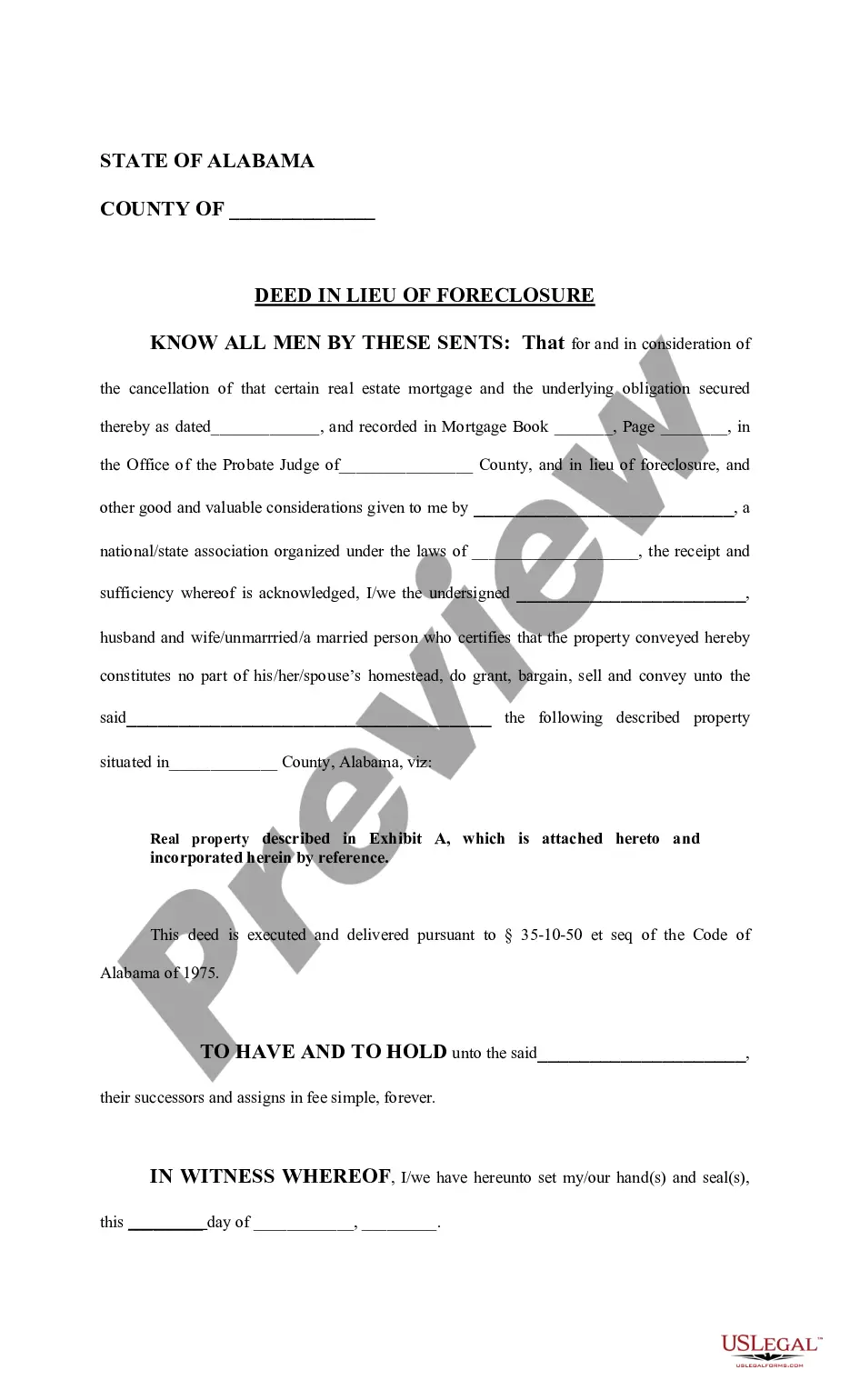

How to fill out Alabama Deed In Lieu Of Foreclosure?

Maneuvering through the red tape of official documents and templates can be difficult, particularly if one is not accustomed to it professionally.

Moreover, selecting the appropriate template to acquire a Deed In Lieu Of Foreclosure Template For Reverse Mortgage will consume a significant amount of time, as it must be accurate and valid down to the very last detail.

However, you will spend notably less time picking a suitable template if it originates from a trustworthy source.

Acquire the correct document in a few straightforward steps: Enter the document's name in the search bar, find the suitable Deed In Lieu Of Foreclosure Template For Reverse Mortgage in the results, check the sample outline or open its preview, and when the template meets your requirements, click Buy Now. Proceed to select your subscription plan, register an account at US Legal Forms using your email and creating a password, choose a credit card or PayPal payment method, and save the template file on your device in your preferred format. US Legal Forms can save you considerable time determining whether the online form is appropriate for your needs. Establish an account to gain unlimited access to all the templates you require.

- US Legal Forms serves as a platform that streamlines the process of locating the correct forms online.

- US Legal Forms is a single hub where you can find the latest samples of documents, seek guidance on their usage, and download these samples for completion.

- It functions as a repository with over 85,000 forms applicable in various sectors.

- When searching for a Deed In Lieu Of Foreclosure Template For Reverse Mortgage, you won’t need to question its authenticity as every form is validated.

- Having an account with US Legal Forms ensures you have all the necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- Your saved forms can be accessed from any device by clicking Log In on the library site.

- If you do not yet possess an account, you can still search for the template you require.

Form popularity

FAQ

A deed in lieu of foreclosure shares similarities with foreclosure but serves as a more beneficial alternative. Unlike foreclosure, which is a formal legal process initiated by lenders, a deed in lieu of foreclosure template for reverse mortgage offers a mutual agreement between the borrower and lender. This process can streamline the transition out of a property and reduce the emotional and financial strain that often accompanies foreclosure. It allows homeowners to take control of their situation while minimizing lasting impacts on their financial future.

One effective option to avoid foreclosure is utilizing a deed in lieu of foreclosure template for reverse mortgage. This approach allows homeowners to relinquish their property voluntarily, which can be less stressful than the foreclosure process. It also helps homeowners avoid the costs associated with prolonged foreclosure proceedings. This option is particularly beneficial for those looking to escape a challenging financial situation.

A deed in lieu of foreclosure is a strong alternative to foreclosure. By using a deed in lieu of foreclosure template for reverse mortgage, homeowners can transfer their property title directly to the lender, avoiding the lengthy foreclosure process. This solution helps protect your credit score and allows for a more straightforward resolution. Additionally, it may provide financial relief to homeowners facing financial difficulties.

The biggest disadvantage for a lender accepting a deed in lieu of foreclosure is the uncertain condition of the property. If the previous homeowner did not maintain it properly, the lender might face costly repairs before selling it again. Additionally, the lender must consider that they might not recover the full amount owed, impacting their overall financial strategy.

For lenders, the most notable disadvantage in accepting a deed in lieu of foreclosure is the potential financial loss. The property may not be worth the outstanding mortgage amount, leading to an unrecoverable loss. Furthermore, lenders sometimes deal with legal issues if other liens exist on the property, complicating their ability to resell it later.

One major disadvantage of a deed is the potential tax implications that could arise from the transaction. If the property has appreciated in value, you might face a substantial tax burden when you transfer the deed. Moreover, the process could lead to complications if the lender refuses to accept the deed for any reason, leaving you in a precarious financial situation.

A deed in lieu of foreclosure can sometimes harm your credit score, though it usually has a less severe impact compared to a traditional foreclosure. Additionally, the lender may require you to prove your financial hardship, which can feel invasive. It’s also essential to understand that this option does not erase your debt, as lenders may still pursue you for any remaining balance.

The 95% rule in reverse mortgages refers to the guideline that states a borrower can access up to 95% of their home's appraised value, depending on the age of the youngest borrower and the current interest rates. This rule helps ensure that homeowners maintain sufficient equity in their property while accessing necessary funds. By understanding this rule, homeowners can make informed decisions and consider a deed in lieu of foreclosure template for reverse mortgage if they face unforeseen financial difficulties.

Typically, older homeowners who need additional income in retirement benefit the most from a reverse mortgage. This financial product provides access to home equity without requiring monthly repayments, which can significantly ease financial burdens. Using a deed in lieu of foreclosure template for reverse mortgage can be a safeguard for these homeowners, ensuring they have a clear path if they can no longer meet mortgage obligations.

Yes, homeowners can lose their homes with a reverse mortgage if they are unable to meet specific obligations, like paying property taxes or maintaining the home. If these conditions are not met, the lender may initiate foreclosure proceedings. Utilizing a deed in lieu of foreclosure template for reverse mortgage can help homeowners navigate this situation by allowing them to voluntarily transfer ownership back to the lender, mitigating further financial issues.