Executor Deed Of Assent Georgia

Description

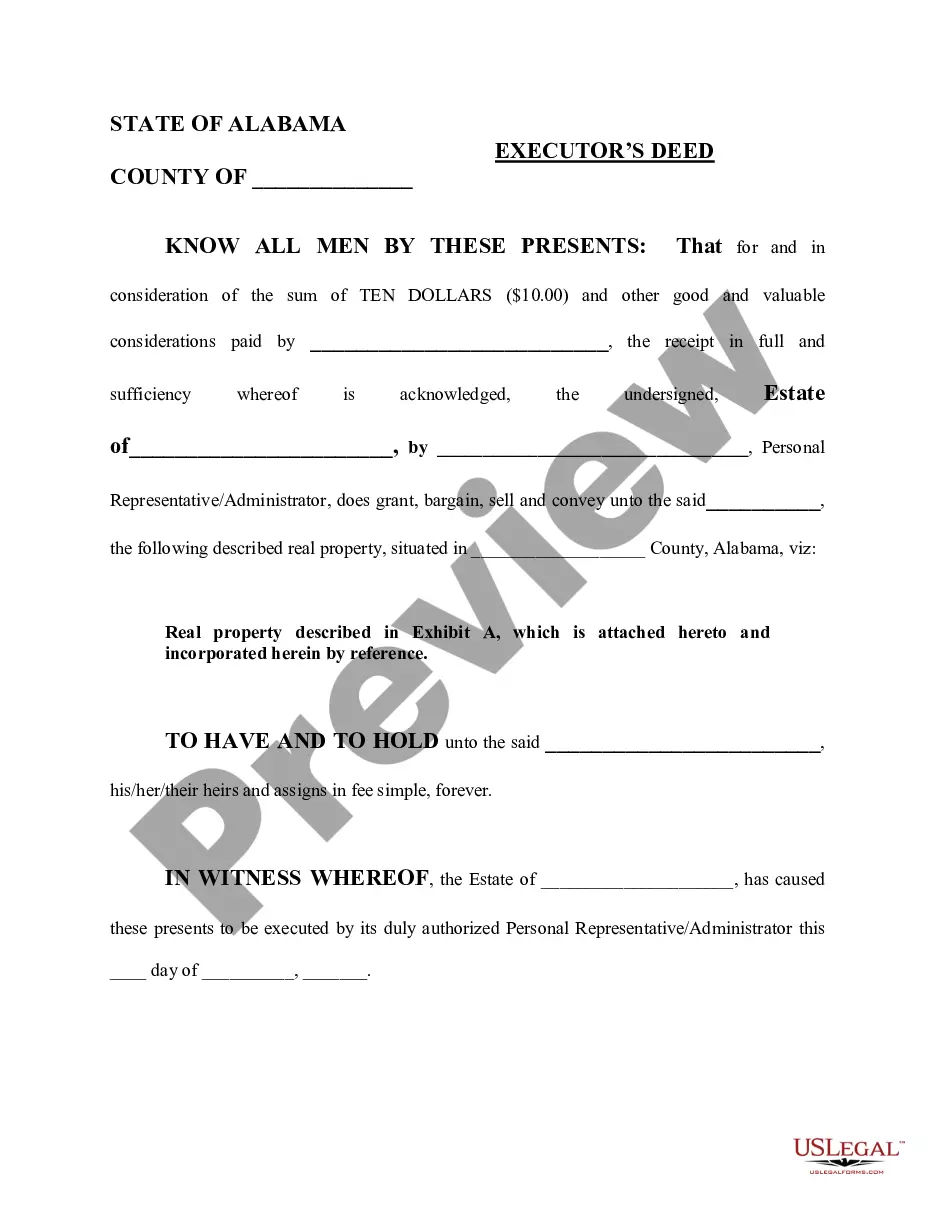

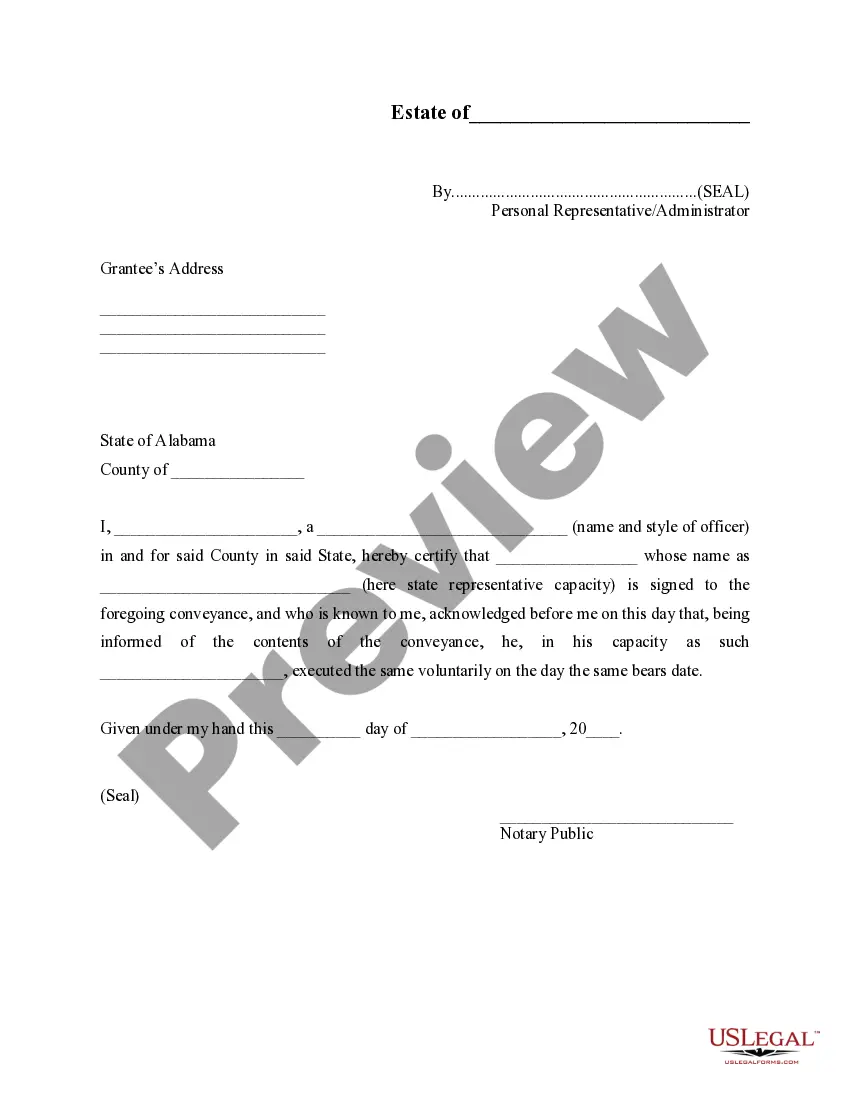

How to fill out Alabama Executor's Deed?

Whether for commercial reasons or personal matters, everyone at some point must handle legal circumstances in their life.

Completing legal paperwork requires meticulous attention, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the correct template online. Take advantage of the library’s straightforward navigation to discover the appropriate form for any circumstance.

- Obtain the required template by using the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to find the Executor Deed Of Assent Georgia sample you need.

- Download the template once it satisfies your requirements.

- If you already possess a US Legal Forms account, just click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Executor Deed Of Assent Georgia.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

No Tennessee State Income Tax Tennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses.

A Tennessee durable power of attorney form allows for the designation of a person (?agent?) to handle financial decision-making and affairs during the lifetime of someone else (?principal?).

Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. Tennessee's tax system ranks 14th overall on our 2023 State Business Tax Climate Index.

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

With a few exceptions, all businesses that sell goods or services must pay the state business tax. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state.

The TN nonimmigrant status allows professionals from Canada and Mexico to work in the U.S. Mexican professionals must obtain a TN visa at a U.S. Consulate or Embassy to enter the U.S. Canadian professionals can request TN status at a U.S. port of entry.

Filing for Child Custody in Tennessee: 5 Steps Step 1: Determine your court. Either you or the other parent must have lived in Tennessee for at least six months before you can begin a case. ... Step 2: Complete your paperwork. ... Step 3: Finalize your forms. ... Step 4: Hand in your paperwork. ... Step 5: Service.

Steps for Making a Financial Power of Attorney in Tennessee Create the POA Using a Form, Software or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Register of Deeds.