Executor Deed Form

Description

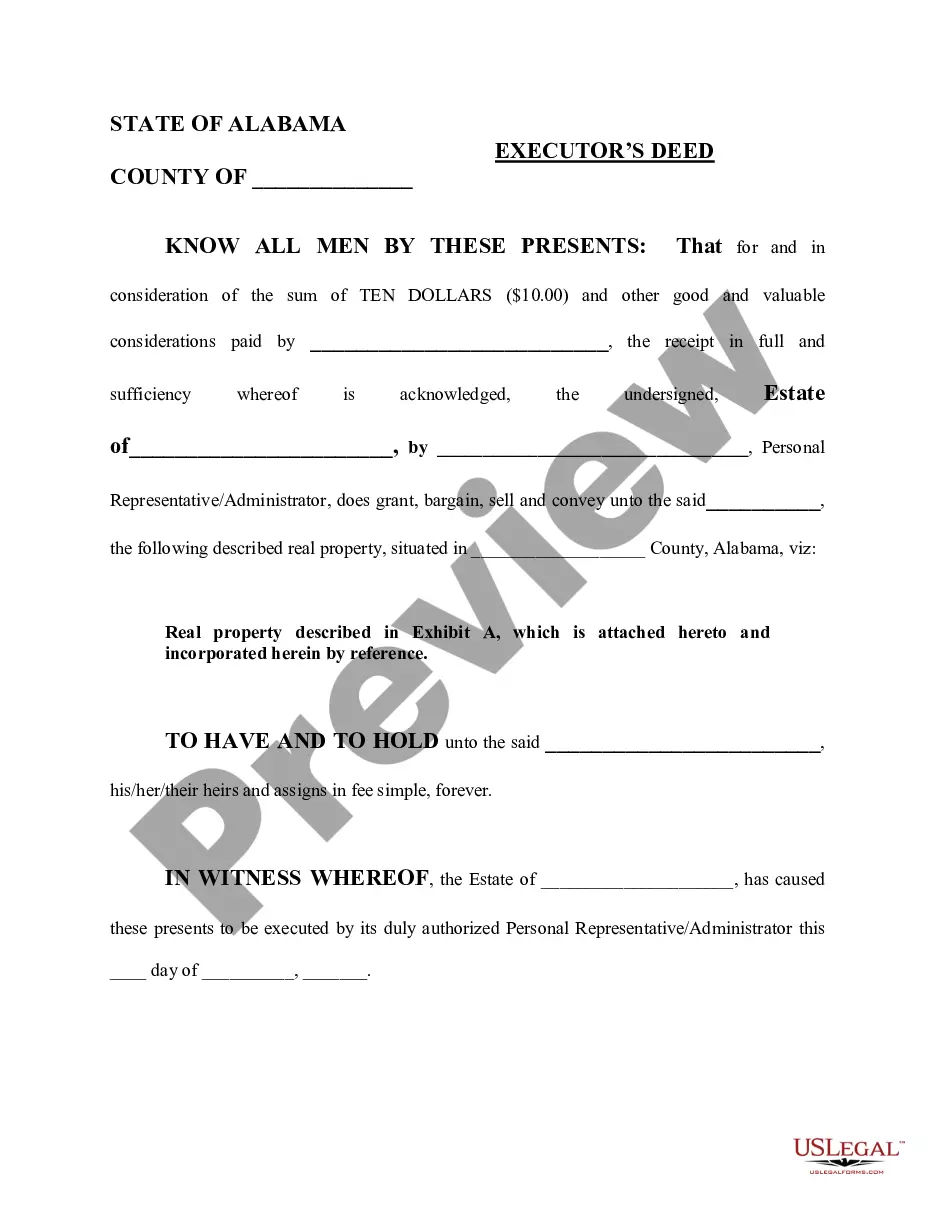

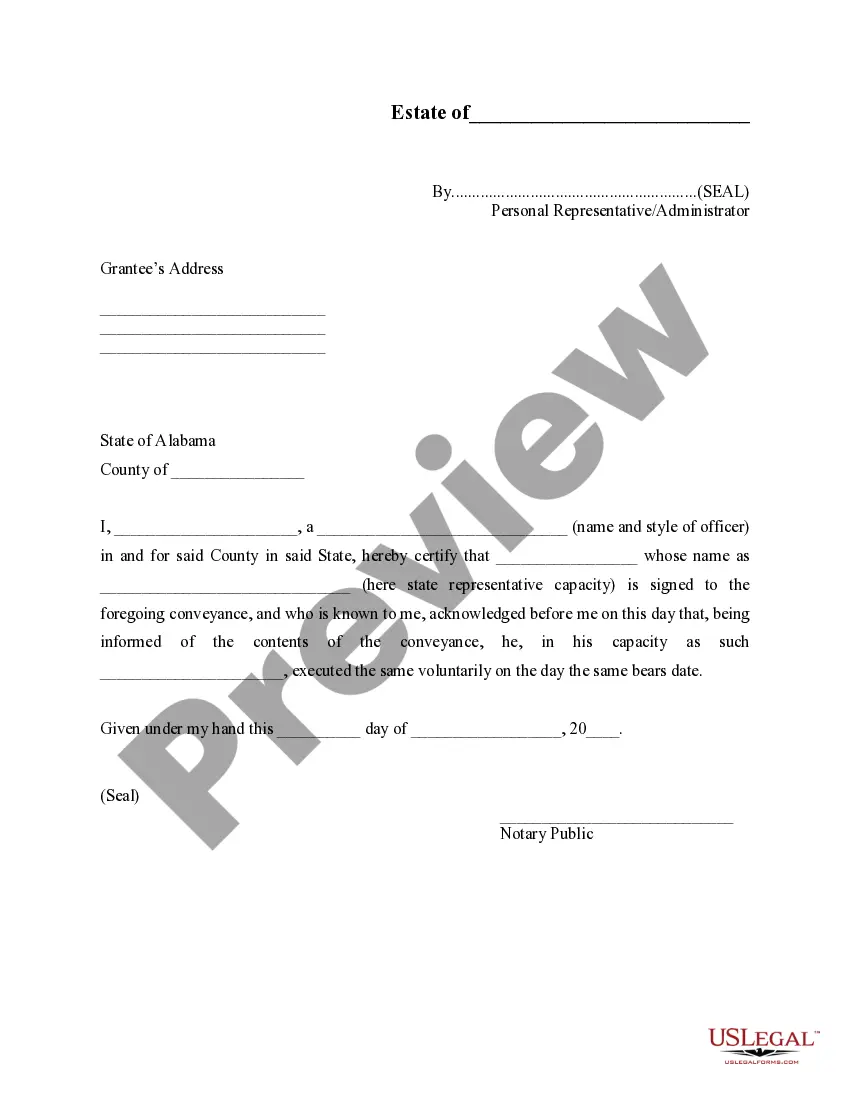

How to fill out Alabama Executor's Deed?

Properly created formal documentation is one of the vital assurances for preventing problems and legal disputes, but acquiring it without an attorney's assistance may require some time.

Whether you are looking to swiftly locate an updated Executor Deed Form or any additional forms for work, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen file. Additionally, you can revisit the Executor Deed Form at any time, as all documents previously obtained on the platform are accessible via the My documents section of your account. Save both time and money on preparing official papers. Give US Legal Forms a try right now!

- Verify that the form aligns with your situation and location by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the top header.

- Select Buy Now once you find the appropriate design.

- Choose the pricing scheme, Log In to your account or create a new one.

- Select your preferred payment option to purchase the subscription plan (through a credit card or PayPal).

- Choose between PDF or DOCX file format for your Executor Deed Form.

- Hit Download, and then print the template for completion or add it to an online editor.

Form popularity

FAQ

To transfer a deed after death in Illinois, an executor must first gather the necessary documentation, including the death certificate and the will. They then complete an Executor deed form, which officially transfers ownership to the beneficiaries specified in the will. This process helps prevent disputes and confirms that the transfer is handled correctly under state law.

Yes, an executor can sell a house in Illinois, but they must follow legal protocols, including obtaining court approval if the will does not expressly allow the sale. The executor should ensure that the sale serves the best interests of the estate and its beneficiaries. Using an Executor deed form is crucial for completing the transaction legally and transparently.

A transfer on death deed in Illinois may create complications if the property owner has outstanding debts or if the beneficiaries are involved in disputes. Additionally, property transferred in this manner may not be subject to the will’s provisions, leading to potential conflicts. Using an Executor deed form can often provide clearer guidance and mitigate these issues effectively.

An executor deed in Illinois is a legal document that allows an executor to transfer property owned by a deceased person. This deed serves to officially convey the title to new owners, typically beneficiaries of the estate. By utilizing an Executor deed form, the process becomes smoother and ensures compliance with state requirements.

In Illinois, an executor must adhere to the terms of the will and cannot act against the wishes of the deceased. For instance, an executor cannot sell property without proper approval from the court or the beneficiaries. It is essential to use an Executor deed form to ensure all actions taken are legally binding and respected by all parties.