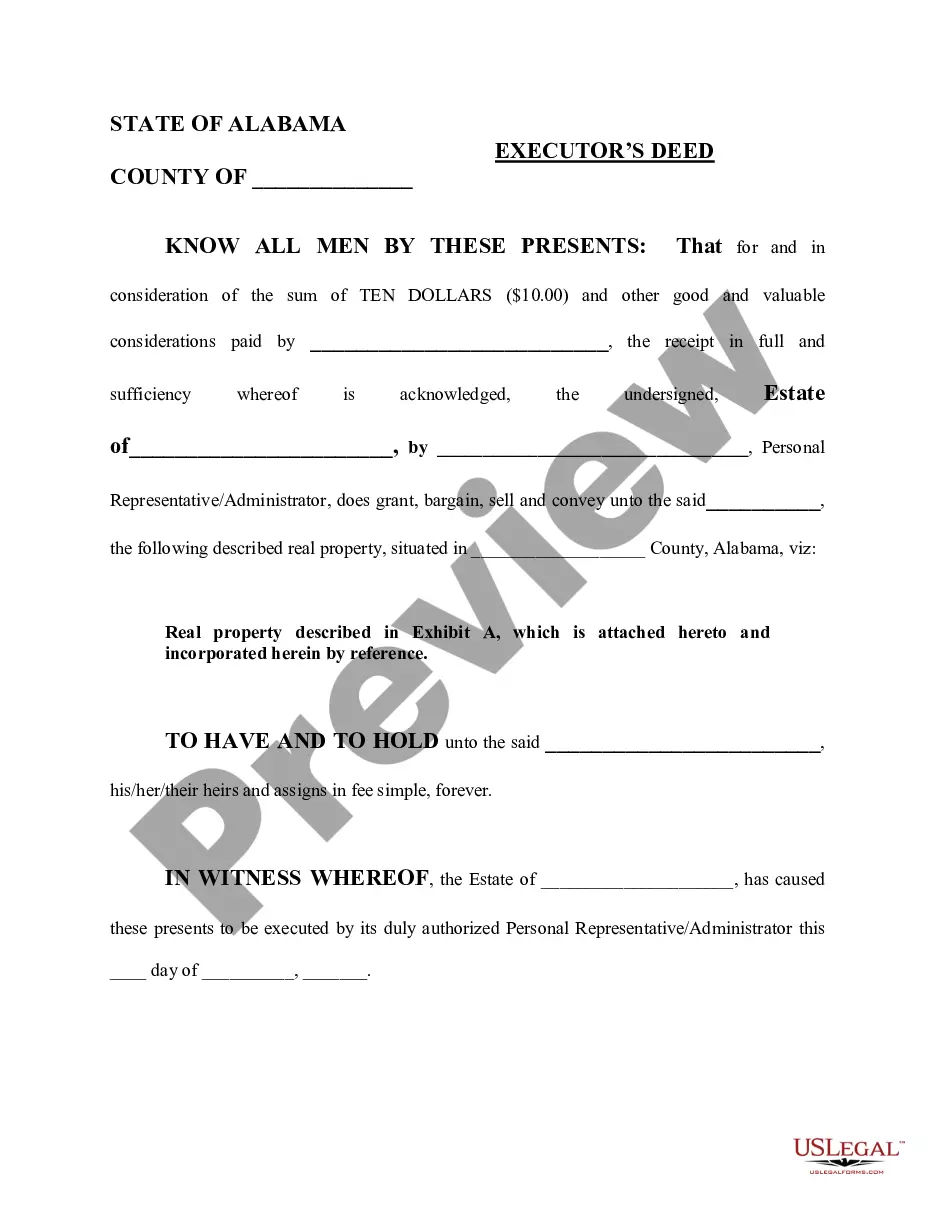

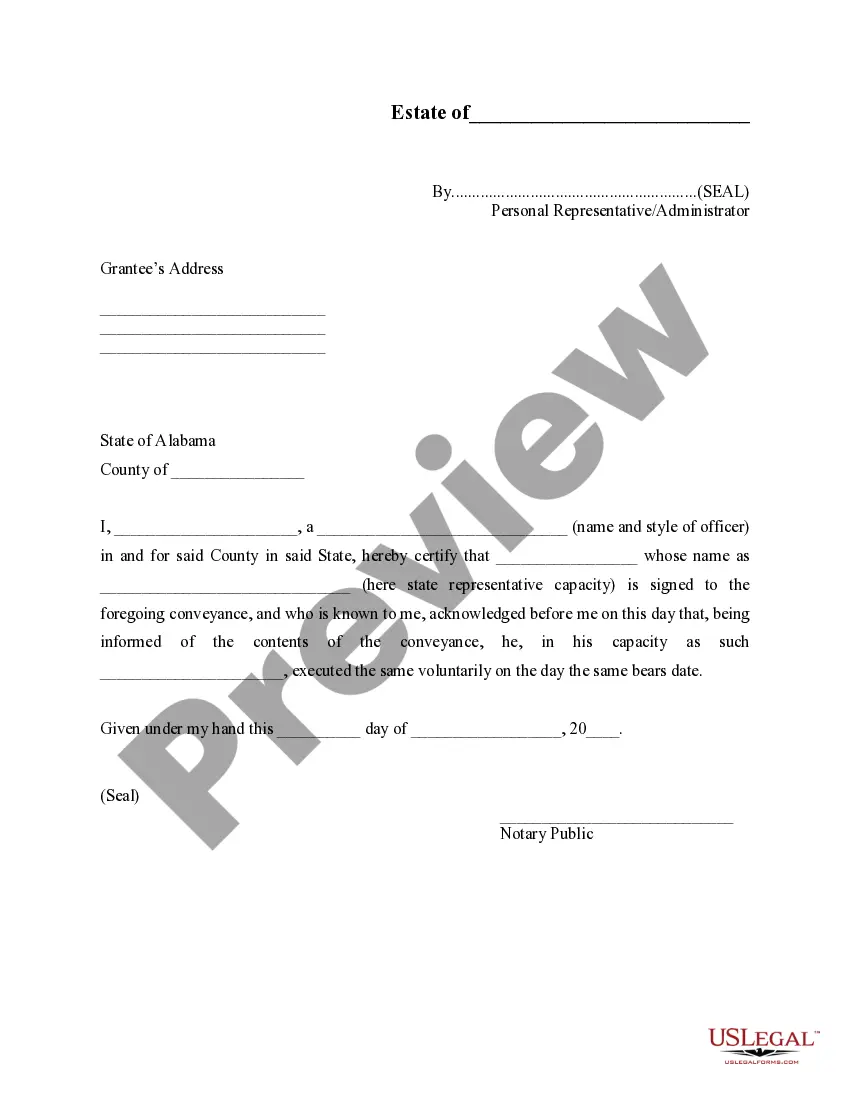

This type of deed is used to transfer property when the grantor is acting in his official capacity as an executor of an estate. The form is available in both word and word perfect formats.

Deed With Executor

Description

How to fill out Deed With Executor?

When you need to complete a Deed With Executor that adheres to your local state's laws and guidelines, there can be multiple choices available. There's no requirement to examine every form to ensure it fulfills all the legal standards if you are a US Legal Forms member.

It is a reliable source that can assist you in obtaining a reusable and current template on any subject. US Legal Forms is the most extensive online library featuring a compilation of over 85k ready-to-use documents for both business and personal legal matters.

All templates are verified to comply with each state's regulations. Thus, when acquiring the Deed With Executor from our website, you can be assured that you possess a valid and up-to-date document.

Select the most suitable subscription plan, Log Into your account, or create a new one. Pay for your subscription (Payment options include PayPal and credit card methods). Download the template in your desired file format (PDF or DOCX). Print the document or fill it out electronically using an online editor. Acquiring professionally drafted official paperwork becomes seamless with the US Legal Forms. Additionally, Premium users can also take advantage of the robust integrated tools for online PDF editing and signing. Give it a try today!

- Obtaining the necessary template from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and maintain access to the Deed With Executor at any moment.

- If this is your first visit to our website, please follow the instructions below.

- Navigate the suggested page and verify it for alignment with your requirements.

- Make use of the Preview mode and review the form description if applicable.

- Search for another sample using the Search field in the header if needed.

- Click Buy Now when you discover the correct Deed With Executor.

Form popularity

FAQ

Having an executor named in title deeds can simplify the transfer process after a property owner's death. This designation allows the executor to manage the estate and streamline how the deed with executor functions. It clarifies authority and responsibility, ensuring that the property transitions smoothly to the designated heirs as per the deceased's wishes. Utilizing platforms like USLegalForms can help facilitate this process efficiently.

Both title and deed play critical roles in property ownership, but they serve different purposes. A deed with executor conveys ownership of the property, while a title represents the legal rights to that property. Without a valid deed, you cannot prove legal ownership, so it is essential for the executor to secure and manage both effectively during the probate process.

The time it takes to transfer a deed in Texas can vary depending on the complexity of the estate and the efficiency of the probate process. Generally, if all paperwork is in order and there are no disputes, transfers can be completed within a few weeks to several months. A deed with executor is crucial in this process as it signifies authority over the property during the transfer.

To transfer a deed on inherited property in Texas, the executor must file an affidavit of heirship or a small estate affidavit with the county clerk. Once the appropriate documents are filed, the deed can be transferred to the beneficiaries named in the will or determined by Texas law. This process ensures that the deed with executor reflects the new owners accurately, allowing them to claim full ownership.

When someone passes away, their property deed is often transferred during the probate process. In this case, the executor steps in to manage the estate and handle the necessary paperwork. The executor works with the probate court to ensure that the deeds are properly transferred to the rightful heirs. This process makes it clear who inherits the property and how the deed with executor is executed.

Yes, an executor of an estate can file for a quiet deed transfer. This process allows the executor to clear the title of any disputes relating to the property, ensuring a smooth transfer to the rightful heirs. Utilizing a quiet deed transfer can simplify the estate settlement process for everyone involved. For more comprehensive assistance in handling deeds with executors, consider exploring the resources available on USLegalForms.

A quitclaim deed is frequently used to clear a title, especially when there are uncertainties about ownership. This type of deed transfers whatever interest the grantor has without guarantees. If you are handling a deed with executor situation, using a quitclaim deed may be practical, but always seek advice to ensure it aligns with your objectives.

The warranty deed is the most commonly used type of deed that provides comprehensive protection to the buyer. It guarantees that the seller has legal title and the right to sell the property, protecting against future claims. When executing a deed with executor, this level of assurance is vital for ensuring that buyers feel secure in their investment.

An executor deed in Texas is used when an executor transfers property from an estate following the death of the property owner. This deed allows the executor to officially convey the property to heirs or beneficiaries. When dealing with a deed with executor, it’s crucial to ensure all legal requirements are met to avoid complications down the line.

The best type of property deed often depends on the specific situation and needs of the parties involved. However, a warranty deed is frequently favored due to its level of protection offered to the buyer. In cases involving a deed with executor, it’s advisable to consult legal resources, like USLegalForms, to ensure the conveyance meets your unique needs and circumstances.