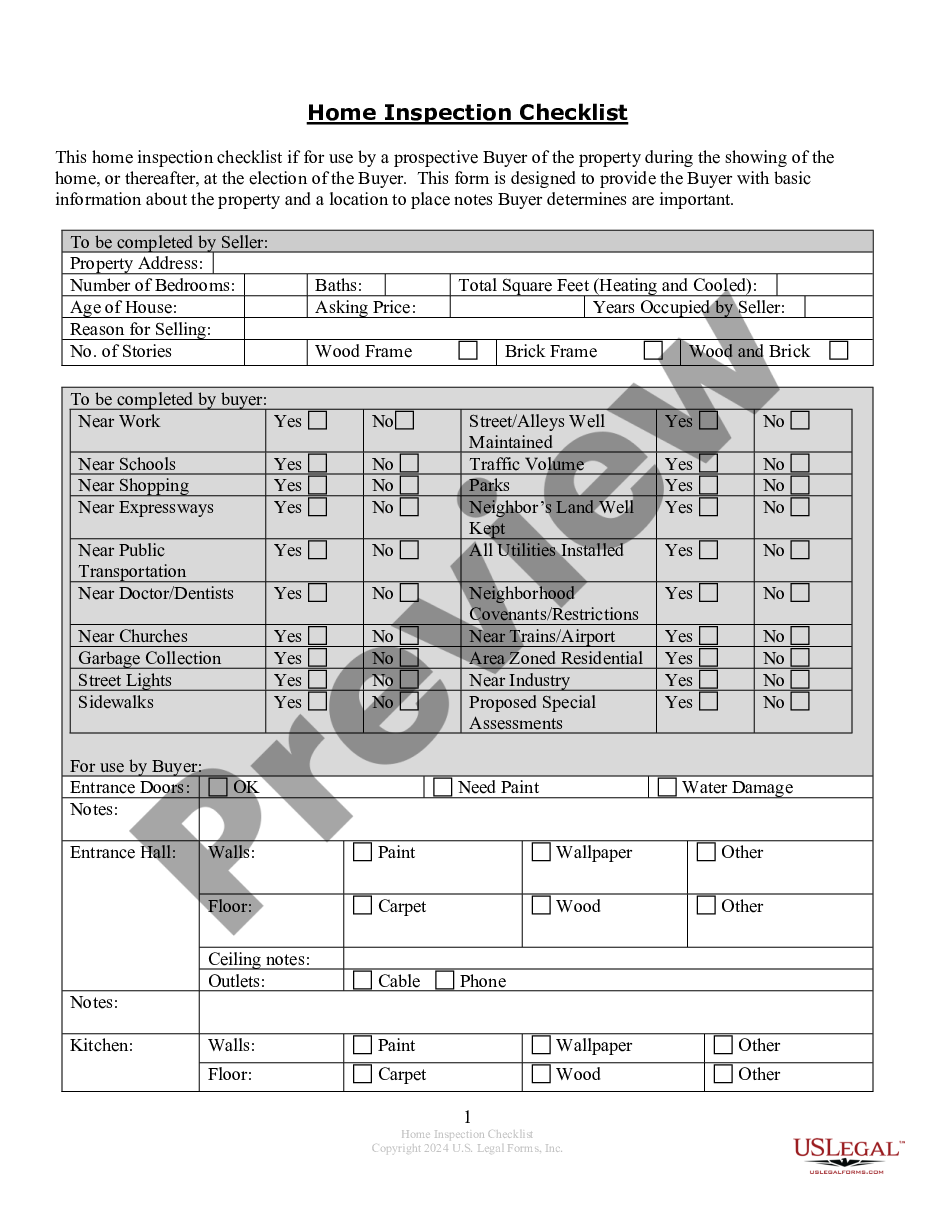

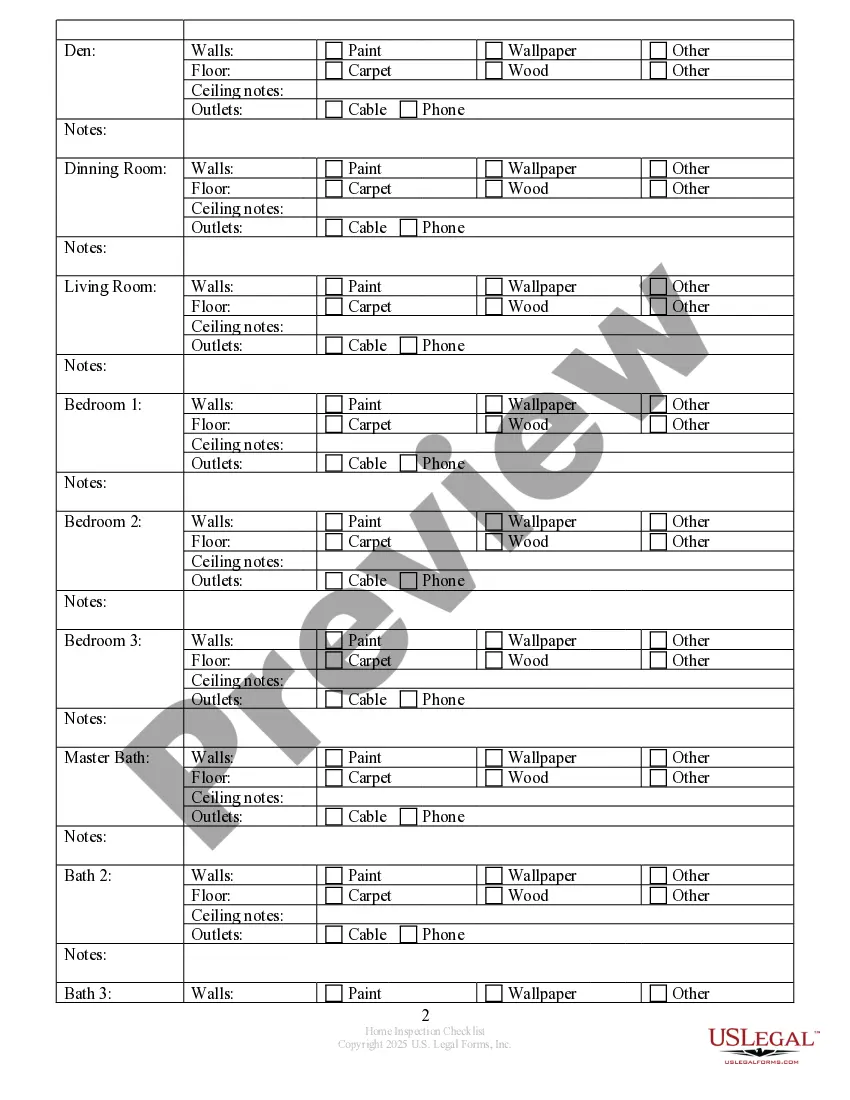

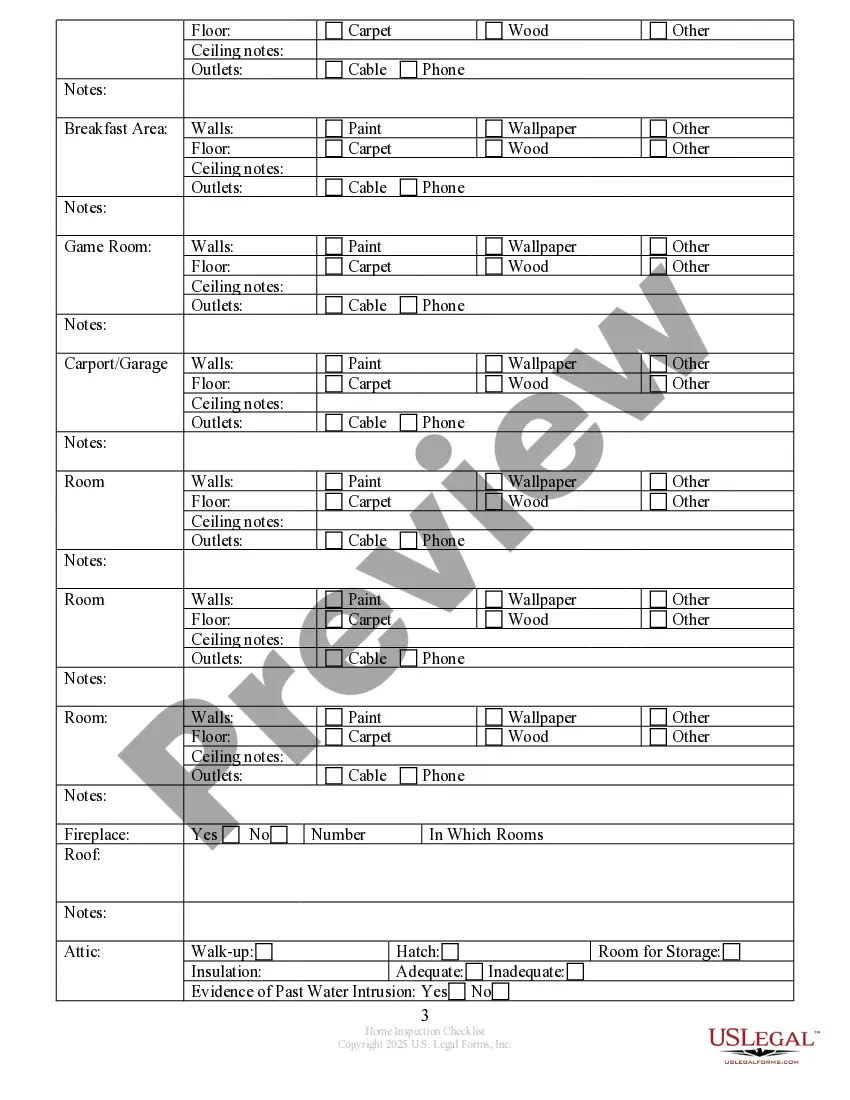

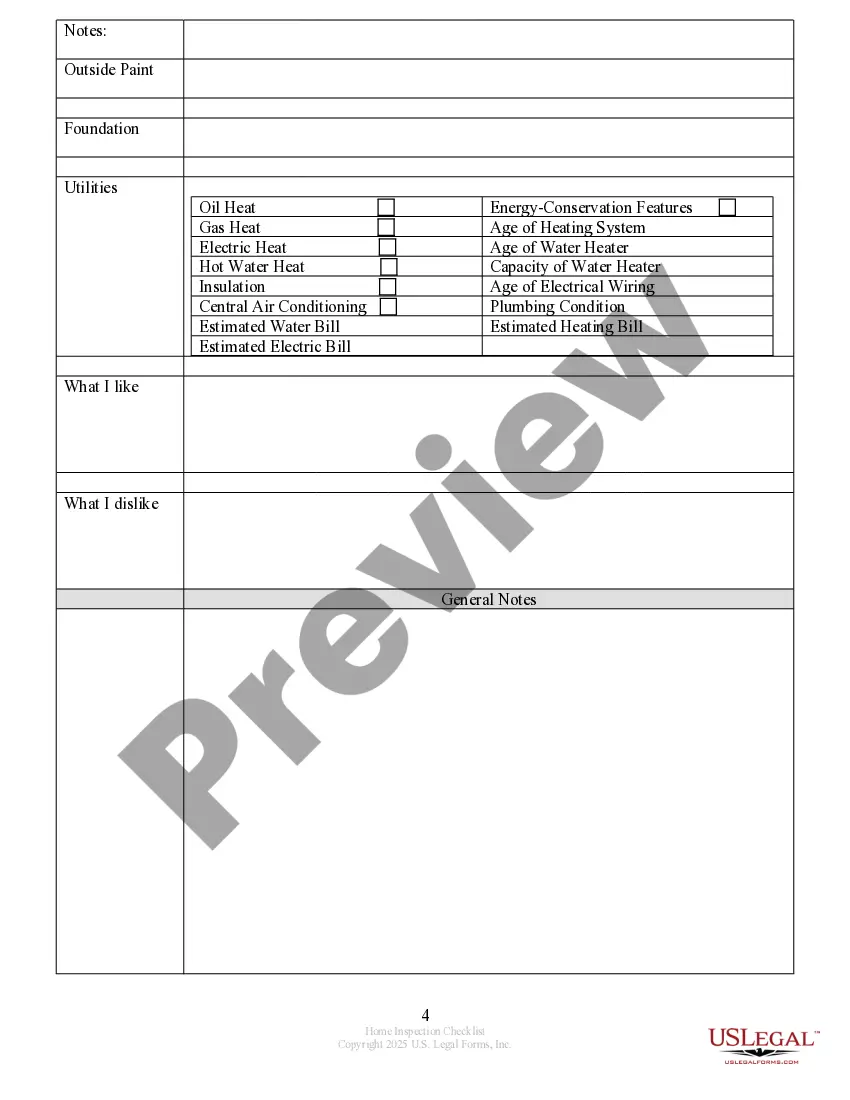

This Buyer's Home Inspection Checklist form is used by the Buyer when initially viewing a home to purchase in Alabama. It provides a comprehensive list of items to check or to ask the Seller prior to making an offer on a home. This is an all-inclusive form and not all items may be applicable to the property being viewed.

When it comes to purchasing a home in Alabama using an FHA loan, it is essential to be aware of the Alabama home inspection checklist. This checklist is a crucial step in the FHA loan process as it helps ensure the property meets the necessary safety and quality standards. Familiarizing yourself with this checklist will help you navigate through the home inspection process smoothly. The Alabama home inspection checklist for FHA loans consists of various key components that a qualified home inspector will assess. Let's take a closer look at some of the main items that are typically included in this checklist: 1. Structural Integrity: The home inspector will evaluate the overall structural stability of the property, inspecting the foundation, walls, roof, and other structural components to identify any signs of damage, cracks, or settlement issues. 2. Safety Hazards: It is essential to identify potential safety hazards within the property. This may include assessing the electrical system, ensuring proper grounding, checking for exposed wiring or faulty outlets, and assessing the presence of smoke and carbon monoxide detectors. 3. Plumbing and Water Systems: The inspection will cover the plumbing system, including pipes, fixtures, and drains, checking for leaks, proper water pressure, and functionality. The water supply source, such as wells or public water systems, will also be assessed for safety and adequacy. 4. HVAC Systems: The heating, ventilation, and air conditioning (HVAC) systems will be inspected to ensure they are in proper working condition. This includes assessing the central heating and cooling units, ductwork, and filters for functionality and efficiency. 5. Roofing and Exterior: The inspector will examine the roof for signs of damage, leaks, or inadequate insulation, as well as assess the condition of the exterior, including siding, windows, doors, and gutters. 6. Pest infestation: A thorough inspection will include assessing the property for any signs of pest infestation, such as termites, rodents, or other wood-destroying insects. This is crucial to ensure the property is free from potential damage caused by pests. It is important to note that depending on the specific FHA loan program, there may be additional checklist items and requirements. For instance, certain loans, like the FHA 203(k) loan, may have additional criteria, especially if the property requires renovation or repairs. To summarize, the Alabama home inspection checklist for FHA loans covers various aspects of the property, ensuring it meets the necessary safety and quality standards. By thoroughly assessing the structure, safety, plumbing, HVAC systems, roofing, exteriors, and identifying any potential pest infestation, this checklist helps protect homebuyers and ensures that they are making a sound investment. Overall, when embarking on the home buying journey in Alabama through an FHA loan, understanding and adhering to the prescribed home inspection checklist will provide peace of mind and help facilitate a smooth transaction process.