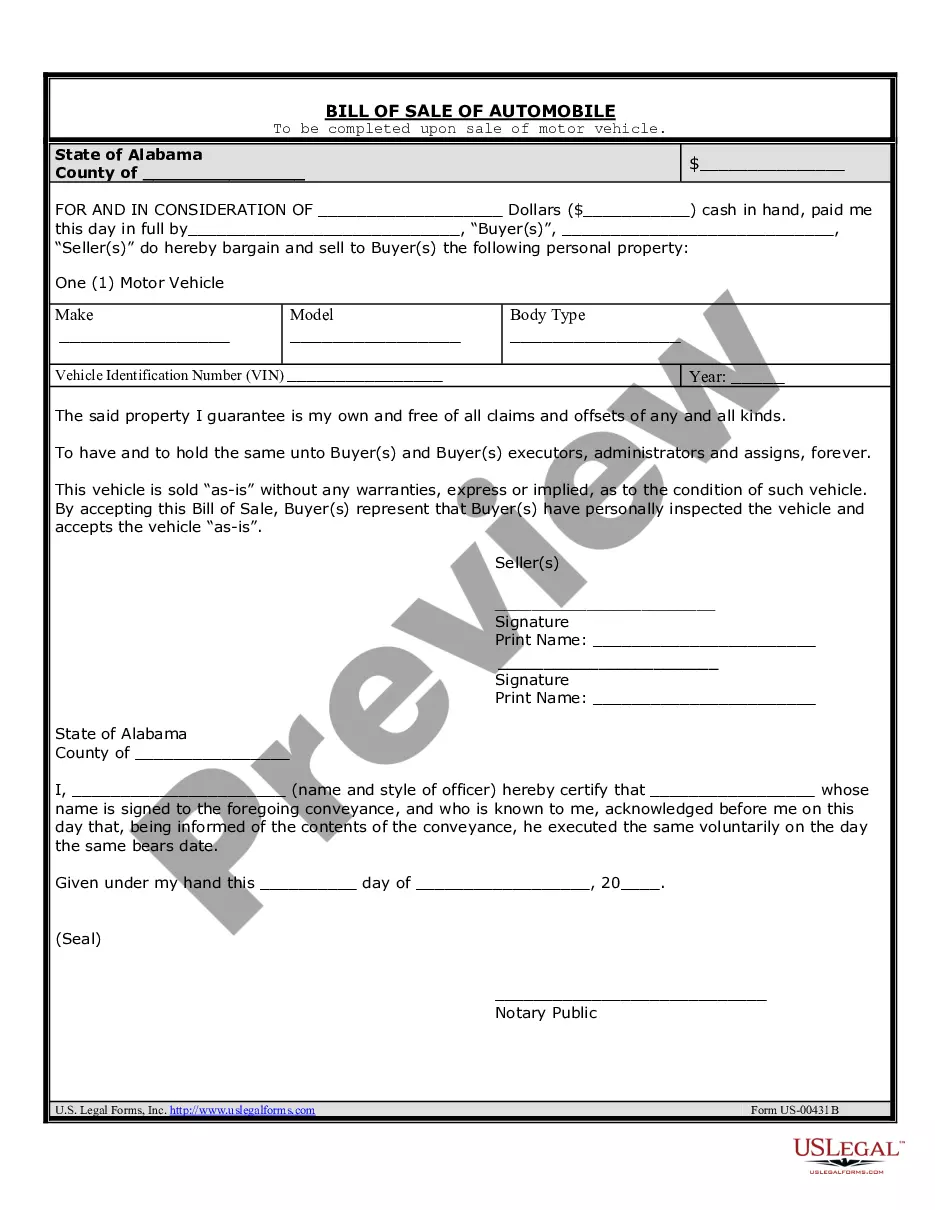

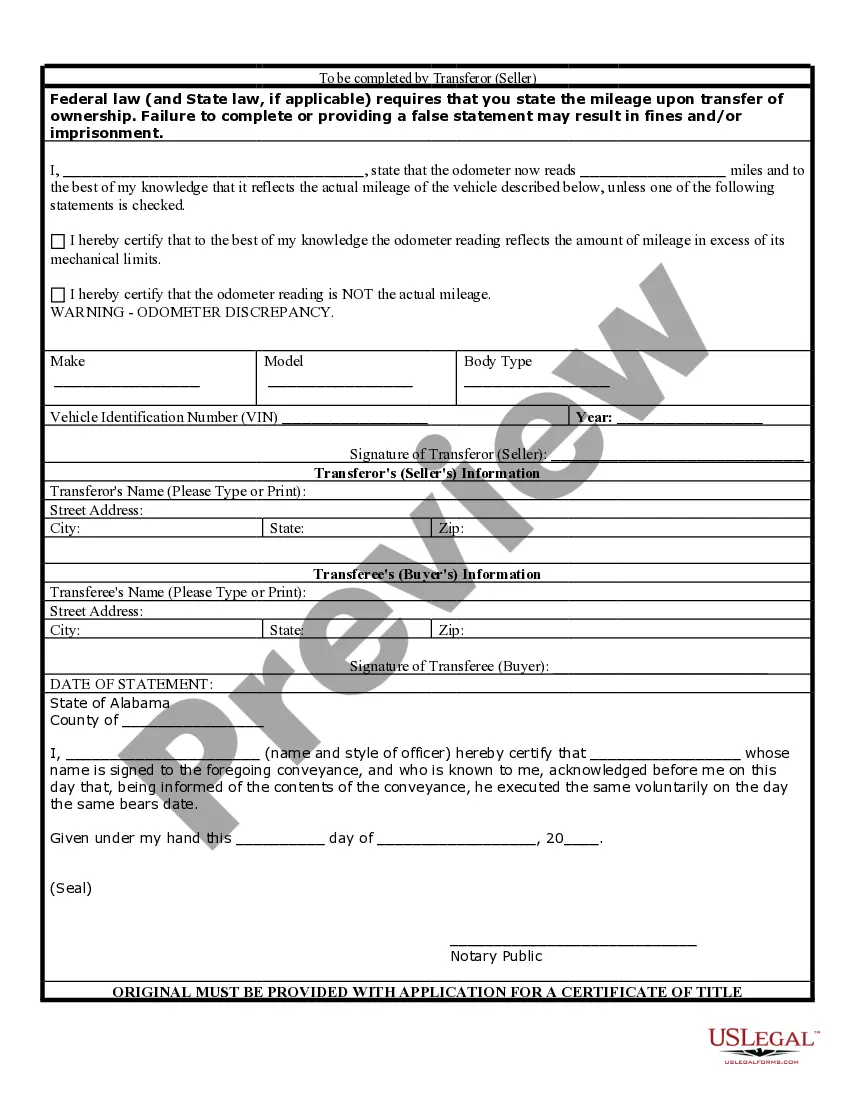

This is a bill of sale of an automobile. The seller(s) guarantees that the automobile is his/her/their property and is free of all claims and offsets of any kind. The bill of sale also states that the automobile is sold "as-is".

Bill Of Sale For Car Alabama With Loan

Description

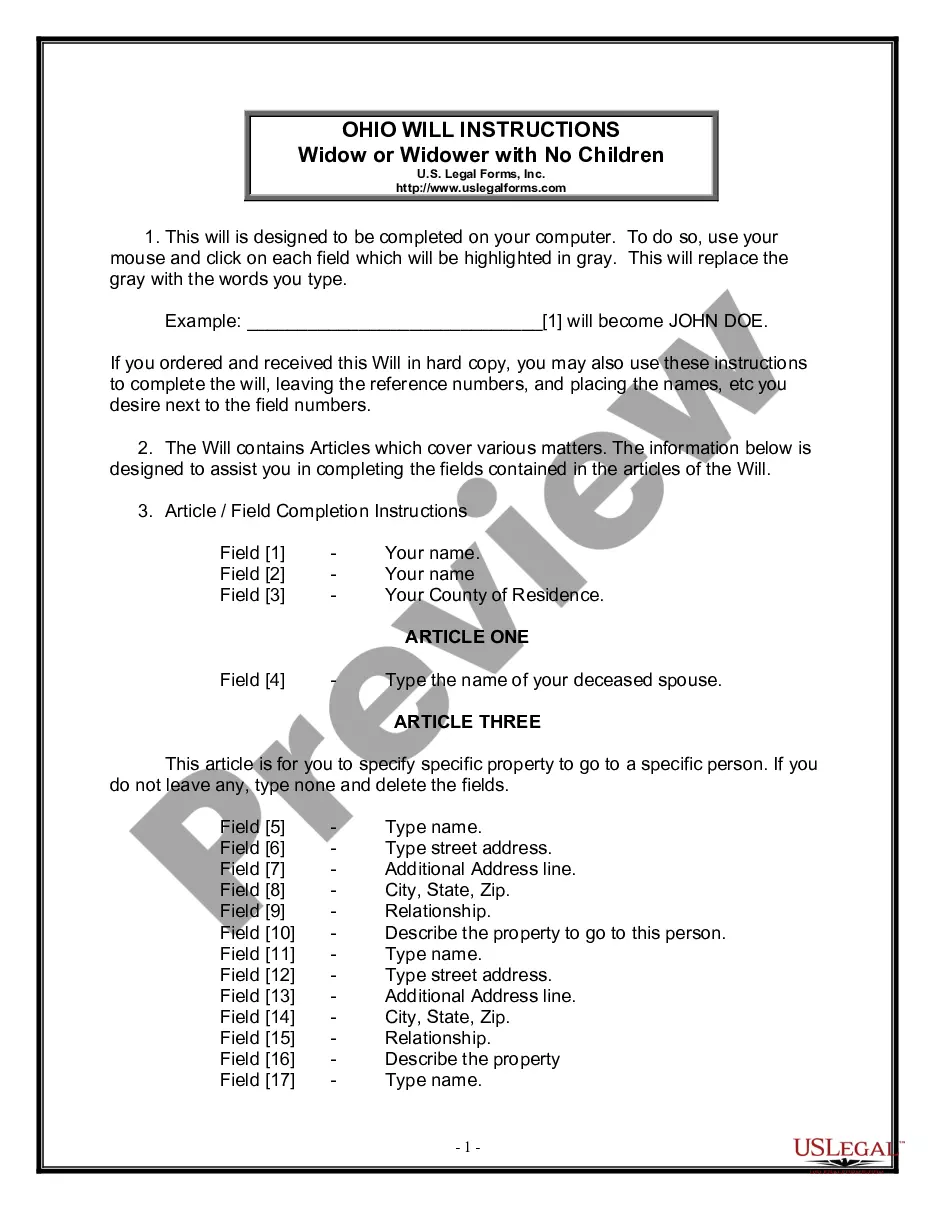

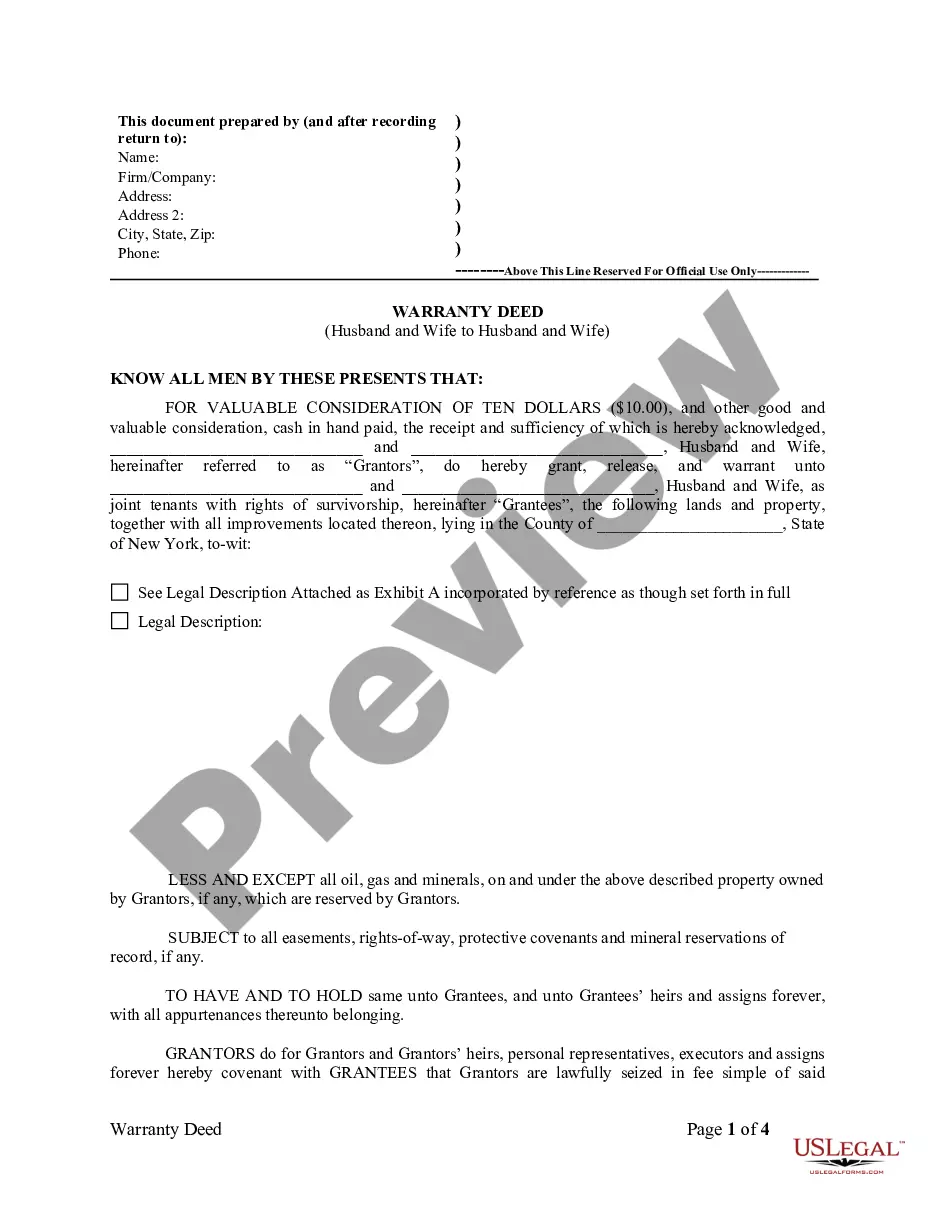

How to fill out Alabama Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Regardless of whether for corporate reasons or personal matters, each individual must navigate legal issues at some point in their life.

Completing legal documents requires meticulous care, beginning with selecting the correct template.

With an extensive US Legal Forms library available, you no longer need to waste time searching for the appropriate sample online. Use the resource’s easy navigation to discover the right document for any circumstance.

- Obtain the required template by using the search bar or browsing the catalog.

- Review the document’s details to ensure it corresponds with your situation, region, and locality.

- Select the document’s preview to examine it.

- If it is the incorrect form, return to the search option to locate the Bill Of Sale For Car Alabama With Loan template you require.

- Download the template if it fulfills your criteria.

- If you have an account with US Legal Forms, click Log in to access previously saved documents in My documents.

- If you do not possess an account yet, you can acquire the document by selecting Buy now.

- Select the suitable pricing plan.

- Complete the registration form for your profile.

- Choose your payment method: use a credit card or a PayPal account.

- Select the document format you prefer and download the Bill Of Sale For Car Alabama With Loan.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Every LLC in Georgia is required to pay a $50 Annual Registration Fee each year. You can file your LLC's Annual Registration Fee by mail or online, but the state prefers online filings as they are more convenient and faster.

To form an LLC in Georgia, you'll need to file Articles of Organization with the Georgia Corporations Division and pay the $100 filing fee ($110 if filing by mail or in person). Your articles are what create your Georgia LLC, you can't have one without forking over the filing fee.

9 best steps to take immediately after registering an LLC in... Open a bank account. ... Get the electronic status of a tax payer and, if necessary, register for VAT. ... Check if a license is required. ... Appoint a manager, conclude an agreement. ... Start keeping accounting records. ... Register full-time employees. ... Order an LLC seal.

Georgia Business License and Permit Requirements Before you start doing business, you must secure the necessary state, federal or local business licenses and permits to operate your LLC. Some of the fees will only need to be paid once, while others may be ongoing charges.

You do not have to register your business with the state of Georgia unless you are planning to incorporate, become a specific legal entity or if you plan to do business with the state. In which case, you will need to become a registered vendor through the Department of Administrative Services (DOAS).

Prepare Articles of Organization and file them with the Georgia Secretary of State Corporations Division Corporations to register your LLC properly. Though it sounds like a big job, that simply means filling out a relatively simple online form and submitting it. You can also send it by mail.

Georgia LLC Approval Times Mail filings: In total, mail filing approvals for Georgia LLCs take 4-5 weeks. This accounts for the average 15 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Georgia LLCs take 7-10 business days.