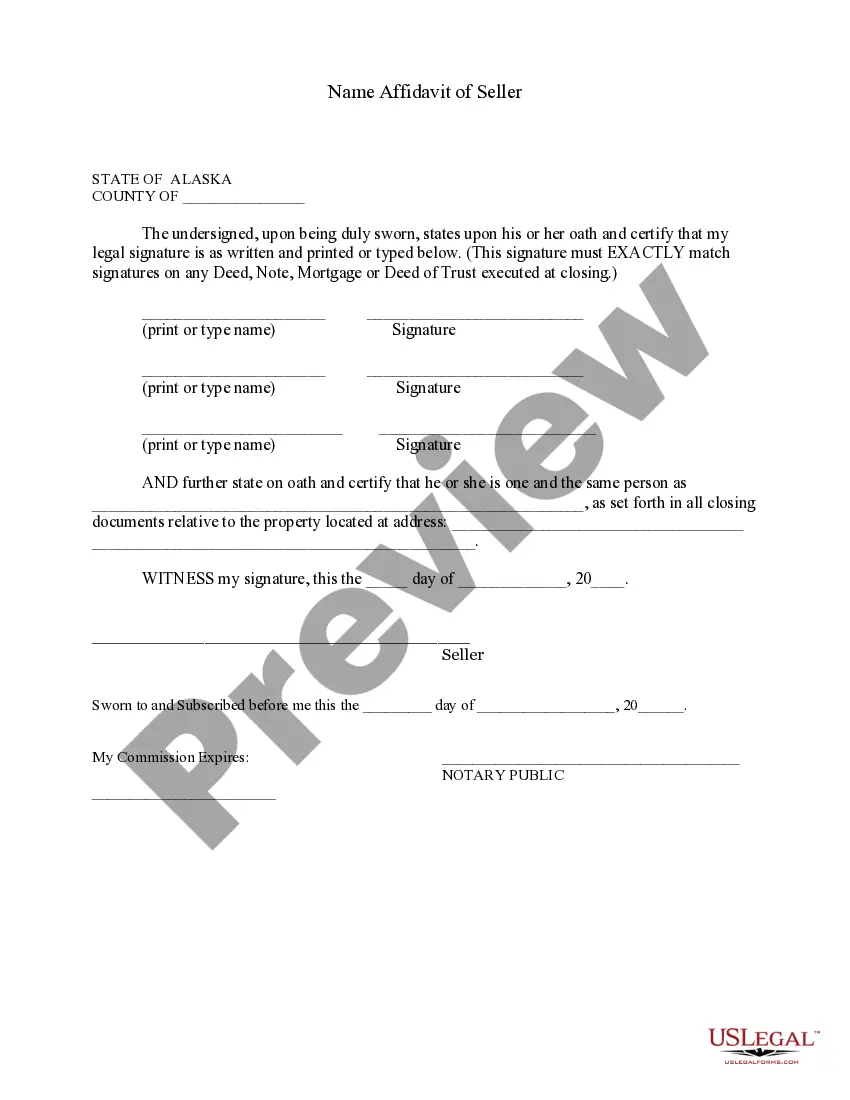

The Seller's Affidavit is for the Seller to provide a statement of his or her legal name and signature, as well as to certify to other "known as" names. Many times persons sign documents in different ways and the name affidavit is necessary to clarify that the signatures are one and the same person. i.e. John Jones, John T. Jones and J.T. Jones are one and the same person.

Affidavit Without Probate

Description

How to fill out Affidavit Without Probate?

Individuals frequently link legal documentation with something complex that only an expert can manage.

In a certain sense, this is accurate, as creating an Affidavit Without Probate requires significant knowledge in subject matters, including state and local laws.

Nevertheless, with US Legal Forms, the process has become more straightforward: a collection of ready-to-use legal templates for various life and business scenarios tailored to state regulations is gathered in one online library and is now accessible to all.

Choose the format for your document and click Download. Print your file or upload it to an online editor for faster completion. All templates in our library are reusable: once acquired, they are stored in your profile. You can access them anytime via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current forms categorized by state and usage area, making the search for an Affidavit Without Probate or any specific template quick and easy.

- Previously registered users with an active subscription must Log In to their account and click Download to get the form.

- New users on the platform will need to register for an account and subscribe before downloading any documentation.

- Here are the step-by-step instructions for obtaining the Affidavit Without Probate.

- Review the page content carefully to ensure it meets your requirements.

- Examine the form description or look at it through the Preview feature.

- If the previous form does not fit, find another option using the Search field above.

- Press Buy Now once the appropriate Affidavit Without Probate is located.

- Select a subscription plan that suits your needs and budget.

- Create an account or Log In to move forward to the payment page.

- Pay for your subscription using PayPal or a credit card.

Form popularity

FAQ

A California small estate affidavit, or Petition to Determine Succession to Real Property, is used by the rightful heirs to an estate of a person who died (the decedent). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

California Small Estate Affidavit InstructionsObtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.

The Affidavit of Heirship form you file must contain:The decedent's date of death.The names and addresses of all witnesses.The relationships the witnesses had with the deceased.Details of the decedent's marital history.Family history listing all the heirs and the percentage of the estate they may inherit.

If the heirs are only looking to transfer the real estate, with no personal possessions, Form DE-310 must be completed and filed. Signing Requirements Must be notarized (Prob. Code § 13104(e)).