Alaska Garnishment Laws For Employers

Description

Form popularity

FAQ

No, Alaska is not classified as a right-to-work state. In Alaska, union membership can be a requirement for certain job positions. Employers should remain aware of how these laws may affect employment relationships and interactions, including compliance with Alaska garnishment laws for employers. Understanding the regulatory landscape helps ensure a compliant and engaged workforce.

Yes, Alaska has comprehensive labor laws that govern work conditions, wages, and employee rights. These laws aim to foster fair treatment within the workplace and cover various areas, including minimum wage and overtime. As employees navigate these laws, it's vital for employers to understand Alaska garnishment laws for employers, ensuring proper handling of employee financial matters while complying with state regulations.

States such as California and New York are often cited as having strict employment laws, particularly regarding wage and hour regulations. Such states enforce various measures to protect employee rights and promote fair workplace conditions. Employers in these regions should stay informed about both general employment laws and Alaska garnishment laws for employers, even if they operate in Alaska. Understanding these laws helps ensure compliance and responsible management.

Alaska does not mandate 15-minute breaks for employees. However, employers may choose to provide them as part of their workplace policies. While breaks benefit employee well-being and productivity, they are not legally required under Alaska garnishment laws for employers. Employers should strive to create an environment that supports their workers.

Wage garnishment can be challenging for both employees and employers under Alaska garnishment laws for employers. While there are no foolproof methods to completely avoid garnishment, there may be some strategies to reduce its impact. For instance, you could negotiate with the creditor for a payment plan or challenge the garnishment in court if you believe it was improperly issued. Additionally, exploring financial counseling or legal advice can help you understand your rights and responsibilities under Alaska garnishment laws for employers.

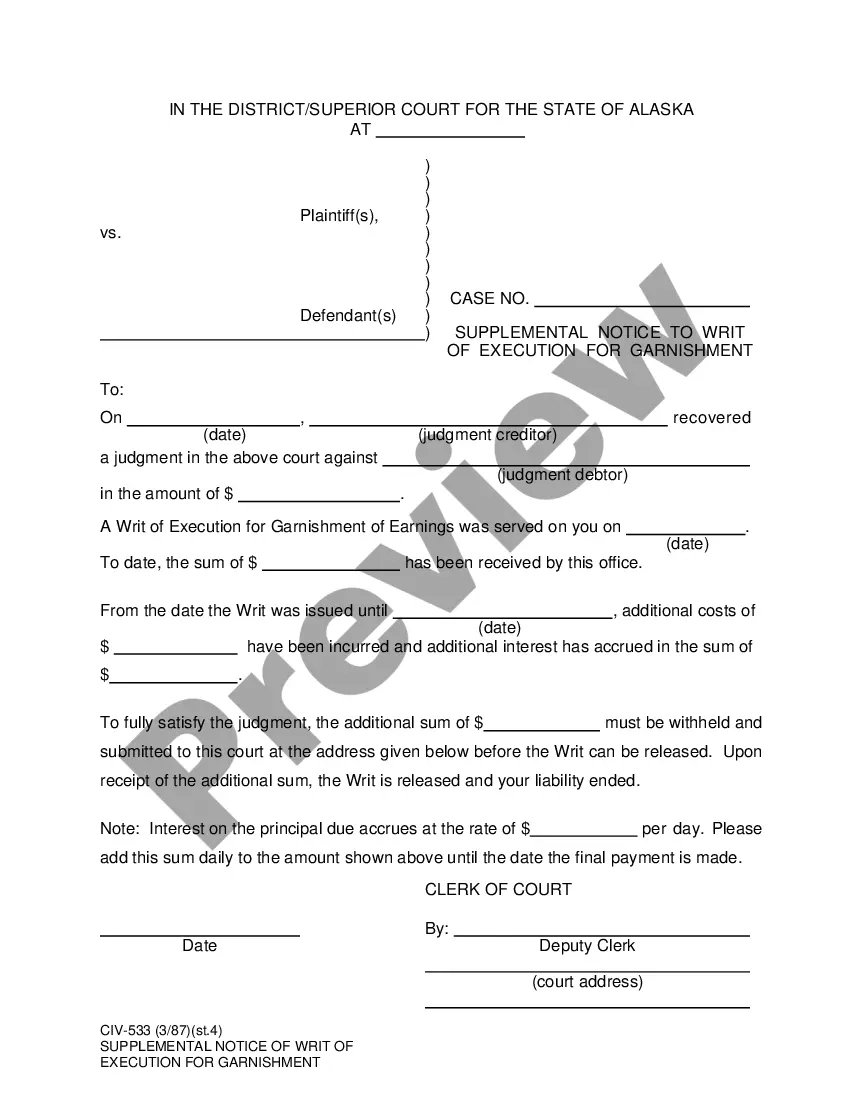

Statute 23.10.071 covers wage and hour regulations, specifically addressing wage deductions and garnishments. Under this statute, employers need to ensure that any garnishment complies with state laws while safeguarding employee rights. Accessing resources from platforms like US Legal Forms can help employers better navigate the complexities of Alaska garnishment laws for employers and ensure compliance.

Statute 23.05.160 in Alaska pertains to the collection of debts through wage garnishments. This statute outlines the procedures and limitations employers must follow when withholding earnings from employees. Familiarizing yourself with this legal framework can help employers manage garnishments more effectively and in accordance with Alaska garnishment laws for employers.

Alaska follows at-will employment laws, meaning employers can terminate employees for almost any reason, as long as it doesn't violate federal or state discrimination laws. However, if the termination relates to issues like wage garnishment, employers must adhere to Alaska garnishment laws for employers to prevent legal repercussions. Understanding these laws helps create fair and compliant workplace practices.

Yes, in Alaska, employees may sue for wrongful termination if they believe their employment was terminated in violation of employment contracts or public policy. Additionally, employers must follow Alaska garnishment laws for employers to avoid wrongful termination claims related to garnishment situations. This ensures that all practices comply with both labor laws and garnishment regulations.

Under Alaska garnishment laws for employers, the maximum amount that can be taken from an employee's wages for debts is 25% of their disposable earnings or the amount by which weekly earnings exceed 40 times the federal minimum wage. This means employers must calculate the employee's income properly and apply the garnishment limits to ensure compliance. Understanding these limits is essential for employers to avoid potential legal issues.