Lease Term

Description

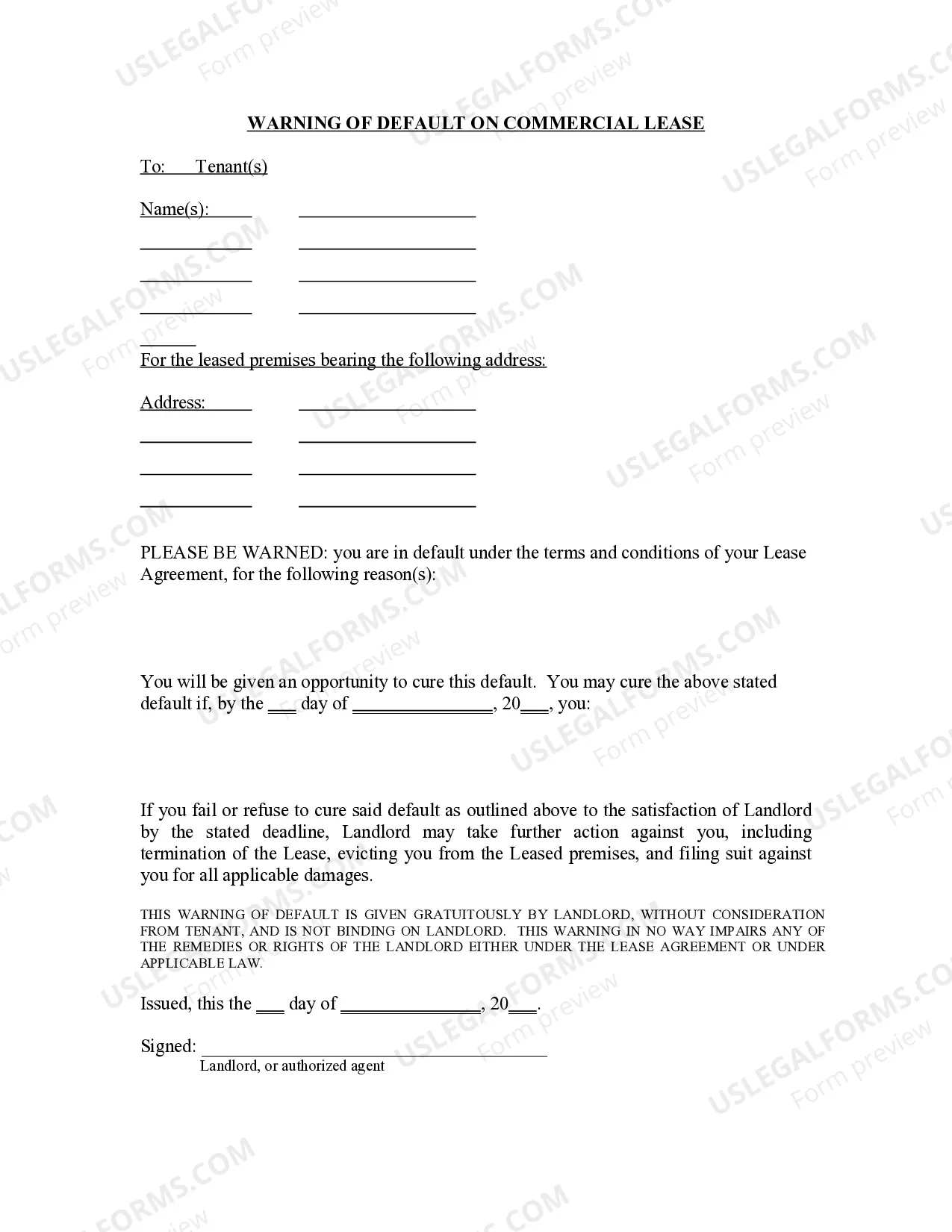

How to fill out Alaska Warning Of Default On Commercial Lease?

- If you're a returning user, log into your account and locate the desired document in your library. Make sure your subscription is current, or renew as needed.

- For first-time users, start by exploring the Preview mode and form descriptions to ensure you select the right form for your jurisdiction.

- If the form isn’t what you need, utilize the Search tab above to find another suitable template. Double-check for accuracy before proceeding.

- When you find the correct document, click the Buy Now button and select your preferred subscription plan, creating an account to access the full library.

- Proceed to payment by providing your credit card details or using your PayPal account to finalize your subscription.

- After purchasing, download your lease term form directly to your device. You can also access it anytime via the My Forms section of your profile.

By following these steps, you can easily access legal documents that meet your needs. The robust library and expert assistance available through US Legal Forms ensure that your lease term documents are precise and compliant with legal standards.

Take control of your legal documents today and explore the extensive resources at US Legal Forms!

Form popularity

FAQ

Calculating lease terms primarily involves determining the start and end dates of the lease. Consider any renewal options or early termination clauses that may affect the overall duration. Having a clear calculation method ensures that both parties are on the same page regarding the lease term.

Lease terms dictate the duration of the rental agreement, significantly affecting both landlords and tenants. Typically, a lease term can be short-term or long-term, outlining when the tenant occupies the property. Understanding the lease term ensures that tenants know their rights and responsibilities while helping landlords maintain a stable income.

Writing a lease term involves specifying the duration of the lease, typically expressed in months or years. Clearly state when the term begins and when it ends, ensuring that both parties agree on these dates. This clarity prevents misunderstandings and contributes to a smooth rental experience.

To fill out a lease agreement form in PDF format, first download the file and open it with a PDF editor. Enter all necessary information, including the lease term, property details, and payment information. After filling out the document, save it and share it with all parties involved for review and signature.

Filling a lease agreement begins with understanding the essential elements, which include the lease term, rental amount, and tenant rights. Start by entering the names and addresses of both parties, then specify the property details. Make sure to clearly outline the lease term to avoid confusion later on.

Deciding between a 24 or 36-month lease term depends on your financial situation and long-term plans. A 24-month lease often offers more flexibility, while a 36-month lease may provide stability and potentially lower monthly payments. Consider using platforms like uslegalforms to review lease options that align with your preferences.

A 1 year lease back occurs when a property owner sells the property but then remains as a tenant for one year under a lease agreement. This arrangement allows the seller to stay in the property while providing the buyer with immediate rental income. It's a beneficial option for both parties when structured correctly.

A good lease term is one that suits both the tenant's and landlord's needs, often falling within six months to two years. It balances flexibility for the tenant with security for the landlord. When determining what constitutes a good lease term for your situation, consider factors such as your financial commitments and housing stability.

A 1 year lease term means that the rental agreement is valid for one full year. During this time, tenants commit to paying the agreed-upon rent, while landlords must ensure the property is maintained. This lease term offers both parties predictability and stability.

While a one-year lease term is common, lease terms can significantly vary. Some leases last for shorter periods, like six months, while others may extend up to multiple years. It’s essential to clarify the lease term before signing to ensure it aligns with your needs.