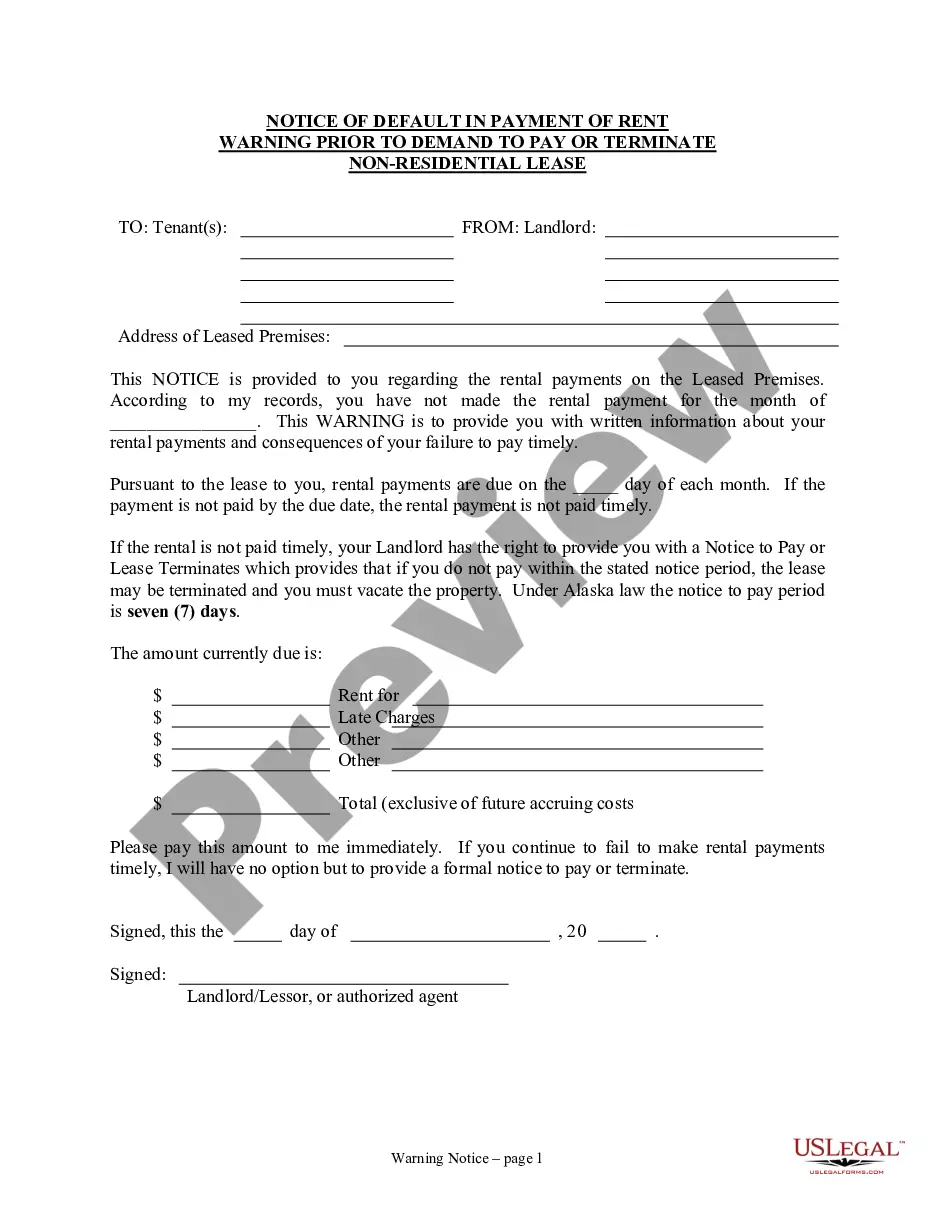

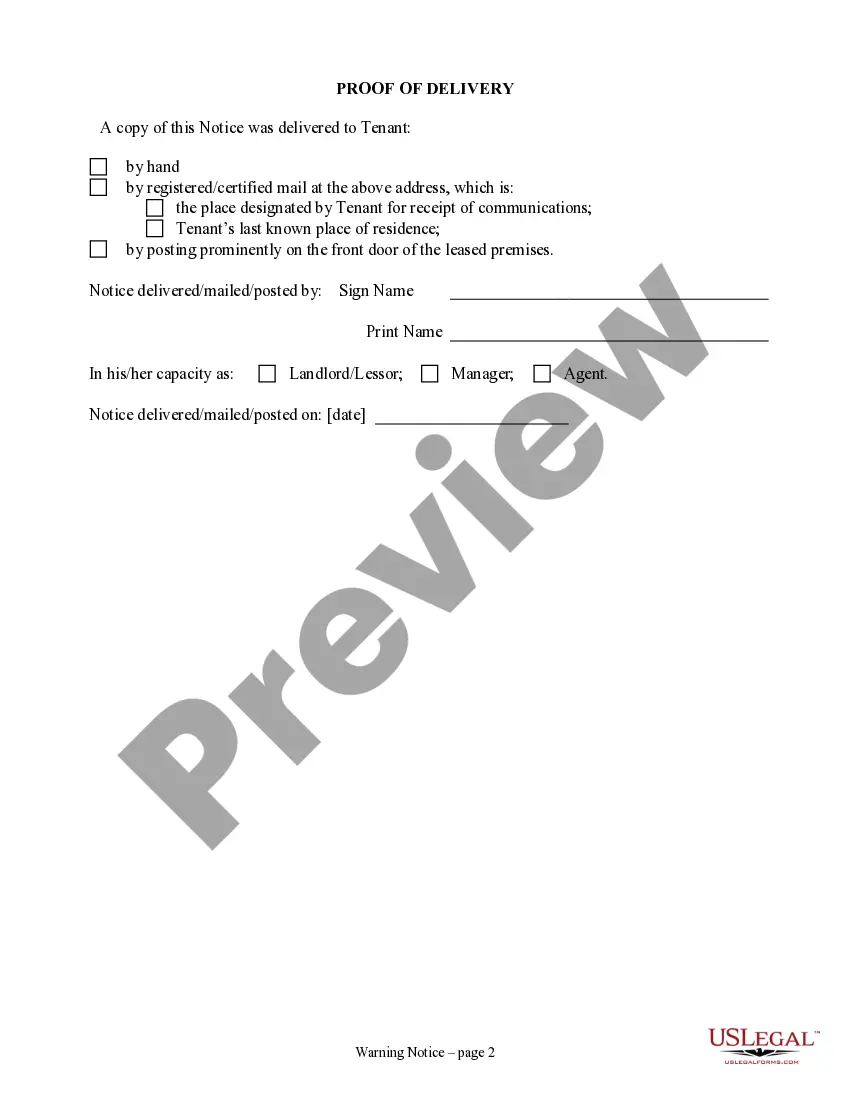

This Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Non-Residential or Commercial Property form is for use by a Landlord to inform Tenant of Tenant's default in the payment of rent as a warning prior to a pay or terminate notice. The form advises the Tenant of the due date of rent and the consequences of late payment. This form may be used where you desire to remind the Tenant of payment terms, the default, demand payment and inform the Tenant that under the laws of this state or lease, the Landlord may terminate if rent is not paid timely.

Notice Default Commercial Foreclosure Process

Description

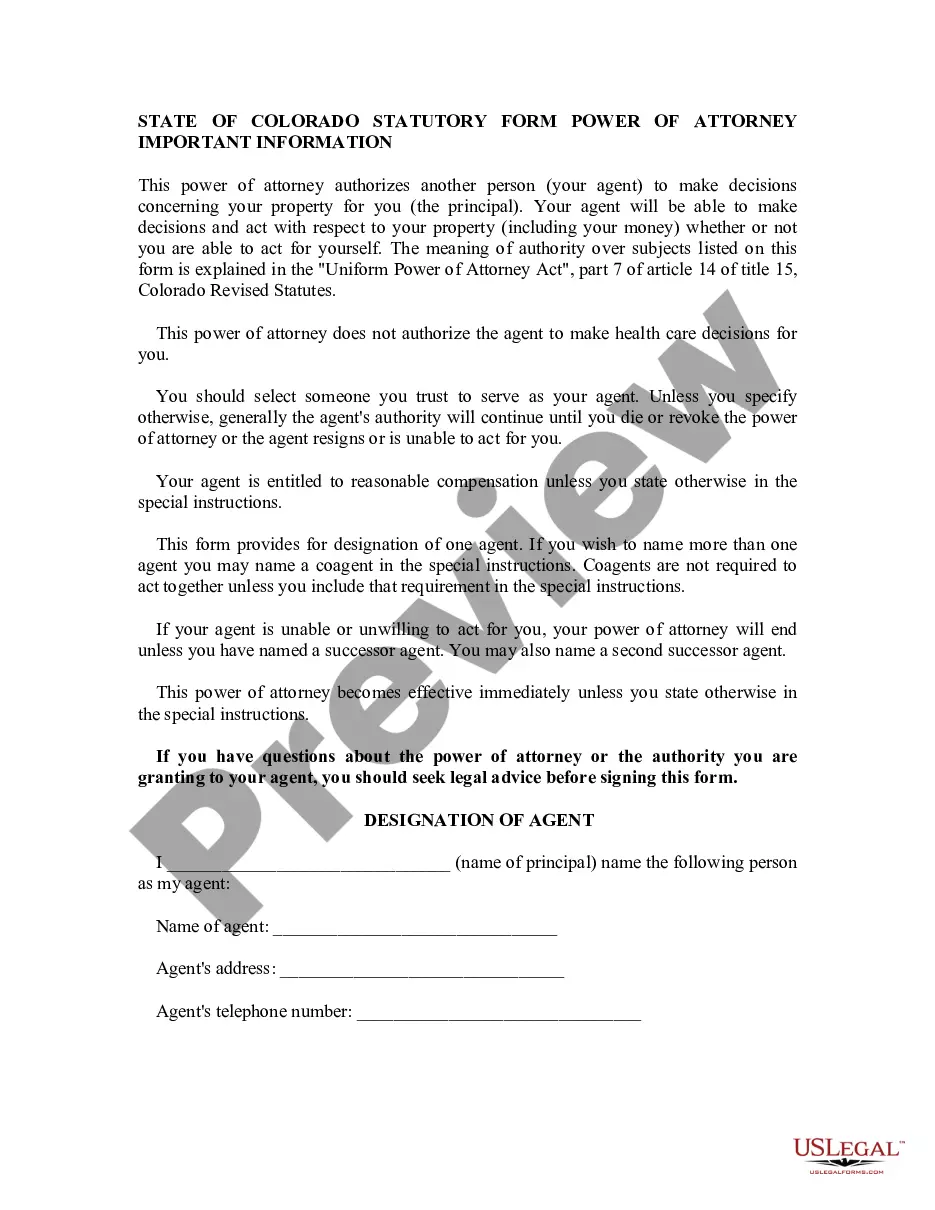

How to fill out Notice Default Commercial Foreclosure Process?

Bureaucracy demands accuracy and meticulousness.

If you do not manage filling out forms like Notice Default Commercial Foreclosure Process on a daily basis, it may lead to some confusion.

Selecting the correct example from the outset will ensure that your document submission proceeds smoothly and avoid the hassles of re-submitting a file or completing the same task from the beginning.

If you are not a registered user, locating the necessary example would require a few additional steps: Locate the template using the search bar, ensure that the Notice Default Commercial Foreclosure Process you have discovered is suitable for your state or district, examine the preview or refer to the description detailing the usage of the example, if the result meets your expectations, click the Buy Now button, select the suitable option among the proposed pricing plans, Log Into your account or create a new one, complete the purchase using a credit card or PayPal account, and download the form in your desired format. Acquiring the correct and current examples for your documentation is a matter of minutes with an account at US Legal Forms. Alleviate the bureaucratic worries and enhance your efficiency with paperwork.

- You can always locate the suitable example for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that contains over 85 thousand examples across various subject areas.

- You can discover the latest and most pertinent version of the Notice Default Commercial Foreclosure Process by simply searching it on the website.

- Find, store, and safeguard templates in your account or verify with the description to ensure you possess the correct one.

- With an account at US Legal Forms, you can obtain, keep in one place, and browse the templates you have saved to retrieve them with just a few clicks.

- When on the site, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your documents are listed.

- Review the description of the forms and save those you require at any time.

Form popularity

FAQ

The 120 day rule for foreclosure requires lenders to wait at least 120 days after a borrower defaults before starting the foreclosure process. This period allows borrowers to explore options such as refinancing or selling the property. Understanding this timeframe is critical when dealing with the notice default commercial foreclosure process. You may access tools and resources to help manage your situation, like those offered by uslegalforms.

The six phases of foreclosure include: 1) Missed payments, 2) Notice of default, 3) Pre-foreclosure, 4) Auction or sale, 5) Redemption period, and 6) Real estate owned (REO) by the bank. Understanding these phases can help you navigate the complex notice default commercial foreclosure process. Each phase has specific timelines and legal implications. Being proactive at each stage can prevent the loss of your commercial property.

To dismiss a foreclosure, you need to resolve the underlying debt. This resolution may involve bringing your mortgage payments current or negotiating a settlement with your lender. You can contest the foreclosure in court, especially if there are errors in the process. Engaging a lawyer familiar with the notice default commercial foreclosure process may increase your chances of a favorable outcome.

When you receive a notice of default, you enter a critical stage in the notice default commercial foreclosure process. This notice indicates that you have fallen behind on your mortgage payments, and it typically initiates a timeline for resolving the issue. During this time, you have the opportunity to make payments or negotiate with your lender to avoid foreclosure. Engaging with a platform like US Legal Forms can provide you resources to navigate this process effectively.

The five stages of a foreclosure action typically include pre-foreclosure, notice of default, auction, judicial foreclosure, and post-foreclosure. Familiarizing yourself with these stages will empower you to take action at each step. Understanding the notice default commercial foreclosure process can help you navigate this challenging period more effectively.

A good explanation for late payments should include specific reasons that caused the delays. Common examples are job loss, unexpected expenses, or medical issues. Honest and clear communication with your lender can positively affect your standing during the notice default commercial foreclosure process.

When writing a letter of explanation for foreclosure, it is essential to clearly convey the events that led to your current situation. Articulate any mitigating factors and express your desire to maintain your home. Including this letter during the notice default commercial foreclosure process can enhance your chances of favorable outcomes.

No, a notice of default is not the same as foreclosure, though they are closely related. A notice of default is a formal declaration that a borrower has fallen behind on payments, often marking the beginning of the foreclosure process. Understanding this distinction is crucial as it can impact the options available to you during the notice default commercial foreclosure process.

To write a letter explaining your financial situation, provide a concise overview of your current circumstances, including income and expenses. Clearly state any factors that have contributed to your financial difficulties. This transparency builds trust with your lender and may assist you significantly in the notice default commercial foreclosure process.

In a mortgage letter of explanation, you should clearly outline the reasons for your financial challenges. Highlight any events, such as job loss or medical emergencies, that have affected your ability to keep up with payments. Maintaining a respectful tone is essential, as this letter may influence your lender’s decisions during the notice default commercial foreclosure process.