Alaska Boat Bill Of Sale Form

Description

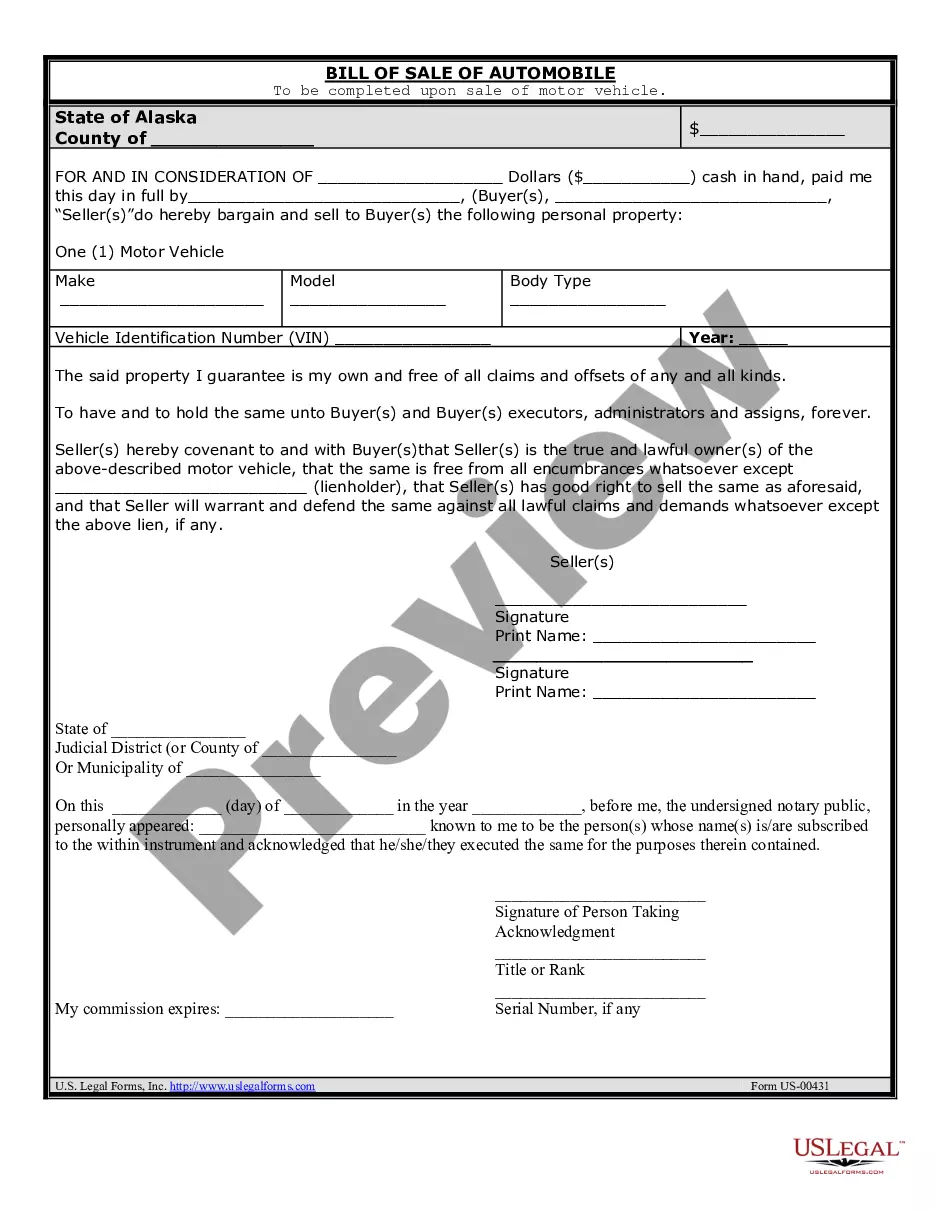

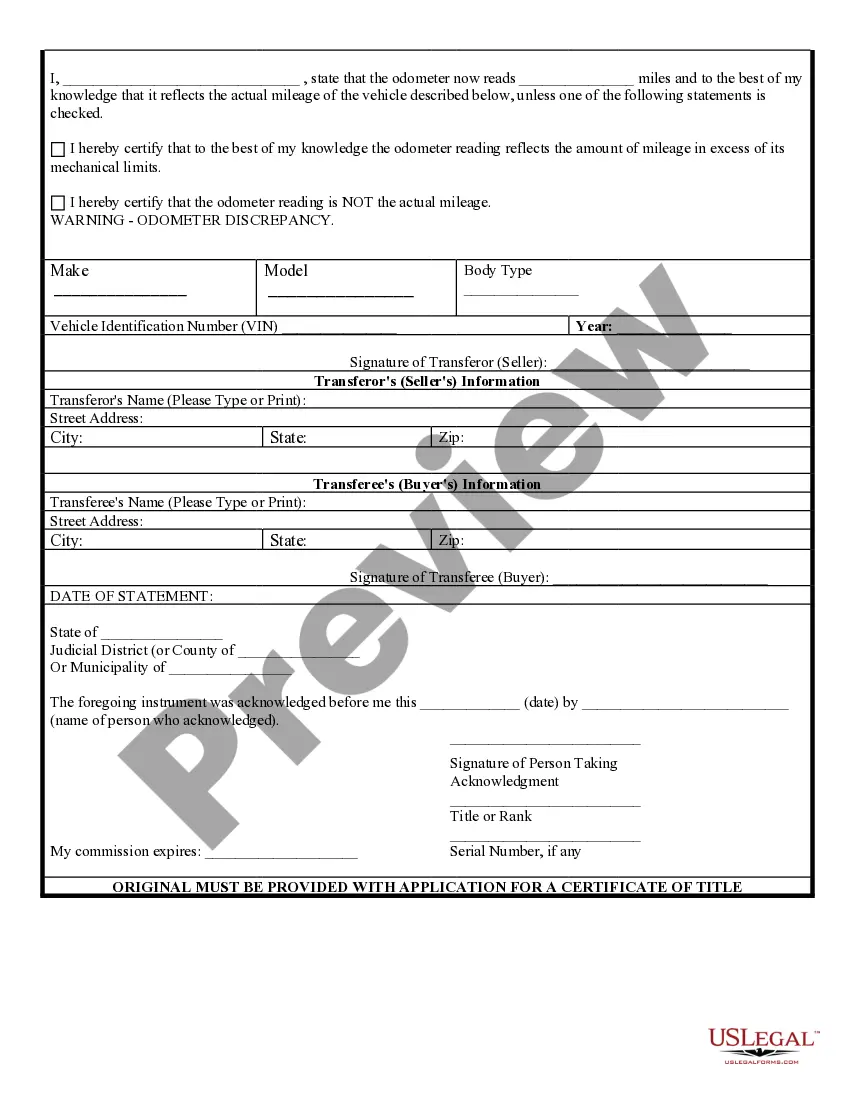

How to fill out Alaska Bill Of Sale Of Automobile And Odometer Statement?

Precisely composed official documentation serves as one of the basic assurances for preventing issues and lawsuits, yet achieving it without a lawyer's guidance might require some time.

Whether you need to swiftly locate an up-to-date Alaska Boat Bill Of Sale Form or any other documents for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even easier for current subscribers of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Furthermore, you can retrieve the Alaska Boat Bill Of Sale Form at any time, as all the documents ever acquired on the platform are accessible within the My documents tab of your account. Conserve time and money on drafting official documents. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- Look for another example (if necessary) using the Search bar in the page header.

- Click on Buy Now once you find the appropriate template.

- Choose the pricing plan, Log In to your account or set up a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Alaska Boat Bill Of Sale Form.

- Click Download, then print the document to complete or upload it to an online editor.

Form popularity

FAQ

A bill of sale for a boat in Alaska must include identifying information: name, physical address, and the driver's license or state ID number for both buyer and seller....Alaska Boat Bill of SaleMake.Year.Length.Hull ID.Registration.Odometer in hours.Title number.

New Alaska Statute 05.25. 056 requires the owner of an undocumented boat that is subject to registration and that is more than 24 feet to apply for a certificate of title or No Title Issued (NTI) registration.

The state law does not require you to notarize the bill of sale for vehicle in Alaska. However, if you wish to add an extra layer of protection to your document, you and the buyer or seller can sign the form in the presence of two witnesses and a notary public and ask them to certify your bargain.

Alaska bill of sale forms are legal documents that offer proof of the transfer of ownership between two (2) parties of vehicles, vessels, or essentially any form of personal property.

Probably the simplest way of avoiding sales taxes on a boat purchase is to buy the boat in a state that doesn't have a sales tax. These include Montana, New Hampshire, Delaware and Oregon. Alaska also has no state sales tax, but municipal sales taxes add an average of a little under 2 percent.