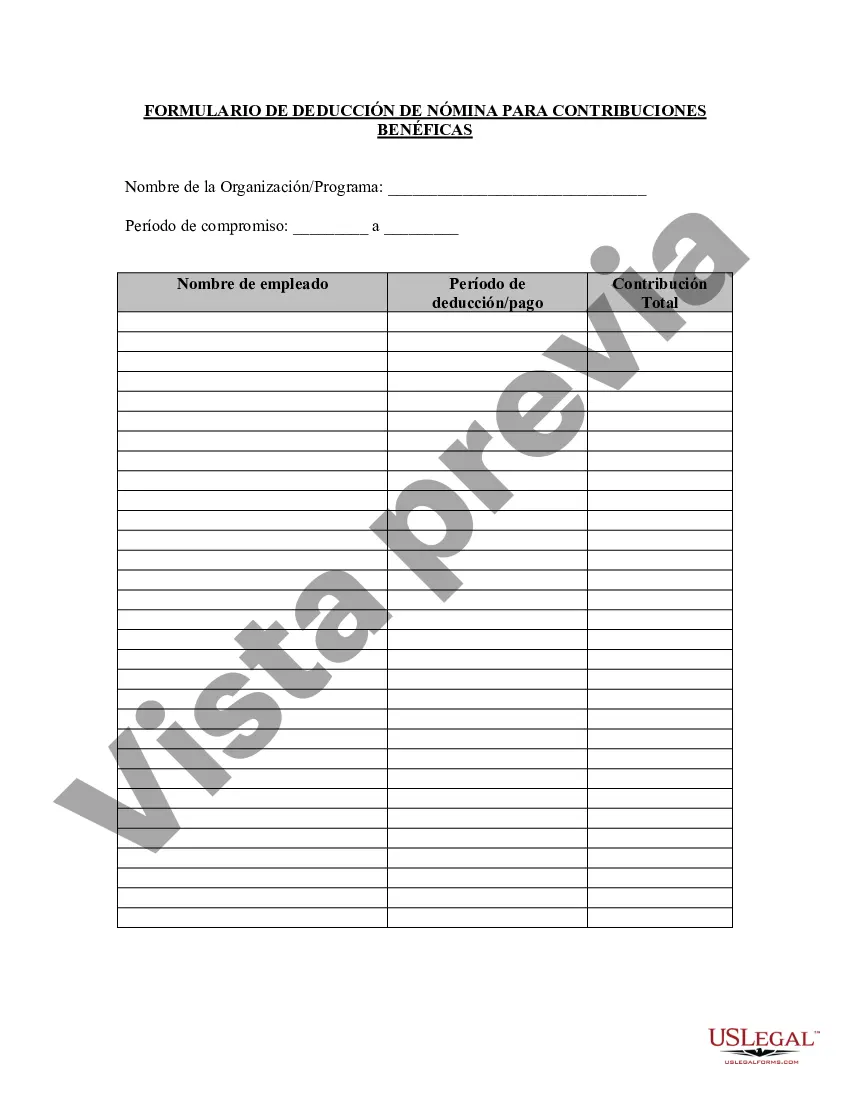

Tucson Arizona Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

State:

Multi-State

City:

Tucson

Control #:

US-134EM

Format:

Word

Instant download

Description

Este formulario se puede utilizar para realizar un seguimiento de las deducciones caritativas realizadas por los empleados a través del departamento de nómina de la empresa.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.