Yonkers New York Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Yonkers New York Notice Of Assignment To Living Trust?

If you’ve previously availed yourself of our service, sign in to your account and retrieve the Yonkers New York Notice of Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have perpetual access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you’ve found a suitable document. Browse through the description and utilize the Preview option, if available, to determine if it satisfies your needs. If it’s not suitable, use the Search tab above to locate the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a transaction. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Yonkers New York Notice of Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

There is no legally required minimum amount for establishing a living trust in New York, which means you can set one up regardless of your asset value. However, it's essential to evaluate whether the benefits of creating a living trust justify the costs involved. Generally, a living trust is most beneficial when your assets exceed a certain threshold, making the process easier for your heirs. To ensure you make an informed decision, you might want to refer to a Yonkers New York Notice of Assignment to Living Trust for guidance on asset guidance.

In New York, a living trust serves as a legal arrangement that allows you to manage your assets during your lifetime and specify how they will be distributed after your death. When you create a living trust, you transfer ownership of your assets into the trust, effectively making it the legal owner. This process simplifies the transfer of assets, as the trust does not go through probate, saving time and costs for your beneficiaries. To ensure proper establishment, consider utilizing a Yonkers New York Notice of Assignment to Living Trust.

One major mistake parents make involves failing to clearly define their wishes in the trust documentation. Without precise instructions, a Yonkers New York Notice of Assignment to Living Trust might not serve its intended purpose, leading to confusion among heirs. It’s crucial to communicate expectations and carefully outline conditions to prevent disputes and ensure the trust operates smoothly.

A trust can limit flexibility, as once assets are placed into it, the grantor usually cannot access them without specific conditions. The formal process involved in a Yonkers New York Notice of Assignment to Living Trust may also set up obstacles for quick access to funds during emergencies. This rigidity, while beneficial in some cases, can create frustration when circumstances change unexpectedly.

Trust funds can pose dangers, including potential misuse of funds by beneficiaries. If not managed correctly, a Yonkers New York Notice of Assignment to Living Trust may lead to financial mismanagement or disputes among family members. This situation often arises when beneficiaries lack experience in handling large sums, potentially causing long-term family rifts.

Setting up a trust can involve significant costs and time investment, which can be a pitfall for many. If you do not properly execute a Yonkers New York Notice of Assignment to Living Trust, you might face tax complications or unintended consequences for beneficiaries. Furthermore, the complexity of the trust structure may confuse individuals who are not well-versed in legal matters, risking your initial intentions.

One significant mistake parents often make when establishing a trust fund is failing to fund the trust properly. This oversight can lead to delays or complications in asset distribution after their passing. To avoid this, it's essential to ensure that all intended assets are transferred into the trust and reflected in the Yonkers New York Notice of Assignment to Living Trust, thereby promoting effective management and distribution of their legacy.

The best trust for placing your house typically depends on your specific goals, but a revocable living trust is popular for many homeowners. This type of trust allows you flexibility during your lifetime, and it can simplify the transfer of your estate after death. By utilizing the Yonkers New York Notice of Assignment to Living Trust, you can secure a clear and organized pathway for managing your property and assets.

A trust in New York operate as a legal arrangement where a trustee manages assets on behalf of beneficiaries. The trust outlines how assets are to be handled and what happens upon the grantor's death or incapacitation. Importantly, the Yonkers New York Notice of Assignment to Living Trust plays a crucial role in conveying property rights, ensuring transparency and legal protection for both the trustee and the beneficiaries.

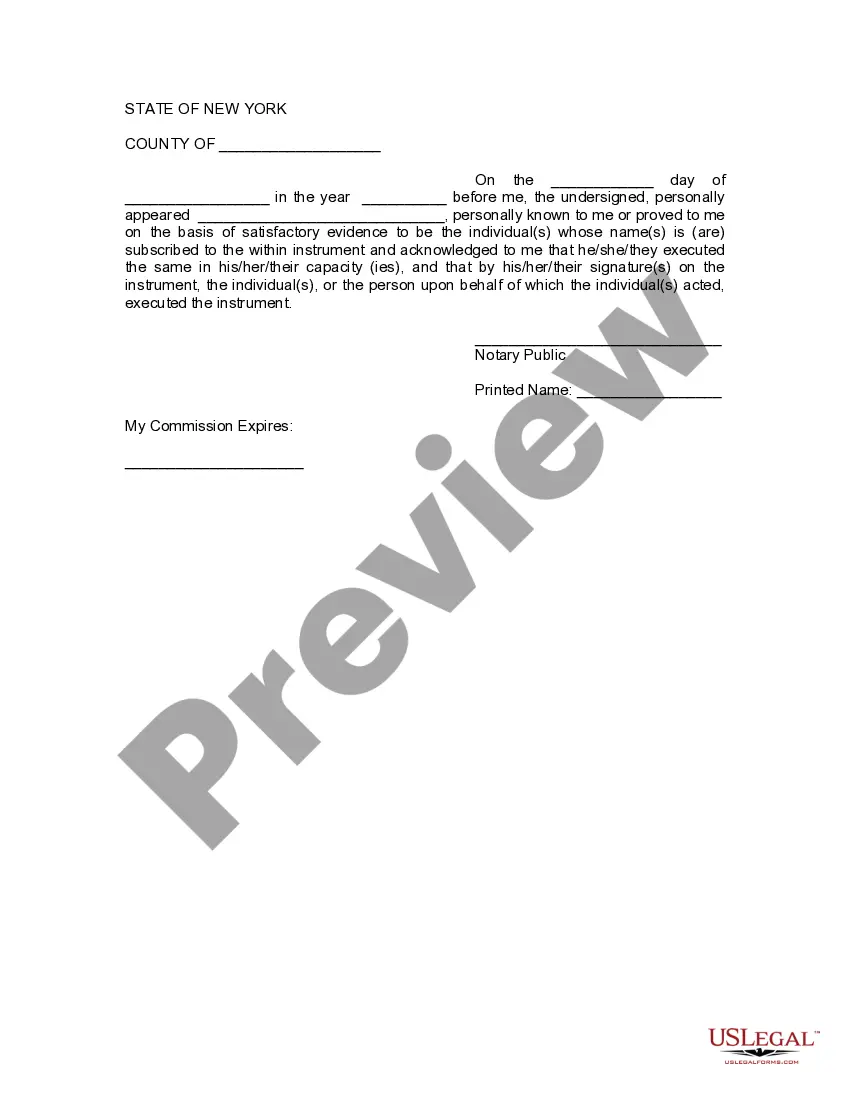

To transfer property to a trust in New York, you must execute a deed that transfers ownership from yourself to the trust. This process involves drafting a new deed that clearly identifies the trust and its trustee. After signing the deed, you must file it with the county clerk's office. Completing these steps ensures that the property is properly documented in connection with the Yonkers New York Notice of Assignment to Living Trust.