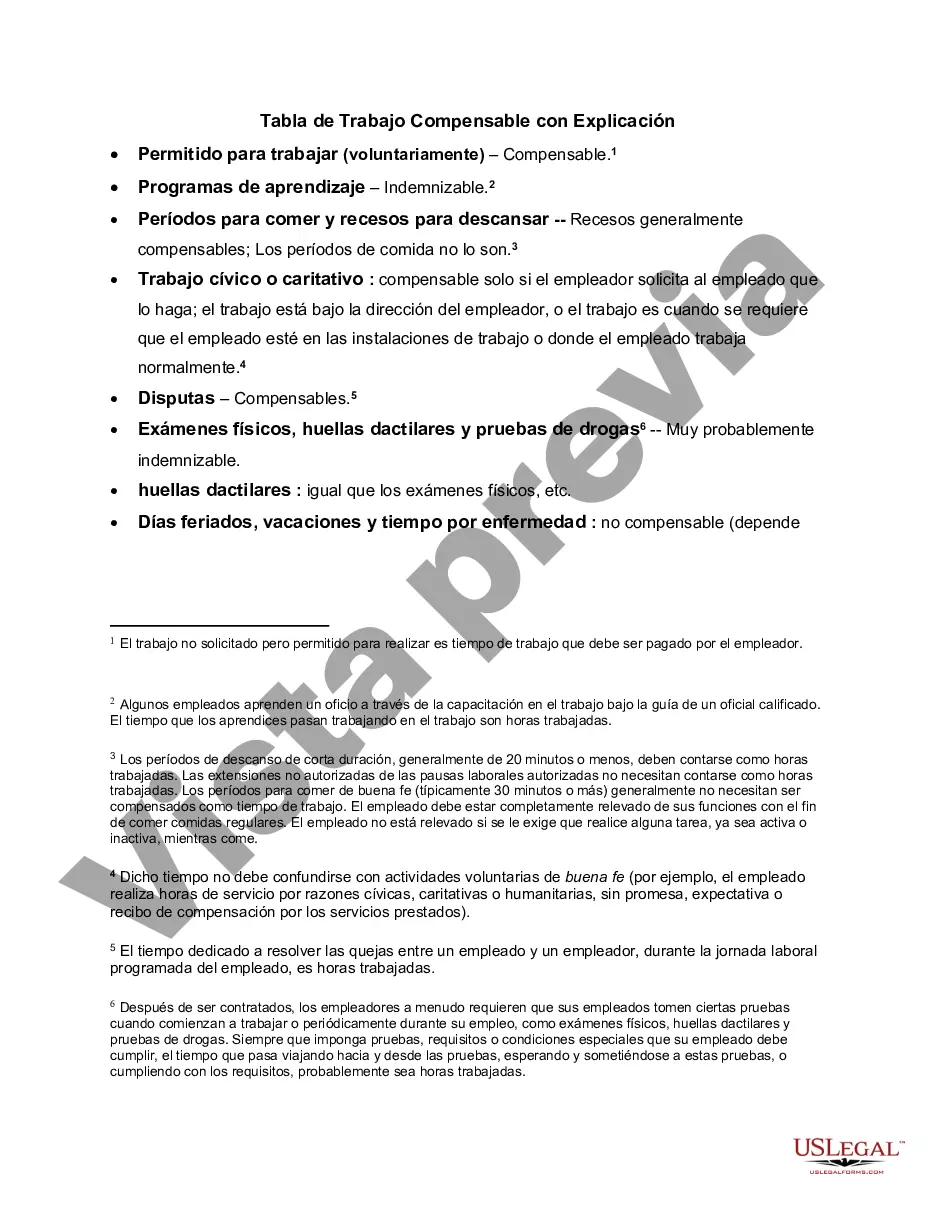

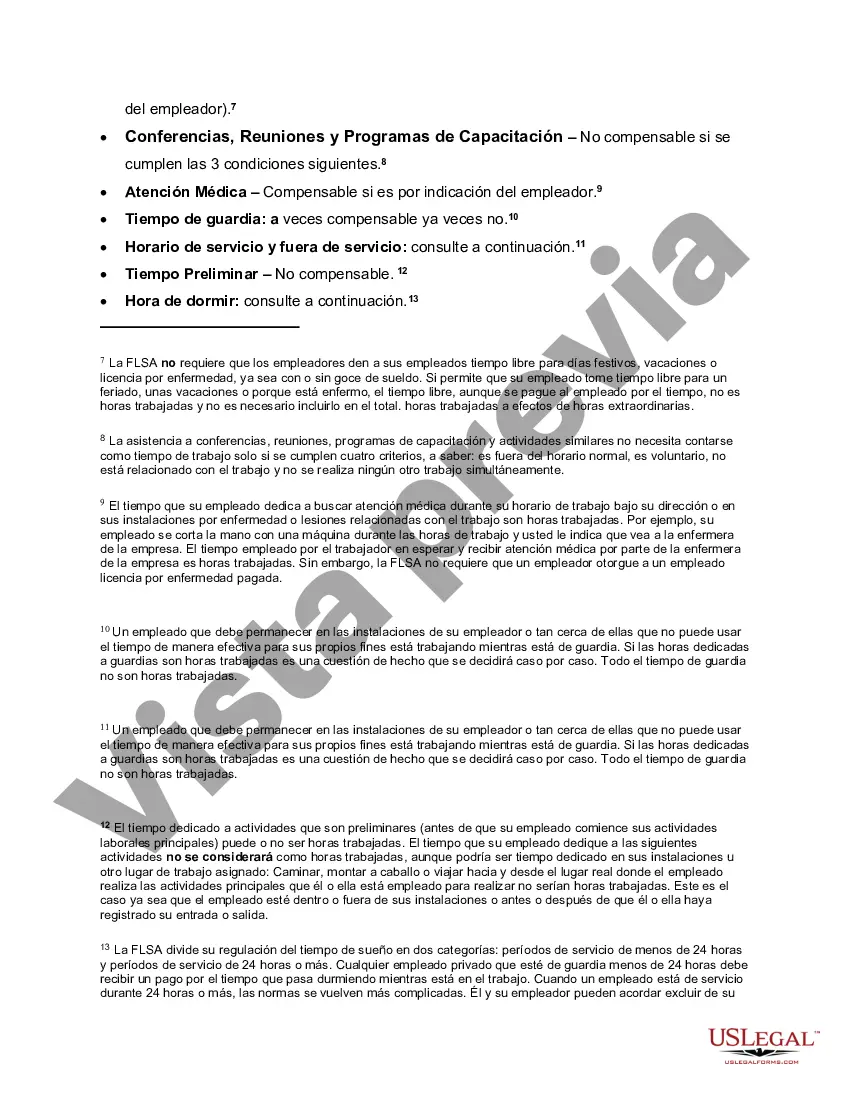

Title: Exploring the West Virginia Compensate Work Chart: Types and Detailed Explanation Introduction: The West Virginia Compensate Work Chart is a crucial tool used to determine the compensability and payment of workers in various industries across the state. This detailed description aims to provide an overview of the West Virginia Compensate Work Chart, explaining its purpose, key features, and different types available. 1. What is the West Virginia Compensate Work Chart? The West Virginia Compensate Work Chart is a comprehensive resource provided by the state's Division of Labor. It serves as a guideline for employers, employees, and insurance agencies to understand the requirements for compensate work and calculate fair payment. 2. Purpose and Benefits: The main purpose of the West Virginia Compensate Work Chart is to establish consistent and fair compensation practices for workers in diverse industries. It helps prevent disputes between employers and employees, providing clarity on what activities qualify as compensate work and how they should be remunerated. 3. Key Features of the West Virginia Compensate Work Chart: a) List of Compensate Work Activities: The chart includes an extensive list of activities that are considered as compensate work. These activities cover multiple industries, such as construction, healthcare, manufacturing, retail, and more. Examples may include actual work performed, training sessions, mandatory meetings, certain travel time, and more. b) Exclusions and Exceptions: The chart also outlines specific instances where certain activities may not be compensated, such as voluntary recreational activities, meal breaks, and commuting time between home and work. c) Hourly Rates and Overtime Calculation: The chart provides information on hourly wage rates, regular working hours, and guidelines for calculating overtime pay in accordance with West Virginia's labor laws. 4. Types of West Virginia Compensate Work Charts: a) General Compensate Work Chart: This is the most commonly used type of chart, applicable to a wide range of industries, job positions, and compensation models. b) Specific Industry Compensate Work Charts: In addition to the general chart, West Virginia also offers industry-specific compensate work charts. These charts cater to sectors like healthcare, construction, transportation, hospitality, and others. They provide tailored guidelines and regulations unique to each industry, ensuring fairness and consistency. Conclusion: The West Virginia Compensate Work Chart is an indispensable resource that ensures fair compensation practices in various industries. It provides employers and employees with clear guidelines on compensate work activities and helps prevent payment disputes. By utilizing the relevant type of chart, employers can adhere to the state's labor laws and offer appropriate remuneration, fostering a fair working environment across West Virginia.

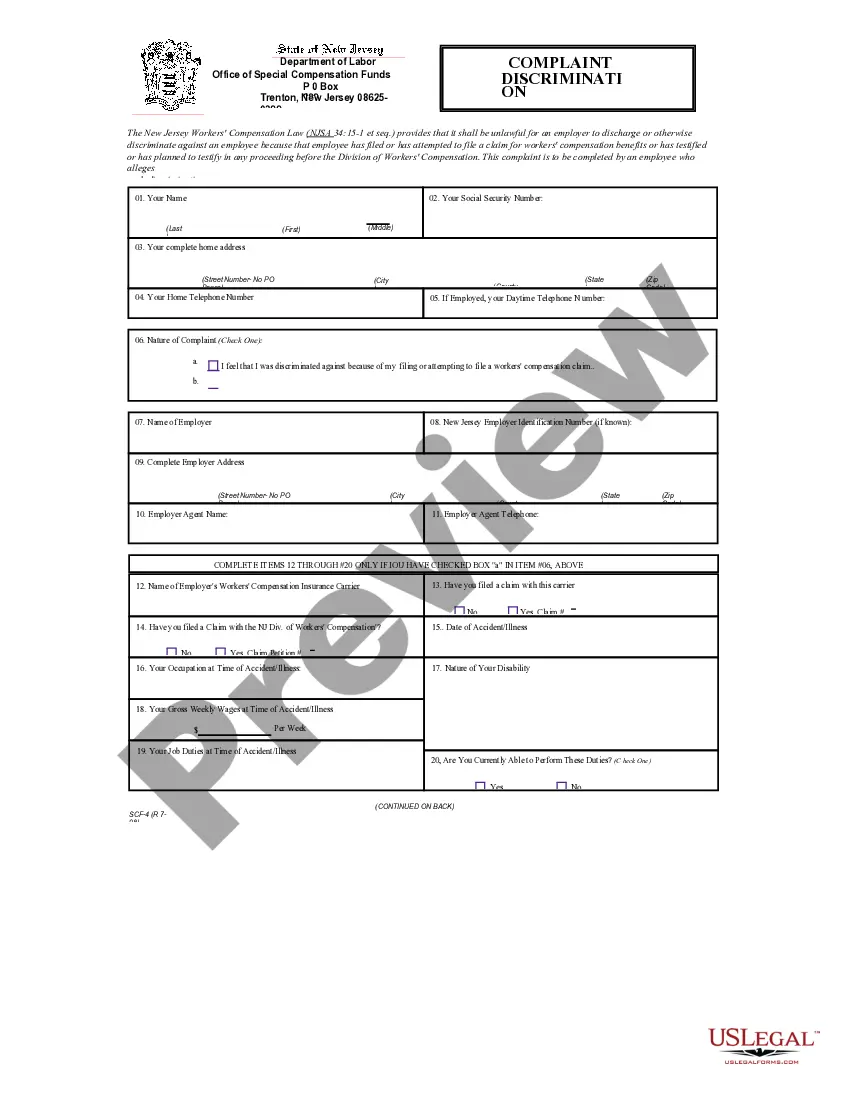

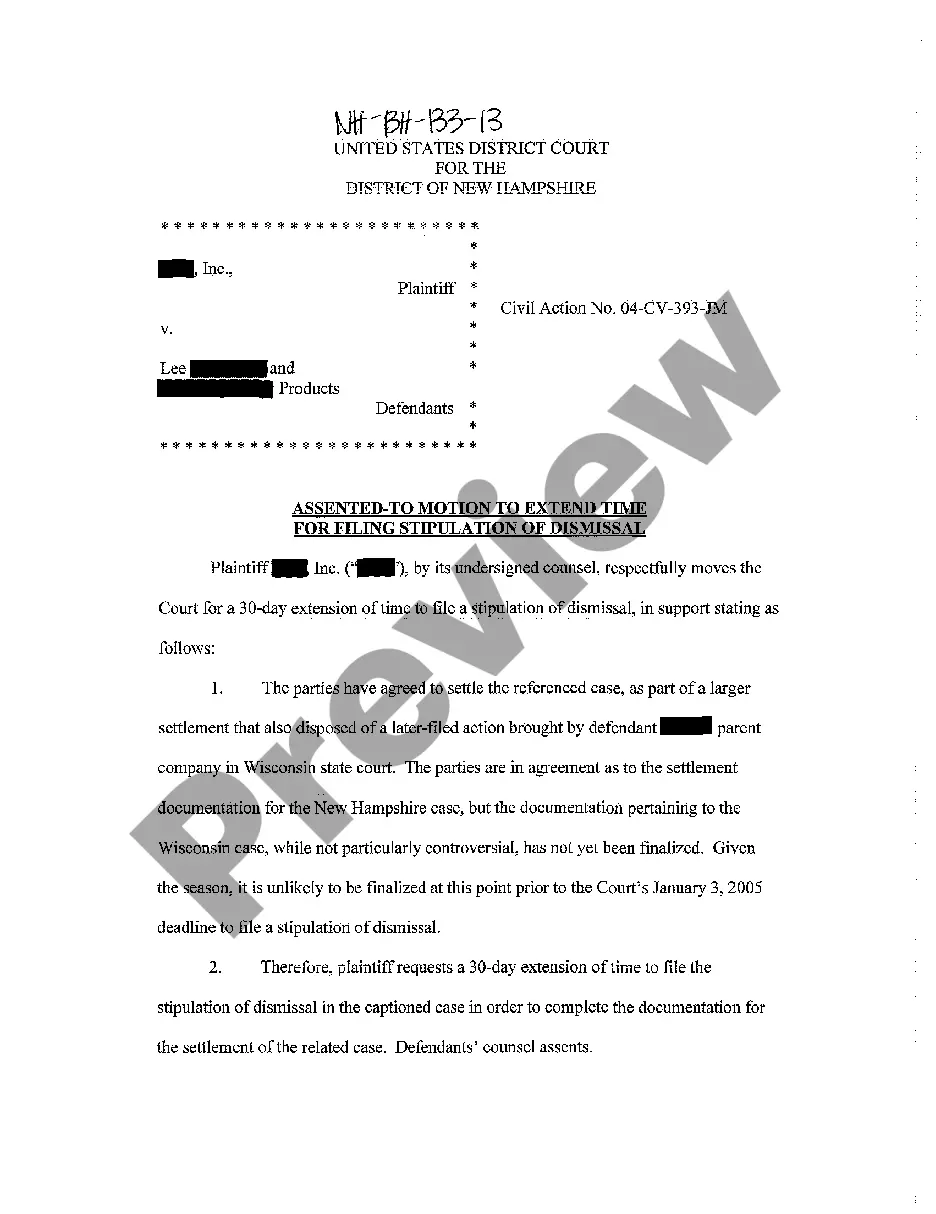

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Tabla de Trabajo Compensable con Explicación - Compensable Work Chart with Explanation

Description

How to fill out West Virginia Tabla De Trabajo Compensable Con Explicación?

If you have to full, down load, or produce authorized papers web templates, use US Legal Forms, the biggest collection of authorized kinds, that can be found on-line. Make use of the site`s simple and practical research to discover the files you will need. Various web templates for enterprise and individual purposes are sorted by groups and says, or key phrases. Use US Legal Forms to discover the West Virginia Compensable Work Chart with Explanation in just a couple of click throughs.

When you are already a US Legal Forms buyer, log in to your account and click the Download key to get the West Virginia Compensable Work Chart with Explanation. You can also accessibility kinds you in the past delivered electronically inside the My Forms tab of your account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that proper metropolis/nation.

- Step 2. Utilize the Preview solution to look through the form`s articles. Do not overlook to read the outline.

- Step 3. When you are unsatisfied together with the form, take advantage of the Search field on top of the monitor to locate other variations of the authorized form web template.

- Step 4. After you have located the shape you will need, go through the Get now key. Pick the costs prepare you prefer and put your accreditations to register on an account.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Pick the format of the authorized form and down load it on your product.

- Step 7. Full, change and produce or sign the West Virginia Compensable Work Chart with Explanation.

Every single authorized papers web template you get is your own property for a long time. You have acces to each and every form you delivered electronically in your acccount. Click the My Forms area and select a form to produce or down load yet again.

Remain competitive and down load, and produce the West Virginia Compensable Work Chart with Explanation with US Legal Forms. There are many skilled and condition-specific kinds you can utilize for your enterprise or individual requirements.

Form popularity

FAQ

West Virginia requires employers to pay employees overtime of 1 1 / 2 times their regular rate for all hours worked in excess of 40 in a workweek (WV Code Sec. 21-5C-3). West Virginia does not generally limit the number of hours an employee may work, unless the employee is a minor.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar.

As per the guidelines set under The Workmen's Compensation Act 1923, employers have to give compensation to their employees and families in case of job-related injuries that may result in death or disability. The compensation amount depends on the nature of the injury and the age of the worker.

Right to rest between work shifts. (a)(1) An employee may decline, without penalty, any work hours that are scheduled or 1 otherwise occur: 2 (A) Less than 11 hours after the end of the previous day's shift; or 3 (B) During the 11 hours following the end of a shift that spanned two days.

Do you have to pay taxes on your workers' compensation payments? The answer is no. Whether you received wage loss benefits on a weekly basis or a lump sum settlement, workers' compensation is not taxable.

Work Period: Section 7(k) of the FLSA provides that employees engaged in fire protection or law enforcement may be paid overtime on a work period basis. A work period may be from 7 consecutive days to 28 consecutive days in length.

Work may be performed beyond eight (8) hours a day provided that the employee is paid for the overtime work, an additional compensation equivalent to his regular wage plus at least twenty-five percent (25%) thereof.

Workers' Compensation Insurance in West Virginia can be purchased from private insurance companies authorized by the state to provide coverage. The Assigned Risk Pool, or an alternate State Insurance Fund, is available for businesses that are unable to find coverage from a private company.

An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $175.33, 33 1/3% of the West Virginia state average weekly wage and may not exceed the Federal minimum hourly wage. The weekly maximum is $526, 100% of the West Virginia state average weekly wage. Maximum period of payments is 104 weeks.

All West Virginia employers are statutorily required to maintain workers' compensation insurance coverage. Visit the West Virginia Offices of the Insurance Commissioner Employer Coverage Unit online to file workers' compensation.