Vermont Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

Choosing the right lawful record format can be a battle. Obviously, there are tons of templates accessible on the Internet, but how would you discover the lawful form you require? Make use of the US Legal Forms internet site. The support offers a large number of templates, like the Vermont Fair Credit Act Disclosure Notice, that you can use for enterprise and personal demands. All the varieties are examined by specialists and fulfill federal and state demands.

When you are presently authorized, log in for your account and click the Down load button to obtain the Vermont Fair Credit Act Disclosure Notice. Use your account to look throughout the lawful varieties you might have purchased formerly. Go to the My Forms tab of your own account and obtain one more version of the record you require.

When you are a brand new customer of US Legal Forms, here are simple instructions that you should stick to:

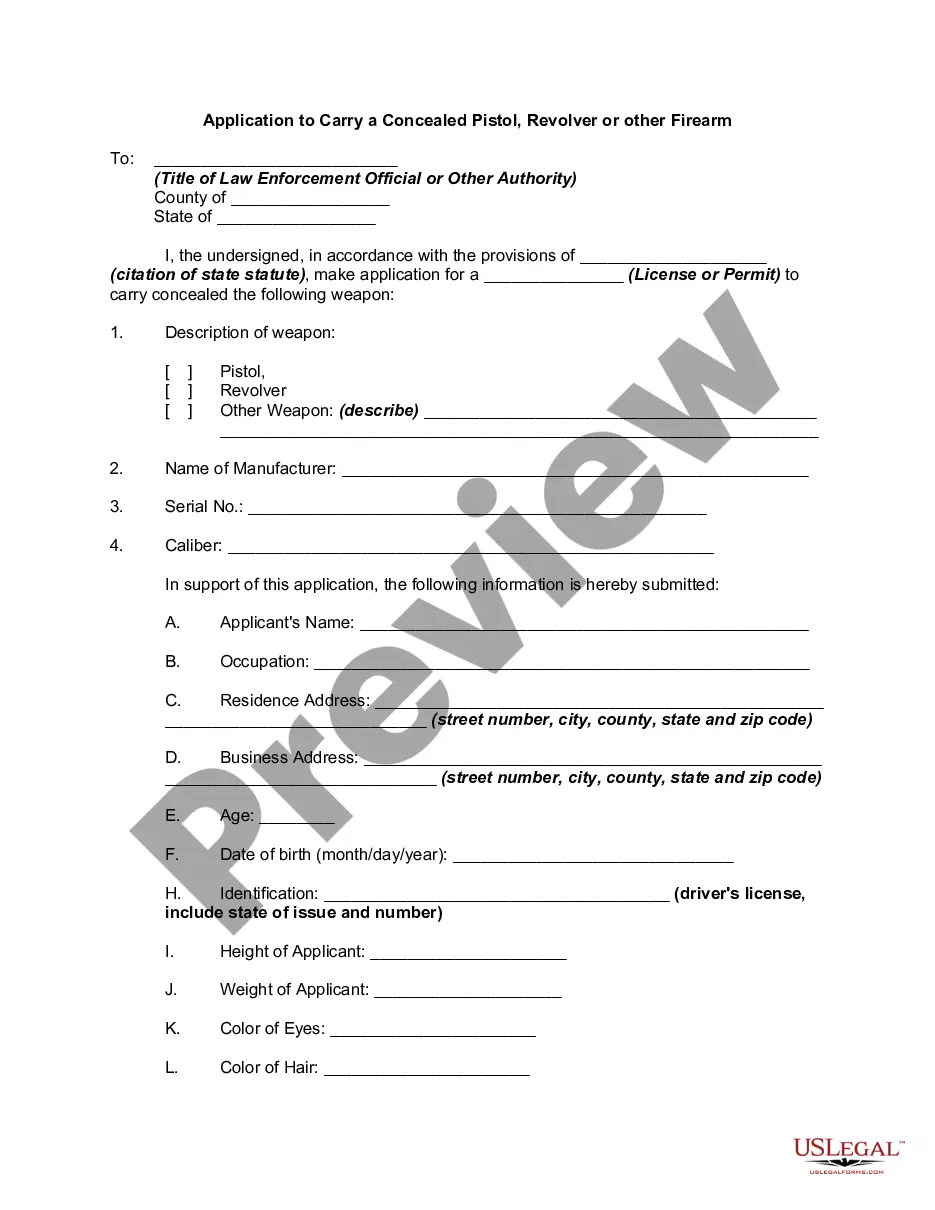

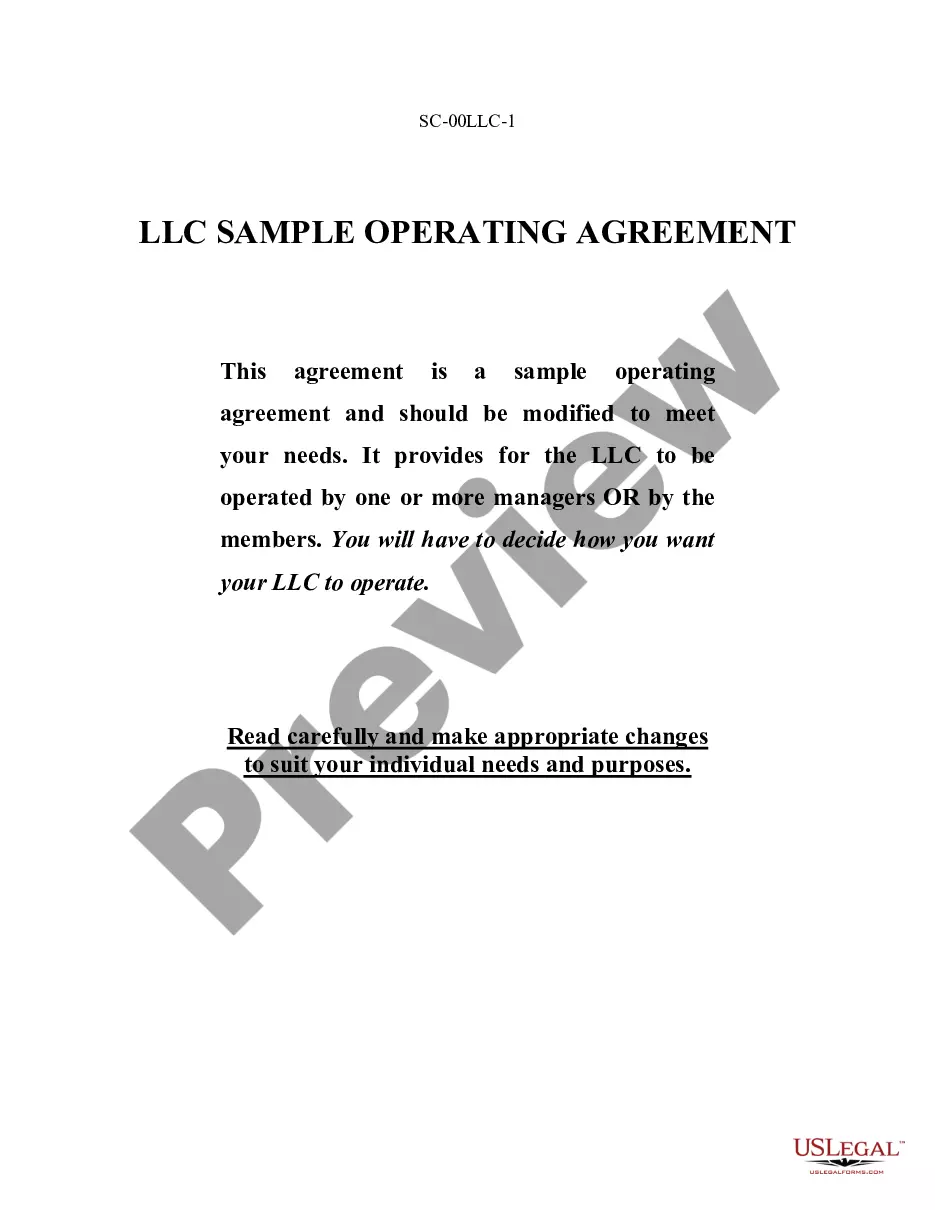

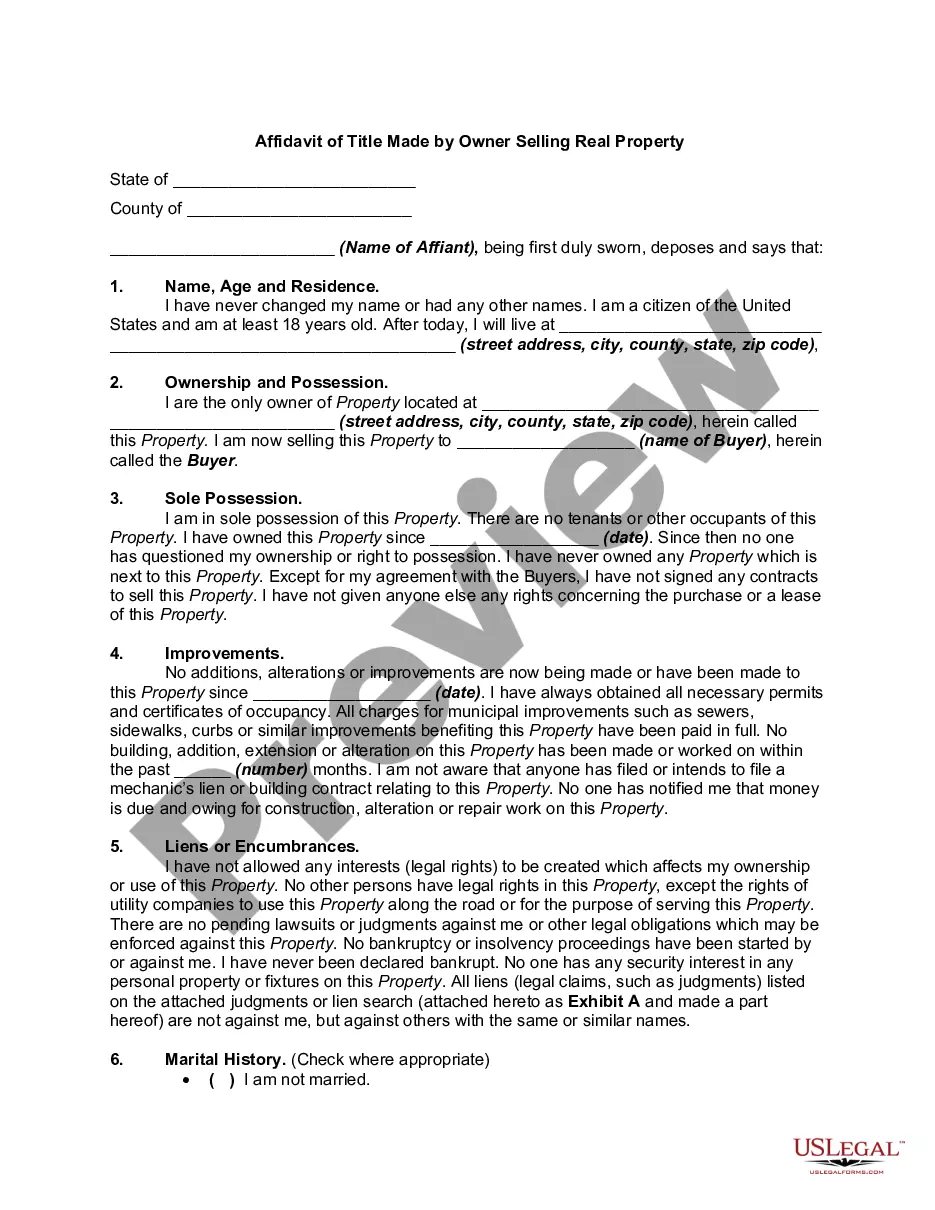

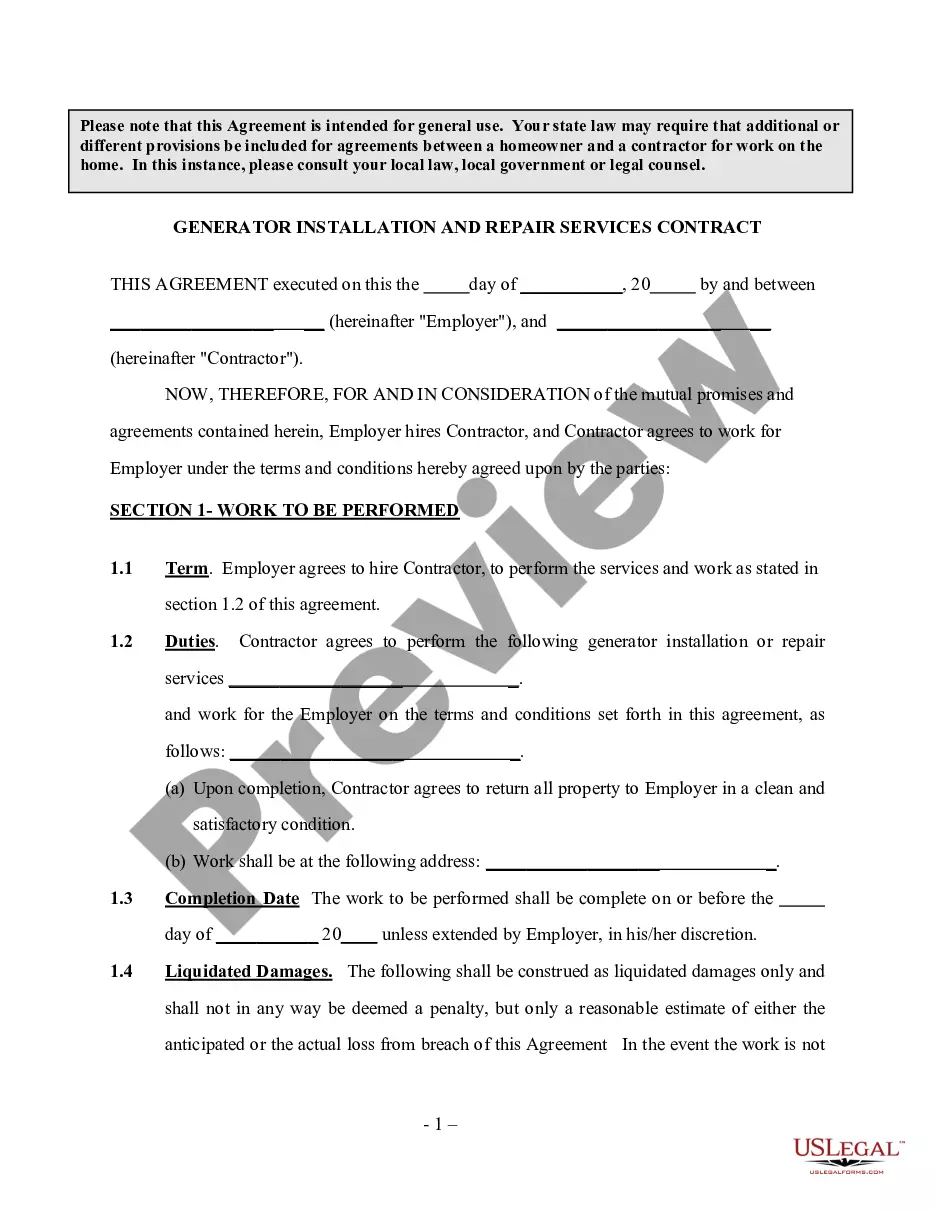

- Initially, make certain you have chosen the proper form to your city/region. You are able to examine the shape while using Preview button and browse the shape explanation to make sure this is basically the best for you.

- If the form does not fulfill your requirements, take advantage of the Seach area to discover the appropriate form.

- Once you are certain that the shape is acceptable, click the Get now button to obtain the form.

- Opt for the pricing plan you would like and enter the necessary info. Design your account and buy your order using your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and obtain the lawful record format for your system.

- Total, edit and printing and signal the received Vermont Fair Credit Act Disclosure Notice.

US Legal Forms will be the largest catalogue of lawful varieties in which you can find a variety of record templates. Make use of the company to obtain professionally-created paperwork that stick to status demands.

Form popularity

FAQ

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

The Fair Credit Reporting Act (FCRA), 15 U.S.C. 1681-1681y, requires that this notice be provided to inform users of consumer reports of their legal obligations.

A creditor must disclose the credit score used by the person in making the credit decision on a risk-based pricing notice. Credit score has the same meaning used in §609(f)(2)(a) of the FCRA. Most credit scores that meet the FCRA definition are scores that creditors obtain from consumer reporting agencies.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

A credit file disclosure provides you with all of the information in your credit file maintained by a consumer reporting company that could be provided by the consumer reporting company in a consumer report about you to a third party, such as a lender.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all