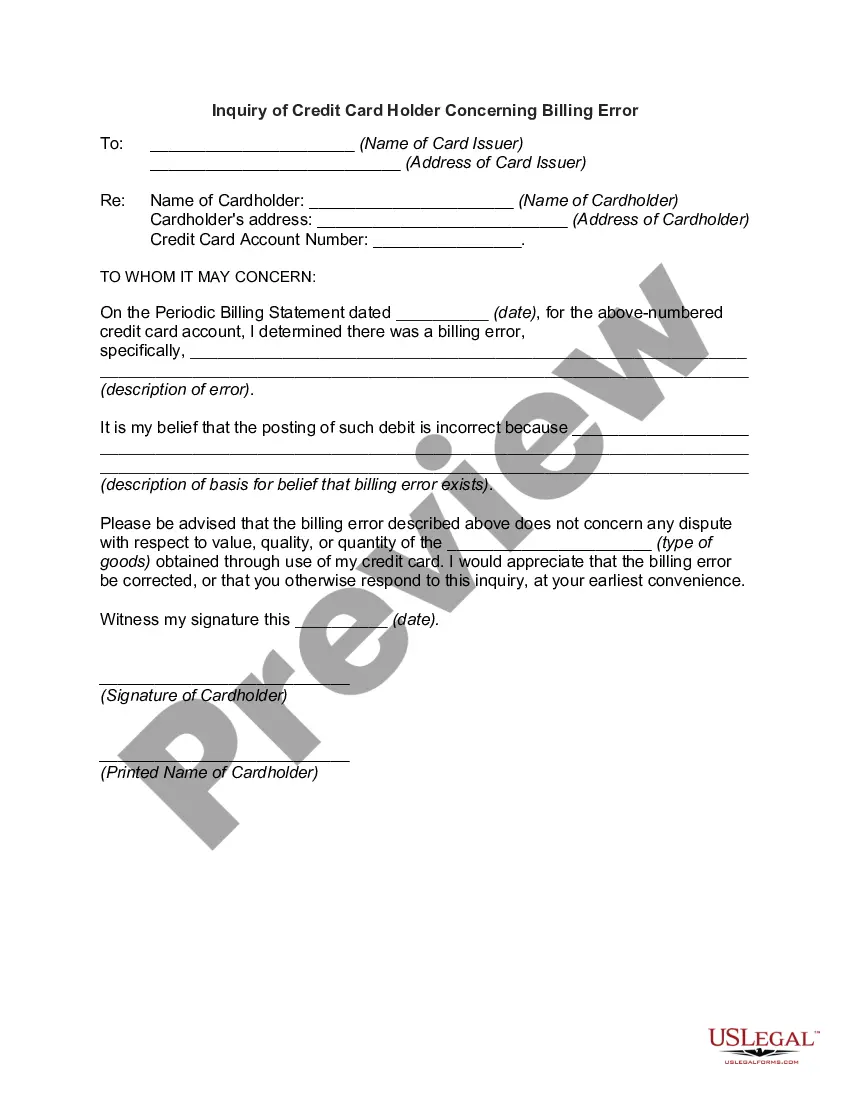

Virgin Islands Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Inquiry Of Credit Cardholder Concerning Billing Error?

You may invest hours on-line trying to find the authorized record format that fits the federal and state demands you will need. US Legal Forms offers a huge number of authorized forms which are analyzed by specialists. It is possible to acquire or produce the Virgin Islands Inquiry of Credit Cardholder Concerning Billing Error from our support.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Obtain key. After that, it is possible to comprehensive, change, produce, or signal the Virgin Islands Inquiry of Credit Cardholder Concerning Billing Error. Every single authorized record format you purchase is your own property forever. To acquire one more backup for any acquired type, visit the My Forms tab and then click the related key.

If you are using the US Legal Forms web site the first time, stick to the basic directions under:

- Initial, ensure that you have selected the proper record format for that area/city of your liking. Read the type information to ensure you have selected the correct type. If readily available, utilize the Preview key to check from the record format also.

- If you want to locate one more version from the type, utilize the Research discipline to find the format that fits your needs and demands.

- Once you have found the format you desire, click Buy now to continue.

- Find the costs plan you desire, key in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal bank account to pay for the authorized type.

- Find the formatting from the record and acquire it to your system.

- Make alterations to your record if needed. You may comprehensive, change and signal and produce Virgin Islands Inquiry of Credit Cardholder Concerning Billing Error.

Obtain and produce a huge number of record layouts making use of the US Legal Forms site, that offers the largest selection of authorized forms. Use professional and express-particular layouts to deal with your organization or individual demands.

Form popularity

FAQ

You normally have 60 days from the date a charge appears on your credit card statement to dispute it. This time limit is established by the Fair Credit Billing Act, and it applies whether you're disputing a fraudulent charge or a purchase that didn't turn out as expected.

One of the most straightforward reasons your card could have been declined is that you've hit the card's credit limit. The card company simply won't let you borrow any more money until you've made a payment.

List of common credit card declined codes. 05 / Do not honor: The customer's bank won't let this payment go through. To resolve the problem, ask the customer to contact their bank and then try again. 14 / Invalid card number: There might be a typo somewhere. Check the credit card number carefully and enter it again.

Call the number on the back of your credit card to speak directly with the issuer. You can typically report the charge by phone, mail or filling out a form on your issuer's website. Be sure to act quickly as you have 60 days from when the billing statement was sent out to call in the dispute.

A credit card decline occurs if, for a particular reason, a credit card payment cannot be processed and the transaction is declined by the payment gateway, the processor, or the bank issuing the money. It's a common problem faced by businesses that process recurring payments.

Report unauthorized charges as soon as you notice themeither to the merchant or your credit card issuer. Follow up the dispute with a letter to your credit card issuer to ensure your rights are fully protected. Take steps to protect your credit card information to prevent future unauthorized charges.

In a courtroom setting, there are consequences for falsifying testimony. Those who make false claims under oath could face fines or even jailtime, depending on the severity of the case. Consumers who file frivolous chargebacks don't typically get hit with those kinds of penalties.

Call the number on the back of your credit card to speak directly with the issuer. You can typically report the charge by phone, mail or filling out a form on your issuer's website. Be sure to act quickly as you have 60 days from when the billing statement was sent out to call in the dispute.

A bank response code is another name for a credit card authorization code, a two-digit numeric code which indicates whether the transaction was approved or declined. If the transaction is declined, the response code provides some basic information about why.

You have incorrectly entered your CVV code. 3. You have incorrectly entered your expiration date. 4.