Virgin Islands Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

Are you presently in a situation where you require documents for either business or personal purposes almost every time.

There are numerous legitimate document templates obtainable on the internet, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Virgin Islands Blind Trust Agreement, designed to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you desire, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virgin Islands Blind Trust Agreement anytime if necessary. Click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of valid forms, to save time and avoid mistakes. The service provides professionally prepared legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Blind Trust Agreement template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/state.

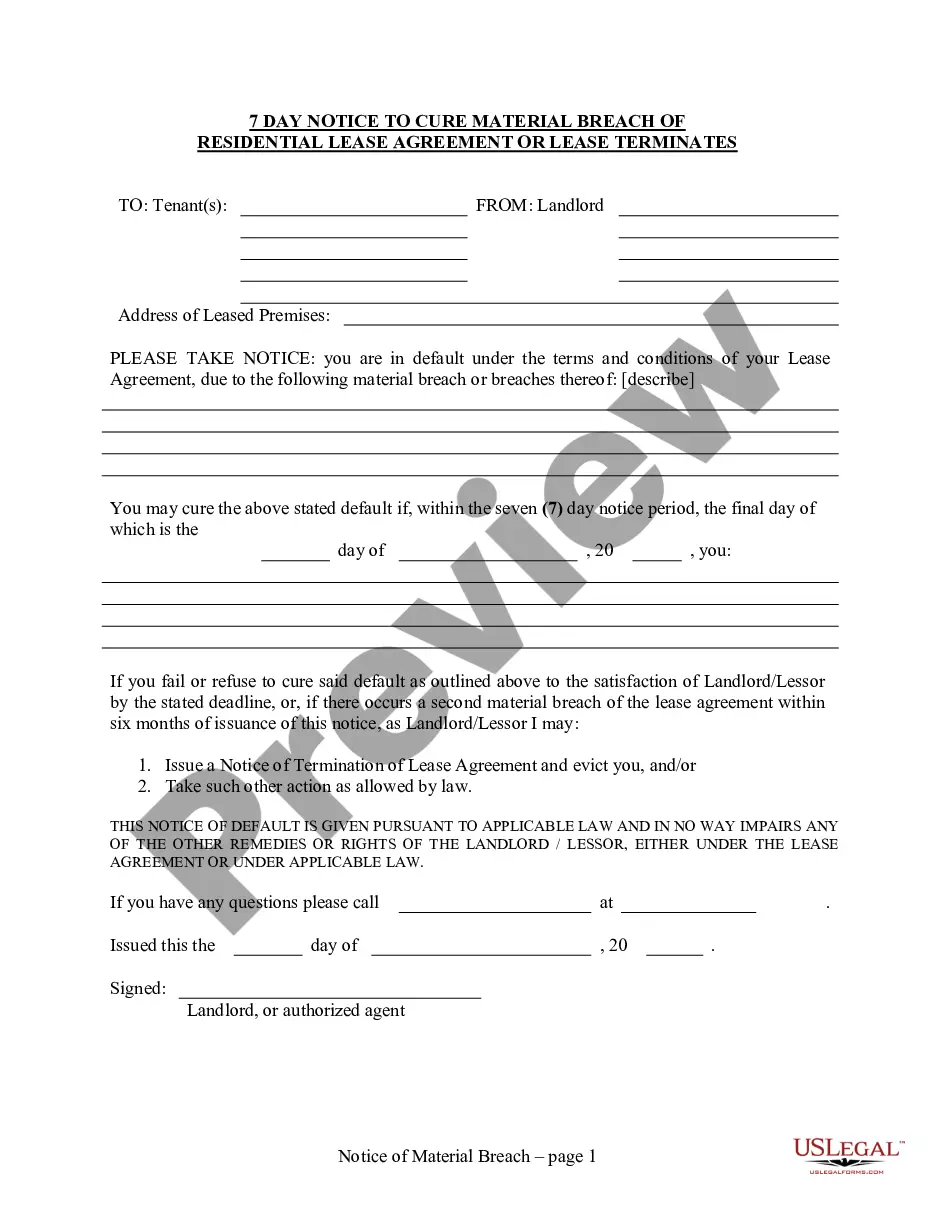

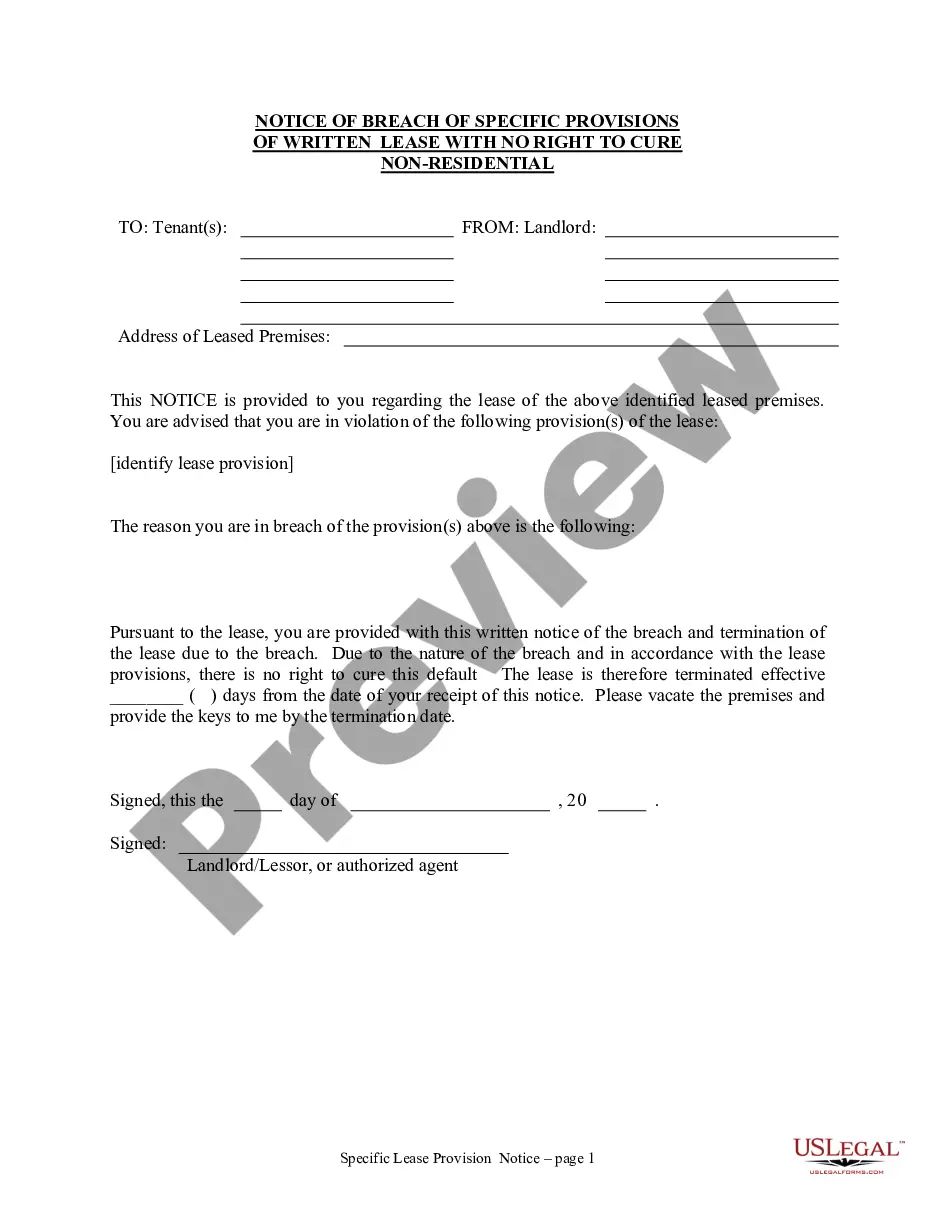

- Use the Preview button to review the form.

- Read the details to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search section to find a form that meets your needs.

Form popularity

FAQ

Having blind trust in someone means placing complete confidence in their decisions without interference. In the context of a Virgin Islands Blind Trust Agreement, it involves relying on a trustee to manage your assets in a way that aligns with your goals, all while remaining uninvolved in the daily operations. This arrangement can foster peace of mind, knowing that experienced professionals handle your financial matters.

A common example of a blind trust involves a wealthy individual who places their assets into a trust, to be managed by a trustee without their influence. This setup is often used by public officials to avoid conflicts of interest. In the case of a Virgin Islands Blind Trust Agreement, the grantor can ensure that their financial activities remain separate from their public duties, maintaining ethical standards and transparency.

There are primarily two types of blind trusts: revocable and irrevocable. A revocable blind trust allows the grantor to retain some control over the assets, making changes as needed. In contrast, an irrevocable blind trust means the grantor relinquishes control permanently, providing additional protection from creditors and ensuring privacy. Establishing a Virgin Islands Blind Trust Agreement can help individuals effectively manage their assets while maintaining confidentiality.

To set up a trust in the British Virgin Islands (BVI), you should first consult with legal experts familiar with local laws. The process generally involves choosing a trustee and drafting a trust deed that complies with BVI regulations. Utilizing a pre-designed framework like the Virgin Islands Blind Trust Agreement can simplify this process and ensure compliance. Platforms like UsLegalForms can guide you through the steps necessary to establish a robust and legally sound trust.

The assets held in a blind trust are owned by the trust itself, not the beneficiary. Although the beneficiary can receive the benefits from the trust, they do not have direct control or knowledge of the assets. This arrangement is particularly beneficial for individuals in positions of public trust, as it helps mitigate potential conflicts of interest. The Virgin Islands Blind Trust Agreement provides the necessary legal framework for ownership and management.

The person in control of a trust is known as the trustee. This individual or entity is charged with managing the trust's assets according to its terms. In the case of a blind trust, the trustee operates independently of the beneficiary, ensuring unbiased management. It is essential to choose a trustworthy and competent trustee for a successful Virgin Islands Blind Trust Agreement.

Establishing a blind trust involves several key steps. First, you will need to select a reputable trustee, someone who can manage the trust assets responsibly. After that, it's vital to draft a Virgin Islands Blind Trust Agreement that outlines the terms and conditions of the trust. This document will serve as a guiding framework to ensure proper management and compliance with local laws.

A blind trust is controlled by a trustee, who manages the trust assets without input from the beneficiary. This setup ensures that the beneficiary's personal interests do not influence the management of the trust. The Virgin Islands Blind Trust Agreement specifies the responsibilities of the trustee, providing clarity and security for all parties involved. Knowing how these roles function is crucial for establishing a successful trust.

A trust is a legal arrangement where one party holds assets for the benefit of another. In contrast, a blind trust is a specific type of trust where the beneficiary has no knowledge of the assets or their management. This structure often helps to avoid conflicts of interest, especially for public officials. Understanding the Virgin Islands Blind Trust Agreement can help you navigate these differences effectively.

To set up a blind trust, start by selecting a trustworthy and experienced trustee to manage your assets. Then, draft a Virgin Islands Blind Trust Agreement that reflects your intentions clearly, outlining the roles of all parties involved. Finally, ensure your assets are properly transferred into the trust, allowing the trustee to operate independently to shield your interests from public scrutiny.