The Virgin Islands Right of First Refusal to Purchase Real Estate refers to a legal provision that grants certain individuals or entities the first opportunity to purchase a property before the owner can sell it to a third party. This right is commonly exercised in real estate transactions to protect the interests of specific stakeholders such as tenants, neighboring property owners, or government bodies. In the Virgin Islands, there are various types of Right of First Refusal to Purchase Real Estate, each catering to different circumstances and beneficiaries. These types may include: 1. Government Right of First Refusal: This type grants local government authorities the priority to purchase a property before it can be sold to private individuals or corporations. The government can exercise this right to preserve public lands, secure necessary space for infrastructure projects, or promote urban redevelopment initiatives. 2. Tenant Right of First Refusal: In some instances, tenants who have been residing in a rental property for a certain period of time may be granted the opportunity to purchase the property if the landlord decides to sell it. This Right of First Refusal helps tenants to secure their living arrangements and potentially become homeowners. 3. Neighboring Property Owner Right of First Refusal: With this type, a neighboring property owner is given the chance to buy an adjacent property before it is sold to someone else. This right helps maintain the integrity of the neighborhood, prevents unwanted developments, and ensures compatible land uses. 4. Co-Owner Right of First Refusal: When co-owners of a property decide to sell their shared asset, they often grant each other the right of first refusal. This gives co-owners the opportunity to acquire the whole property, maintaining their ownership stake and avoiding potential conflicts with unfamiliar buyers. To exercise the Right of First Refusal, the beneficiary typically needs to provide written notice within a specific timeframe to the selling party, expressing their intention to purchase the property for a price that matches or exceeds the offer from the potential third-party buyer. If the beneficiary fails to exercise this right within the designated period, the seller is free to proceed with the sale to the third party on the agreed terms. It is essential to consult local real estate attorneys or professionals in the Virgin Islands to ensure a clear understanding of the specific regulations, limitations, and procedures related to the Right of First Refusal in real estate transactions. Whether it is the government, tenant, neighboring property owner, or co-owner, this right serves to protect the interests of the designated beneficiaries and maintain a fair and transparent real estate market.

Virgin Islands Right of First Refusal to Purchase Real Estate

Description

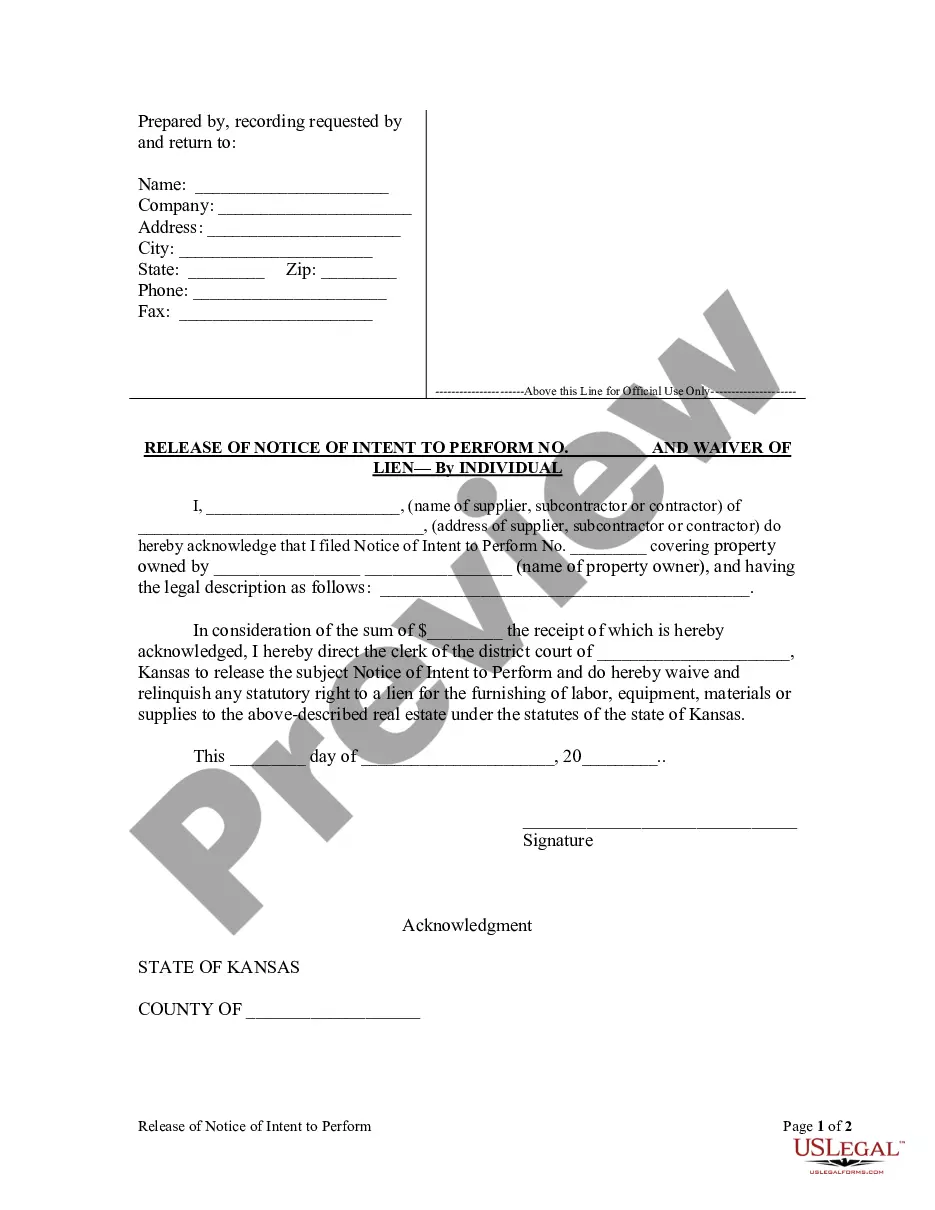

How to fill out Virgin Islands Right Of First Refusal To Purchase Real Estate?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest editions of forms like the Virgin Islands Right of First Refusal to Purchase Real Estate in just moments.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Once you're satisfied with the form, confirm your selection by clicking the Get Now button. Next, choose the pricing plan you prefer and enter your information to register for an account.

- If you have an account, Log In to download the Virgin Islands Right of First Refusal to Purchase Real Estate from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You can access all previously obtained forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you've selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

A right of first refusal in the Virgin Islands typically gets triggered when a property owner intends to sell their real estate. The terms of this right should specify the conditions under which you must be notified about a potential sale. Understanding these triggers ensures you are prepared to exercise your option when the opportunity arises, safeguarding your interests in the property.

The landlord's right of first refusal is a provision that allows landlords the first opportunity to buy the property being rented by a tenant before it is offered to any other potential buyers. This right is beneficial for landlords who wish to retain control over their rental properties and make investment decisions based on market value. In the Virgin Islands, understanding this right can enhance a landlord's position in negotiations and real estate planning.

Right of First Refusal. An option is a right to purchase property at a set price for a fixed period of time, whereas a right of first refusal is a right to purchase property only if it is offered for sale in the future.

For the ROFR to be effective, there must be a valid contract. You will often see this right as part of another contract, such as a rental lease or an operating agreement. However, it can also be a standalone contract. In either case, the contract itself must be legally enforceable.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

To be enforceable, options and rights of first refusal must usually be in writing, signed, contain an adequate description of the property, and be supported by consideration. They may be included in lease contracts, or they may be drafted as standalone agreements.

Imagine being able to make an offer on a house before any other interested home shoppers can even have a look-see. If you have a right of first refusal negotiated into your lease or other housing agreement, you get to be the first in line to buy the real estate.

People often talk about giving or getting a Right of First Refusal ("ROFR") in real estate transactions. But what is a ROFR? A simple definition might be: If the owner of the property decides to sell the property, then the person holding the ROFR gets the opportunity to buy the property on the same terms first.

The value of the right of first refusal to the holder at the time an offer was made by a third party should be the difference between the inherent value assumed by the assignee and the offering price by the third party.

Duration: The ROFR may expire after a certain amount of time or after an event occurs, such as the expiration of a lease. After the specified time, the property owner may enter into a transaction without notifying the holder of the ROFR.