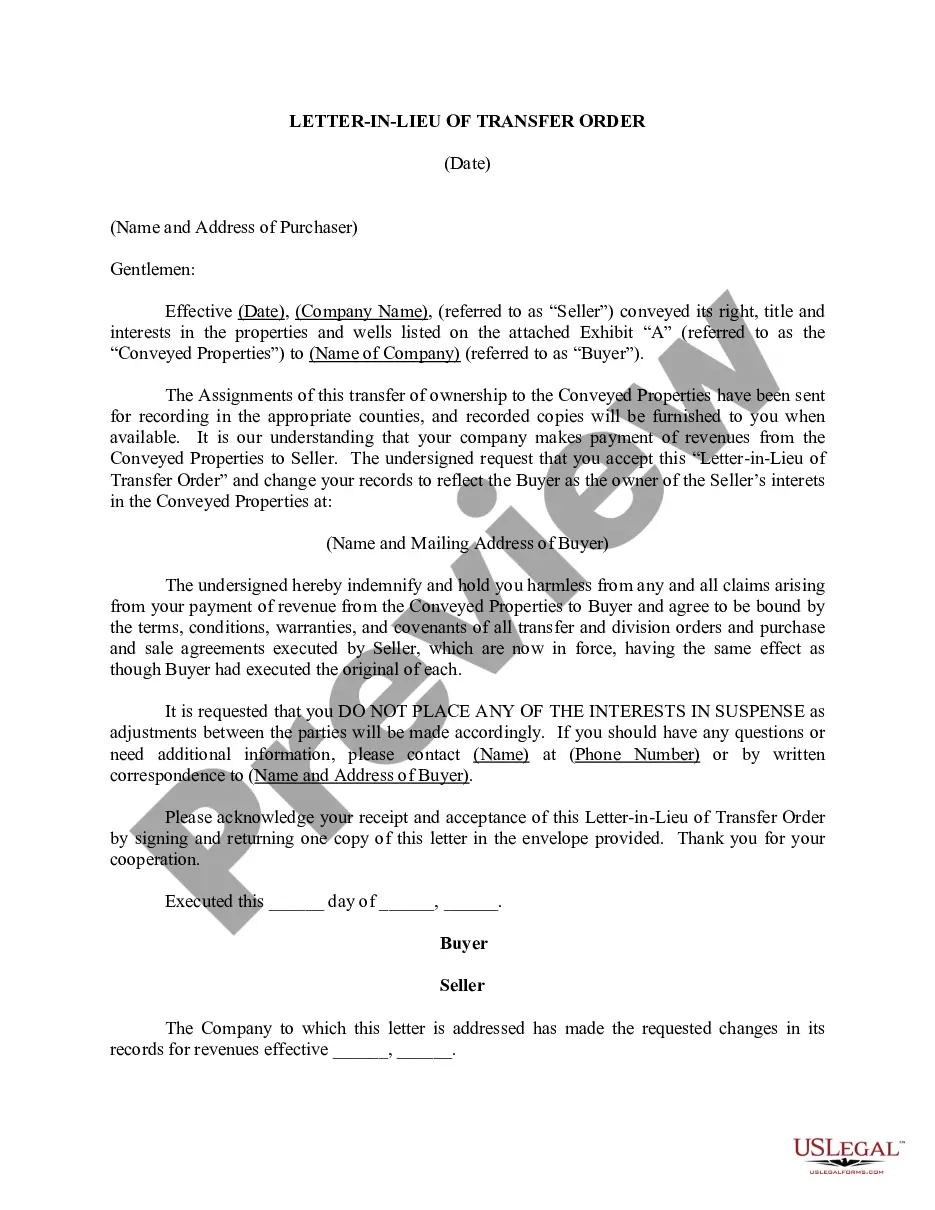

Letter in Lieu of Transfer Order

Overview of this form

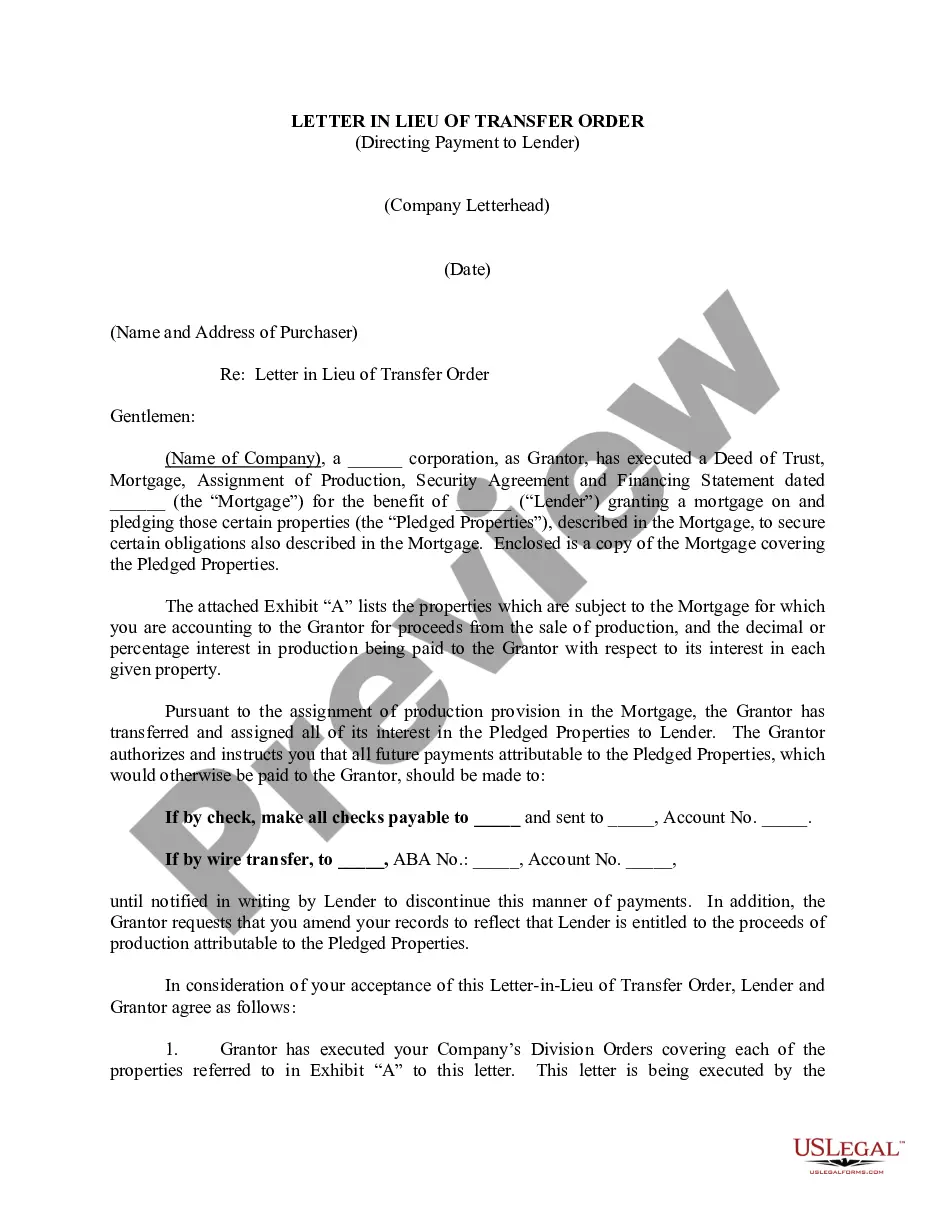

The Letter in Lieu of Transfer Order is a legal document used to facilitate the change of a company's records, indicating that the buyer is now the owner of the seller's interest in specified properties. This form serves as a notification to the relevant parties and ensures that ownership records are updated without the need for a detailed transfer order, making it distinct from other property transfer documents.

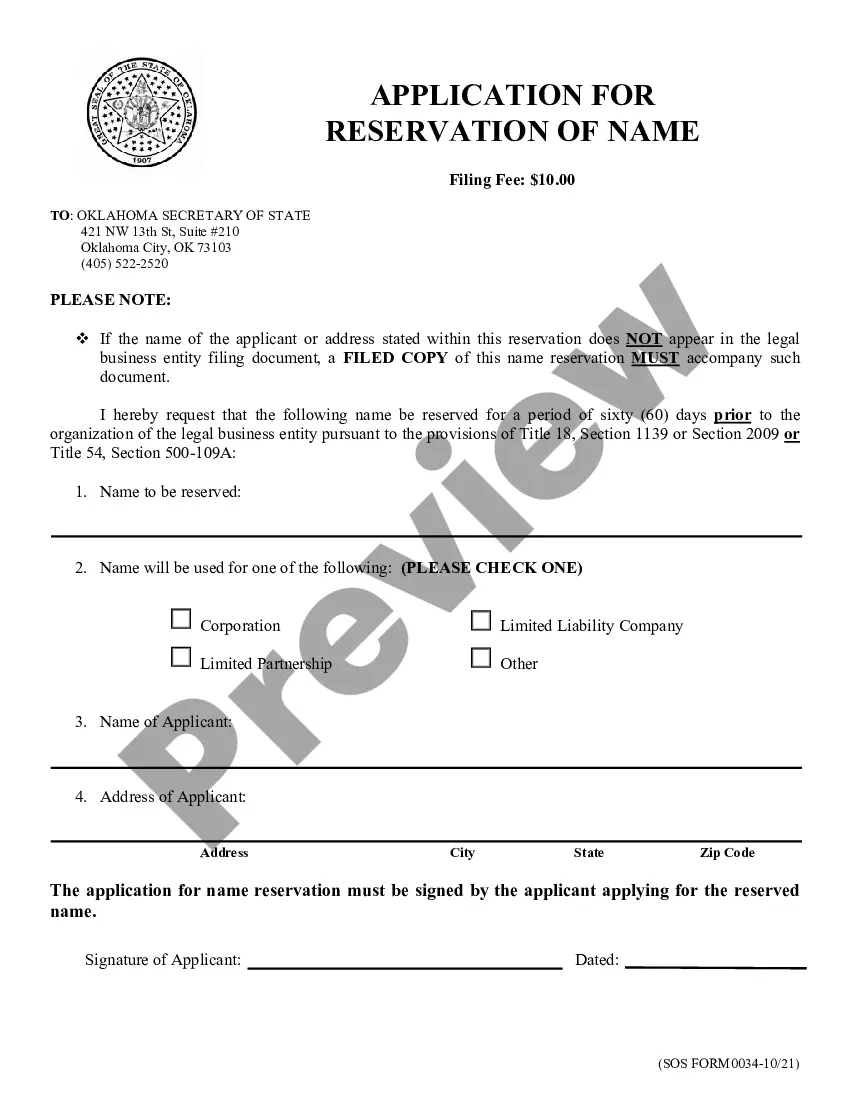

Form components explained

- Date of the letter

- Name and address of the purchaser

- Name of the seller company

- Description of the conveyed properties listed on Exhibit A

- Request for record-keeping updates

- Signature lines for buyer and seller

State-specific requirements

This form is suitable for use across multiple states but may need changes to align with your state’s laws. Review and adapt it before final use.

Common use cases

This form is typically used when ownership of specific properties or wells is transferred from one company to another. It allows for a smooth transition of ownership records in situations where the formal transfer order process may be delayed or impractical. Common scenarios include mergers, acquisitions, or sales of assets where the ownership needs to be swiftly reflected in revenue payments and property records.

Intended users of this form

- Buyers acquiring interest in properties or wells

- Sellers transferring ownership of their assets

- Lawyers representing companies engaged in property transactions

- Corporate accountants handling record-keeping for ownership changes

Completing this form step by step

- Enter the date at the top of the document.

- Fill in the name and address of the purchaser.

- Specify the name of the seller company.

- List the conveyed properties as described in Exhibit A.

- Provide the buyer's information for record updates.

- Obtain signatures from both the buyer and seller.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Typical mistakes to avoid

- Failing to accurately identify and describe the properties being transferred.

- Omitting the necessary signatures or dates.

- Not providing complete contact information for the buyer.

- Ignoring the indemnification clause, which can lead to disputes later on.

Advantages of online completion

- Easy download and access to needed templates at any time.

- Editable forms that can be tailored to specific transactions.

- Reliability of forms drafted by licensed attorneys, ensuring compliance.

- Convenience of completing forms from home without the need for a trip to an office.

Key Concepts & Definitions

Letter in Lieu of Transfer Order: A letter issued by an employer, often in government or corporate sectors, that serves as an official notification for an employee stating a transfer or reassignment. It specifies reasons if any transfer order hasn't been issued formally but acknowledges and effects the transfer administratively.

Step-by-Step Guide to Handling a Letter in Lieu of Transfer Order

- Receive and Read: Upon receiving the letter, read thoroughly to understand the details of the reassignment, including location, role, and timeframe.

- Clarify Doubts: If there are any ambiguities, contact your human resources department or immediate supervisor for clarification.

- Review Terms: Check if the letter aligns with your employment agreement, particularly regarding relocation support and compensation adjustments.

- Accept or Request Review: If agreeable, confirm your acceptance in writing. If not, consider discussing alternatives or adjustments with HR.

- Plan the Transition: Organize your affairs and plan the physical and role transition accordingly, considering the timeline provided.

Risk Analysis

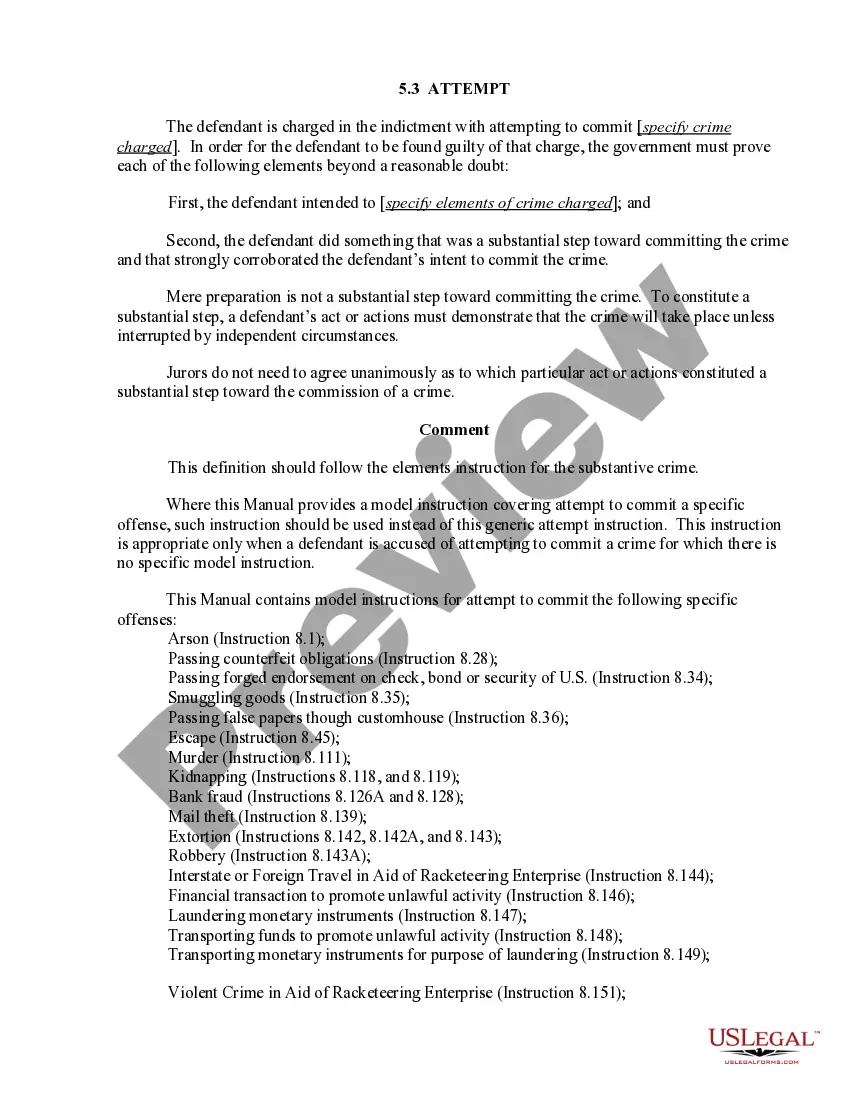

- Legal Risks: Misinterpretation of employment terms due to unclear communication can lead to legal disputes.

- Compliance Risks: Failure to comply with organizational or statutory transfer policies might result in penalties or administrative problems.

- Personal Risks: Inadequate preparation for relocation can lead to personal and financial strain.

Best Practices

- Thoroughly Review Employment Contracts: Always check your employment terms regarding transfers prior to acknowledging any such letters.

- Communicate Openly: Engage openly with HR to express any concerns or seek clarifications about the transfer.

- Seek Legal Advice: If unsure about any aspect, consulting with a legal professional can provide clarity and safeguard your interests.

- Prepare Proactively: Upon confirmation, put in place a detailed plan to manage the logistics and family arrangements if applicable.

Form popularity

FAQ

Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

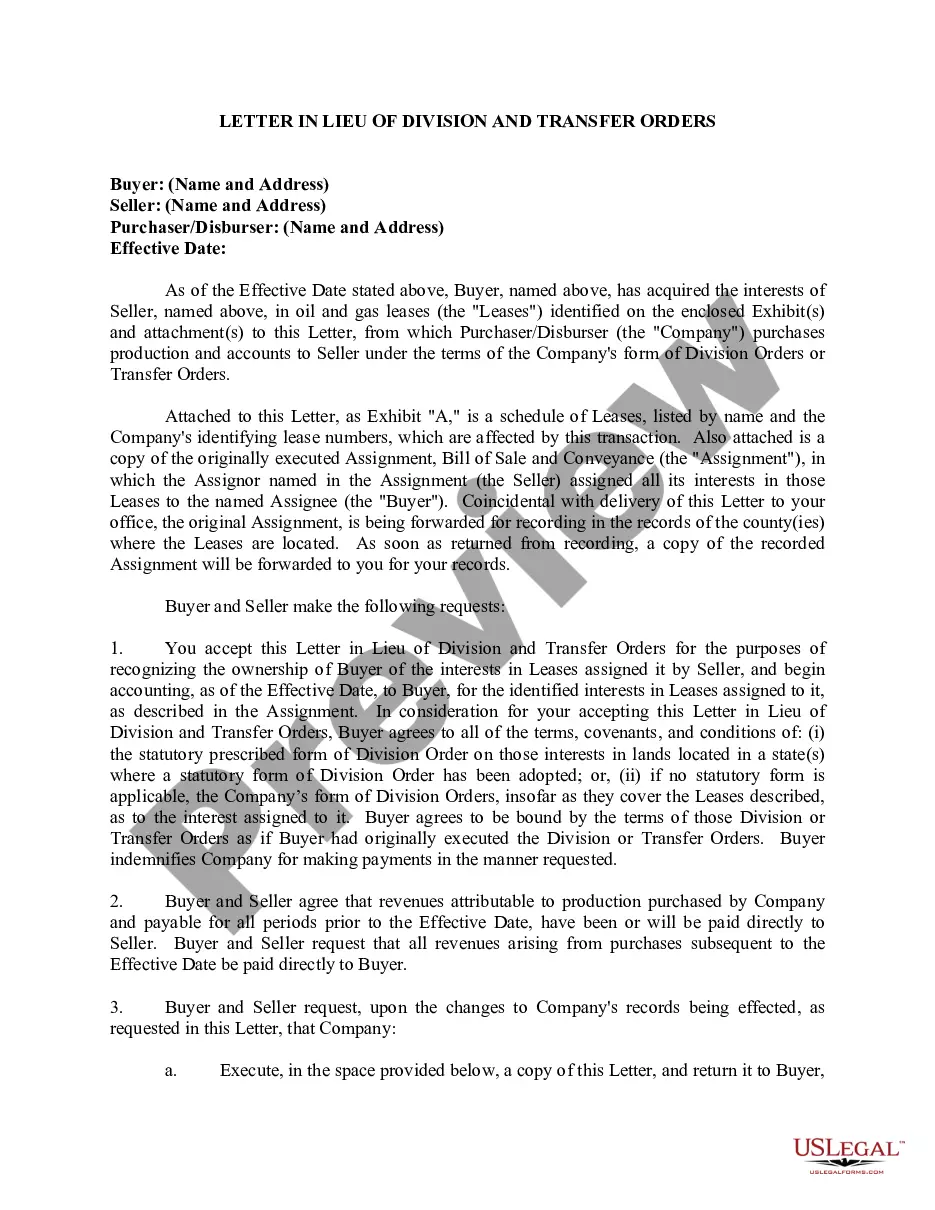

A Division Order (DO's), also known as a Division of Interest (DOI), is the instrument which details the proportional ownership of produced minerals, including oil, liquids, natural gas, etc., in a well or unitized area of production.

Transferring Deeded Oil, Gas or Mineral Rights Into Your Trust. The process is easiest if you own the actual real estate that holds the oil, gas or mineral deposits. You can simply create and sign a new deed transferring ownership of the real estate from your name into that of your trust.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

You have no idea how troublesome it is to probate wills decades after the person died so that the oil company will pay royalties to the heirs. But if you push they will pay per the state statutes. So, if you had no siblings, your state statute probably says that you inherit from your mother.

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).