Simple Agreement for Future Equity

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

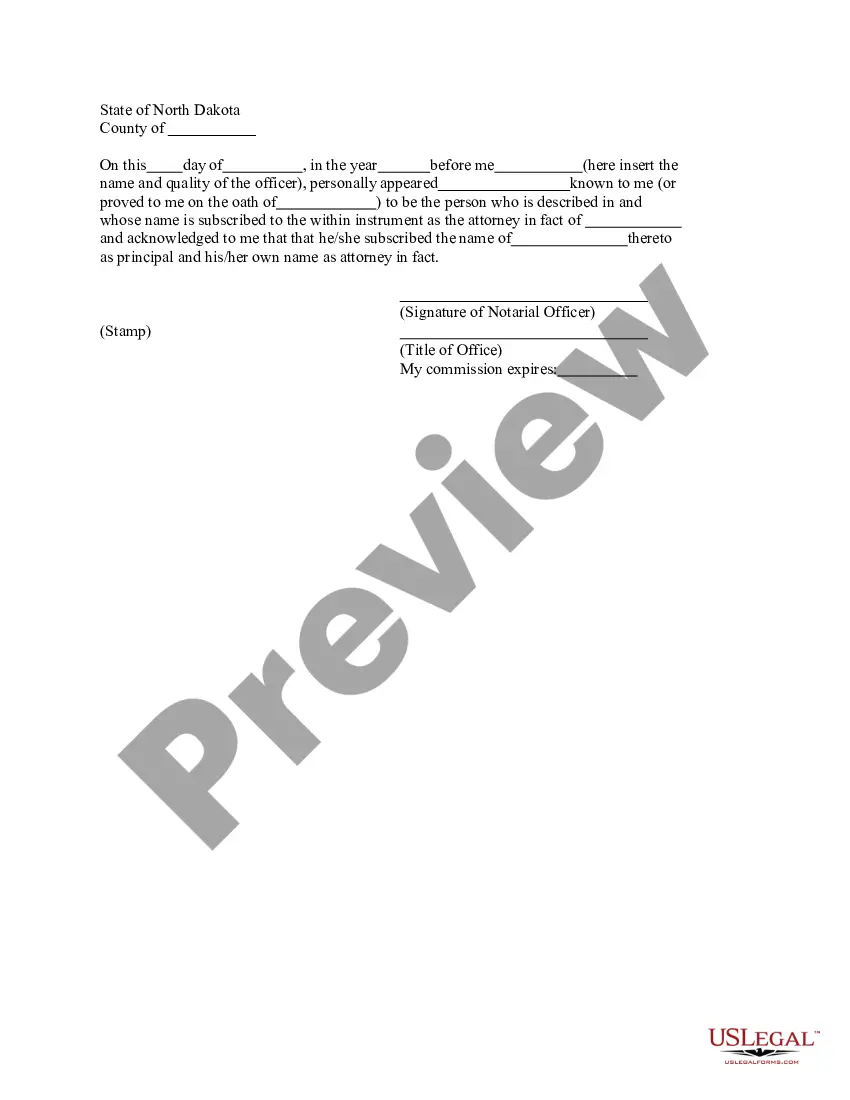

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Simple Agreement for Future Equity (SAFE): Introduced as an instrument for startup financing, a SAFE allows investors to convert their investments into equity at future valuations, subject to specific triggering events. Unlike traditional priced equity, a SAFE does not assign an immediate valuation to the company. Future equity refers to ownership rights granted to investors or entities like venture capital or private equity firms, often facilitated through SAFE or convertible notes.

Step-by-Step Guide

- Assess Needs: Determine if SAFE suits your startups financial strategy and growth expectations.

- Seek Legal Advice: Consult with a lawyer skilled in startup financing to understand implications of a SAFE agreement.

- Negotiate Terms: Work out the terms of the future equity, addressing milestones or valuation caps with potential investors.

- Prepare Documentation: Create the actual SAFE document, ensuring all terms are clear and comprehensive.

- Execute Agreement: Sign the SAFE agreement alongside investors, formalizing the terms of future equity ownership.

Risk Analysis

- Lack of Immediate Valuation: Startups may struggle to estimate their worth, potentially disadvantaging founders during investment conversions.

- Conversion Events Uncertainty: The ambiguity about when and how investments convert can create financial planning challenges.

- Control Dilution: Founders might cede more control than anticipated depending on future valuations and equity distributions.

Best Practices

- Transparency with Investors: Clearly communicate terms and potential scenarios with all stakeholders.

- Regular Valuations: Even without immediate pricing, strive to get periodic valuations to monitor company growth and equity distribution.

- Expert Guidance: Continuously consult with financial advisors and lawyers specializing in startup financing and investment funds.

Common Mistakes & How to Avoid Them

- Ignoring Long-Term Impact: Consider future rounds of funding and how they might affect your current SAFE agreements.

- Not Setting a Cap: Implement a valuation cap in your SAFE to prevent excessive dilution during high growth phases.

Case Studies / Real-World Applications

For example, many startups in accelerator programs such as those offering accelerator capital, often use SAFEs due to their flexibility and simplicity, facilitating quicker fund-raising rounds without the immediate need for a convertible valuation.

FAQ

What is the main advantage of a SAFE over traditional equity? SAFEs provide a non-debt financial option that converts into equity, potentially simplifying early-stage startup funding.

Can SAFEs dilute founder equity? Yes, especially if no valuation cap is set, founders might find their percentage of ownership significantly reduced post-funding.

Summary

A Simple Agreement for Future Equity is an innovative financial tool designed to simplify early-stage investment, providing startup founders and investors a flexible mechanism for equity distribution based on future valuations. With correct handling, SAFEs can effectively support startup growth while attracting substantial venture capital.

How to fill out Simple Agreement For Future Equity?

Use US Legal Forms to obtain a printable Simple Agreement for Future Equity. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue on the web and offers cost-effective and accurate templates for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Simple Agreement for Future Equity:

- Check to make sure you have the correct template with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Simple Agreement for Future Equity. Over three million users have already utilized our platform successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.