Sample Series A Preferred Stock Purchase Agreement between BirthdayExpress, Inc. and Purchaser

Definition and meaning

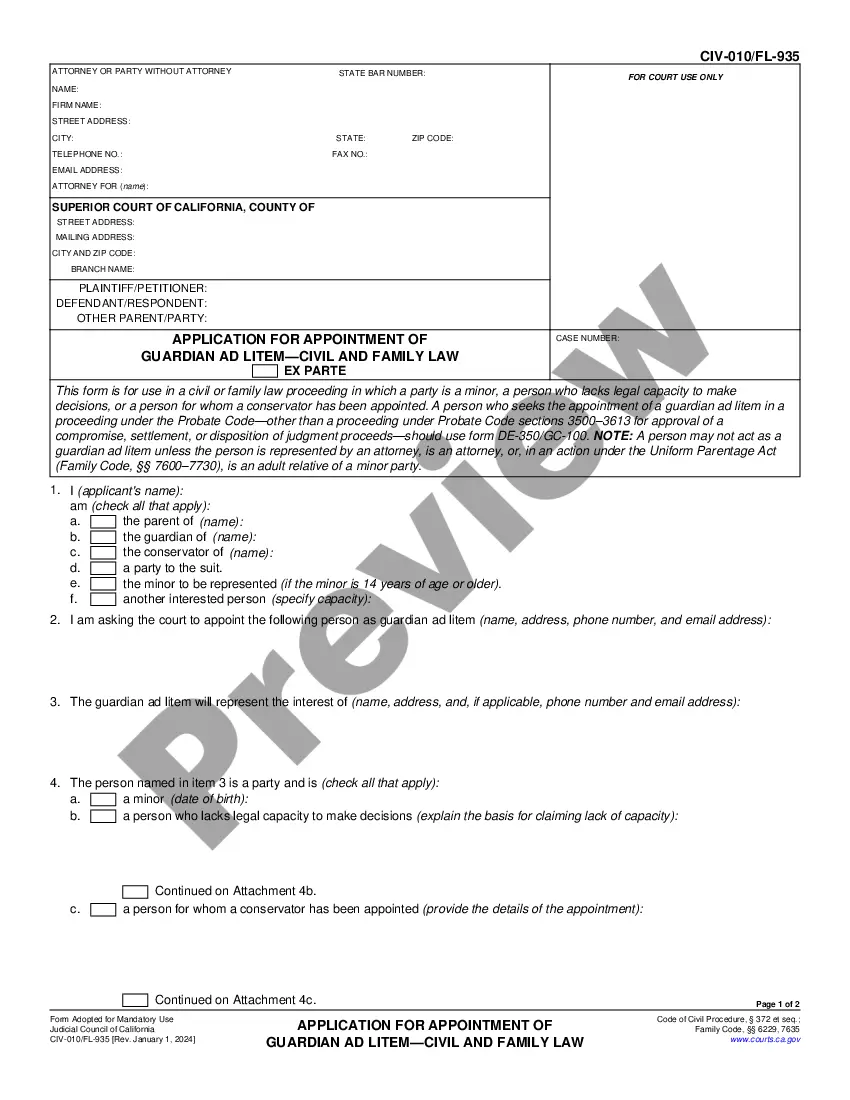

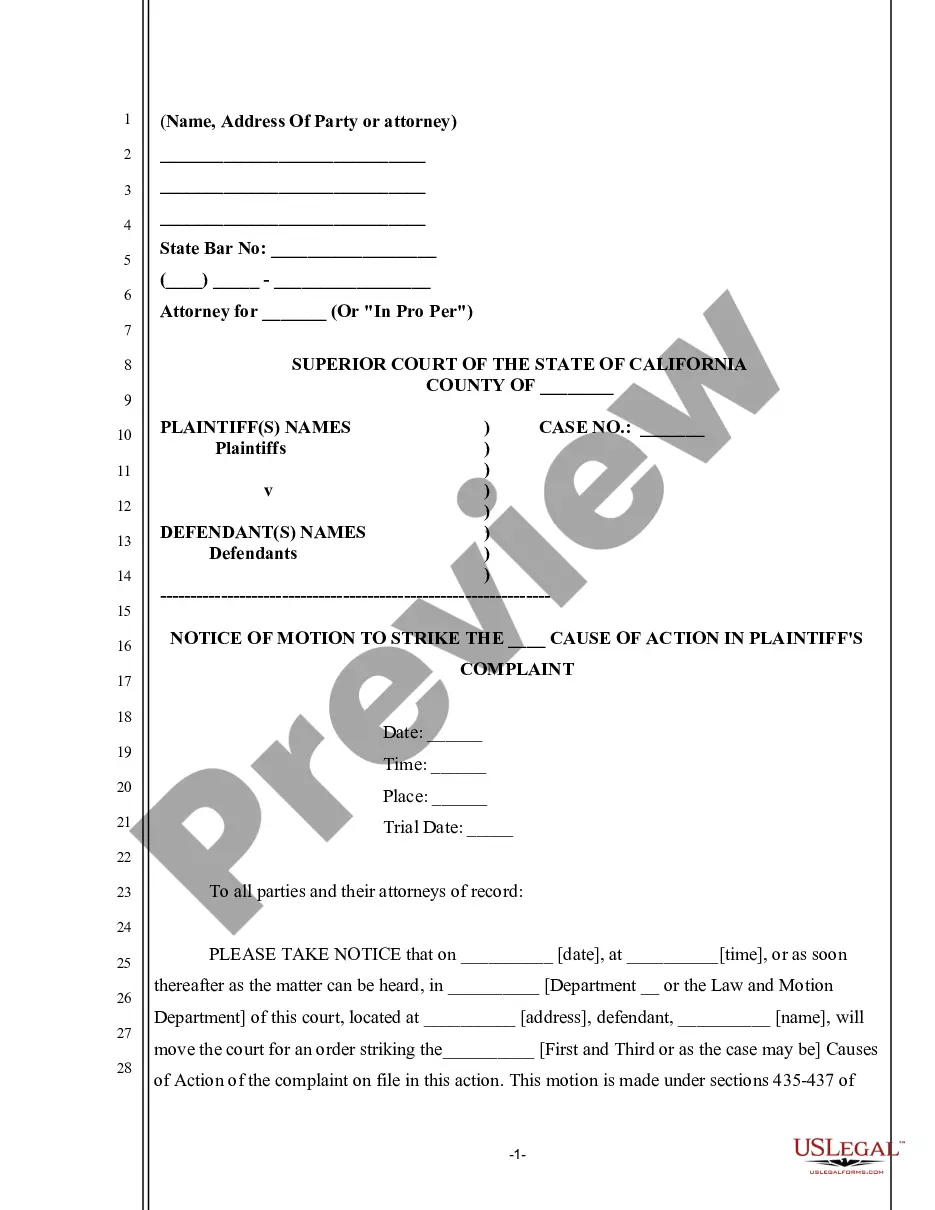

A Series A Preferred Stock Purchase Agreement is a legal document that outlines the terms and conditions under which an investor (referred to as the 'Purchaser') agrees to buy shares of Series A Preferred Stock from a company, in this case, BirthdayExpress, Inc. This agreement establishes the rights, privileges, and responsibilities associated with the ownership of these shares including the price per share, the total number of shares offered, and the mechanisms for selling or transferring ownership.

Key components of the form

This agreement typically includes the following key components:

- Purchase price: The cost per share and the total number of shares being purchased.

- Closing date: The specified date when the purchase will take place.

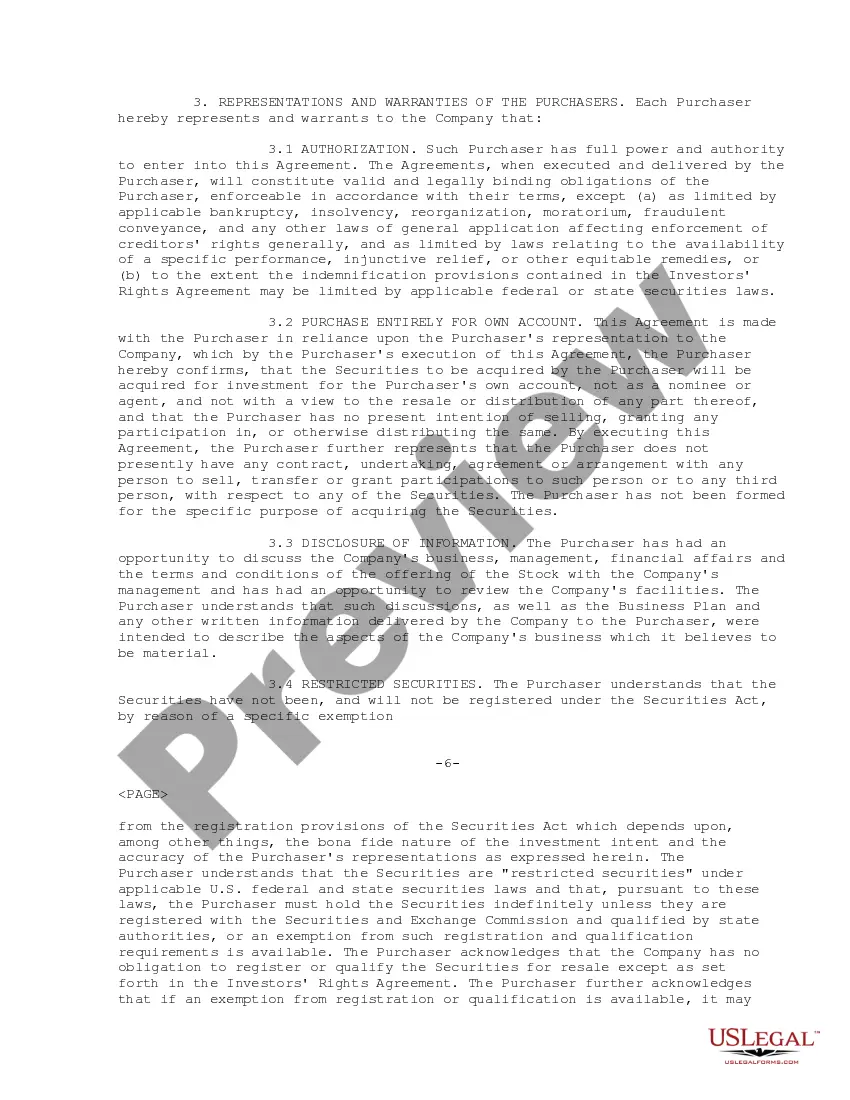

- Representations and warranties: Statements made by both the company and the purchasers regarding their legal status and financial condition.

- Conditions precedent: Conditions that must be fulfilled before the deal can close.

- Rights of the stockholders: Any special voting rights or privileges that accompany the preferred stock.

How to complete a form

To complete the Series A Preferred Stock Purchase Agreement, the following steps should be followed:

- Fill in the Purchaser's details: Include the name and address of the Purchaser as stated in Exhibit A.

- Specify the number of shares: Indicate the number of shares being purchased along with the price per share.

- Review the warranties: Both parties should carefully review the representations and warranties sections to ensure all statements are accurate.

- Sign the agreement: Both the company and the Purchaser must sign the document, indicating their agreement to the terms laid out.

Who should use this form

This form is designed for companies seeking to raise capital by offering shares of Series A Preferred Stock to investors who are interested in acquiring ownership of the company. It is particularly suitable for startups and early-stage companies that are looking to attract investors willing to provide funding in exchange for equity.

Legal use and context

The Series A Preferred Stock Purchase Agreement is predominantly used during financing rounds for startups. By using this form, companies can ensure that the terms of the investment are clearly outlined, protecting both the investors and the company. It is crucial in establishing the legal framework within which stock ownership and investment are managed, ensuring compliance with state and federal securities laws.

Benefits of using this form online

Utilizing an online platform for the Series A Preferred Stock Purchase Agreement offers several advantages:

- Convenience: Users can easily access and fill out the form from anywhere at any time.

- Time-saving: Immediate access to forms allows for quicker completion and processing of agreements.

- Guidance: Online platforms often provide instructions and prompts that help users understand how to complete the form correctly.

- Cost-effective: Downloadable forms are generally more affordable than hiring a legal professional to draft a document from scratch.