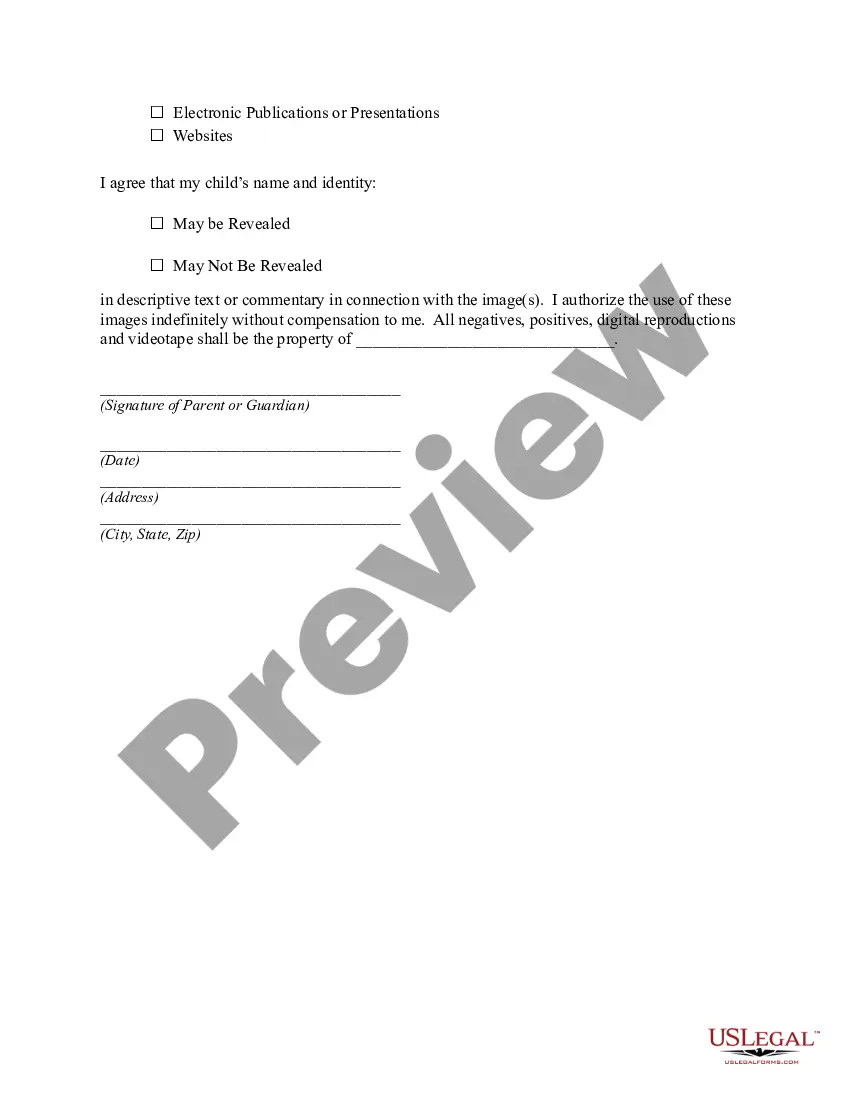

501(c)(1) Non-Profit Charter School Photography Consent is a document that is used to obtain permission from the parents or guardians of students to take photographs or videos of them for use in school events or activities. This consent form is typically required for any event or activity that involves photography or video recording of students. It specifies the purpose of the photography or video recording, how the photos will be used, and the parental or guardian’s permission for the school to use the photos. There are two types of 501(c)(1) Non-Profit Charter School Photography Consent: one for parents/guardians and one for students over the age of 18. Both forms must be signed and dated in order for the consent to be valid.

501(c)(1) Non-Profit Charter School Photography Consent

Description

How to fill out 501(c)(1) Non-Profit Charter School Photography Consent?

Handling official paperwork requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your 501(c)(1) Non-Profit Charter School Photography Consent template from our service, you can be certain it meets federal and state laws.

Dealing with our service is simple and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your 501(c)(1) Non-Profit Charter School Photography Consent within minutes:

- Make sure to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the 501(c)(1) Non-Profit Charter School Photography Consent in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the 501(c)(1) Non-Profit Charter School Photography Consent you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

A major distinction between private benefit and inurement is that the former is construed broadly. Inurement pertains to a narrow category of disqualifying actions, while private benefit is permitted in limited instances. As the IRS points out: inurement and private benefit are often incorrectly used interchangeably.

The private inurement doctrine The important relationship between the organization and the ?disqualified person? is that by way of their position within the organization, they can exercise control and influence over the organization. The most common example of private inurement is excessive compensation.

Rev. Rul. 98-15 incorporates the two-part test from Plumstead and Housing Pioneers: that (1) a joint venture must further a charitable purpose and (2) the joint venture documents must allow the exempt organization to continue furthering its exempt purpose without benefiting the private parties more than incidentally.

The IRS defines a 509(a)(1) as: an organization that receives a substantial part of its financial support in the form of contributions from publicly supported organizations, from a governmental unit, or from the general public.

Simply put, a 509a1 is a specific type of 501c3. The IRS notes that 501(c)(3) organizations are either private foundations or public charities. A 509(a)(1) is one type of public charity.

The most common punishment for nonprofits guilty of private inurement is monetary sanctions--also called "intermediate sanctions." Revocation of a nonprofit's tax-exempt status is rare--as a practical matter, it is a death sentence for any nonprofit.

A section 501(c)(3) organization must not be organized or operated for the benefit of private interests, such as the creator or the creator's family, shareholders of the organization, other designated individuals, or persons controlled directly or indirectly by such private interests.

Private inurement occurs when an individual working on the inside (commonly known as an insider) receives any of the organization's net income or inappropriately uses any of its assets for personal gain.