Sample Letter for Notice Under Fair Debt Collection Act

Description

Definition and meaning

The Sample Letter for Notice Under Fair Debt Collection Act is a formal communication intended to inform consumers about their rights regarding debt collection. This letter serves as a notification that a debt is being collected and details the steps a recipient can take if they dispute the validity of the debt. Understanding this letter is crucial for anyone dealing with debt collection issues.

Who should use this form

This letter is primarily designed for individuals who have received notice of a debt that they believe may be incorrect, inflated, or otherwise disputable. If you feel that you are being unfairly targeted by debt collectors or need to clarify your obligation regarding a debt, this letter can help protect your rights under the Fair Debt Collection Act.

Legal use and context

The Fair Debt Collection Act (FDCA) governs the actions of third-party debt collectors. This letter assists individuals in formally disputing a debt within 30 days of receiving the initial notice. By using the Sample Letter for Notice Under Fair Debt Collection Act, consumers can ensure that they communicate their intentions as outlined in the FDCA, demanding verification of the debt and stopping any further collection tactics until the dispute is resolved.

Key components of the form

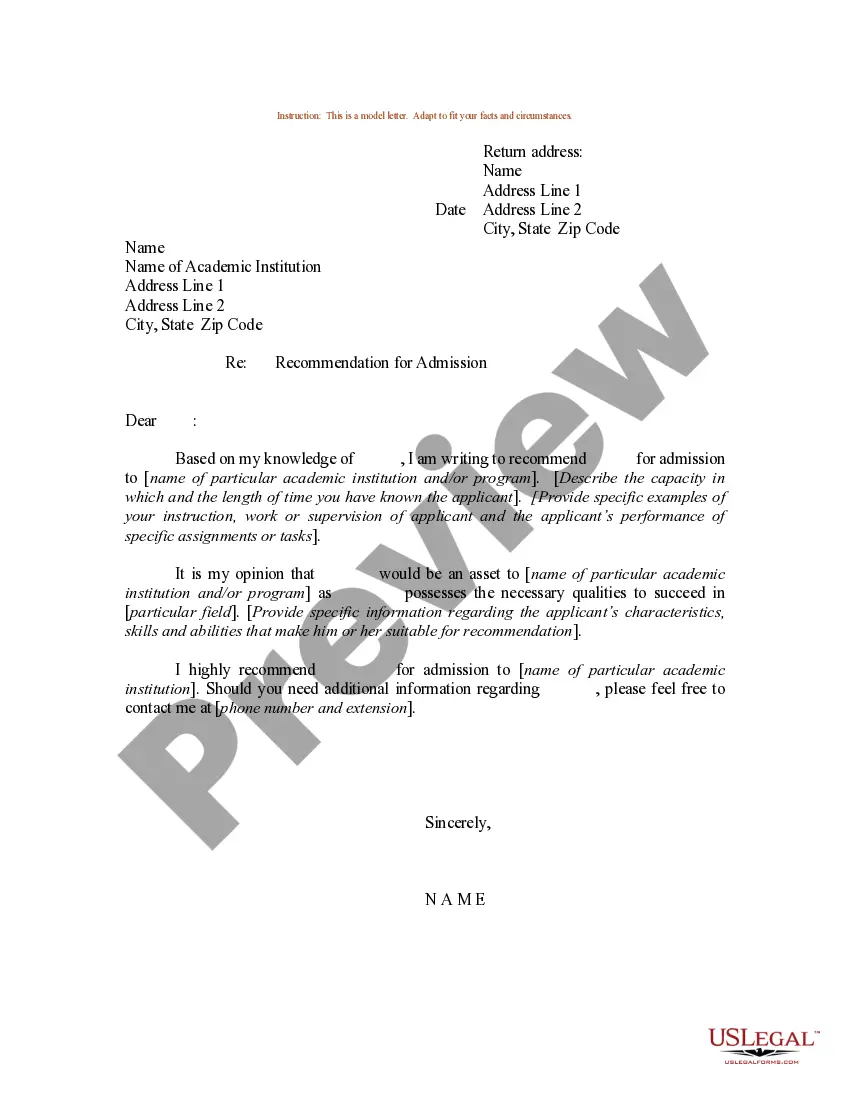

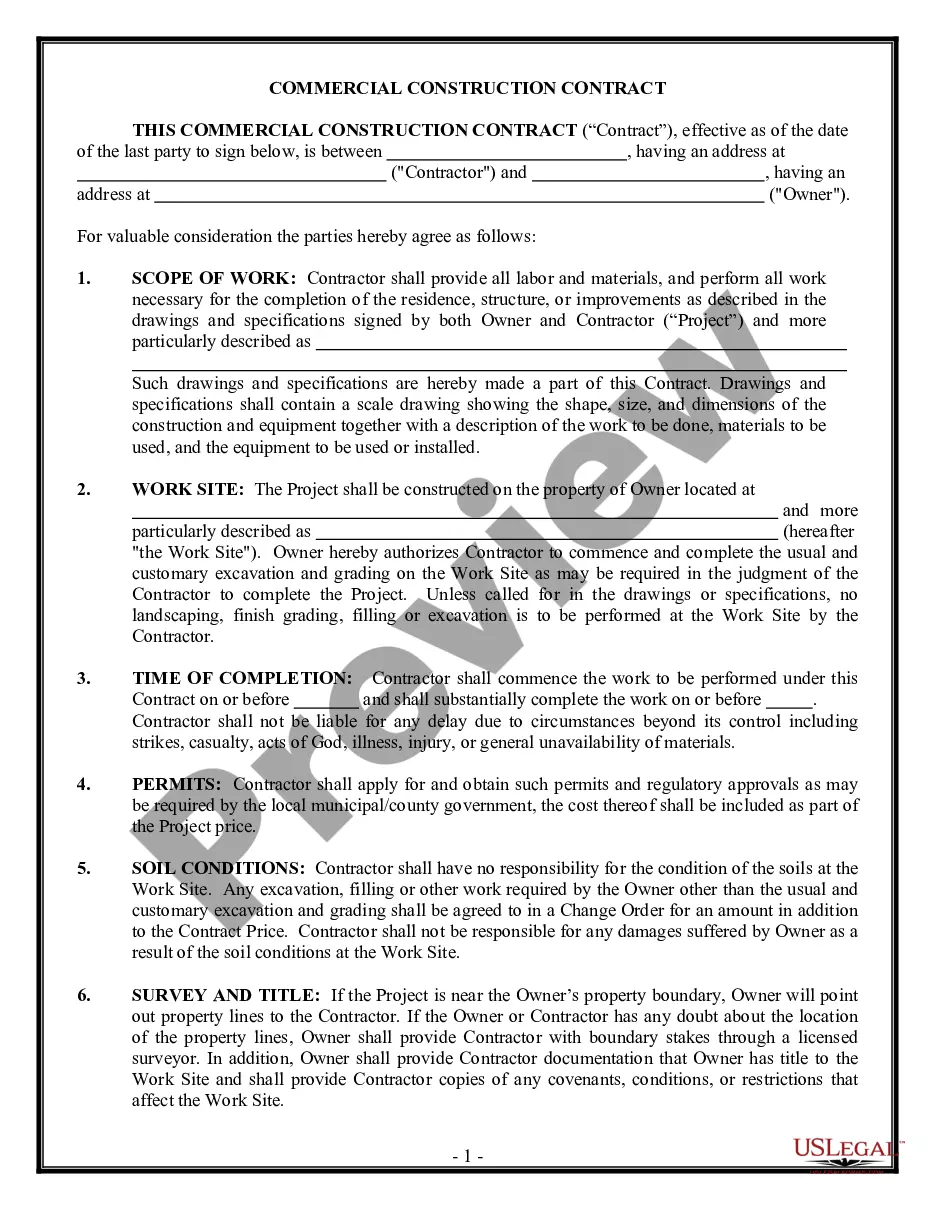

A comprehensive Sample Letter for Notice Under Fair Debt Collection Act typically includes the following key components:

- Your name and contact information: Ensures the collector can identify you.

- Reference to the debt being disputed: Includes details about the debt in question.

- A clear statement disputing the debt: Clearly communicates your position.

- A request for verification: Asks the collector for details and documentation about the debt.

- Date of the letter: Provides a timeline for any future actions related to the dispute.

Common mistakes to avoid when using this form

When using the Sample Letter for Notice Under Fair Debt Collection Act, avoid the following common mistakes:

- Not responding within the 30-day timeframe: Failing to send your letter within the 30 days can weaken your dispute.

- Using vague language: Clearly state the debt you are disputing and why.

- Neglecting to keep a copy: Always retain a record of your communication for future reference.

- Not sending the letter via certified mail: This provides proof of delivery, which is crucial for legal documentation.

What to expect during notarization or witnessing

While notarization is not typically required for the Sample Letter for Notice Under Fair Debt Collection Act, having the letter notarized can add an extra layer of credibility and ensure the authenticity of your communication. If you choose to proceed with notarization, expect the following:

- Identity verification: The notary will confirm your identity, so bring a valid form of ID.

- Signature verification: You will need to sign the letter in the presence of the notary.

- Official seal: The notary will provide an official seal to certify the notarized letter.

Key takeaways

Utilizing the Sample Letter for Notice Under Fair Debt Collection Act is a vital step in protecting your rights as a consumer. Remember the following key points:

- Respond within 30 days of receiving a debt notice.

- Clearly dispute the debt and request verification.

- Keep records of all communications.

- Consider notarizing the letter for added credibility.

How to fill out Sample Letter For Notice Under Fair Debt Collection Act?

Use US Legal Forms to obtain a printable Sample Letter for Notice Under Fair Debt Collection Act. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms library on the internet and provides affordable and accurate templates for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Sample Letter for Notice Under Fair Debt Collection Act:

- Check out to ensure that you get the proper form with regards to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Click Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Notice Under Fair Debt Collection Act. Above three million users have already used our platform successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Fair Debt Collection Practices Act (FDCPA) Validation Letter The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies.

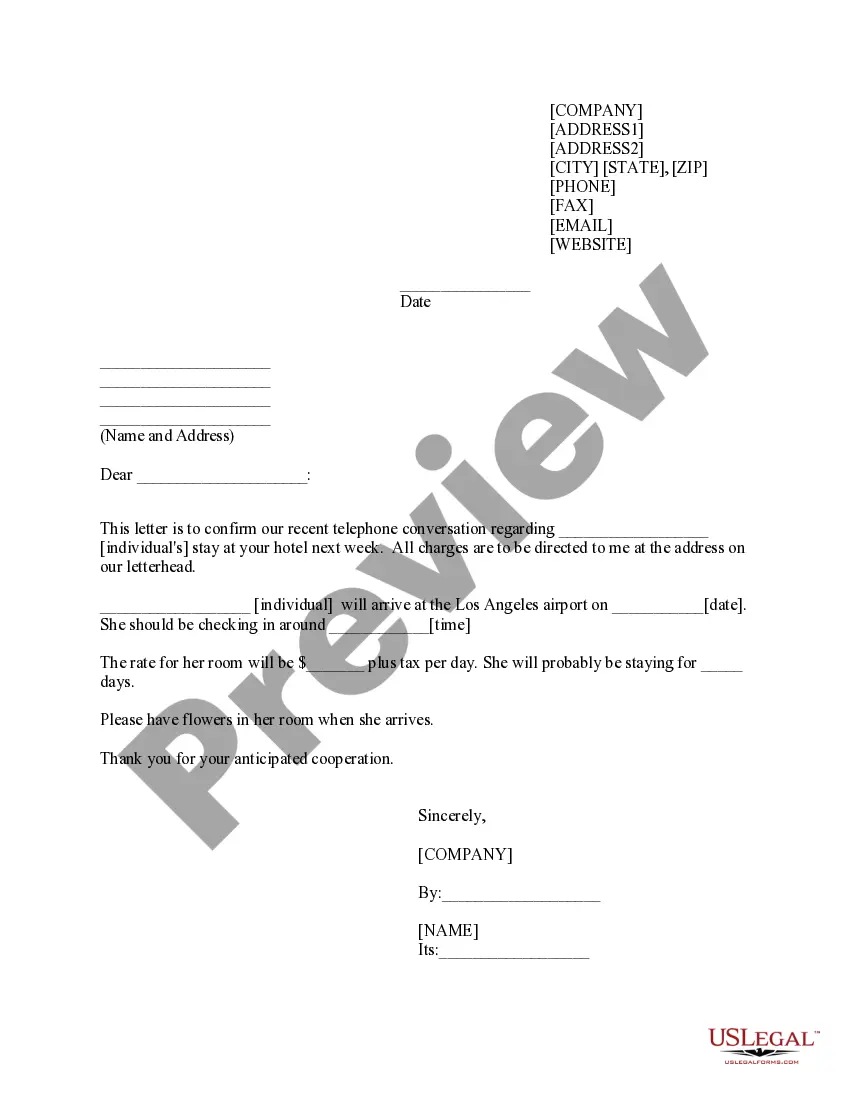

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

For the name and contact information of the original creditor. why the collector believes you own the debt in the first place. for a record of all owners of the debt. the amount and age of the debt (including an account number if you're able). under what authority the collector has to collect.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

Know What to Include A demand letter should include the name of the creditor, the amount owed, action required, debt reference, deadline, and the consequences. Ensure you include all these details so your letter is not only compliant with the FDCPA, but also practical.

The letter should be sent certified mail (so you can have proof of receipt) and include your account number, the date they contacted you, the method they used to contact you, and a statement requesting that they provide validation of the debt. It doesn't have to be long, as you can see from this sample letter.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.