Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

Key Concepts & Definitions

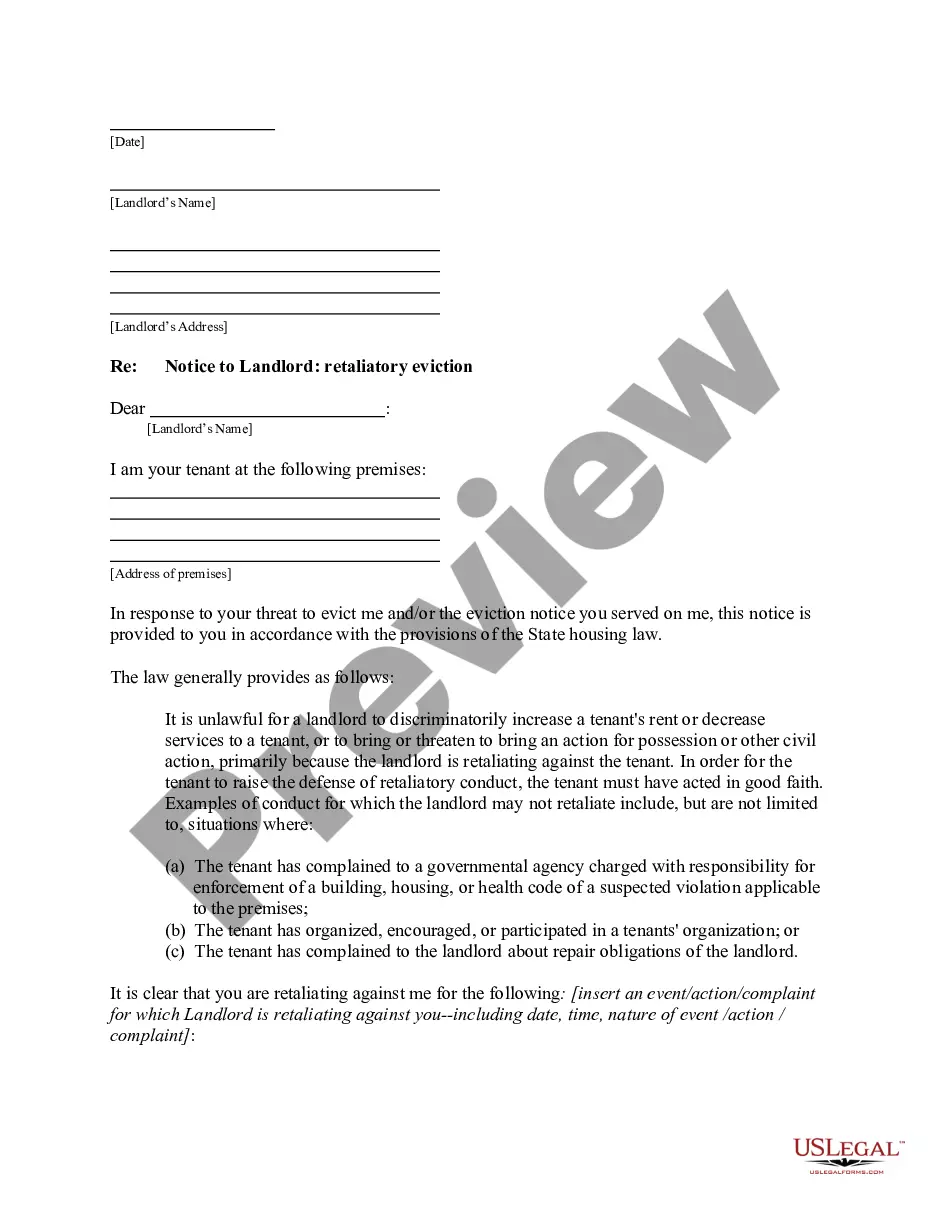

Notice of Intention to Foreclose and of Liability is a legal document issued by a lender when a borrower fails to meet the obligations of a mortgage contract. This notice serves as a preliminary step before foreclosure proceedings are initiated, informing the borrower of the lenders intent to recover the mortgaged property and highlighting the borrower's liability for any deficiencies.

Step-by-Step Guide to Responding to a Notice of Intention to Foreclose

- Review the Notice: Carefully read the document to understand the specifics of the liability and the timeline provided.

- Consult with an Attorney: Seek legal advice to explore your options and rights under your state laws.

- Contact the Lender: Discuss possibilities such as loan modification, forbearance, or other arrangements to potentially stop the foreclosure process.

- Respond Officially: Depending on your strategy, respond to the notice either through legal representation or directly, citing any agreements made with the lender.

- Prepare Financially: Assess your financial situation and consider alternatives like refinancing or selling the property.

Risk Analysis of Ignoring a Notice of Intention to Foreclose

- Legal Proceedings: The lender may proceed with foreclosure, leading to the loss of your property.

- Credit Damage: Foreclosure significantly impacts your credit score and ability to obtain future loans.

- Addition of Fees: Late fees and legal fees may accumulate, increasing the debt owed.

- Emotional Stress: The foreclosure process can be stressful and emotionally taxing.

Key Takeaways

Understanding the process and implications of receiving a notice of intention to foreclose and of liability is crucial for effectively managing the situation. It's important not to ignore the notice and consider all available legal and financial options promptly.

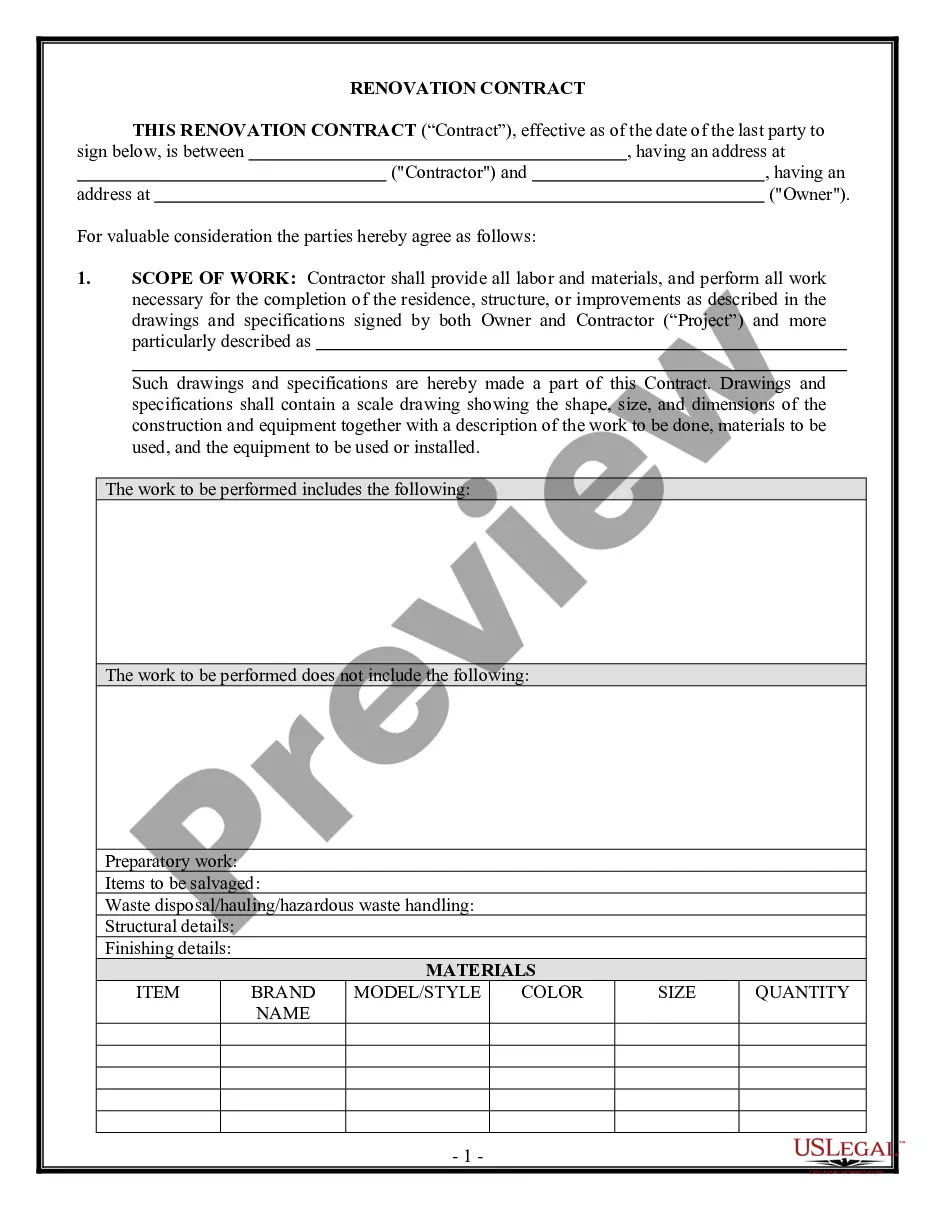

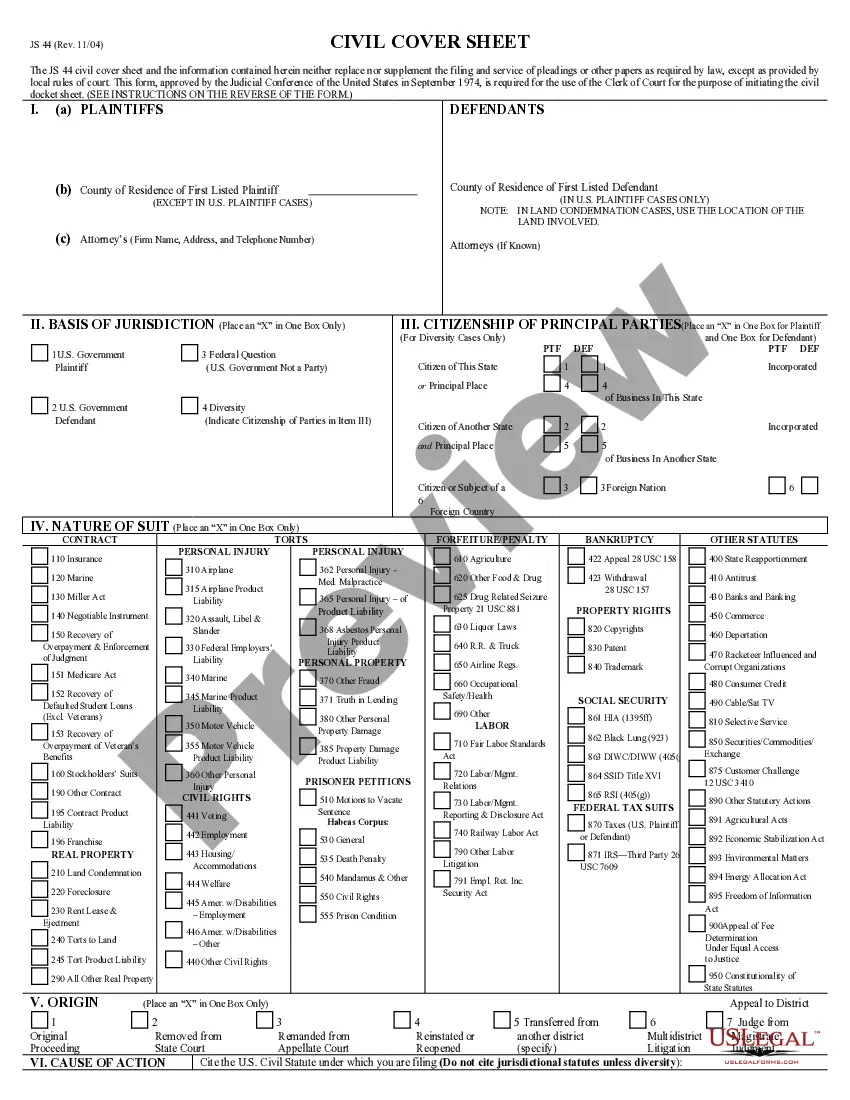

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

Use the most comprehensive legal library of forms. US Legal Forms is the best platform for finding up-to-date Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage templates. Our service offers a large number of legal documents drafted by licensed lawyers and categorized by state.

To download a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the document you are looking for and buy it. Right after purchasing templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the template features a Preview option, use it to review the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template meets your expections.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and complete the Form name. Join thousands of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

How much is your home worth? Regardless of your state's deficiency laws, if your home will sell at a foreclosure sale for more than what you owe, you will not be obligated to pay anything to your lender after foreclosure. Your lender is obligated to apply the sale price of your home to the mortgage debt.

Deficiency Judgments After Judicial Foreclosures in California. Deficiency judgments are generally allowed after judicial foreclosures in California. But the lender can't get one if the loan was: used to buy a dwelling that consists of one to four units that's owner-occupied (called a purchase money loan)

After foreclosure, you might still owe your bank some money (the deficiency), but the security (your house) is gone. So, the deficiency is now an unsecured debt.

Most states allow lenders to sue borrowers for deficiencies after foreclosure or, in some cases, in the foreclosure action itself. Some states allow deficiency lawsuits in judicial foreclosures, but not in nonjudicial foreclosures.Your lender most likely won't sue you if they think they won't recover anything.

Filing a complaint or petition for foreclosure with the courts, Issuing summons to the borrower and all interested parties notifying them of the suit and stating the time period in which they must contest the foreclosure, and.

The automatic stay will stop the foreclosure in its tracks. The bank may file a motion for relief from the stay. Benefits of a Chapter 13 bankruptcy.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.

Declaring Bankruptcy. Negotiating a Waiver of the Lender's Right to Seek a Deficiency Judgment. Making a Settlement Offer. Taking the Chance that Your Lender Won't Actually Sue You for the Deficiency.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale.